Carrier Screening Market Overview:

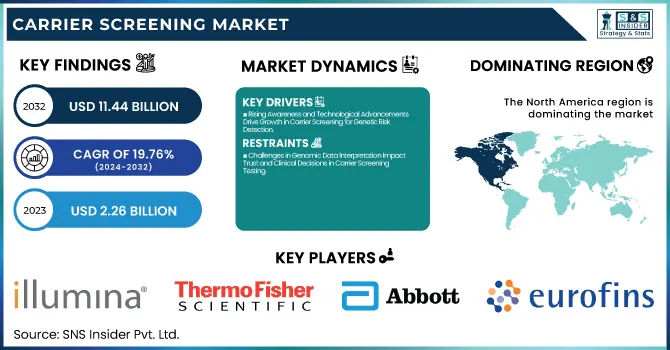

The Carrier Screening Market Size was valued at USD 2.26 Billion in 2023 and is expected to reach USD 11.44 Billion by 2032 and grow at a CAGR of 19.76% over the forecast period 2024-2032. Increased incidence and prevalence of genetic disorders due to changing risk factors and lifestyles and genetic compatibility disorders are the major factors driving the growth of the global carrier screening market as carrier screening assesses an individual to identify if they carry a gene mutation that when present with a respective partner may result in a genetic disorder. Carrier Screening Market in the U.S. is growing, owing to a rise in awareness of genetic disorders and advancements in testing technologies. Expanded panels are capable of screening for more than 200 genetic conditions and prenatal genetic testing is more frequently performed. This has led to growth with ACOG guidelines suggesting that all women contemplating pregnancy be offered carrier screening. Over 60% of U.S. healthcare providers provide expanded carrier screening in clinical practice, for example. Expanded carrier screening programs such as the California Genetic Disease Screening Program (GDSP) demonstrate how government-funded programs can facilitate access to carrier screening for many diverse populations.

To Get more information on Carrier Screening Market - Request Free Sample Report

U.S. Carrier Screening Market Size & Forecast

The U.S. carrier screening market was valued at USD 0.67 billion in 2023 and is estimated to expand at a CAGR of 18.26% over the forecast period. The growth can be attributed to the increasing prevalence of genetic disorders, the rise in the adoption of advanced screening technologies, and better healthcare infrastructure. This drives the market features the demand for early diagnosis and personalized medicine.

Carrier Screening Market Dynamics

Key Drivers:

-

Rising Awareness and Technological Advancements Drive Growth in Carrier Screening for Genetic Risk Detection

One important factor is growing awareness of genetic disorders and their possible effects on children. Increasing awareness around genetic disorders like cystic fibrosis, sickle cell anemia, and Tay Sachs disease has led to a higher demand for carrier screening to help you catch it early. Updates in technology for genetic testing, including next-generation sequencing (NGS) and expanded carrier screening panels, allow for increased accuracy of testing and improved risk assessment for couples planning pregnancy. Along with this, increasing government initiatives to support genetic counseling and screening programs, are accelerating the growth of the market. The greater occurrence of consanguineous marriages and pregnancies at an older age along with it cannot be overlooked, so carrier screening for genetic risk is more prominent than ever.

Restrain:

-

Challenges in Genomic Data Interpretation Impact Trust and Clinical Decisions in Carrier Screening Testing

The intricacy of Genomic data interpretation is one major restraint. Although advanced screening technologies uncover high-detail genomic data, translating these findings into actionable insights necessitates a level of expertise not available at every prenatal clinic. Patients could become unduly anxious or culminate in invasive investigations to rule out medical conditions due to misinterpretation of results. Moreover, false-positive or false-negative screening results also have an impact, which could affect clinical decisions as well as trust in this kind of testing.

Opportunity:

-

Advancements in Genomic Research and AI Fuel Growth and Accessibility of Carrier Screening Services

The carrier screening market is poised for continued growth as advances in genomic research and precision medicine drive new opportunities. The growth sectors comprise the developing economies that are investing in backbone healthcare infrastructure and jumpstarting health consciousness. Artificial intelligence (AI) is being incorporated into genetic data analysis efforts to improve risk prediction and screening. Direct-to-consumer (DTC) genetic testing is already being used to address these market shifts by expanding access to important carrier screening services. Partnerships between service providers and genetic testing companies are also paving the way for innovations, making carrier screening solutions, easier and cheaper to access.

Challenges:

-

Low Awareness and Ethical Challenges Hinder Global Adoption of Carrier Screening Despite Technological Advancements

A key challenge is the low awareness of and familiarity with carrier screening, especially in developing parts of the world. Failure to embrace screening — whether due to unfamiliarity with genetic risks or lack of early screening adoption, remains low within many populations. Genetic testing is subjected to many normative and societal ethical issues, including discrimination or privacy, thus making the market growth more complex. These include difficulties that healthcare professionals may also have in communicating carrier screenings appropriately with patients, especially in situations with cultural sensitivity. Additionally, the widespread introduction and implementation of these tests in clinical practice requires a high level of training and education for health practitioners, which is a major obstacle to the widespread uptake of these tests. These challenges can be overcome with better awareness campaigns, more accessible genetic counseling services, and the uptake of new technologies that streamline result interpretation.

Carrier Screening Market Segmentation Analysis

By Type

Expanded carrier screening held a leading market share in 2023 and will grow at a faster CAGR between 2024 and 2032. It is mainly attributed to the ability of genetic screening to test for an increased number of genetic conditions in a single test, making it the preferred option for healthcare providers and patients. Expanded carrier screening provides greater scope to identify several genetic mutations, which facilitates early risk identification. Next-generation sequencing (NGS), an advanced technology for rapid genome sequencing has allowed for even faster and greater accuracy expanded carrier screening, solidifying its place as the leading carrier and reproductive screening method in the industry. Moreover, increasing awareness regarding genetic disorders, along with the availability of advanced screening pathways, propels the market growth. The market is further propelled by healthcare providers increasingly incorporating expanded carrier screening into the provision of routine prenatal and preconception care.

By Medical Conditions

The high prevalence of spinal muscular atrophy (SMA) along with the easy availability of genetic screening methods are drivers for this market leading to a larger share of the carrier screening market for spinal muscular atrophy (SMA) in 2023. SMA is a debilitating, genetic disease that causes motor neurons to die leading to progressive muscle weakness. SMA is busted to be one of the most making the screening instrument market due to the early detection through carrier screening which is vital in counseling and preventive care.

The Cystic Fibrosis segment is projected to show the fastest CAGR from 2024 to 2032. Cystic fibrosis, an inherited disease that primarily affects the lungs and digestive system, is being identified and diagnosed more often thanks to greater awareness and improvements in screening technology. With the addition of new treatments, also the demand for CF carrier screening will rapidly grow on the backdrop of increasing implementation of CF screening of newborns as an integral part of regular screening at the healthcare providers' end.

By Technology

Carrier screening market share in 2023 is driven by high accuracy, efficiency, and ability to detect a wide range of genetic mutations, DNA sequencing dominated the carrier screening market share. It has the potential to analyze genetic material as a whole and provide high-resolution functional information about the genetic pathways involved in the expression of an inherited condition. DNA sequencing is a widely utilized approach for carrier screening because of its ability to detect even low-frequency and complicated genetic variants. Next-generation sequencing (NGS) driven testing is paving the way for faster, cheaper tests. Carrier screening is continuously advancing with DNA sequencing due to, respectively, increased demand in personalized medicine and predictive medicine in the coming age.

By End-user

In 2023, the carrier screening market share was mainly dominated by the laboratory segment owing to high infrastructure, focusing on professionals, infrastructure, and other testing facilities. With advanced technologies like next-generation sequencing (NGS), polymerase chain reaction (PCR), etc., laboratories provide exact genetic readings. Such facilities offer comprehensive carrier screening tests, from wider panels to personalized test options, improving the diagnostic yield. Secondly, labs have high-quality control standards to keep the quality of the results. In hospitals and clinics, laboratory-based testing has become more appealing, and partnerships between diagnostic labs and healthcare facilities are on the rise, which has also contributed to this segment's market leadership.

Carrier Screening Market Regional Insights

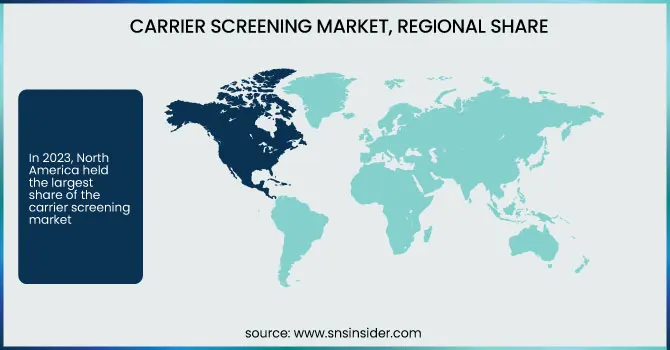

In 2023, North America held the largest share of the carrier screening market, owing to the presence of advanced healthcare systems, an increasing inclination of individuals toward genetic disorders, and a proclivity for advanced screening technologies. This is one of the main drivers of this dominance, having many healthcare institutions and diagnostic laboratories that provide screening tests for a vast variety of carriers. In practice, this is also seen in the much more prevalent implementation of expanded carrier screening in clinical settings, like tests from Invitae and Counsyl (both now Labcorp), In addition, initiatives by governments such as the recommendations for genetic testing from the U.S. Centers for disease Control and Prevention have led to the increased uptake of carrier screening services. In addition, North America has emerged as a leader in the market due to the emphasis on personalized healthcare.

Asia Pacific is estimated to experience the highest growth from 2024-2032. Healthcare breakthroughs and gene testing awareness are rapidly growing in this region. As genetic testing becomes more accessible, the demand for carrier screening is growing rapidly in countries such as China and India. China's BGI Group and India’s MedGenome, for instance, are adding to their genetic screening services. Furthermore, the growing burden of inherited diseases, along with the development of healthcare infrastructure and specific government initiatives, is anticipated to drive the market in Asia Pacific during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Carrier Screening Market

-

Illumina (TruSight Carrier Screening)

-

Thermo Fisher Scientific (CarrierSeq)

-

Abbott Laboratories (Verifi Prenatal Test)

-

Roche (KARTOS Carrier Screening)

-

Danaher (Ion Torrent Genexus System)

-

Eurofins Scientific (NTD's Genetic Carrier Screening Panels)

-

Natera (Horizon Carrier Screening)

-

Fulgent Genetics (Beacon Carrier Screening Test)

-

Myriad Genetics (Foresight Carrier Screen)

-

GeneTech (Comprehensive Carrier Screening Gene Panel)

-

BGI Genomics (VISTA Carrier Screening)

-

Sequenom (MaterniT21 PLUS)

-

OPKO Health (Pan-ethnic Carrier Screening)

-

Ambry Genetics (eCLIPSE™ Expanded Carrier Screen)

-

Invitae Corporation (Carrier Screening Panel)

Recent Developments and Trends

-

In June 2024, Illumina’s DRAGEN v4.3 introduces industry-leading innovations, including a pangenome reference and AI-powered variant calling, delivering the most comprehensive and accurate genomic analysis.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.26 Billion |

| Market Size by 2032 | USD 11.44 Billion |

| CAGR | CAGR of 19.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Expanded Carrier Screening, Targeted Disease Carrier Screening) • By Medical Conditions (Cystic Fibrosis, Tay-Sachs, Gaucher Disease, Sickle Cell Disease, Spinal Muscular Atrophy, Other) • By Technology (DNA Sequencing, Polymerase Chain Reaction, Microarrays, Other) • By End-user (Hospitals, Laboratories, Physician Offices & Clinics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Thermo Fisher Scientific, Abbott Laboratories, Roche, Danaher, Eurofins Scientific, Natera, Fulgent Genetics, Myriad Genetics, GeneTech, BGI Genomics, Sequenom, OPKO Health, Ambry Genetics, Invitae Corporation. |