Hospital Services Market Report Scope & Overview

Get More Information on Hospital Services Market - Request Sample Report

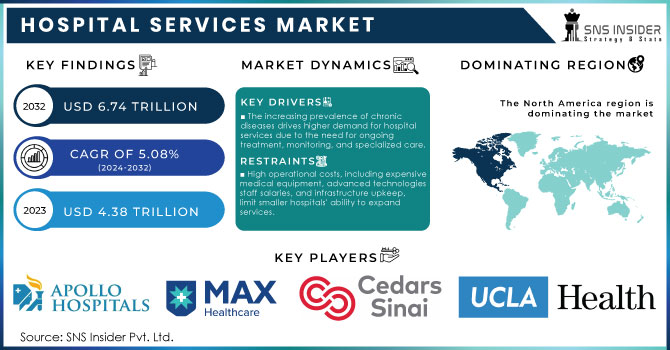

The Hospital Services Market size was estimated at USD 4.38 trillion in 2023 and is expected to reach USD 6.74 trillion by 2032 at a CAGR of 5.08% during the forecast period of 2024-2032.

The Hospital Services Market has grown significantly in recent years due to a wide range of factors. Some of the trends that have contributed to the growth of this service market include a growing prevalence of chronic disease which requires an increase in hospital visits and long-term management chronic diseases such as diabetes and cardiovascular disorders are becoming more and more prevalent. In addition, a growing aging population is pushing hospitals to improve their service provision in order to cater to the complex health needs of older citizens continually. In addition, some of the more current trends seem to be pushing towards more patient-centered care as more and more hospitals work on the improvement of patient experience and outcomes. One such trend is the use of telehealth services which has seen a significant growth even before the pandemic and has only accelerated their use with the need to keep patient loads in the hospitals to a minimum. The use of artificial intelligence and machine learning is often used in the hospital setting in order to facilitate operations and optimize diagnosis and treatment plans. The U.S. had approximately 6,093 hospitals with 920,531 licensed beds and an average occupancy rate of 66.4%, indicating that about two-thirds of beds were in use. The average length of stay for hospital patients was 4.6 days. In 2022, hospitals recorded 36.2 million inpatient admissions and over 880 million outpatient visits, highlighting the growing reliance on outpatient services. Hospital services represented 31% of total healthcare spending, amounting to USD 1.24 trillion. U.S. hospitals performed around 48 million surgical procedures annually and received 130 million emergency visits, with 16 million resulting in admissions. The healthcare workforce in hospitals comprises 5.4 million people, with over 2.9 million registered nurses. The adoption of telemedicine surged post-pandemic, with 76% of hospitals offering telehealth services by 2021, and telehealth accounting for 20% of outpatient visits in 2022.

Therefore, a wide variety of different value-based incentives are giving them incentives to invest in such programs and decrease the amount of money per patient that they have to spend. Furthermore, one should not forget about the trend of expanded health insurance coverage that is being experienced in many emerging and developing markets, which is allowing more and more hospital visits to occur. Finally, hospitals are expanding investment in the up-to-date infrastructure to house modern medical practices thus increasing their specialist services and outpatient facility options.

MARKET DYNAMICS

DRIVERS

-

The increasing prevalence of chronic diseases drives a higher demand for hospital services due to the need for ongoing treatment, monitoring, and specialized care.

The rising prevalence of chronic diseases is a significant driver of increased demand for hospital services. Conditions such as diabetes, cardiovascular diseases, cancer, and respiratory disorders require ongoing treatment, regular monitoring, and specialized care, often leading to frequent hospital visits. As chronic diseases typically persist over long periods, patients require continuous medical attention, including medication management, diagnostic tests, rehabilitation services, and surgical interventions. Hospitals play a critical role in delivering these services, making them essential for patients who require multidisciplinary care and advanced treatment options.

In addition to direct care, chronic disease patients often need specialized equipment and expertise for effective management. Cancer patients may need chemotherapy or radiation therapy, while individuals with cardiovascular conditions might require regular monitoring through specialized tests like ECGs and angiograms. These specialized services can only be provided in well-equipped hospitals, driving up the demand for hospital-based treatments.

Moreover, as chronic conditions are frequently linked to aging populations and unhealthy lifestyle habits, the global rise in life expectancy and sedentary lifestyles further accelerates this trend. Hospitals are increasingly being relied upon to provide comprehensive and long-term care solutions, from preventive measures to palliative care. Consequently, the growing prevalence of chronic diseases not only increases the number of patients seeking hospital services but also the complexity and frequency of their care needs, placing greater pressure on healthcare infrastructure and resources. This growing demand makes hospitals vital in managing the global chronic disease burden.

-

Technological advancements like telemedicine, AI diagnostics, and robotic surgeries enhance patient care and efficiency, boosting hospital service demand and market growth.

Technological advancements such as telemedicine, AI-driven diagnostics, and robotic surgeries are transforming the hospital services market by enhancing both patient care and operational efficiency. Telemedicine allows patients to receive remote consultations and treatments, reducing the need for physical hospital visits and expanding access to healthcare, especially in rural or underserved areas. AI diagnostics enable faster and more accurate disease detection, leading to improved treatment outcomes and better patient management. Additionally, robotic surgeries offer greater precision, shorter recovery times, and reduced risk of complications, increasing patient satisfaction and hospital efficiency. These innovations not only improve the quality of care but also help hospitals optimize resources, reduce operational costs, and handle larger patient volumes. As a result, the growing adoption of these technologies is driving increased demand for hospital services and contributing to the overall growth of the market, as hospitals seek to stay competitive and meet evolving patient expectations.

RESTRAIN

-

High operational costs, including expensive medical equipment, advanced technologies, staff salaries, and infrastructure upkeep, limit smaller hospitals' ability to expand services.

High operational costs pose a significant challenge for hospitals, particularly smaller ones, by constraining their ability to expand services. These expenses include the purchase and maintenance of costly medical equipment, such as MRI machines and robotic surgery systems, which are essential for offering advanced care. Additionally, hospitals must continually invest in cutting-edge technologies, like electronic health records (EHRs) and telemedicine platforms, to remain competitive and meet patient demands for efficient and modern healthcare services. Staff salaries also contribute significantly to operational costs, with hospitals needing to pay competitive wages to retain skilled doctors, nurses, and specialists. Furthermore, infrastructure maintenance, such as upgrading facilities to meet safety standards and accommodating growing patient volumes, adds to the financial burden. These combined costs make it difficult for smaller hospitals and healthcare centers, which often operate with tighter budgets, to expand their offerings, improve their services, or invest in the latest innovations.

KEY MARKET SEGMENTATION

By Type

The inpatient services segment dominated the market, accounting for the largest market share of 49.03% in 2023. The demand for this sector is anticipated to grow due to the increased requirement for around-the-clock extensive healthcare services offered through hospitalization, particularly for serious health conditions and surgical treatments. Furthermore, the rise in insurance availability in emerging nations is anticipated to drive up the number of patients staying in hospitals, leading to an increased demand for this sector on a global scale.

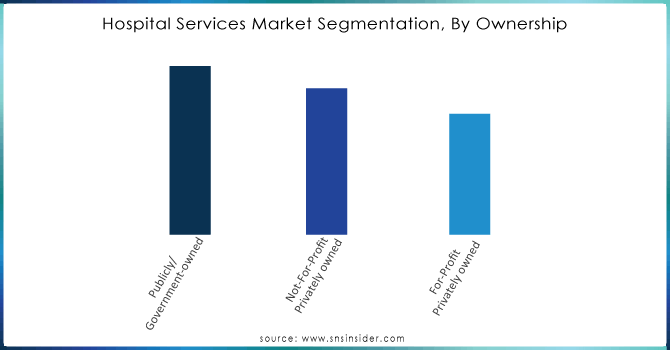

By Ownership

The publicly/government-owned segment held the largest revenue share of 42.58% in 2023 due to the large number of patients in these facilities as a result of lower prices or more affordable healthcare options when compared to private facilities. Moreover, nations are prioritizing the expansion of public hospitals in remote regions to offer top-notch healthcare to areas that lack access. Therefore, governments allocate resources to public health in order to improve workforce capabilities and quality of care.

Need any customization research on Hospital Services Market - Enquiry Now

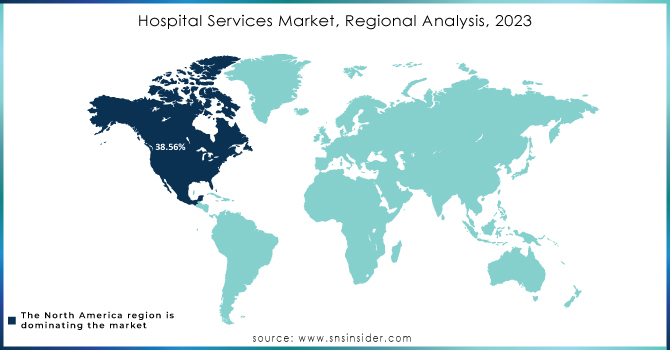

REGIONAL ANALYSES

North America hospital services market dominated the market with a share of 38.56% in 2023. This can be attributed to the growing need for advanced services, the rising use of technologically advanced solutions in facilities, and significant investments in healthcare infrastructure and services by government and private sectors. The expansive hospital network and comprehensive care in the U.S. hospital services market are fueled by the rising use of advanced technologies and significant healthcare spending. Furthermore, changes in policies and expanded healthcare coverage through the Affordable Care Act have broadened access for a wider demographic. Furthermore, the movement towards consolidation, where hospitals combine to create larger systems, is anticipated to improve healthcare delivery and enhance patient outcomes, thus helping boost market expansion.

The Asia Pacific hospital services market is experiencing rapid growth due to the rapidly aging population, increasing prevalence of chronic diseases, and significant improvements in healthcare infrastructure. In addition, rising healthcare expenditures, growing health consciousness among the population, and government initiatives aimed at improving healthcare access and quality are expected to drive the growth of the market.

KEY PLAYERS

Some of the major key players of Hospital Services Market

-

Apollo Hospitals Enterprise Ltd.: (Specialty care services, Telemedicine, Health check-ups, Preventive health packages)

-

Max Healthcare: (Multi-specialty care, Cancer care, Cardiac services, Telemedicine solutions)

-

West Suffolk NHS Foundation Trust: (Emergency care services, Diagnostic services, Rehabilitation programs)

-

Royal Papworth Hospital NHS Foundation Trust: (Specialist heart and lung services, Cardiothoracic surgery, Transplant services)

-

Cedars-Sinai: (Cancer care, Neurology & neurosurgery, Cardiac care, medical research)

-

UCLA Medical Centers: (Multi-specialty care, Orthopedic surgery, Organ transplants, Neuroscience programs)

-

The Johns Hopkins Hospital: (Cancer treatment, Neurology & neurosurgery, Pediatrics, Cardiac care)

-

Mayo Clinic: (Cancer care, Cardiac care, Regenerative medicine, Advanced diagnostic tools)

-

Keio University (Medical Services): (Cardiovascular surgery, Oncology services, Neurology services)

-

The Royal Melbourne Hospital: (Acute medical care, Trauma and emergency services, Neurosurgery)

-

Burjeel Holdings: (Advanced surgical care, Cardiac services, Robotic surgery, Telemedicine)

-

Cleveland Clinic: (Cardiac surgery, Neurology, Cancer care, Wellness programs)

-

Massachusetts General Hospital: (Cancer care, Neurology, Cardiac care, Organ transplants)

-

Singapore General Hospital (SGH): (Acute care services, Specialist outpatient services, Cancer care)

-

Mount Sinai Health System: (Cardiac services, Cancer treatment, Neurosurgery, Robotic surgery)

-

Karolinska University Hospital: (Specialist care, Pediatric services, Transplantation surgery, Research services)

-

Tokyo Medical University Hospital: (Cancer care, Emergency medical care, Organ transplants, Advanced diagnostics)

-

Ramsay Health Care: (Private hospital services, Day surgery, Rehabilitation, Mental health care)

-

Fortis Healthcare: (Multi-specialty care, Cardiac care, Neurology services, Oncology services)

-

Columbia Asia Hospitals: (Inpatient and outpatient care, Cardiology, Orthopedics, Maternity services)

RECENT DEVELOPMENTS

In June 2024: the University of Alabama at Birmingham (UAB) launched the first Tele-ICU expanded hospital in Alabama, U.S., by partnering with Whitefield Regional Hospital. This partnership is expected to improve the Tele-ICU capabilities of UAB, and to provide evidence-based care services to patients.

In July 2023: Nutex Health Inc. opened Covington Trace ER & Hospital, a new microhospital in Louisiana. The hospital includes eight private exam rooms, an emergency room, ten private inpatient beds, and an in-house pharmacy, laboratory, and imaging services.

In January 2023: the Government of India launched thefirst 100% carbon-neutral hospital in Bengaluru, India, with a capacity of 500 beds.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.38 Trillion |

| Market Size by 2032 | USD 6.74 Trillion |

| CAGR | CAGR of 5.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Inpatient, Outpatient) • By Ownership (Publicly/Government-Owned, Not-For-Profit Privately owned, For-Profit Privately Owned) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University, The Royal Melbourne Hospital, Burjeel Holdings, Cleveland Clinic, Massachusetts General Hospital, Singapore General Hospital (SGH), Mount Sinai Health System, Karolinska University Hospital, Tokyo Medical University Hospital,Ramsay Health Care, Fortis Healthcare, Columbia Asia Hospitals |

| Key Drivers | • The increasing prevalence of chronic diseases drives higher demand for hospital services due to the need for ongoing treatment, monitoring, and specialized care. • Technological advancements like telemedicine, AI diagnostics, and robotic surgeries enhance patient care and efficiency, boosting hospital service demand and market growth. |

| RESTRAINTS | • High operational costs, including expensive medical equipment, advanced technologies, staff salaries, and infrastructure upkeep, limit smaller hospitals' ability to expand services. |