Cloud Migration Services Market Size & Overview:

Get More Information on Cloud Migration Services Market - Request Sample Report

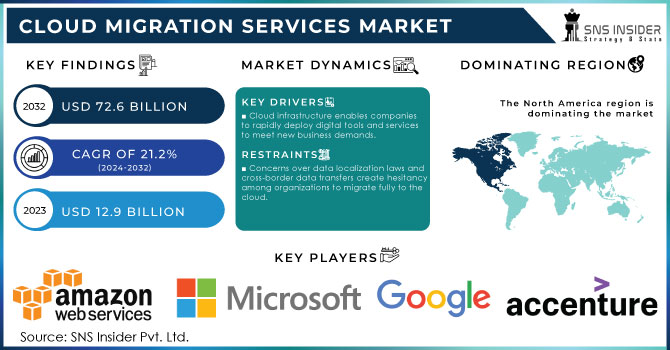

Cloud Migration Services Market size was valued at USD 12.9 billion in 2023 and is expected to grow to USD 72.6 billion by 2032 and grow at a CAGR of 21.2% over the forecast period of 2024-2032.

The cloud migration services market has witnessed significant growth driven by rising government initiatives and the adoption of cloud technologies among different industries. As per the recent stats published by the U.S. Federal Government Cloud Smart Strategy, cloud migration is gaining rapid momentum in government agencies–with over 60% of federal agencies migrating mission-critical workloads to a cloud infrastructure through 2023. This strategic shift is aligned with the government's broader digital transformation efforts, which aim to modernize legacy IT systems and improve operational efficiency. In addition, the U.S., countries including the UK, Germany, and Australia have also bolstered their cloud migration efforts, spurred by national digital agendas and policies that call for a cloud-first approach. Examples include the UK, whose Government Cloud Framework (G-Cloud) is experiencing 20% year-on-year growth in cloud service adoption and public sector cloud spending exceeding GBP 1.3 billion during FY 2023. While these governmental initiatives are encouraging cloud solutions in the public sector, they are also causing a ripple effect by speeding up cloud adoption for industries such as healthcare, finance, and manufacturing.

The cloud migration services market is projected to continue its robust growth due to the increasing need for agility, scalability, and cost-efficiency, with market players continuously innovating to meet the growing demand. The cloud migration services market has also witnessed significant growth due to government policies emphasizing data sovereignty, security, and compliance. The healthcare sector is witnessing a considerable increase in cloud migration with demands for skilled data management systems and integrity leading the way. Healthcare organizations generate and process large volumes of sensitive data, much of which is still stored on-premises, posing security risks. A survey report reveals that 80 percent of healthcare providers are planning cloud migration or have already migrated to the cloud to give access to data, revamp operations, and boost IT infrastructure. According to the HIMSS 2022 survey, 63% of healthcare organizations have already deployed cloud applications, with 45% planning further migrations. Cloud adoption supporting telehealth expansion and satisfying the needs for cost, security, and compliance can pave the way for more growth in this sector.

Market Dynamics

Drivers

-

Businesses are adopting cloud migration to scale operations efficiently without heavy capital investment. Pay-as-you-go models reduce operational costs, making it a financially viable solution for enterprises.

-

Cloud infrastructure enables companies to rapidly deploy digital tools and services to meet new business demands.

-

Cloud services provide enhanced security features, helping businesses meet regulatory compliance requirements.

The shift towards remote work and ongoing digital transformation programs is one of the most prominent drivers for cloud migration services. As these businesses have quickly transitioned to hybrid and remote work models in the post-pandemic world, cloud infrastructure supporting geographically dispersed teams and operations has become a critical necessity. According to a recent 2023 survey, nearly 74% of CFOs plan to shift a significant portion of their workforce to remote roles permanently. This shift necessitates robust cloud-based solutions for collaboration, communication, and data accessibility. It allows organizations to ensure that employees have access to essential tools like video conferencing, file sharing, and productivity applications from anywhere. Microsoft Teams and Google Workspace, for example, reported record-high levels of adoption as businesses looked to scalable, cloud-based platforms to enable productivity from home. For instance, in the finance and healthcare industry, a cloud-based digital transformation aids in bringing workflows to life while still ensuring compliance with stringent regulations.

Cloud services are also flexible, this allows businesses to react swiftly to transform market requests and operational necessities. Having the option to create or reduce static IT resources on demand gives a significant advantage. Firms with more advanced digital capabilities throughout the pandemic were twice as likely to claim strong financial performance, the proof cloud migration proves helpful for long-term business resilience and operational agility.

Restraints

-

Concerns over data localization laws and cross-border data transfers create hesitancy among organizations to migrate fully to the cloud.

-

Migrating legacy systems to the cloud is complex, often requiring extensive reconfiguration and integration efforts.

Data privacy and sovereignty issues are some of the major restraints in the cloud migration services market. With the trend of companies migrating their data and applications to the cloud, there is a concurrent problem for enterprises around data governance especially in geographies with tough data protection regulations. For instance, regulations like the General Data Protection Regulation (GDPR) in Europe require companies to store and process data within specific geographic boundaries, limiting the flexibility that cloud solutions offer. This poses a significant challenge for global enterprises that operate across multiple jurisdictions, as they must navigate a complex web of compliance requirements. Moreover, businesses fear that they will lose control of their sensitive data because the information stored in third-party cloud ecosystems is at risk of unauthorized access or government surveillance. Such fear of breaches or misuse of data can make the cloud migration process slow or even stop altogether, especially in sectors like finance and healthcare that deal with sensitive cases.

Segment analysis

By Platform

In 2023, the solution segment held the largest revenue share of 68% and is projected to gain a steady market share over the forecast period. This dominance is highly attributed to the more comprehensive and customized we cloud migration solutions offered to businesses, thus allowing them to seamlessly move their workloads and applications to cloud platforms with zero operational interruption. Solution-based offerings are extremely attractive due to the increasing demand for customized solutions targeting specific challenges, including data security, regulatory requirements, and business continuity. Moreover, the government initiatives concentrating on cloud migration solutions such as the U.S. government Cloud Smart an initiative to promote the use of cloud-based solutions for efficient operation have also propelled the demand for them significantly. Government reports indicate that over 55% of cloud migration spending in 2023 was directed toward solution-based services, as they offer businesses the flexibility to choose the right cloud platform and architecture tailored to their unique needs. As cloud environments become more complex, the need for specialized solutions is anticipated to fuel the growth of this segment further.

By Enterprise Size

The large enterprise segment accounted for the largest revenue share of 68% in 2023 due to the massive migration of complex workloads and higher cloud infrastructure needs characteristic of larger organizations. Large enterprises deal with huge data volumes and multiple regions, and they need complex cloud migration services that combine efficiencies with existing IT architecture. More than 70 percent of large enterprises in the U. S had adopted a kind of cloud migration service, as published by the U.S. Department of Commerce report-2023, which exhibits a noticeable transition around native systems towards cloud computing services. In addition, large enterprises are having the budget and technical capabilities to invest in full-scale cloud migration plans that involve data security solutions, compliance, and disaster recovery solutions. In addition, the government is encouraging big corporations to move towards a cloud environment leading to this demand since it is extremely necessary in sectors like finance, health care, and manufacturing where data sensitivity and operation continuity play an important role.

By End-Use Industry

IT & telecommunications segment accounted for the highest revenue share of 19% in 2023. The segment led the way because of early adoption in the sector towards cloud technologies and demand for flexible, scalable & secure infrastructure capability to support operations. According to 2023 data from the National Institute of Standards and Technology (NIST), IT and telecommunications sector accounted for 30% of the total cloud infrastructure expenditure in the U.S. due to high dependency on a cloud for storage, processing, or hosting applications. This segment is also expected to account for the largest growing demand for cloud migration services due to the increasing complexity of telecom networks, requiring more efficient management by adapting to cloud systems, especially with the implementation of 5G networks.

Cloud migration services have helped companies from different sectors:

|

Industry |

Company |

Benefits of Cloud Migration |

|---|---|---|

|

Retail |

Walmart |

Enhanced data management, improved supply chain efficiency, and personalized customer experiences through big data analytics. |

|

Healthcare |

Cleveland Clinic |

Increased IT flexibility and security, integrated patient data with AI for better care insights. |

|

Finance |

Capital One |

Improved agility, security, and innovation in financial products by leveraging AWS cloud services. |

|

Manufacturing |

General Electric |

Streamlined operations, reduced IT costs, and enabled more efficient data analysis across global operations. |

|

Media |

Netflix |

Shifted all its operations to the cloud to handle vast amounts of streaming data, improving scalability and viewer experience. |

|

Education |

University of Notre Dame |

Enhanced collaboration and learning tools accessibility, improved disaster recovery and data security. |

Regional Analysis

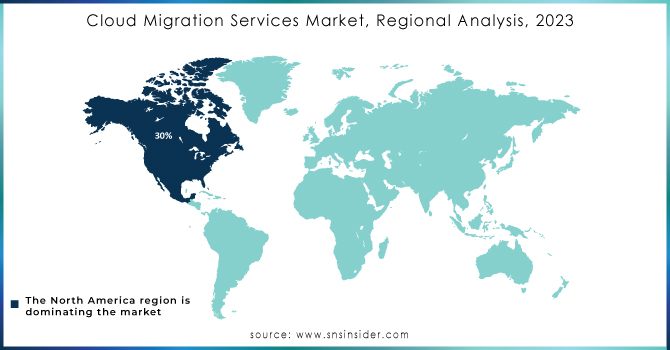

The cloud migration services market was dominated by North America in 2023, contributing the highest market share, around 35%. This dominance in the region is primarily attributed to early cloud technology adoption, the availability of major cloud service providers, and favorable government initiatives for cloud migration. In the United States, for example, the Cloud Smart policy of the U.S. government has also prompted public and private sectors to hasten their move away from on-premise by leveraging cloud solutions, which in turn has driven massive growth of this market segment. As per the U.S. government statistics, cloud migration services in the U.S., measured by revenue lines, increased in 2023 at a rate of 25% year-on-year basis.

The fastest-growing region is expected to be Asia-Pacific, with a significant CAGR during the forecast period. In the APAC region business and technology landscapes are evolving quickly, with China's Cloud First policy and India Digital India program boosting digital transformation in countries like China, India, and Japan, thereby contributing strongly towards increased demand for cloud migration services. This growth indicates that this global cloud migration market is gaining momentum. Growing economic development in the region and higher adoption of cloud technologies from small and medium enterprises (SMEs) is expected to further amplify the growth of this market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Key Service Providers/Manufacturers:

-

Amazon Web Services (AWS) (AWS Migration Hub, AWS Database Migration Service)

-

Microsoft Corporation (Azure Migrate, Azure Site Recovery)

-

Google Cloud (Google Cloud Anthos, Google Cloud Migrate for Compute Engine)

-

IBM Corporation (IBM Cloud Paks, IBM Cloud Migration Services)

-

Accenture PLC (Accenture Cloud Migration Factory, myNav)

-

VMware, Inc. (VMware Cloud on AWS, VMware HCX)

-

Rackspace Technology (Rackspace Cloud Migration Services, Rackspace Elastic Engineering)

-

Cognizant Technology Solutions (Cognizant Cloud Steps, Cognizant Migration Accelerator)

-

Tata Consultancy Services (TCS) (TCS Cloud Migration Factory, TCS BaNCS Cloud)

-

HCL Technologies (HCL CloudSmart, HCL Cloudification Framework)

Key Users of Cloud Migration Services/Products:

-

Netflix, Inc.

-

Capital One Financial Corporation

-

Airbnb, Inc.

-

Johnson & Johnson

-

Unilever PLC

-

Spotify AB

-

General Electric (GE)

-

BMW Group

-

Pfizer Inc.

-

Coca-Cola Company

Recent News and Developments

-

In April 2024, Tata Consultancy Services (TCS) announced a strategic partnership with Amazon Web Services (AWS) aimed at helping clients accelerate large-scale cloud migrations. TCS intends to utilize AWS's features to achieve digital transformations, particularly with regard to data and contemporary artificial intelligence (AI) solutions.

-

Amazon Web Services (AWS) gained the U.S. Department of Defense's approval to pursue a new partnership in February 2023 that will help migrate mission-critical workloads onto cloud infrastructure as part of the Joint Enterprise Defense Infrastructure (JEDI) contract. Through advanced cloud solutions, this collaboration aims to improve national security and AWS aims at establishing itself firmly in the cloud migration services industry.

-

Google Cloud announced the new AI-powered cloud migration services in June 2023 to help companies move to Google Cloud from on-premises systems faster. This initiative is the latest effort in Google Cloud's digital transformation support for the public sector, according to a joint announcement with the U.S. General Services Administration (GSA). This launch could strengthen Google Cloud's market share, especially in the healthcare and government sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.9 billion |

| Market Size by 2032 | USD 72.6 billion |

| CAGR | CAGR of 21.2 % From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Solution, Service) • By Enterprise Size (Large Size Enterprises, Small and Medium Sized Enterprises (SMEs)) • By Deployment (Public, Private, Hybrid) • By End-use Industry (IT & Telecommunications, BFSI, Healthcare, Government & Public Sector, Manufacturing, Automotive, Retail & Consumer Goods, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS), Microsoft Corporation, Google Cloud, IBM Corporation, Accenture PLC, VMware, Inc., Rackspace Technology, Cognizant Technology Solutions, Tata Consultancy Services (TCS), HCL Technologies |

| Key Drivers | •Businesses are adopting cloud migration to scale operations efficiently without heavy capital investment. Pay-as-you-go models reduce operational costs, making it a financially viable solution for enterprises. •Cloud infrastructure enables companies to rapidly deploy digital tools and services to meet new business demands. •Cloud services provide enhanced security features, helping businesses meet regulatory compliance requirements. |

| Market Opportunities | •Concerns over data localization laws and cross-border data transfers create hesitancy among organizations to migrate fully to the cloud. •Migrating legacy systems to the cloud is complex, often requiring extensive reconfiguration and integration efforts. |