Coiled Tubing Market Report Scope & Overview:

The Coiled Tubing Market size was valued at USD 4.01 Billion in 2025E. It is expected to grow to USD 6.50 Billion by 2033 and grow at a CAGR of 6.21% over the forecast period of 2026-2033.

The global coiled tubing market is expanding significantly, fueled by advancements in oil recovery technologies and increased environmental regulations. This growth is driven by the rising adoption of Enhanced Oil Recovery (EOR) techniques, such as thermal recovery, gas injection, and chemical injection, which utilize coiled tubing for efficient well intervention and fluid management. A recent development that underscores the importance of technological innovation is the U.S. Department of Energy’s (DOE) announcement of up to $30 million in funding for technologies aimed at reducing methane emissions from natural gas flaring.

Market Size and Forecast:

-

Market Size in 2025E: USD 4.01 Billion

-

Market Size by 2033: USD 6.50 Billion

-

CAGR: 6.21% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Coiled Tubing Market - Request Free Sample Report

Key Coiled Tubing Market Trends

-

Increasing well intervention & maintenance in mature oilfields

-

Rising deployment in unconventional resources (shale, tight gas/oil)

-

Growing offshore and deepwater exploration & production activities

-

Advancements in coiled tubing materials and manufacturing technologies

-

Integration of digitalization, real-time monitoring, and automation

-

Heightened environmental and regulatory compliance requirements

-

Strong focus on cost efficiency and operational productivity

The U.S. Coiled Tubing market size was valued at an estimated USD 1.55 billion in 2025 and is projected to reach USD 2.55 billion by 2033, growing at a CAGR of 6.1% over the forecast period 2026–2033. Market growth is driven by increasing shale gas exploration and production activities, rising demand for cost-effective and efficient well intervention techniques, and the expanding number of mature oil and gas fields requiring maintenance and optimization. Growing adoption of coiled tubing for drilling, well cleanouts, and stimulation operations, along with technological advancements in high-strength tubing materials and real-time monitoring systems, is supporting market expansion. Additionally, strong upstream investments, supportive energy policies, and the presence of major oilfield service providers continue to reinforce the growth outlook of the U.S. coiled tubing market during the forecast period.

Coiled Tubing Market Growth Drivers

- Increased investments and exploration and production efforts are propelling the growth of the coiled tubing market.

The worldwide coiled tubing market is seeing substantial expansion due to higher investments in exploration and production (E&P) and increased efforts to explore hydrocarbon resources. Operators are making significant investments in drilling and production operations to fulfill the increasing demand for oil and gas and meet energy requirements. The increase in investments is especially noticeable in the United States, as it has placed a strong emphasis on the tight oil industry in order to become a top producer of global oil and gas. The U.S. Energy Information Administration (EIA) reported that around 3.04 billion barrels (equivalent to 8.32 million barrels per day) of crude oil were extracted from tight-oil sources in the U.S. in 2023, accounting for roughly 64% of the nation's total crude oil output that year.The DPR emphasizes how the oil and gas industry can change rapidly, with rig productivity metrics varying greatly based on active rigs and well completions. The DPR's methods for smoothing data consider fluctuations in production caused by factors like weather and market issues, highlighting the importance of dependable drilling technologies (DPR). Coiled tubing is essential for enabling well intervention and drilling operations. Utilization in hydraulic fracturing, well stimulation, and work over operations is crucial for hydrocarbon production, making it indispensable. The technology offers an affordable way to maintain and improve production rates, crucial for meeting rising energy needs and optimizing resource extraction. The coiled tubing market is anticipated to experience significant benefits as the industry grows and invests in new technologies. Advancements in coiled tubing technology are expected to aid in the effective and affordable extraction of oil and gas.

- Increasing need for well intervention services drives growth of coiled tubing market.

The well intervention sector is expected to lead the coiled tubing market, due to the rising need for specialized services in older and developing oil fields. Coiled tubing services are highly valued for well intervention operations because of their ability to efficiently complete various tasks, including stimulation, re-perforation, fluid pumping, fishing, sand control, and zonal isolation. The increasing investment in improving well performance and cleaning operations is also driving this demand. With the depletion of oil and gas reservoirs, the demand for completion and mechanical operations such as fishing, perforation of producing wells, scale removal, and setting plugs or packers is on the rise. These actions are crucial for maintaining and increasing production from current wells, particularly in mature offshore areas like those in the Gulf of Mexico and onshore areas throughout the United States. Ongoing exploration and production operations in areas abundant in shale gas in North America and Asia-Pacific offer potential long-term prospects for coiled tubing services. North America is in the lead when it comes to the significant amount of coiled tubing units, showing the high demand. In 2019, North America had 665 coiled tubing units, of which 432 were located in the United States. The market's expansion is also shown through important contracts, like Ukrgasvydobuvannya JSC's July 2020 tender for coiled tubing and nitrogen-compressor equipment services, emphasizing the essential role of coiled tubing in contemporary well intervention. Therefore, the growing need for effective well intervention activities in mature fields is a major factor pushing the expansion of the coiled tubing market, establishing its importance as a vital service in the oil and gas sector.

Coiled Tubing Market Restraints

- Effects of Fluctuating Crude Oil Prices and Expensive Maintenance on the Coiled Tubing Industry

The coiled tubing market is encountering major difficulties because of the fluctuations in crude oil prices and the expensive upkeep linked with these services. Changes in global market conditions, policy shifts, and supply and demand dynamics strongly impact fluctuations in crude oil prices. For example, sudden and unpredictable fluctuations in oil prices can be triggered by factors such as geopolitical tensions, regulatory changes for environmental protection, and shifts in global energy consumption patterns. These changes in prices have a direct effect on how profitable and how much money oil and gas companies can invest, causing them to decrease their exploration and production work. In periods of low oil prices, companies frequently reduce non-essential activities such as well interventions and services that depend on coiled tubing. Also, the expenses related to coil tubing operations maintenance are significantly high, covering costs for equipment maintenance, skilled workers, and necessary Service s needed to guarantee the safe and effective provision of these services. In a volatile market, low profit margins make it challenging for service providers to either absorb or transfer these expenses to clients, making them especially burdensome. As a result, the coiled tubing market's growth is limited by the combination of fluctuating crude oil prices and expensive maintenance costs. Businesses might choose to postpone or scrap scheduled well interventions, cut back on maintenance activities, or look for cheaper options, all of which could result in a decrease in the need for coiled tubing services. In order to stay competitive in a volatile market, the coiled tubing market needs to find ways to lower costs and improve efficiency while facing economic challenges in the oil and gas industry.

- Operational risks and safety regulations limit the expansion of the coiled tubing market.

The coiled tubing market encounters major obstacles because of the risks involved in coiled tubing operations and the strict regulations regarding operational safety. Coiled tubing is defined by its thin-walled tubing, prone to bending and straightening while enduring high internal pressure. This constant pressure can worsen even small defects in the tubing, whether they are due to corrosion, physical harm, or production imperfections. Research indicates that the majority of coiled tubing string failures in the last twenty years, between 80 to 90%, were caused by corrosion, mechanical damage, human error, and manufacturing problems. The tubing's susceptibility to corrosion, due to its thin walls, may result in critical malfunctions while in use. Additionally, inadequate handling or exposure to harsh conditions can lead to mechanical damage, thereby heightening the likelihood of failure. Potential failures can create safety risks and lead to substantial financial losses from both downtime and equipment replacement costs. Furthermore, the oil and gas sector must adhere to strict government safety regulations, such as those imposed by OSHA in the US, which require strict compliance with safety standards during operations. Although necessary for worker safety and environmental protection, these regulations increase operational costs and complexity for companies offering coiled tubing services. Adhering to these rules typically involves significant spending on safety education, machinery upkeep, and following strict operational procedures, all of which can impact the profitability of coiled tubing activities.

Coiled Tubing Market Segment Analysis

By Medium

Based on medium, Well Intervations & Production capture the largest share in coiled tubing market with 70% of share in 2025. The dominance of this segment highlights how important it is for improving the efficiency and flexibility of oil and gas extraction. Coiled tubing, a lengthy pipe of small diameter, is commonly used in well interventions for tasks like cleanouts, plug removals, and stimulations to maintain and enhance well performance. The technology's capacity to offer immediate, on-the-move interventions with little set-up time makes it the preferred option for enhancing well production. Schlumberger and Halliburton are at the forefront of the market, providing cutting-edge coiled tubing solutions that improve operational efficiency and safety. Schlumberger's SPECTRUM Coiled Tubing services incorporate state-of-the-art materials and live monitoring to enhance dependability and prolong the lifespan of well interventions. Halliburton's HydraRite Coiled Tubing technology provides strong solutions for intricate interventions, such as high-pressure tasks and deep well uses, solidifying its dominance in the market. The industry's expansion is propelled by rising worldwide need for hydrocarbon resources and the necessity for economical, effective production methods. The flexibility of coiled tubing enables various uses, such as hydraulic fracturing and acidizing, making it an appealing choice for operators looking to improve their production methods. This substantial market share indicates the crucial role that well interventions and production play in the coiled tubing industry, underscoring its significance in contemporary oil and gas activities.

By Location

Based On Location, Onshore is dominate the Coiled Tubing Market with 60% of share in 2025. The strong growth of domestic shale gas and tight oil reserves, especially in areas like North America, where advancements in hydraulic fracturing and horizontal drilling have transformed onshore oil and gas production, is a major factor in this dominance. The increase in oil and gas extraction has led to a need for coiled tubing services, crucial for improving productivity and maximizing yields from current wells. Onshore operations are a more appealing choice for operators due to their cost-effectiveness when compared to offshore projects. Expenses for onshore wells, such as land acquisition, drilling, completion, facilities, processing, and transportation, are easier to handle compared to the costly nature of offshore projects. Nevertheless, numerous land-based oilfields, with a production history of more than 150 years, are currently encountering faster depletion rates. The decrease in production has forced operators of assets to make significant investments in recovery techniques and interventions on wells to maximize output and prolong the lifespan of these fields. Coiled tubing is essential for activities like well cleanouts, acidizing, and stimulation, which help to maintain and improve production levels. Baker Hughes and Weatherford International have been leading the way by offering specialized coiled tubing services designed for the specific obstacles of land-based fields. An example is Baker Hughes' CoilTrak™ Coiled Tubing Services, which provide accuracy and effectiveness in well intervention to assist operators in reaching maximum production levels. As land-based oil fields get older and run out of resources, the need for coiled tubing in land-based operations is predicted to stay high, underscoring its important position in the worldwide energy industry.

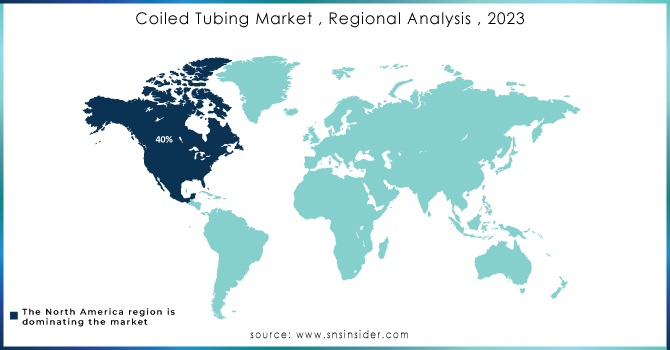

Coiled Tubing Market Regional Analysis

North America Coiled Tubing Market Insights

North America dominate the Coiled Tubing Market with 40% of share in 2025. The region's dominance is attributed to the substantial growth of shale gas and tight oil reserves, leading to a notable rise in the need for coiled tubing services. The United States has been leading the way in this market expansion, largely due to its advancements in technology related to hydraulic fracturing and horizontal drilling. Discoveries in areas such as the Permian Basin, Bakken Shale, and Eagle Ford Shale have provided North America with abundant oil and gas resources, solidifying its position as a major player in the global energy industry. The increased oil and gas production in North America has created a higher demand for well intervention and stimulation services, with coiled tubing being essential. Coiled tubing is extensively utilized in a range of activities such as well cleaning, acid treatment, fracturing, and drilling, playing a crucial role in boosting well performance. As the production of shale oil and gas has increased, the demand for these services has also gone up, strengthening the coiled tubing market in the area. Key players in North America, like Halliburton, Schlumberger, and Baker Hughes, have played a crucial role in propelling the market's expansion. These companies provide various coiled tubing services and technologies tailored to address the specific obstacles of oilfields in North America. Schlumberger's ACTive Services offer live downhole readings while coiled tubing is in operation, allowing operators to use data to improve production efficiency. Likewise, Halliburton's Frac Express™ Coiled Tubing Unit is created for effectively executing high-pressure fracturing and well intervention tasks, specifically for the unconventional resource market.

Europe Coiled Tubing Market Insights

Europe is holding second largest market share in coiled Tubing market in 2025. The growing demand for effective well intervention and enhanced oil recovery (EOR) methods in mature North Sea fields, which have been producing oil and gas for many years, is the main factor behind this substantial market share. As these fields near the end of their productive life, the need for coiled tubing services has increased, as operators aim to optimize production and prolong the life of their assets. Coiled tubing is extremely beneficial in these situations due to its capacity to carry out a range of tasks below the surface, such as cleanouts, acid stimulation, and nitrogen lifting, without requiring a complete rig. This results in lower operational expenses and downtime. Nations such as the United Kingdom, Norway, and the Netherlands have been leading the way in implementing advanced coiled tubing technologies to tackle the issues of decreasing production rates and the intricate geology of the North Sea. The dedication to innovation and the utilization of advanced technologies in the area have greatly contributed to sustaining and potentially improving production levels in these well-established fields. For example, Altus Intervention, a top service provider in the area, has created customized coiled tubing solutions designed for the specific needs of the North Sea environment, such as interventions in highly deviated wells and operations in challenging offshore conditions. Additionally, the strict environmental regulations in Europe have also encouraged the use of coiled tubing, as it provides a more eco-friendly alternative to conventional drilling and intervention methods by emitting fewer emissions and having a smaller surface footprint.

Asia Pacific Coiled Tubing Market Insights

The Asia Pacific Coiled Tubing Market is experiencing robust growth in 2025, driven by rising oil and gas exploration and production activities across China, India, and Australia. Rapid industrialization and increasing energy demand are pushing operators to invest in well intervention and stimulation services. Additionally, the presence of large unconventional reserves, coupled with growing offshore field development projects, is accelerating adoption. Government initiatives to enhance domestic hydrocarbon production and reduce import dependency are further fueling regional market expansion.

Latin America (LATAM) Coiled Tubing Market Insights

The LATAM Coiled Tubing Market is steadily gaining momentum in 2025, supported by increased drilling and completion operations in Brazil, Mexico, and Argentina. The region’s rising focus on revitalizing mature oilfields and developing deepwater resources is driving demand for coiled tubing services. Local service providers are partnering with international players to leverage advanced coiled tubing technologies, while favorable government policies and energy sector reforms are encouraging investments in upstream oil and gas activities.

Middle East & Africa (MEA) Coiled Tubing Market Insights

The MEA Coiled Tubing Market holds a strong position in 2025, fueled by the region’s abundant hydrocarbon reserves and ongoing investments in upstream oilfield development. Countries such as Saudi Arabia, the UAE, and Qatar are leading adopters, utilizing coiled tubing for well intervention, cleanouts, and stimulation operations. The expansion of onshore and offshore exploration projects, combined with government-led diversification efforts and growing demand for enhanced oil recovery (EOR) techniques, is expected to further boost market growth across the region.

Need any customization research on Coiled Tubing Market - Enquiry Now

Coiled Tubing Market Competitive Landscape

Halliburton

Halliburton is one of the world’s largest oilfield services companies, providing products and services for exploration, development, and production of oil and natural gas. The company operates in over 70 countries, delivering solutions across drilling, evaluation, completion, production, and intervention stages to enhance reservoir performance and maximize recovery.

-

In May 2025, Halliburton unveiled the installation of an extensive coiled tubing intervention system at its New Iberia Training Facility in Louisiana. This system features Halliburton's V135HP coiled tubing injector, a reel with a capacity to hold 36,000 feet of 2-3/8-inch coiled tubing, and a tension lift frame with a 750-ton capacity, making it the largest, most powerful, and robust system ever deployed.

Baker Hughes

Baker Hughes is a leading energy technology company that provides solutions for energy and industrial customers worldwide. It offers products and services for oilfield services, oilfield equipment, turbomachinery, digital solutions, and energy transition technologies, focusing on efficiency, productivity, and lower carbon emissions.

-

In December 2025, Baker Hughes announced its intention to acquire wells specialist Altus in March, taking on the company’s 1,200 employees, including over 500 based in Portlethen near Aberdeen, to strengthen its well services and intervention capabilities.

Coiled Tubing Market Key Players

-

Halliburton

-

Weatherford International plc

-

Calfrac Well Services Ltd.

-

Step Energy Services Ltd.

-

Oceaneering International, Inc.

-

Trican Well Service Ltd.

-

Archer Limited

-

Superior Energy Services, Inc.

-

C&J Energy Services (part of NexTier Oilfield Solutions)

-

Pioneer Energy Services Corp.

-

RPC, Inc. (Cudd Energy Services)

-

Nabors Industries Ltd.

-

Precision Drilling Corporation

-

Welltec A/S

-

DeepWell Services

-

ProPetro Holding Corp

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.01 Billion |

| Market Size by 2033 | USD 6.50 Billion |

| CAGR | CAGR 6.21% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Well Intervention & Production [Well Completion, Well Cleaning, Others], Drilling, Others) • By Operation (Circulation, Pumping, Logging, Perforation, Others) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Altus Intervention, Calfrac Well Services Ltd., Baker Hughes Company, Halliburton, Step Energy Services, Key Energy Services, Llc., Oceaneering International, Inc., Schlumberger Limited, Trican, Weatherford International Plc |