Commercial Artificial Intelligence Market Key Insights:

To Get More Information on Commercial Artificial Intelligence Market - Request Sample Report

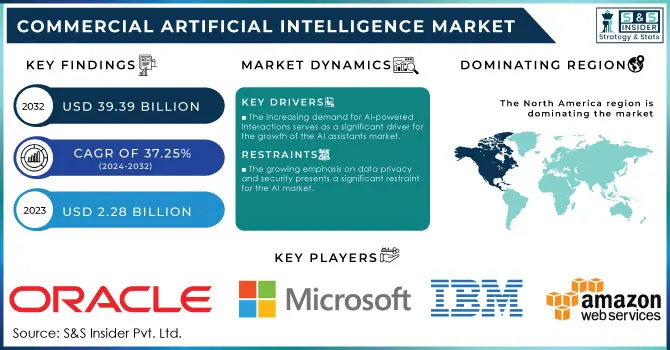

The Commercial Artificial Intelligence Market Size was valued at USD 2.28 Billion in 2023 and is expected to reach USD 39.39 Billion by 2032, and grow at a CAGR of 37.25% over the forecast period 2024-2032.

The commercial artificial intelligence (AI) market is on a significant growth trajectory, driven by innovations in machine learning, natural language processing, and automation technologies that enhance operational efficiencies across various sectors. Industries such as healthcare, finance, retail, and energy are leveraging AI to optimize their processes. For example, AI is transforming brewing by improving production efficiency and predicting consumer preferences. In energy, it fosters innovations in resource management, while the financial sector benefits from enhanced fraud detection and risk management, and retailers use AI to personalize customer experiences. Additionally, advancements in generative AI are revolutionizing contract management in banking, streamlining operations and improving efficiency.

The U.S. Department of Defense (DoD) has successfully deployed commercial AI solutions for Maritime Domain Awareness, enhancing unmanned and autonomous platform capabilities through Project Overmatch and the Defense Innovation Unit. By integrating AI-driven technologies, the DoD aims to maintain critical maritime navigation and improve operational efficiency in denied bandwidth environments. Key vendors, such as Ditto and Syntiant, demonstrated their capabilities, achieving significant advancements in real-time data sharing and mission autonomy. This initiative highlights the growing reliance on AI in defense operations.

Market Dynamics

Drivers

- The increasing demand for AI-powered interactions serves as a significant driver for the growth of the AI assistants market.

As consumers become more accustomed to personalized and efficient services, businesses are leveraging AI technologies to enhance customer engagement and improve operational efficiencies. Around 60% of smartphone users have reported engaging with voice assistants, which reflects their growing acceptance and integration into everyday life. This growth is largely attributed to rapid advancements in natural language processing and machine learning capabilities, which enable more sophisticated and user-friendly interactions. Companies that adopt these AI solutions not only improve their customer service but also position themselves competitively in an increasingly digital landscape. The urgency for businesses to implement AI technologies is further heightened by evolving customer expectations, as consumers seek seamless interactions across various platforms. As industries, continue to embrace these innovations, the potential for enhanced customer satisfaction and loyalty increases, ultimately driving business success. This trend highlights the critical need for organizations to stay ahead by integrating AI solutions that meet the growing demand for intuitive and responsive digital interactions. The combination of consumer adoption and technological advancements is set to shape the future of AI assistants and their role in the market.

Restraints

- The growing emphasis on data privacy and security presents a significant restraint for the AI market.

With AI systems increasingly reliant on vast amounts of data for training and operational purposes, concerns regarding data protection are escalating. A report highlighted that 80% of organizations experienced a data breach in the past year, underscoring the urgent need for stringent data privacy measures. Additionally, Hong Kong's privacy watchdog has signed a global guiding statement amid rising fears over AI data scraping, reflecting widespread apprehension about the potential misuse of personal data by AI technologies. This regulatory pressure can limit the ability of companies to leverage data effectively, slowing innovation and market growth. Moreover, the introduction of new language models, such as those from Mistral AI, showcases the transformative potential of AI; however, these innovations come with increased scrutiny regarding their data handling practices. Businesses must navigate complex legal frameworks to comply with regulations like GDPR, which imposes hefty fines for non-compliance, further complicating AI deployment. The result is a challenging landscape where organizations must balance the benefits of AI with the imperative to protect user data, leading to slower adoption rates and increased operational costs. Until comprehensive solutions to data privacy concerns are established, the AI market may face significant barriers to growth and widespread acceptance, ultimately limiting its potential impact across industries.

Segment Analysis

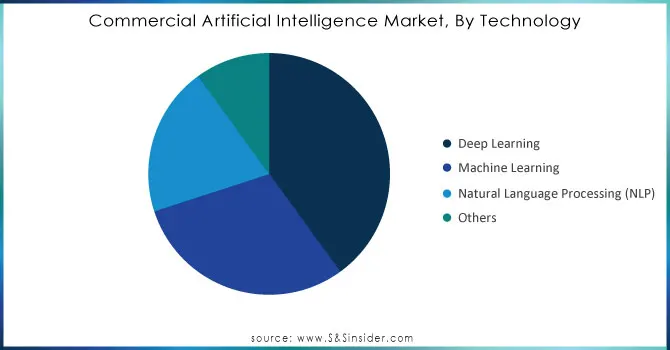

By Technology

In 2023, deep learning has emerged as the dominant technology segment within the commercial artificial intelligence (AI) market, capturing approximately 40% of the overall revenue. This growth can be attributed to deep learning's unparalleled ability to process vast amounts of data, facilitating more accurate predictions and decisions across various applications. Industries such as healthcare, finance, and automotive are leveraging deep learning for tasks ranging from medical image analysis to fraud detection and autonomous driving.

Recent advancements and product launches underscore this trend. For instance, major players like Google have developed sophisticated deep learning frameworks, such as Tensor Flow, which allows organizations to build and deploy machine learning models effectively. Additionally, NVIDIA has launched new graphics processing units (GPUs) optimized for deep learning tasks, significantly enhancing processing power and efficiency for developers. Moreover, companies like OpenAI are pushing the boundaries of deep learning with the release of advanced language models that improve natural language understanding and generation, enabling more intuitive human-computer interactions. Startups are also entering the space, focusing on niche applications of deep learning, such as AI-driven personal assistants and predictive analytics tools. This dynamic environment suggests a robust pipeline of innovation, with deep learning set to continue its trajectory as the cornerstone of AI development. As organizations increasingly recognize the strategic advantages of implementing deep learning solutions, the segment is poised for sustained growth, driving the overall expansion of the commercial artificial intelligence market.

Do You Need any Customization Research on Commercial Artificial Intelligence Market - Inquire Now

By Implementation

In 2023, cloud hosting emerged as a dominant force in the commercial artificial intelligence (AI) market, capturing around 76% of total revenue. This substantial share underscores the increasing adoption of cloud-based AI solutions, which offer businesses scalability, flexibility, and cost-efficiency. By leveraging cloud infrastructure, organizations can access powerful AI tools without significant upfront hardware investments, enabling the rapid deployment of AI applications. This trend is largely fueled by the exponential growth of data and the need for efficient processing capabilities. Leading cloud service providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are continuously enhancing their AI service offerings, including features like natural language processing and predictive analytics. This evolution facilitates seamless integration of AI into existing operations, fostering innovation and competitiveness among businesses. Additionally, the rise of remote work and digital transformation has accelerated demand for cloud-hosted AI solutions, ensuring productivity and collaboration irrespective of location. As companies increasingly acknowledge the strategic benefits of cloud-based AI, this segment is poised for continued growth, reinforcing its essential role in driving innovation within the commercial artificial intelligence market.

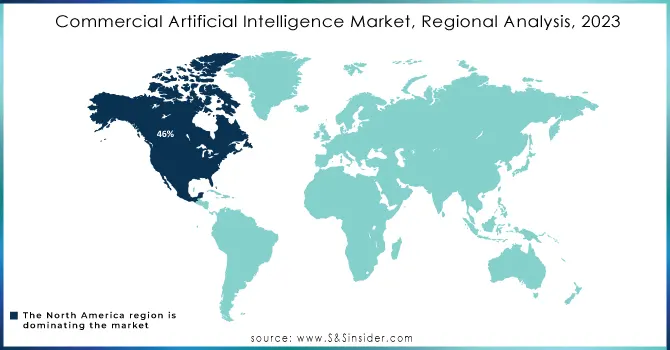

Regional Analysis

In 2023, North America held the largest share of the commercial artificial intelligence (AI) market, accounting for approximately 46% of total revenue. This dominance can be attributed to several factors, including a robust technology infrastructure, significant investment in research and development, and a thriving startup ecosystem. The presence of major tech companies and AI innovators like Google, Microsoft, and Amazon enhances the region's competitive edge.

North America benefits from a high adoption rate of AI technologies across various industries, such as healthcare, finance, and retail, driving demand for advanced AI solutions. The increasing emphasis on digital transformation and data analytics is also fueling growth, as businesses seek to leverage AI for improved operational efficiency and enhanced customer experiences. Supportive government initiatives and funding for AI research contribute to the region's leadership in the commercial AI landscape. Overall, North America's strategic investments and innovative approaches position it as a pivotal player in the ongoing evolution of artificial intelligence.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for commercial artificial intelligence (AI), driven by several key factors. Rapid industrialization and increasing digital transformation initiatives across countries like China, India, and Japan have led to heightened investments in AI technologies. The region's vast population and expanding internet penetration create a large consumer base for AI-driven applications, enhancing demand for personalized services. Governments in the Asia-Pacific are also prioritizing AI development through supportive policies and funding, fostering innovation in sectors such as healthcare, finance, and manufacturing. Major tech companies are actively establishing research centers and partnerships, further propelling growth. The combination of these factors positions Asia-Pacific as a critical player in the global AI landscape, with a trajectory set for continued expansion.

Key Players

Some of the major key Players in Commercial Artificial Intelligence Market with product:

-

Google (Alphabet Inc.) (Google AI, TensorFlow)

-

Microsoft Corporation (Azure AI, Microsoft 365 AI)

-

IBM (Watson AI)

-

Amazon Web Services (AWS) (Amazon SageMaker, AWS AI Services)

-

Facebook (Meta Platforms, Inc.) (Facebook AI Research, PyTorch)

-

NVIDIA Corporation (NVIDIA Deep Learning AI, CUDA)

-

Salesforce (Salesforce Einstein)

-

Oracle Corporation (Oracle AI Cloud Services)

-

SAP SE (SAP AI Core and AI Foundation)

-

Baidu, Inc. (Baidu AI, DuerOS)

-

Tencent Holdings Ltd. (Tencent AI Lab)

-

Alibaba Group (Alibaba Cloud AI Services)

-

Intel Corporation (Intel AI Analytics Toolkit, OpenVINO)

-

Siemens AG (Siemens MindSphere)

-

C3.ai (C3 AI Suite)

-

Palantir Technologies (Palantir Foundry, Palantir Gotham)

-

Zoho Corporation (Zoho AI, Zia)

-

UiPath (UiPath RPA, AI Fabric)

-

OpenAI (ChatGPT, DALL-E)

-

Nuro (Autonomous Delivery Vehicles)

List of potential customer companies across various sectors that are likely to benefit from commercial artificial intelligence (AI) solutions:

-

Apple Inc. (Technology)

-

UnitedHealth Group (Healthcare)

-

JPMorgan Chase & Co. (Financial Services)

-

Walmart Inc. (Retail)

-

Ford Motor Company (Automotive)

-

Boeing Company (Manufacturing)

-

Verizon Communications Inc. (Telecommunications)

-

ExxonMobil Corporation (Energy)

-

Cargill, Inc. (Agriculture)

-

FedEx Corporation (Logistics and Transportation)

-

Marriott International, Inc. (Hospitality)

-

Salesforce.com Inc. (Technology)

-

Tesla, Inc. (Automotive)

-

Target Corporation (Retail)

-

Pfizer Inc. (Healthcare)

Recent Developments

-

November 4, 2024, highlights how companies are leveraging AI and data analytics to optimize commercial strategies and accelerate drug discovery processes, leading to improved efficiency and enhanced patient outcomes. This convergence of technologies is fundamentally reshaping the landscape of pharma and innovative medicine, fostering significant advancements in healthcare.

-

On September 11, 2024, the U.S. Navy announced the successful deployment of integrated commercial AI solutions for Project Overmatch, enhancing its capabilities for critical Maritime Domain Awareness (MDA) by utilizing unmanned and autonomous platforms to supplement crewed assets and improve navigation and access to waterways globally.

-

On October 31, 2024, Enders Analysis reported that publishers are increasingly utilizing AI technologies to enhance productivity through initiatives like creating audio editions and leveraging archives, although the firm notes that while these advancements are beneficial, they are not considered game-changing for the industry.

-

On August 26, 2024, a study published in Nature Medicine by researchers at the University of North Carolina highlighted that nearly half of the commercially available AI devices cleared by the U.S. FDA lack adequate clinical validation, urging both the FDA and AI developers to prioritize publishing clinical validation data and conducting prospective studies to enhance patient safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.28 Billion |

| Market Size by 2032 | USD 39.39 Billion |

| CAGR | CAGR of 37.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Deep Learning, Machine Learning, Natural Language Processing (NLP), Others) • by Implementation (Cloud-hosting and On-premises) • by Application (Customer relationship management, Supply chain analysis, Merchandising, virtual personal assistant, Warehouse automation, Others) • by End-User (BFSI, Retail & Commerce, Food & beverages, Manufacturing, Healthcare, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google (Alphabet Inc.), Microsoft Corporation, IBM, Amazon Web Services (AWS), Facebook (Meta Platforms, Inc.), NVIDIA Corporation, Salesforce, Oracle Corporation, SAP SE, Baidu, Inc., Tencent Holdings Ltd., Alibaba Group, Intel Corporation, Siemens AG, C3.ai, Palantir Technologies, Zoho Corporation, UiPath, OpenAI, and Nuro. |

| Key Drivers | • The increasing demand for AI-powered interactions serves as a significant driver for the growth of the AI assistants market. |

| RESTRAINTS | • The growing emphasis on data privacy and security presents a significant restraint for the AI market. |