Fuel Dispenser Market Report Scope & Overview:

To get more information on Fuel Dispenser Market - Request Free Sample Report

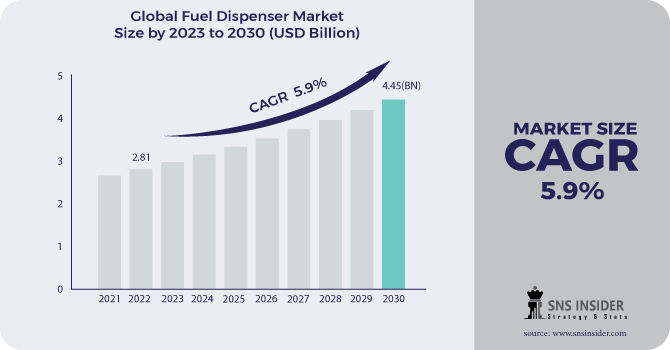

The Fuel Dispenser Market was valued at USD 2.83 billion in 2023 and is expected to reach USD 4.38 billion by 2032, with a growing CAGR of 4.98% over the forecast period 2024-2032. This report offers unique insights into the fuel dispenser market by focusing on operational efficiency, maintenance metrics, and downtime analysis. It examines technological advancements in dispensers, highlighting regional trends in digital adoption and automation. The report also covers global trade patterns, emphasizing the dynamics of exports and imports. Additionally, it explores emerging eco-friendly innovations in dispenser design and the growing trend of integrating advanced monitoring systems for improved performance and reliability.

MARKET DYNAMICS

DRIVERS

The growth in global fuel demand, especially in emerging economies, drives the need for more advanced and diverse fuel dispensers for both petroleum and alternative fuel sources.

The growth in fuel demand is a key driver for the fuel dispenser market, as global energy consumption continues to increase, particularly in emerging economies. Fuel demand is simultaneously growing, with fast-industrializing and urbanizing impacted areas similar to India, China, and other creating areas. This is leading to an increased demand for efficient and reliable fuel dispensing infrastructure, capable of handling a variety of energy sources, including petroleum as well as alternative fuel sources like CNG, LPG and hydrogen. Moreover, the increasing shift toward sustainable energy is propelling a heightened emphasis on dispensers for alternative fuels thar help accelerate the transition toward clean energy solutions. These fuel dispensers are enhancing their offerings as demand for a wide variety of fuel types increases, with multi-fuel dispensing capabilities and eco-friendly technologies. This combination of rising fuel demand and emerging fuel types offers significant growth potential for the fuel dispenser market in the coming years.

RESTRAINT

The high initial investment required for advanced fuel dispensers can deter small-scale fuel stations from adopting modern technology, limiting market growth.

The high initial investment required for the installation of advanced fuel dispensers is a major challenge in the market. Advanced fuel dispensers with features like touchless payment solutions, innovative monitoring, and compliance with stringent safety and environmental standards usually come at a higher price. This kind of capital expenditure represents a barrier for small or independent fuel station owners who do not have the funds to build this infrastructure. Installation, customization, and infrastructure updates to support this further adds to the expense. This may result in minor operators delaying or avoiding the implementation of recent fuel dispensers, hence affecting their meeting with master stations that are implementing the latest technology. This factor is particularly limiting in regions where fuel consumption is high, but small operators dominate the market, thus slowing down overall market growth.

OPPORTUNITY

Smart fuel dispensers, leveraging IoT, AI, and machine learning, enable real-time monitoring, predictive maintenance, and enhanced fuel management, driving efficiency and improving customer experience.

Smart fuel dispensers, powered by the integration of IoT (Internet of Things), AI (Artificial Intelligence), and machine learning, are revolutionizing the fuel dispensing industry. The ability to collect data effectively and monitor operations in real-time is crucial, which these technologies provide, allowing operators to track fuel usage, dispenser performance, and customer behavior with a high level of precision. IoT connectivity not only allows dispensers to be remotely monitored and provides updates on the system's health but also triggers alerts when maintenance is required. Advanced analytics powered by AI and machine learning take this a step further by analyzing operational data to assess the health of the equipment, predict when an asset may fail, and enable scheduled maintenance, minimizing downtime and reducing repair costs. Additionally, these intelligent dispensers are capable of optimizing fuel management, enhancing transaction accuracy, and ensuring smooth customer experiences with contactless payments and personalized offers. As fuel stations continue to evolve, the adoption of smart dispensers not only boosts efficiency but also helps in maintaining compliance with environmental regulations and safety standards, positioning the market for substantial growth.

CHALLENGES

Regulatory challenges in the fuel dispenser market stem from the need to comply with varying safety, environmental, and operational regulations across different regions.

Regulatory challenges in the fuel dispenser market stem from the need to comply with a wide range of local, national, and international regulations. These rules regulate safety standards, environmental impact, precision of fuel measurements, and setup of fuel dispensers. Requirements can be different across each country or region, presenting a challenge for manufacturers looking to standardize their products across markets. Different regulations are in place regarding safety in handling such hazardous materials like fuel, controls and emission, adherence to energy preservation regulations and so forth. Naturally, they have to navigate regulatory developments for alternative fuels and environmental sustainability, infusing complexity as companies must adapt to changing requirements and ensure their products secure all the required certifications. Failure to abide by these requirements could lead to legal liabilities, fines, or postponed product approval, which may further complicate installation at fuel stations. As a result, manufacturers need to invest in research and adaptation to ensure their dispensers meet diverse regulatory demands in different regions.

SEGMENTATION ANALYSIS

By Fuel Type

The Petrol/Gasoline segment dominated with a market share of over 36% in 2023, owing to the dominance of gasoline in various applications, especially in the transportation industry. As the primary type of fuel for cars, motorcycles, and other vehicles around the world, gasoline provides an ever-present source of demand for fuel dispensers. Every gas station around the world is equipped with gasoline dispensers, and as a result, this segment holds the largest market share. Its widespread infrastructure and existing consumer base also play a role in its dominance. The accessibility, affordability, and extensive distribution networks of gasoline ensure that it continues to be the fuel of choice throughout the world. Despite the growth of alternative fuels, gasoline remains the dominant fuel type in terms of consumption, fueling the continued demand for fuel dispensers in this category.

By Dispenser System

The submersible systems segment dominated with a market share of over 76% in 2023, due to their cost-effectiveness and ease of installation. An in-tank system includes a pump directly inside the fuel tank, which helps eliminate any external plumbing complexity. In turn, reducing the volume required at the dwindling gas station, this configuration helps lower installation costs, thus allowing it to be deployed in both new and retrofit installations. Submersible systems are also reliable, because the pump stays immersed in the fuel, preventing the pump from burning out and wearing. This type of arrangement facilitates effective fuel dispensing and has lower maintenance requirements, making it an attractive option for modern fueling stations seeking operational efficiency and long-term cost savings.

By Flow Meter

The Electronic segment dominated with a market share of over 68% in 2023, due to their superior accuracy and reliability compared to mechanical flow meters. these systems measure the fuel flow accurately to ensure that customers are being supplied the exact amount of fuel required to maintain insurance regulations and customer satisfaction. Moreover, electronic flow meters come with special features such as real-time data collection, which on the other hand allows remote monitoring and analytics. They also facilitate automated calibration, minimizing manual adjustments and the potential for human error. As a result, these electronic flow meters help optimize the process of fueling stations by streamlining transactions through digital payment systems. Their ability to offer these benefits has made electronic flow meters the preferred choice in the market.

.png)

Need any customization research on Fuel Dispenser Market - Enquiry Now

KEY REGIONAL ANALYSIS

The Asia-Pacific region dominated with a market share of over 38% in 2023, due to high fuel demand, rapid urbanization, and expanding transportation infrastructure. As for the growth of vehicle ownership, it continues in regions such as China, India and Southeast Asia thus also increasing fuel consumption. The increasing availability of fuel stations combined with the government's investments in energy infrastructure are expected to drive the growth of the market. The presence of major fuel dispenser manufacturers, including Censtar and Beijing Sanki, further establishes the region's leadership. Rising industrialization and economic growth also play a significant role in creating demand for superior fueling solutions. The demand for alternative fuels such as CNG and LNG is leading to the evolution of fuel dispenser technology in the Asia-Pacific, which is the largest market for conventional as well as next-generation fuel dispensers.

Europe is the fastest-growing region in the fuel dispenser market, primarily driven by the transition toward alternative fuels such as electric, hydrogen, and biofuels. As the world moves toward greener and more sustainable energy alternatives, fuel dispensers are adapting to the developing need for these new fuels. Emerging regulations for environmental compliance in the region are also stimulating the development of sophisticated fueling technologies that can satisfy both environmental requirements and consumer expectations. The growing trend towards digital and smart fuel dispensers that provide better efficiency, advanced payment solutions, and fuel management is also leading to a rise in sales in Europe. This shift toward innovation and sustainability, coupled with regulatory support, is positioning Europe as a key player in the rapidly growing fuel dispenser market.

Some of the major key players of the Fuel Dispenser Market

-

Bennett pump Company (Fuel Dispensers, Retail & Commercial Fueling Systems)

-

Censtar Science & Technology Corp. (Fuel Dispensers, LPG Dispensers, CNG Dispensers)

-

Dover Corporation (Wayne Fueling Systems, Tokheim Dispensers, Clean Energy Solutions)

-

Gilbarco Inc. (Fuel Dispensers, DEF Dispensers, Point-of-Sale Systems)

-

KoreaEnE (Fuel Dispensers, LPG Dispensers, CNG Dispensers)

-

LanFeng Co., LTD. (Fuel Dispensers, LPG Dispensers, Payment Systems)

-

Sankipetro (Fuel Dispensers, Refueling Systems, Fueling Nozzles)

-

Scheidt & Bachmann Tubs d.o.o. (Fuel Dispensers, Payment Systems, Fleet Management)

-

TATSUNO Corporation (Fuel Dispensers, CNG Dispensers, Payment Terminals)

-

TOMINAGA MFG CO. (Fuel Dispensers, LPG Dispensers, Fueling Equipment)

-

Wayne Fueling Systems (Helix Fuel Dispensers, DEF Dispensers, Retail Fueling Solutions)

-

Tokheim (Quantium Fuel Dispensers, Payment Systems, AdBlue Dispensers)

-

Piusi S.p.A. (Diesel Dispensers, DEF Dispensers, Flow Meters)

-

Neotec (Fuel Dispensers, CNG Dispensers, Tank Gauging Systems)

-

Beijing SANKI Petroleum Technology Co., Ltd. (Fuel Dispensers, LPG Dispensers, Automatic Tank Gauging)

-

Jiangsu Furen Group (Fuel Dispensers, LPG Dispensers, Metering Systems)

-

Midco Limited (Fuel Dispensers, CNG Dispensers, Industrial Pumps)

-

Petrotec Group (Fuel Dispensers, Payment Systems, Fleet Management Solutions)

-

Zhejiang Lanfeng Machine Co., Ltd. (Fuel Dispensers, CNG Dispensers, Fuel Nozzles)

-

Sanki Global Mexico (Fuel Dispensers, Payment Systems, Retail Fueling Equipment)

Suppliers for (for gasoline, diesel, alternative fuels ) on Fuel Dispenser Market

-

Gilbarco Veeder-Root

-

Dover Fueling Solutions

-

Tatsuno Corporation

-

Scheidt & Bachmann GmbH

-

Piusi S.p.A.

-

Censtar Science & Technology Corp., Ltd.

-

Beijing Sanki Petroleum Technology Co., Ltd.

-

Korea EnE Co., Ltd.

-

Bennett Pump Company

-

LanFeng Co., Ltd.

Dover Corporation-Company Financial Analysis

RECENT DEVELOPMENT

In May 2024: SANKI showcased its AIoT-powered Skyline series fuel dispenser and introduced other products like the upgraded Prime series dispenser, fuel tank ATG, cloud platform FMS, and charging piles at UNITI Expo 2024. The Skyline series, with built-in cloud services, gained attention for its adaptability to various network environments.

In May 2024: Dover Fueling Solutions (DFS) launched RDM by DFS, a remote diagnostics and management solution for fuel dispensers, available in the Europe, Middle East, and Africa region. This module, compatible with Wayne Helix dispensers, enables enhanced OEM data collection and remote monitoring via DX Monitor.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.83 Billion |

| Market Size by 2032 | USD 4.38 Billion |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fuel Type (Petrol/Gasoline, Diesel, CNG, Others) • By Dispenser System (Submersible System, Suction System) • By Flow Meter (Mechanical, Electronic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bennett Pump Company, Censtar Science & Technology Corp., Ltd, Dover Corporation, Gilbarco Inc., KoreaEnE, LanFeng Co., LTD., Sankipetro, Scheidt & Bachmann Tubs d.o.o., TATSUNO Corporation, TOMINAGA MFG CO., Wayne Fueling Systems, Tokheim, Piusi S.p.A., Neotec, Beijing SANKI Petroleum Technology Co., Ltd., Jiangsu Furen Group, Midco Limited, Petrotec Group, Zhejiang Lanfeng Machine Co., Ltd., Sanki Global Mexico |