Cold Pain Therapy Market Report Scope & Overview:

Get More Information on Cold Pain Therapy products Market - Request Sample Report

The Cold Pain Therapy Market Size was valued at USD 1.91 billion in 2023, and is expected to reach USD 2.96 billion by 2032, and grow at a CAGR of 5% over the forecast period 2024-2032.

The ageing population, rising healthcare costs, and rising consumer awareness of cold pain therapy products are all contributing to the significant rise of the worldwide cold pain therapy market. A rise in creative products is another factor. Releases, a surge in traffic accidents, and sport-related injuries worldwide are all contributing to the market's expansion.

Based on product, the OTC sector dominates the global market for cold pain therapy due to its accessibility, lack of a prescription from a doctor, and simplicity of usage. The availability of several pain relief solutions on the market has contributed to the popularity of cold pain therapy goods. Cold packs, rolls, cooling towels, lotions, gels, ointments, sprays, creams, and both motorised and non-motorised devices are among these items.

Products in this category include cooling towels, cold packs, rolls, lotions, gels, ointments, sprays, and both motorised and non-motorised devices. According to the application, the musculoskeletal disorders market dominates the whole world because of the rise in cases of arthritis, osteoarthritis, joint pain, and back pain. It is anticipated that the makers of items for cold pain therapy will see better growth prospects due to the emerging countries' quick expansion and technical advancements in the creation of more efficient products. The main barriers to the expansion of the worldwide market, however, are the high cost of prescription-based goods, a lack of reimbursement, and the health risks connected with the use of products for cold treatment.

MARKET DYNAMICS

DRIVERS

-

Rising Prevalence of Musculoskeletal Disorders

-

Increasing Awareness of Non-Pharmacological Pain Relief

RESTRAIN

-

Increasing competition from other non-invasive pain management therapies like heat therapy and TENS

OPPORTUNITY

-

Increasing development of smart cold therapy devices with features like temperature control, compression, and app connectivity

-

Increasing adoption of analgesic patches

A transdermal drug delivery system, which is a minimally intrusive method of administering medication via the skin, is included in analgesic patches. When applied to the skin, patches disperse analgesic medication over the dermis at a constant rate. Applying painkiller patches Compared to oral drugs, transdermal drug delivery methods provide a number of benefits.

CHALLENGES

-

Rise of counterfeit or substandard cold therapy products

IMPACT OF RUSSIA-UKRAINE WAR

Tariffs and Trade Barriers Trade restrictions and taxes on products and services between contending nations and their trading partners might come from geopolitical conflicts. These trade restrictions may limit the export and import of goods used in cold pain treatment, limiting their accessibility to markets and supply. Healthcare Infrastructure Challenges The continuous fighting may strain the region's healthcare system, taking resources and attention away from less urgent medical requirements like the use of cold pain treatment. Change in the Patient Population Conflict can cause migration and population displacement, which might alter patient demographics. This may affect the need for medical supplies, such as equipment for cold pain management, in both the afflicted areas and places where displaced people seek safety.

IMPACT OF ONGOING RECESSION

Consumers and healthcare professionals may become more price-sensitive during economic downturns and look for cheaper solutions for medical items, such as cold pain treatment devices. Product Innovation and Value-Driven Design Recessions can spur innovation as businesses work to provide more affordable and value-driven cold pain treatment goods to appeal to a price-sensitive consumer. Changes in employment and insurance policies during a downturn may affect patients' access to medical care and treatments, such as cold pain therapy. Public healthcare During recessions, spending on government healthcare programmes may be limited. This may have an impact on financing and reimbursement plans for medical equipment, which may have an impact on the uptake of goods for cold pain management.

Economic downturns can affect the supply chains for medical equipment, particularly those used in cold pain treatment, which could result in shortages or delayed availability.

KEY MARKET SEGMENTATION

By Product

-

OTC Products

-

Gels, Ointments, & Creams

-

Sprays & Foams

-

Patches

-

Roll-Ons

-

Cold Packs

-

Others

-

Prescription Products

-

Motorized Devices

-

Non-motorized Devices

By Application

-

Orthopedic Conditions

-

Post-operative Therapy

-

Post-trauma Therapy

By Distribution Channel

-

Hospital Pharmacy

-

Retail Pharmacy

-

E-Commerce

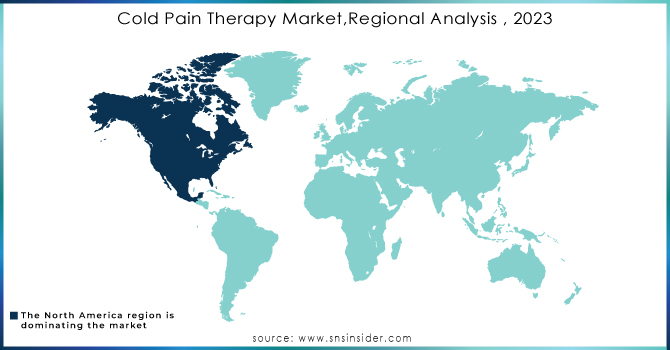

REGIONAL ANALYSIS

North America dominated the cold pain therapy market in 2023. In this region, a significant portion of the population suffers from conditions like arthritis or back pain, which cold therapy can effectively manage. The aging population, prone to chronic pain, also finds relief in cold therapy. The region's active lifestyle and sports culture lead to a high number of injuries, making cold therapy a popular recovery tool. For instance, in 2021, Breg, Inc. introduced the Polar Care Cube, a high-tech cold therapy system specifically designed for post-surgery pain relief. The growing popularity of cold therapy is further highlighted by its increasing use in professional sports leagues, where athletes utilize it for pain management and injury recovery.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major players are Beiersdorf AG, DJO Global, Inc, Hisamitsu Pharmaceutical Co., Inc., Ossur, Johnson & Johnson, Pfizer, Sanofi, Rohto Pharmaceutical, 3M, Cardinal Health Inc., Bird & Cronin, Compass Health Brands, Breg, Inc., Medline Industrie, Performance Health, Romsons Group of Industries, Unexo Life Sciences, Polar Products, Rapid Aid, Mueller Sports Medicines, Pic Solution, Bruder Healthcare Company, Brownmed Inc., Medichill, and others.

RECENT DEVELOPMENTS

Food and Drug Administration: April 2022, Enjaymo (sutimlimab-jome) infusion was given the go-ahead by the Food and Drug Administration to help individuals with cold agglutinin disease (CAD) avoid the requirement for blood transfusions caused by hemolysis (red blood cell breakdown).

Zixa: April 2022, Innovative oil-in-water FlashMicelle Technology with a dual-action formulation was introduced by Zixa Strong for quick relief from severe pain.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.91 Bn |

| Market Size by 2032 | US$ 2.96 Bn |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (OTC Products, Gels, Ointments, & Creams, Sprays & Foams, Patches) • By Application (Orthopedic Conditions, Post-operative Therapy, Sports Medicine, Post-trauma Therapy) • By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, E-Commerce) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Beiersdorf AG, DJO Global, Inc, Hisamitsu Pharmaceutical Co., Inc., Ossur, Johnson & Johnson, Pfizer, Sanofi, Rohto Pharmaceutical, 3M, Cardinal Health Inc., Bird & Cronin, Compass Health Brands, Breg, Inc., Medline Industrie, Performance Health, Romsons Group of Industries, Unexo Life Sciences, Polar Products, Rapid Aid, Mueller Sports Medicines, Pic Solution, Bruder Healthcare Company, Brownmed Inc., Medichill |

| Key Drivers | • Increasing usage of inexpensive painkillers for quick relief. |

| Market Restraints | • Ibuprofen, aspirin, and paracetamol, or acetaminophen, are the three most commonly used OTC analgesic medications |