Digital Tattoos Market Report Scope & Overview:

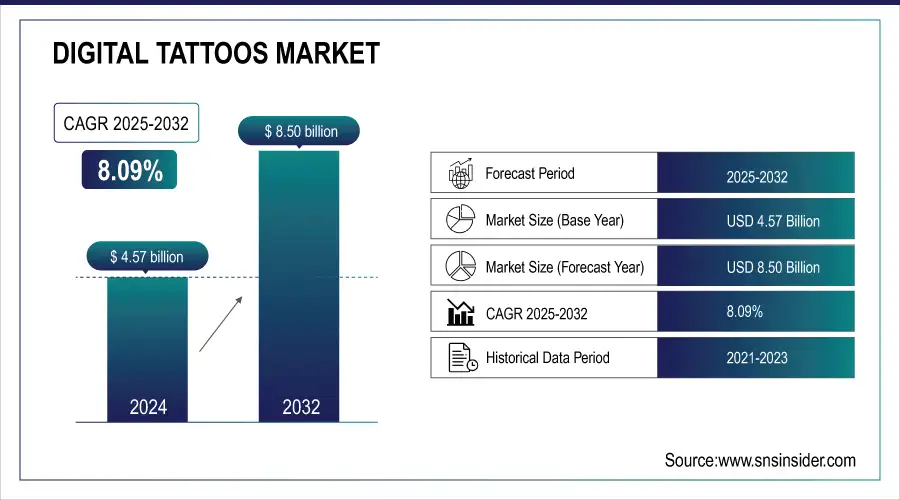

The Digital Tattoos Market Size was valued at USD 4.57 billion in 2024 and is expected to reach USD 8.50 billion by 2032 and grow at a CAGR of 8.09% over the forecast period of 2025-2032.

The digital tattoos industry is a newly expanding market that is at the crossroads of wearable technology, healthcare, and electronics. These super-thin, wearable stickers are directly applied on the skin and use NFC to send and receive information to an NFC-enabled mobile app. Digital tattoos are also popular in fields such as medical diagnosis, cyberspace experiments, and consumer electronics as a minimally invasive, seamless information interface for health querying and human-machine integration.

Rise in flexible electronics, bio-integrated sensors, and IoT connectivity has driven the market growth. When the U.S. healthcare spending exceeds USD 6 trillion a year by 2028 and makes up 20% of the GDP, electronic tattoos will be indispensable for healthcare. Still, challenges remain, such as interoperability and data aggregation, even as billions have been invested in EHRs and digital tools. With the continuation of wearables in development, such as digital tattoos, that offer real-time diagnostics, personalized care, and improved health, making it a core focus of the future of connected health and wearables innovation.

To Get more information on Digital Tattoos Market - Request Free Sample Report

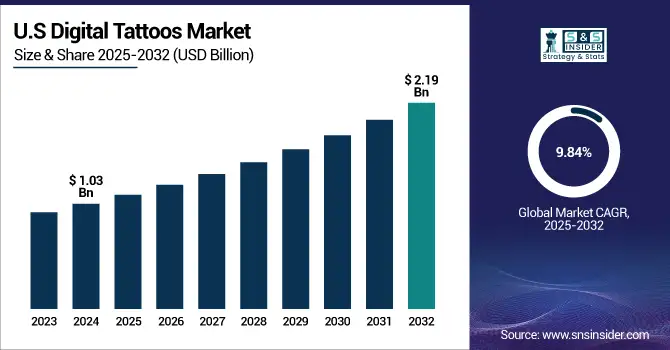

The U.S. digital tattoos market size was valued at USD 1.03 billion in 2024 and is projected to reach USD 2.19 billion by 2032, growing at a CAGR of 9.84% during the forecast period from 2025-2032. This results from wearable technology, the demand for continuous health monitoring, and the adoption of IoT-enabled services in healthcare. North America is currently led by the U.S., with having robust healthcare infrastructure, high R&D spending, and a favorable regulatory environment for health tech development. Such market supremacy is also bolstered by the growing emphasis on personalized healthcare solutions and tech-oriented medical applications.

Digital Tattoos Market Dynamics:

Key Drivers:

-

Growing Demand for Personalized Health Monitoring Drives Adoption of Digital Tattoos for Real-Time, Non-Invasive Care

The digital tattoos market growth demand for personalized healthcare solutions has significantly impacted the These ultra-thin, flexible devices provide continuous, non-invasive health monitoring, making them ideal for tracking vital signs including heart rate, temperature, and hydration. As the healthcare industry increasingly looks to provide patient-centric care, digital tattoos are poised to make a significant contribution to better outcomes through access to real-time health information that allows doctors and patients to make important decisions. The possibility to connect these devices to IoT, artificial intelligence, and other technologies opens new opportunities for them, stimulating market growth.

In 2023, NHE grew 7.5%, driven by increased access to care, as the share of the population with health insurance coverage rose to a high of 93.1%, largely due to expansions in Medicaid and direct-purchase plans. Also of note is the increase in physician and clinical services spending of 5.6% a year, revealing increased use of health care, with similar trends in spending for private health insurance. Such trends point to an opportune setting for digital health monitors, and digital tattoos in particular, which present non-invasive wearable replacements for current diagnostic processes.

Restraints:

-

High Production Costs and Technological Limitations Hinder the Growth of the Market

High production costs and current technological limitations are some of the most notable constraints of the market. Developing and manufacturing the corresponding devices, such as flexible materials, bio-integrated sensors, and ultra-thin electronics, is often expensive. Moreover, the equipment also must be lightweight, tough, and able to perform for extended periods without a break, which adds additional complexity and costs to the manufacturing process.

Also, the technology is not yet ready for production, including a lack of efficiency, battery life, and sensor accuracy. Such limitations make the development of long-lasting health monitoring devices difficult, especially for cost-sensitive markets. However, if the tattoo market is to become integrated into the day-to-day lives of the general public, manufacturers will need to find ways to make them more affordable. The difficulties with producing these products, as well as the high prices of such tattoos, may block their wider use, especially for consumer healthcare reasons, particularly without important advances in production precision and methods.

Opportunities:

-

Recent Technological Advancements in Digital Tattoos Unlock New Opportunities for Market Expansion

This market circumstance in the modern technological improvement, particularly in the improvement of graphene-enabled tattoos. Being strong, flexible, and conductive, graphene can make the digital tattoos more permanent and consume less energy in the process. This milestone could drive the future of digital tattoos, particularly in medical fields including real-time monitoring of chronic diseases, such as diabetes and cardiovascular disease. These developments will aid in making these devices more efficient and thus will help them provide consistent long-term usage.

As the healthcare providers are looking for tools that are continuous and non-invasive. It could also lower the cost of producing them, expanding the base of consumers who will be able to play around with digital tattoos. In a word, the combination of these developments should facilitate further integration with other digital health technologies with both clinical and consumer applications.

Challenges:

-

Data Privacy Concerns Pose Challenges for Widespread Adoption of Digital Tattoos

These devices gather private biometric data such as heart rate, temperature, and other health indicators, forms may be open to violations or unauthorized access. As digital tattoos become integrated with other connected devices, such as smartphones and health apps, the risk of data privacy violations increases. Moreover, since there is no common standard protocol in place to ensure secure data transmission and storage, this data is also very vulnerable. Regulatory authorities have not yet provided guidelines for how health data should be used, which creates indecision for consumers and health providers regarding the use of health data.

Since trust is of utmost importance when it comes to using digital health technologies, breaches of privacy can jeopardize consumer confidence in the future. Hence, market players need to improve security features, comply with regulatory requirements, and meet consumer expectations on data privacy to enhance confidence and consequently speed up the development of the market. But the digital tattoos market has to cross this hurdle with stringent data security measures to gain wider acceptance in healthcare and other fields.

Digital Tattoos Market Segmentation Analysis:

By Type

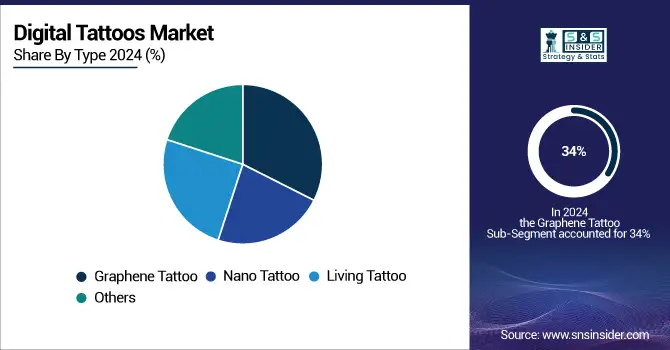

In 2024, the Graphene Tattoo segment led with 34% revenue share. Behind this leadership is graphene, which possesses high flexibility, conductivity, and biocompatibility. Thus, it is suitable for continuous health monitoring with the value of ease of wear. Several graphene-based tattoo technologies have been introduced by companies, including e-tattoos to check cardiovascular conditions. These innovations are cost-effective, non-invasive alternatives to many existing medical devices, which expands the applicability of digital tattoos in healthcare, promoting the growth of the digital tattoos market.

The Nano Tattoo segment is expected to register the highest CAGR of 11.97% during the forecast period due to advances in nanotechnology, ultrathin, flexible tattoos that can monitor vital signs, such as heart rate and glucose levels in real-time are now available. This growth is attributed to continued product developments, such as nano tattoos intended for customized health monitoring, the segment is likely to propel market growth. Since these devices are non-invasive, they are wearable, and this demand will also trigger the growth of this industry and make nano tattoos an important part of the digital tattoos market trends.

By Application

In 2024, the medical application segment dominates the digital tattoos market, holding a 33% revenue share. Digital tattoos for healthcare are non-invasive, continuous monitoring of vital signs, such as heart rate, glucose levels, and even body temperature, leading to better care for patients. These tattoos are being used in wearable health monitoring systems that have been released commercially for the management of chronic health conditions, such as diabetes and cardiovascular disease. The growing demand for personalized and remote monitoring solutions, along with innovative digital tattoos that enable more patient-centric care, drives the need for improved patient outcomes while translating into expanding market growth.

The commercial application segment is growing at the highest CAGR of 12.14% during the forecast period. This growth is driven by the increasing adoption of digital tattoos in consumer products such as fitness trackers and wearable electronics. These companies started to develop some more engaging solutions where a digital tattoo activates in contact with a smart device to track data. The availability of continuous, non-invasive data is making these tattoos increasingly popular in the commercial sector, which include fitness, sports, and entertainment sectors, fostering growth in the digital tattoos market analysis.

Digital Tattoos Market Regional Analysis:

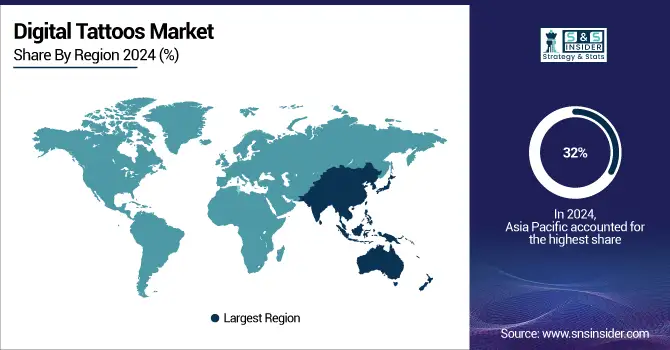

In 2024, the Asia Pacific region held an estimated 32% digital tattoos market share, emerging as the fastest-growing regional market. The Asia Pacific market for digital tattoos is set to observe significant growth due to the fastest adoption of wearable health technologies, increasing prevalence of chronic diseases, and high investment for R&D in developing economies. China's large and rapidly aging population, rising healthcare expenses, and advancements in flexible electronics manufacturing make the country a central hub for digital health in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

In 2024, North America is the fastest-growing region in the digital tattoos market, with an estimated CAGR of 10.1% during the forecast period. Increasing demand for personalized healthcare, high adoption of advanced wearable tech, widespread adoption of advanced wearable devices, and strong investments that support the advancements in digital health solutions. The North American digital tattoos market is dominated by the US, owing to the advanced healthcare infrastructure, increasing penetration of wearable medical devices, and technical developments, such as implementing AI and IoT, and commercialization of digital tattoos in the U.S.

Europe is showing steady growth in the digital tattoos sector, which is also expected to grow in 2024 as technological advancements in the healthcare sector are boosting the demand for non-invasive and wearable health systems. In the U.K., the emphasis is on bringing advanced health technologies into the mainstream to achieve the best outcomes for patients. The region is home to strong healthcare systems and growing interest in personal healthcare solutions. The U.K.-based industry activity dominates the European market, owing to the robust healthcare infrastructure, increasing acceptance of wearable health devices, and consistent government funding of health tech innovations.

In 2024, the Middle East & Africa (MEA) and Latin America regions exhibit gradual growth throughout the forecast period, mainly attributed to the positive outlook for healthcare technologies and investment in these regions. Countries, such as the UAE are seeing a rise in demand for wearable health technologies, especially in urban areas with essential healthcare infrastructure and innovative culture, in the MEA region. Also, Brazil has a growing inclination for digital tattoos due to economic viability to solve health monitoring problems in Brazilian urban and rural areas, showing the expansion of its health sector, paving the way to adopt wearable health technologies.

Key Players:

The Digital Tattoos Market companies are MC10 Inc., Google (Alphabet), VivaLNK, Wearable X, Chaotic Moon, Xsensio, Epidermal Electronics Lab, Rogers Corporation, Tattoos Alive, iSkin Technologies, and others.

Recent Developments:

-

In March 2024, MC10 Inc. could be ranked on the same platform in the digital tattoos market by accounting for 20–25% of the industry. They continue to work on bio-integrated wearable sensors and smart tattoos to monitor health and track biometrics in real-time.

-

In March 2024, Google LLC partnered with VivaLNK, Inc. to introduce new digital tattoo technology, enhancing its health monitoring capabilities. Bringing Real-Time Health Data Using This collaboration integrates VivaLNK showable sensors with Google's information analytics to be able to sell real-time health data. Roughly USD 50–60 million, over a 5–7-year partnership

-

In March 2024, the company VivaLNK, in partnership with Google LLC, will attempt to combine its wearable sensor technology with Google's data analytics to improve real-time health monitoring via digital tattoos. This effort is part of a wider push towards developing medical-grade digital tattoos and wireless biometric sensors for remote patient monitoring.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.57 Billion |

| Market Size by 2032 | USD 8.50 Billion |

| CAGR | CAGR of 8.09% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Nano Tattoo, Graphene Tattoo, Living Tattoo, and Others) • By Application (Experiment and Research, Teaching, Commercial, Medical, Electronic, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | MC10 Inc., Google (Alphabet), VivaLNK, Wearable X, Chaotic Moon, Xsensio, Epidermal Electronics Lab, Rogers Corporation, Tattoos Alive, iSkin Technologies, and Others. |