Robotic Surgical Procedures Market Size & Overview:

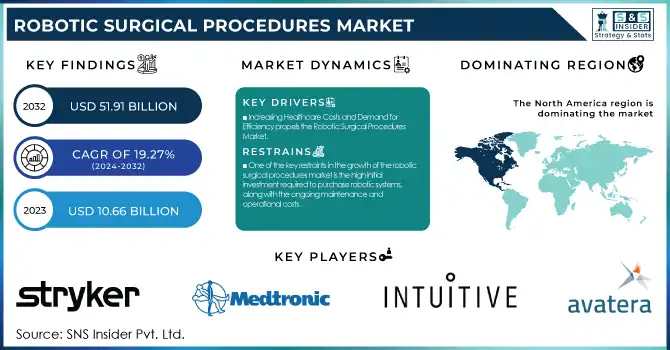

The Robotic Surgical Procedures Market was valued at USD 10.66 billion in 2023 and is expected to reach USD 51.91 billion by 2032, growing at a CAGR of 19.27% from 2024-2032.

Get More Information on Robotic Surgical Procedures Market - Request Sample Report

The robotic surgical procedures market has become a key component of the international healthcare environment, powered by developments in robotics, artificial intelligence, and an increasing need for minimally invasive surgeries. Such systems improve precision, minimize post-operative complications, and decrease recovery times, making them a more desirable option for both surgeons and patients. Some of the key procedures that an Endoscopic/microsurgical robotic system is used for include urology, gynecology, orthopedics, general surgery, and cardiology.

Emerging economies are witnessing accelerated adoption of robotic systems driven by the increasing quality of health infrastructure as well as the need for advanced surgical solutions. According to NIH, In early 2023, more than 11 million robotic procedures had been performed worldwide using Intuitive Surgical's Da Vinci systems, with over 7,500 units actively in use.

More than a quarter of all surgeons in developed areas performed more than 25% of their procedures robotically in 2023, and by 2032 it is anticipated that adoption will soar internationally. The increasing incidence of chronic disorders, such as cancer and cardiovascular diseases, has also fueled demand, as robotic-assisted procedures are commonly preferred for the treatment of complex cases due to their precision.

The market is driven by technological advancements. For example, in 2024, Medtronic announced 14 new AI-powered algorithms to enhance its Touch Surgery Performance Insights ecosystem, to improve surgical workflows and training. Similarly, in 2024, Stryker received FDA clearance for its Q Guidance System software to enhance spine surgeries and announced the launch of robotic features that will be added to spine and shoulder procedures.

Market growth is also robust driven by continued innovation, growing applications, and greater acceptance in regions. The conventional methods will be complemented with robotic surgical procedures, thanks to the (R&D) research and development investments by major players in the robotic surgical procedures market and cross-sector collaborations, which are the catalysts for transforming the future of surgery.

MARKET DYNAMICS

DRIVERS

-

Increasing Healthcare Costs and Demand for Efficiency propels the Robotic Surgical Procedures Market

Healthcare professionals are under increasing pressure to improve operational efficiency and reduce costs while maintaining the quality of care that patients expect. Robotics-assisted surgeries are showing cost-effectiveness over the long term through reduced lengths of hospital stay, lower complications, and greater accuracy in surgical procedures. Robotic modalities allow for shorter recovery times, shorter hospitalization times, and fewer complications, which all translate to lower costs in healthcare delivery. For instance, robotic procedures particularly in the fields of urology and orthopedics often result in shorter hospital admissions and consequently decreased utilization of hospital facilities, leading to reductions in various indirect costs of caring for patients. Lastly, robotic systems have started to become more affordable, providing more value for money, and making them an attractive option for healthcare institutions wanting to streamline surgical departments. Increasing demand for cost-effective solutions is driving the higher adoption of robotic surgical systems.

-

The ability of robotic surgical systems to provide immersive training experiences and enhance surgeons' skill sets is fueling their widespread use.

Robotic systems often come with simulation platforms and other AI-infused performance metrics to help surgeons practice iterative skills before performing complex procedures on patients. The launch of platforms like Medtronic’s Touch Surgery Live Stream this past April 2024, which provides real-time viewing and helps to improve surgical training, is spearheading a burgeoning trend within the market to bring robotics to surgical education. Surgeons can train with virtual settings, improve skills, and receive performance feedback on the spot, helping them get accustomed to robotic surgery faster. The trend to enhance skills and rising surgeon confidence in robotic-assisted approaches are furthering the requirement for robotic systems across various medical domains.

RESTRAINT

-

One of the key restraints in the growth of the robotic surgical procedures market is the high initial investment required to purchase robotic systems, along with the ongoing maintenance and operational costs.

Robotic surgical systems – e.g. Intuitive Surgical Da Vinci and Medtronic Hugo, etc – may run into millions of dollars in cost and become a deterrent for smaller healthcare facilities to be able to use them, especially in emerging markets with less budget. These systems typically entail a high purchase price and the need for costly training programs for surgeons and support staff, as well as ongoing maintenance and updates to guarantee optimal operating conditions. The clinical advantages of robotic surgeries — like improved complication rates and quicker recovery times — are widely acknowledged, but the cost of purchasing and maintaining robotic surgical systems remains an obstacle for many hospitals and clinics, hampering widespread adoption.

MARKET SEGMENTATION INSIGHTS

By Application

The general surgery segment dominated the market with 38.65% market share in 2023, owing to its widespread acceptance and the advantages that robotic systems provide in carrying out various surgeries. This includes systems like the Da Vinci Surgical System that allow for minimally invasive surgery, which is favored due to benefits such as smaller incisions, lower pain levels, quicker recovery times, and shorter hospital stays. General surgery includes some of the broadest procedures, from gallbladder removals to hernia repairs, which can benefit from the precision, improved 3D visualization, and flexibility that robotic systems offer. Moreover, robotic systems streamline the operational process, which results in lowering the cost-associated complications and downtime, which can benefit the operational aspect of the healthcare facility. Moreover, the growing uptake of minimally invasive procedures will further contribute to making general surgery the application area in robotic surgical procedures.

The neurology segment is expected to be the fastest-growing segment in the robotic surgical procedures market with a growing CAGR of 22.39% due to, the growing need for precision in complex surgical procedures such as neurological procedures. An example of robotic systems is the Mazor X which performs spinal surgeries with the precision of a human hand and lowers potential risk. In neurosurgery for brain tumors, spinal disorders, etc., better accuracy enables efficient and minimally invasive procedures with faster recovery times. Furthermore, the increasing number of neurological disorders like Parkinson's disease is also driving the demand for robotic assistance. The rapid growth of this segment is aided by advancements in robotics and AI to improve the efficiency and safety of surgeries.

By End User

In 2023, The hospital segment dominated the surgical robotic procedures market on the back of the elaborate nature of surgeries carried out in hospitals and the key amount of investments made by hospitals toward advanced robotic systems. Hospitals are also usually early adopters of advanced technologies and have more access to capital for these expensive systems.

Ambulatory surgery centers (ASCs) are the fastest-growing segment because they tend to focus on minimally invasive procedures that can be performed in a one-day outpatient setting. Given the growing need for high-quality, economical care, ASCs are capitalizing on robotic technologies whose costs and accessibility continue to decrease. Consequently, the growth of the robotic surgical procedures market will be led by ASCs.

REGIONAL ANALYSIS

In 2023, North America held the highest market share of 48%, owing to advanced surgical procedures and hospitals for various diseases. For instance, the increasing adoption of robotic-assisted procedures for various indications which provide more favorable outcomes than conventional open surgery and reduced hospital stay and recovery times among children will further contribute to the market growth. Moreover, the development of surgical instruments with miniaturization is required for optimal performance in a smaller operative space; this trend is likely to directly affect the volume of robotic surgical procedures and propel the robotic surgical procedures market.

Asia Pacific is the fastest-growing region in the surgical robotics procedures market exhibiting a CAGR of 22.91%, this is due to several key factors. For Instance, the rapid development of healthcare infrastructure and the growing adoption of robotic technology in hospitals and surgical centers will propel this growth. Minimally invasive surgeries have experienced increased adoption in the region owing to various benefits including lesser recovery time, trauma, and complications as compared to the conventional approach. In addition, the increase in the prevalence of chronic diseases, an increase in the geriatric population, and the expansion of access to healthcare in emerging economies such as China and India are driving the growth of the market. Governments focusing on increasing healthcare expenditure and adopting advanced medical technologies as well further support the growth of robotic surgeries in the Asia Pacific. This combination positions Asia Pacific as a substantial force in the growth of the robotic surgical procedures market.

Do You Need any Customization Research on Robotic Surgical Procedures Market - Enquire Now

Robotic Surgical Procedures Market Key Players

-

Avatera Medical (Avatera Robotic System, Avatera Instrument Line)

-

Intuitive Surgical, Inc. (da Vinci Surgical System, Ion Endoluminal System)

-

Medtronic plc (Hugo RAS System, Mazor X)

-

Stryker Corporation (MAKO Robotic-Arm Assisted Surgery System, SPY Imaging Technology)

-

Smith & Nephew plc (CORI Surgical System, Navio Surgical System)

-

Zimmer Biomet (ROSATM One Surgical Robotic System, OrthoGuidance)

-

Johnson & Johnson (Ethicon) (OTTAVA Surgical System, VERO Biopsy Robot)

-

TransEnterix, Inc. (Asensus Surgical) (Senhance Surgical System, Intelligent Surgical Unit (ISU))

-

Medrobotics Corporation (Flex Robotic System, Flex ENT)

-

Titan Medical Inc. (SPORT Surgical System, ARTEMIS Surgical Instruments)

-

Corindus Vascular Robotics (Siemens Healthineers) (CorPath GRX, Neurovascular Robotic System)

-

Think Surgical, Inc. (TSolution One System, TMINI Miniature Robot)

-

Auris Health (Johnson & Johnson subsidiary) (Monarch Platform, LungPoint Virtual Bronchoscopic Navigation)

-

Renishaw plc (Neuromate Stereotactic Robot, Neurolocate)

-

CMR Surgical (Versius Surgical Robotic System, Enhanced Vision Tools)

-

Accuray Incorporated (CyberKnife System, TomoTherapy System)

-

Preceyes BV (Preceyes Surgical System, Vitreoretinal Robot)

-

Monteris Medical (NeuroBlate System, BrainPath Access System)

-

KUKA AG (KUKA Robotics) (LBR Med, Robotic Biopsy System)

-

Verb Surgical (Collaborative Robotic System, Integrated Imaging Platform)

Suppliers

Suppliers that provide essential components, materials, and technologies for the robotic surgical procedures market products

-

Harmonic Drive LLC

-

Allied Motion Technologies

-

Microchip Technology Inc.

-

Bosch Rexroth AG

-

Asahi Intecc Co., Ltd.

-

Smiths Interconnect

-

Maxon Group

-

Omron Corporation

-

Schunk GmbH & Co. KG

RECENT DEVELOPMENT

-

July 2024: Stryker announced its plans to expand the capabilities of its Mako robotic system by introducing spine and shoulder features later in the year, following a record-breaking quarter for Mako installations. The company also secured FDA clearance for a new software designed for its Q Guidance System, enhancing spine surgeries. CEO Kevin Lobo highlighted Stryker's interest in entering the soft tissue robotic surgery space and emphasized the company's active acquisition strategy, which included recent acquisitions of Artelon and Molli Surgical.

-

April 2024: Medtronic unveiled 14 new AI-powered algorithms for its Touch Surgery Performance Insights platform, designed to enhance post-operative analysis for laparoscopic and robotic-assisted procedures. The company also launched Touch Surgery Live Stream, enabling remote observation to improve surgical training and collaboration. These innovations further expanded Medtronic's digital ecosystem, aimed at streamlining surgical workflows and providing more detailed performance insights.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.66 Billion |

| Market Size by 2032 | US$ 51.91 Billion |

| CAGR | CAGR of 19.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Orthopedics, Neurology, Urology, General Surgery, Gynecology, Others) • By End-use (Hospitals, Ambulatory Surgery Centers, Diagnostic Labs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avatera Medical, Intuitive Surgical, Inc., Medtronic plc, Stryker Corporation, Smith & Nephew plc, Zimmer Biomet, Johnson & Johnson (Ethicon), TransEnterix, Inc. (Asensus Surgical), Medrobotics Corporation, Titan Medical Inc., Corindus Vascular Robotics (Siemens Healthineers), Think Surgical, Inc., Auris Health (Johnson & Johnson subsidiary), Renishaw plc, CMR Surgical, Accuray Incorporated, Preceyes BV, Monteris Medical, KUKA AG, Verb Surgical, and other players. |

| Key Drivers | •Increasing Healthcare Costs and Demand for Efficiency propels the Robotic Surgical Procedures Market •The ability of robotic surgical systems to provide immersive training experiences and enhance surgeons' skill sets is fueling their widespread use. |

| Restraints | •One of the key restraints in the growth of the robotic surgical procedures market is the high initial investment required to purchase robotic systems, along with the ongoing maintenance and operational costs. |