Oil and Gas Data Management Market Report Scope & Overview:

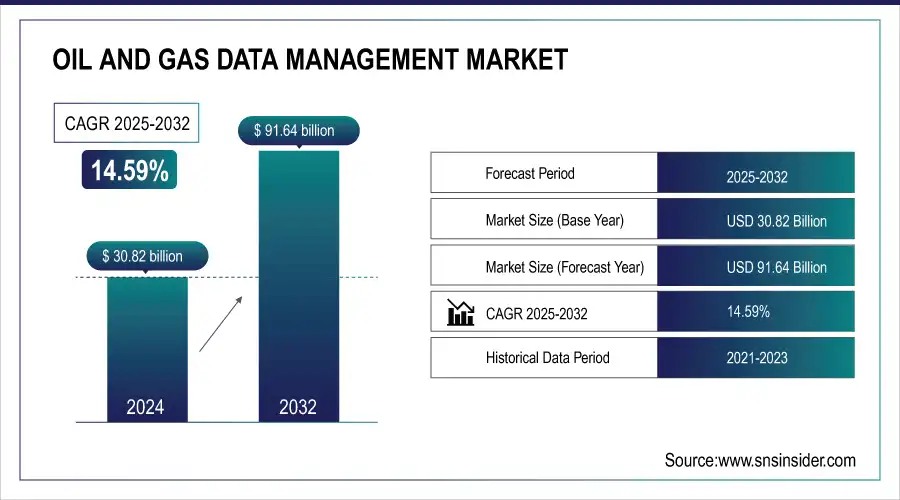

The Oil and Gas Data Management Market was valued at USD 30.82 billion in 2024 and is expected to reach USD 91.64 billion by 2032, growing at a CAGR of 14.59% from 2025-2032.

To Get more information on Oil and Gas Data Management Market - Request Free Sample Report

This report presents a detailed analysis of the Oil and Gas Data Management Market, highlighting key operational trends and emerging technology adoption patterns transforming the sector. In 2024, adoption rates of cloud-based data management solutions surged globally, with North America and the Middle East leading the shift due to rising demand for scalable, secure, and real-time asset monitoring and operational control systems. Alongside this, data volume growth across upstream, midstream, and downstream operations has intensified, driven by the expansion of sensor networks, digital oilfield initiatives, and IoT-enabled infrastructure capturing vast operational data. The integration of AI and predictive analytics has also gained significant traction, particularly in applications like predictive maintenance, equipment health monitoring, and production optimization. Moreover, investments in data security and regulatory compliance solutions steadily increased from 2020 to 2024, as operators respond to escalating cyber threats and stricter regional data protection mandates. New additions in this year’s report include insights into AI-powered reservoir modeling, hybrid cloud-edge data architectures, and evolving vendor strategies reshaping real-time decision-making in the oil and gas industry.

Market Size and Forecast

-

Market Size in 2024: USD 30.82 Billion

-

Market Size by 2032: USD 91.64 Billion

-

CAGR: 14.59% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Oil and Gas Data Management Market Trends

-

Rising complexity of upstream, midstream, and downstream operations is driving oil and gas data management adoption.

-

Integration of AI, cloud computing, and analytics is enhancing exploration, production, and operational efficiency.

-

Growing demand for real-time monitoring and predictive maintenance is boosting market growth.

-

Increasing focus on regulatory compliance, data security, and environmental reporting is shaping adoption trends.

-

Expansion of digital oilfield initiatives and IoT deployment is accelerating data-driven decision-making.

-

Adoption of centralized data platforms is improving collaboration across exploration, drilling, and refinery operations.

-

Collaborations between energy companies, software vendors, and technology providers are fostering innovation and scalable solutions.

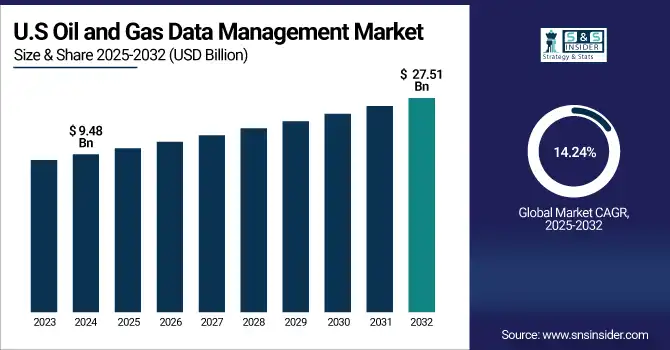

U.S. Oil and Gas Data Management Market was valued at USD 9.48 billion in 2024 and is expected to reach USD 27.51 billion by 2032, growing at a CAGR of 14.24% from 2025-2032.

The U.S. Oil and Gas Data Management Market is growing due to increasing digitalization in upstream and downstream operations, adoption of advanced analytics, IoT integration, real-time monitoring, regulatory compliance needs, and the rising focus on operational efficiency and cost optimization.

Oil and Gas Data Management Market Growth Drivers:

-

Increasing adoption of digital oilfield technologies is accelerating demand for advanced, real-time data management solutions in oil and gas operations.

Increasing incorporation of digital oilfield technologies is a key factor responsible to boosting the growth of advanced data management in oil and gas solutions in the market. Firms are greatly embracing IoT sensors, AI-enabled monitoring, and predictive analytics in order to avoid the practical and asset-related decisions they make in real-time. With upstream, midstream and downstream operations producing petabytes of structured and unstructured data, solid data management frameworks are critical to maximize production efficiency, minimize downtime, and enhance safety. Cloud-based, AI-integrated data platforms, in particular, are seeing strong investments, particularly as this shift toward intelligent, data-driven operations is gaining momentum, especially in the region with the highest adoption of the digital oilfield — North America and the Middle East.

Oil and Gas Data Management Market Restraints:

-

High implementation and integration costs of data management systems limit adoption, especially among small and mid-sized operators.

Despite growing awareness of the benefits of data management solutions, the high costs associated with implementing and integrating these systems remain a key restraint. Oil and gas enterprises often face significant expenses in upgrading legacy infrastructure, training personnel, and ensuring compatibility between new software and existing operational technologies. Particularly for small and mid-sized operators, these upfront capital and operational expenditures can deter investments, delaying digital transformation initiatives. Moreover, customizing solutions to meet unique operational and regulatory needs across upstream, midstream, and downstream segments adds to implementation complexity, making it difficult for some companies to realize immediate ROI from advanced data management deployments.

Oil and Gas Data Management Market Opportunities:

-

Expanding use of AI and predictive analytics for asset optimization and operational efficiency creates significant market growth opportunities.

The increasing integration of AI and predictive analytics in oil and gas operations presents a strong growth opportunity for the data management market. By leveraging AI-driven insights, operators can improve reservoir management, forecast equipment failures, and optimize production workflows in real time. These technologies enable proactive decision-making, minimizing unplanned outages and reducing operational risks. With rising global energy demand and pressure to improve operational efficiency, oil and gas companies are investing heavily in intelligent data platforms. Vendors offering scalable, AI-integrated solutions tailored for upstream, midstream, and downstream applications are well-positioned to capitalize on this rapidly expanding market opportunity.

Oil and Gas Data Management Market Challenge:

-

Rising cybersecurity threats and complex regulatory compliance requirements hinder the seamless deployment of data management solutions.

The increased digitization of oil and gas operations, combined with the adoption of cloud-based data management systems, has amplified cybersecurity risks across the sector. Companies face threats ranging from data breaches and ransomware attacks to unauthorized access to critical operational systems. Additionally, adhering to evolving regulatory requirements like GDPR, NIST standards, and regional data sovereignty laws adds further complexity to managing sensitive operational and financial data. As a result, oil and gas enterprises must invest in advanced cybersecurity frameworks and compliance tools, which can strain IT budgets and complicate the integration of data management solutions, especially for multinational operators managing cross-border assets.

Oil and Gas Data Management Market Segment Analysis

By Technology, Big Data Analytics dominates the Oil and Gas Data Management Market, Artificial Intelligence (AI) is expected to grow fastest.

In 2024, Big Data Analytics dominated the Oil and Gas Data Management Market, holding the largest revenue share of more than 49%, due to its critical role in processing vast operational datasets generated across upstream, midstream, and downstream activities. The technology enables operators to optimize production, forecast demand, enhance drilling accuracy, and manage asset performance in real-time. As digital oilfields, IoT sensors, and cloud platforms proliferate, the dependency on big data tools for actionable insights and risk mitigation will continue to expand. The segment is expected to maintain its lead, driven by widespread operational digitalization and data-driven decision-making initiatives.

Artificial Intelligence (AI) is projected to register the fastest CAGR in the Oil and Gas Data Management Market from 2025 to 2032. AI-powered analytics tools are increasingly being used for predictive maintenance, production forecasting, reservoir modeling, and anomaly detection. Operators are leveraging AI to minimize downtime, reduce operational risks, and optimize asset utilization in complex and high-risk environments. Rising demand for real-time operational insights, combined with growing investments in AI-integrated cloud platforms and edge computing, will fuel the segment’s rapid growth. Additionally, AI’s role in automating workflows and enhancing decision support systems is reshaping data-driven strategies in the sector.

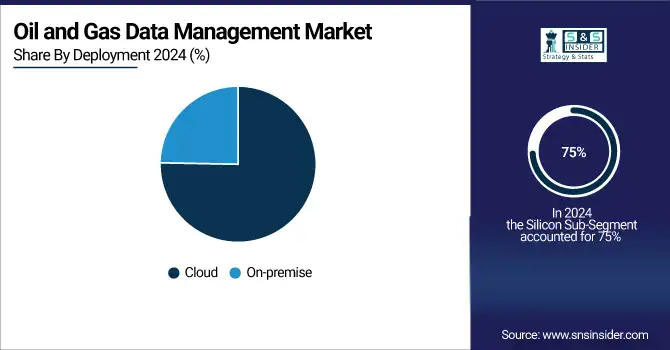

By Deployment, Cloud deployment dominates the Oil and Gas Data Management Market, Cloud is also expected to grow fastest.

In 2024, the Cloud segment dominated the Oil and Gas Data Management Market and accounted for 75% of revenue share. This shift is attributed to the industry's increasing need for secure, scalable, and cost-effective data management solutions. Cloud-based systems offer enhanced flexibility, real-time data access, and improved collaboration across geographically dispersed teams. The adoption of cloud solutions enables oil and gas companies to streamline operations, reduce infrastructure costs, and respond swiftly to market dynamics, thereby driving the segment's growth.

The Cloud segment is also projected to register the fastest Compound Annual Growth Rate from 2025 to 2032. This rapid growth is fueled by the industry's ongoing digital transformation initiatives, which prioritize agility, scalability, and real-time data analytics.

By Application, The Upstream segment dominates the Oil and Gas Data Management Market, Midstream segment is expected to grow fastest.

In 2024, the Upstream segment dominated the market and accounted for a significant revenue share. The dominance is due to massive data handling requirements in exploration, production , and related activities. The upstream has a tremendous amount of complex data generated from geological surveys, the drilling information, and production measures. Managing the data in this segment effectively helps to improve the optimization of the reservoir, enhance drilling efficiency, and reduce exploration risk. Advanced analytics and real-time monitoring enable proactive decision-making, which guarantees operational efficiency and minimizes costs.

The Midstream Segment is anticipated to record the fastest compound annual growth rate from 2025 to 2032. The surge is being fueled in large part by the growing need for streamlined data management to enable pipeline monitoring, logistics, inventory management, and regulatory compliance. The midstream industry deals with vast amounts of data connected to oil and gas transportation and storage.

Oil and Gas Data Management Market Regional Analysis

North America Oil and Gas Data Management Market Insights

North America dominated the market and accounted for 38% of the revenue share in 2024 due to the region's sophisticated technology infrastructure, increased oil and gas field operations, and significant investments in data management solutions. The U.S. and Canada are progressively applying data analytics, IT infrastructure, and solutions to improve operational efficiency and drive decision-making processes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Oil and Gas Data Management Market Insights

The Oil and Gas Data Management Market is expected to register the fastest CAGR in the Asia-Pacific region from 2024 to 2033. This growth is driven by rising energy demand, substantial investments in oil and gas infrastructure, and the adoption of advanced digital technologies. Countries such as China, India, and South Korea are leveraging data management solutions to optimize operations, enhance efficiency, and support sustainable energy development across the region.

Europe Oil and Gas Data Management Market Insights

Europe plays a significant role in the Oil and Gas Data Management Market, driven by advanced digital infrastructure, stringent regulatory compliance, and adoption of smart oilfield technologies. Key countries like the U.K., Norway, and Germany are investing in data analytics, IoT, and AI solutions to optimize exploration, production, and operational efficiency. Collaborative initiatives between technology providers and energy companies are further accelerating innovation and growth across the European oil and gas sector.

Middle East & Africa and Latin America Oil and Gas Data Management Market Insights

The Middle East, Africa, and Latin America are emerging markets in the Oil and Gas Data Management sector, fueled by growing energy demand, large-scale oil and gas investments, and digital transformation initiatives. Countries like Saudi Arabia, UAE, Brazil, and Mexico are adopting advanced analytics, IoT, and cloud-based solutions to enhance operational efficiency, ensure regulatory compliance, and optimize production, positioning these regions as key contributors to global data management growth.

Oil and Gas Data Management Market Competitive Landscape:

Schlumberger (SLB)

Schlumberger is a leading global oilfield services company, offering integrated technology solutions for exploration, drilling, production, and reservoir management. The company focuses on digitalization, advanced analytics, and automation to enhance operational efficiency, optimize hydrocarbon recovery, and reduce costs. With a strong portfolio of software, subsurface, and well-completion technologies, Schlumberger enables energy companies to achieve safer, more sustainable, and data-driven oil and gas operations worldwide.

-

2025 – SLB launched Electris, a portfolio of digitally enabled electric well completion technologies delivering real-time production intelligence, enhancing reservoir management, and reducing total cost of ownership through advanced data-driven control.

-

2025 – SLB announced a partnership with Shell to deploy Petrel™ subsurface software globally, enhancing seismic interpretation workflows to drive operating cost efficiencies and digital transformation in exploration and production.

-

2023 – SLB partnered with Rockwell Automation, Sensia, and Cognite to optimize FPSO (Floating Production, Storage and Offloading) asset performance via digital, low-carbon workflows enhancing reliability, efficiency, and safety.

Oracle Corporation

Oracle Corporation is a multinational technology company specializing in cloud computing, database management, and enterprise software solutions. Its energy-focused offerings provide unified data management, analytics, and AI-driven insights to help utilities, oil, and gas companies optimize operations. Oracle supports digital transformation, real-time decision-making, and operational efficiency while addressing regulatory compliance and sustainability goals. The company enables data-driven energy management through innovative, scalable, and secure cloud solutions.

-

2024 – Oracle unveiled its Energy and Water Data Intelligence solution at Oracle CloudWorld offering unified data, analytics, and AI capabilities tailored for utilities to accelerate decision-making and actionable insights.

Key Players

Some of the Oil and Gas Data Management Market Companies

-

Schlumberger

-

Baker Hughes

-

IBM

-

Oracle

-

SAP SE

-

AVEVA Group

-

Cognite

-

Merrick Systems

-

TIBCO Software

-

Seeq Corporation

-

Quorum Software

-

CGG

-

Kongsberg Gruppen

-

Aspen Technology, Inc.

-

Yokogawa Electric Corporation

-

Siemens Energy

-

Rockwell Automation, Inc.

-

Schneider Electric

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 30.82 Billion |

|

Market Size by 2032 |

US$ 91.64 Billion |

|

CAGR |

CAGR of 14.59 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2032 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Technology (Big Data Analytics, AI, IoT) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Schlumberger, Halliburton, Baker Hughes, IBM, Oracle, SAP SE, Honeywell, AVEVA Group, Cognite, Merrick Systems, TIBCO Software, Seeq Corporation, Quorum Software, CGG, Kongsberg Gruppen |