Commercial Refrigeration Equipment Market Report Scope & Overview:

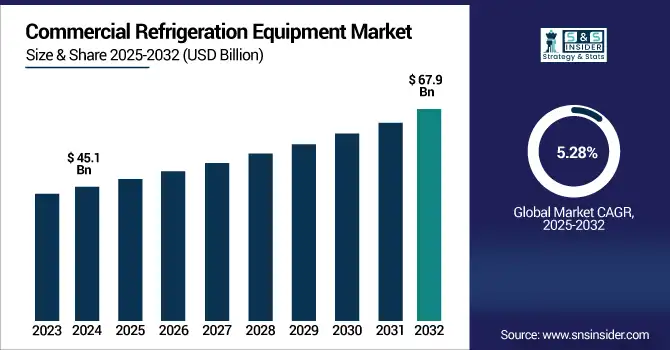

The Commercial Refrigeration Equipment Market was at USD 45.1 Bn in 2024 and is expected to reach USD 67.9 Bn by 2032, at a CAGR of 5.28% from 2025-2032.

The Commercial Refrigeration Equipment Market is expanding due to rising demand in the food, retail, and hospitality sectors. Growth is driven by efficient cooling needs, global food trade, and energy-efficient technologies, with ENERGY STAR-certified units using 1.89 kWh/day versus 4.44 kWh/day for traditional models. Manufacturers are adopting eco-friendly solutions, including low-GWP refrigerants and magnetic cooling systems, improving energy efficiency by up to 30%, reducing environmental impact, and lowering operational costs, fueling future market growth.

To get more information on Commercial Refrigeration Equipment Market - Request Free Sample Report

Key Commercial Refrigeration Equipment Market Trends:

-

Rising demand in food, beverage, retail, and hospitality sectors is driving the need for reliable and efficient refrigeration solutions.

-

Expansion of global food trade and frozen food distribution is boosting demand for advanced storage and transport refrigeration systems.

-

Integration of energy-efficient technologies, like ENERGY STAR-certified units, reduces energy consumption from 4.44 kWh/day to 1.89 kWh/day, lowering operational costs.

-

Smart refrigeration systems with automated temperature control are increasingly adopted for precise monitoring in commercial kitchens.

-

Environmental concerns over high-GWP refrigerants are pushing manufacturers to develop eco-friendly options, including magnetic and low-GWP cooling systems.

-

Growing focus on sustainable, cost-effective, and energy-efficient solutions is expected to fuel market growth through 2032.

Commercial Refrigeration Equipment Market Drivers:

-

Rising global food trade, especially in frozen and processed foods, is boosting demand for advanced commercial refrigeration systems to ensure proper storage and transportation of perishable goods.

The process of international food trade that increases worldwide due to the growing popularity of various types of meals, frozen and processed foods first of all, is the primary factor that for the development of contemporary advanced commercial refrigeration systems. Growing international trade results in the increasing demand for effective, stable and reliable methods of storage and transportation of various perishable products. Frozen and processed foods require precise temperature controls because the quality, the safety and the shelf life of these products may be rather different and various. Another reason for the growing popularity of refrigeration systems is their effectiveness for retail. Not only systems of this type allow retaining the freshness of the product but they also cut down spoilage that is crucial for cutting down the losses retailers and suppliers may suffer due to non-optimal conditions during storage and transportation. Finally, increasing role of processed food in the diet of modern Americans may also contribute to the growing demand for powerful refrigeration options. These systems are characterized by the effective use of modern technology such as the range of possibilities to monitor the efficiency of the system remotely and improved energy consumption. The growing popularity of these systems may be also explained by the increasing stringency of rules that are developed to ensure the quality and the safety of the food the companies produce. Thus, these rules make companies purchase permission to preserve food according to these regulations and to meet the demand of their customers. Generally, the growing international food trade plays a critical role in the growing popularity of powerful modern refrigeration systems and stimulates the development of new ideas and technologies to improve the process of food transportation between countries.

-

Technological innovations in refrigeration, including liquid-vapor compression, ammonia absorption systems, and smart refrigeration with automated controls, are driving demand by enhancing efficiency and usability for commercial kitchens and retailers.

Advancement in refrigeration technology led to significant changes in the environment for such businesses as restaurants or stores, making the solutions more efficient and user-friendly. One of the elements of modern refrigeration that becomes increasingly standard and popular is a liquid-vapor compression system. The use of such systems as the foundation for the bulk of contemporary refrigeration delivery is impressive since they provide more excellent energy effectiveness and reliability compared to conventional approaches. A special type of refrigerant travels through the system and changes phases numerous times to absorb and release heat most efficiently. It leads to decreased power use and lower operational expenses for the consumers. Additionally, many people are interested in ammonia absorption systems as they are relatively safe for the environment without losing the efficiency for the large-scale supply. The ammonia serves as a refrigerant in the cooling process that is enabled by the use of heat sources rather than electric power. Such solutions are cheap and environmentally friendly with the subsequent decrease of energy costs, which makes it an appealing alternative for industrial businesses. Finally, with the advent of smart refrigeration technology, there are changes in the way businesses work with their cooling systems. The automated controls allow immediate monitoring and adaptation to facilitate the best temperature effect while decreasing energy waste and prolonging the lifespan of a piece of equipment. The integration of the Internet of Things may ensure proactive maintenance and warn the people about the potential problem at the moment, which is necessary for preventing larger losses. In conclusion, the overall effect of these trends makes the solutions more attractive by providing dependable, cheap, and environmentally friendly refrigeration options for the commercial kitchens, as well as retailers. It results in better operational efficiency and food safety.

Commercial Refrigeration Equipment Market Restraints:

-

High initial costs of advanced and energy-efficient commercial refrigeration systems may deter smaller businesses from upgrading, limiting market penetration.

One of the most substantial obstacles for small businesses is the expensive initial cost of implementing more advanced, energy-efficient commercial refrigeration systems. While the new system would save money in the long run because it uses less power and has lower operating costs, a small business may be unable to afford the high initial expense. Smaller companies often operate on low margins and are unable to invest in new equipment by setting significant amounts of money aside, especially given that their current maintenance needs are still relatively simple. It is to a severe degree a lack of desire to invest that restricts the market acceptance of these technologies, both in terms of overall progress and creativity. As a result, a large number of smaller businesses may not experience the benefits of higher productivity or the relative eco-friendliness of the more modern solutions, merely reinforcing the old, inefficient methods in the market. The shift is not as quick as expected, and, as a result, the environmental goals can suffer, as well as the development of the sector on the whole.

Commercial Refrigeration Equipment Market Segmentation Analysis:

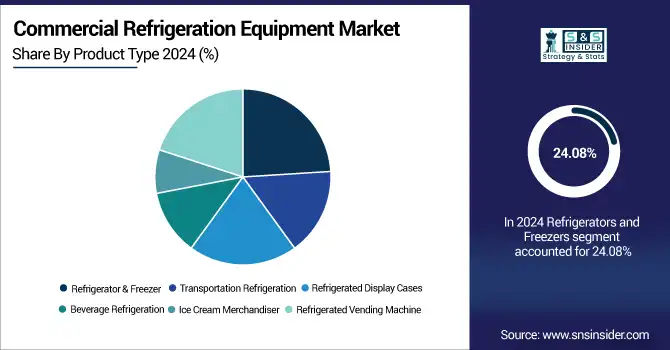

By Product Type, Refrigerators & Freezers Lead Market Growth, Driven by Travel, Tourism, and Healthcare Refrigeration Needs.

The refrigerators and freezers segment registered a market share of over 24.08% in 2024. It happened due to the development of the travel and tourism sector all around the world; as a consequence, millions of dining restaurants and eateries started to emerge. This particular part also talks about blast chillers, which are mainly used to freeze or cool the item at a lower temperature to prevent bacteria from growing in the stored product, and, in general, the usage of chillers is expanding because healthcare professionals are widely utilizing them to preserve tissue samples of vaccines and controlled tests, as well as critical medicines.

By Refrigeration Type, Fluorocarbons Dominate, While Hydrocarbons Show Fastest Growth Due to Energy Efficiency and Low-GWP Demand.

The Fluorocarbons segment dominates the Commercial Refrigeration Equipment Market with a 47% revenue share in 2024. This leadership is driven by the refrigerant’s high stability and efficiency, which enhance cooling performance in large-scale applications. The widespread adoption of fluorocarbon-based systems in supermarkets, restaurants, and food processing units causes increased demand. Additionally, their compatibility with existing infrastructure and lower maintenance needs reduces operational costs, reinforcing their dominant position and making fluorocarbons the preferred choice for commercial refrigeration globally. The Hydrocarbons segment is growing at the highest CAGR in the Commercial Refrigeration Equipment Market due to increasing environmental regulations and demand for low-GWP solutions. Hydrocarbons, such as propane and isobutane, provide energy-efficient cooling with minimal environmental impact, causing businesses to replace high-GWP refrigerants. Rising awareness of carbon footprint reduction and government incentives for sustainable refrigeration drives adoption. As companies strive to meet sustainability goals while controlling operational costs, hydrocarbon-based systems are rapidly expanding across commercial refrigeration applications.

By Application, Supermarkets & Hypermarkets Hold Largest Share, Convenience Stores Exhibit Highest Growth in Commercial Refrigeration Market.

Supermarkets & Hypermarkets account for the largest application share at 53% in 2024. This dominance is caused by the extensive need for large-scale, reliable refrigeration to store perishable and frozen goods safely. Growing consumer demand for fresh and packaged foods increases the installation of advanced refrigeration units. Additionally, energy-efficient systems reduce operational costs and maintain compliance with U.S. Department of Energy standards, reinforcing the segment’s revenue leadership and driving investments in high-performance commercial refrigeration equipment across retail sectors. The Convenience Stores segment is witnessing the highest CAGR in the Commercial Refrigeration Equipment Market, driven by the rapid expansion of small-format retail outlets. Rising urbanization and increasing on-the-go consumption create a need for compact, energy-efficient refrigeration solutions. Adoption of advanced technologies like smart temperature control and low-GWP refrigerants causes reduced energy consumption, aligning with sustainability goals. As convenience stores expand nationwide, the demand for cost-effective, reliable commercial refrigeration systems continues to grow, fueling the segment’s accelerated market growth.

Commercial Refrigeration Equipment Market Regional Analysis

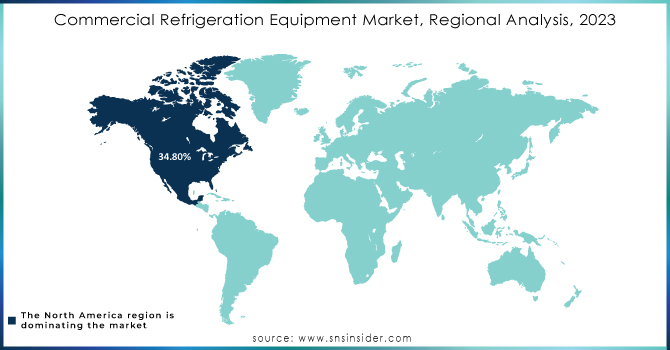

North America Dominates Commercial Refrigeration Equipment Market in 2024

North America is the dominant region in the Commercial Refrigeration Equipment Market, holding an estimated 38% market share in 2024. This leadership is driven by advanced retail and foodservice infrastructure, high adoption of energy-efficient refrigeration technologies, and growing consumer demand for fresh and frozen food, which accelerates commercial refrigeration deployment across supermarkets, restaurants, and convenience stores.

-

United States Leads North America’s Commercial Refrigeration Equipment Market

The United States dominates due to its mature retail, hospitality, and food processing sectors, coupled with high investments in energy-efficient and technologically advanced refrigeration systems. Supermarkets, hypermarkets, and large-scale foodservice chains are rapidly adopting fluorocarbon and hydrocarbon-based systems to improve cooling efficiency and reduce operational costs. Government initiatives promoting sustainability and low-GWP refrigerants further drive market expansion. The U.S. remains central to North America’s commercial refrigeration landscape, setting technological and environmental standards that influence regional market growth.

Asia Pacific is the Fastest-Growing Region in the Commercial Refrigeration Equipment Market in 2024

Asia Pacific is the fastest-growing region, with an estimated CAGR of 9.2% during 2024. Growth is fueled by rapid urbanization, increasing demand for supermarkets and convenience stores, and rising awareness of energy-efficient refrigeration, which drives adoption of advanced commercial cooling solutions.

-

China Leads Commercial Refrigeration Equipment Market Growth in Asia Pacific

China dominates due to its expanding retail sector, including hypermarkets, supermarkets, and convenience stores, coupled with a growing foodservice industry. Rising consumer income and urbanization increase the demand for fresh and frozen food storage, requiring advanced refrigeration solutions. Government regulations on low-GWP refrigerants and energy-efficient cooling systems encourage adoption of sustainable technologies. Local manufacturers and international suppliers are investing in advanced commercial refrigeration systems to meet rising demand, positioning China as the central hub for the Asia Pacific market.

Europe Commercial Refrigeration Equipment Market Insights, 2024

Europe accounts for a significant share of the Commercial Refrigeration Equipment Market, driven by modern retail infrastructure, hospitality growth, and sustainability initiatives. Germany’s high adoption of energy-efficient refrigeration solutions reduces operational costs and environmental impact, boosting market deployment. Germany dominates due to its advanced retail and foodservice sectors, widespread use of energy-efficient systems, and stringent environmental regulations. Manufacturers focus on low-GWP refrigerants and smart temperature-controlled equipment. Germany’s leadership ensures high-quality standards, encourages technological adoption, and sets benchmarks for energy-efficient commercial refrigeration across Europe.

Middle East & Africa and Latin America Commercial Refrigeration Equipment Market Insights, 2024

The Commercial Refrigeration Equipment Market in the Middle East & Africa and Latin America is growing steadily, supported by expanding retail chains, foodservice sectors, and urbanization. Countries such as Brazil, Mexico, UAE, and Saudi Arabia are increasingly investing in energy-efficient refrigeration systems for supermarkets, restaurants, and convenience stores. Rising demand for fresh and frozen foods, combined with government incentives for sustainable cooling technologies, is driving adoption. While still behind North America, Europe, and Asia Pacific, these regions are witnessing accelerated deployment of commercial refrigeration equipment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape of the Commercial Refrigeration Equipment Market:

AHT Cooling Systems GmbH

AHT Cooling Systems GmbH is a Germany-based leader in commercial refrigeration solutions, specializing in plug-in refrigerators, refrigerated display cabinets, and freezers. With decades of experience, the company designs, engineers, and installs high-efficiency refrigeration systems tailored for supermarkets, restaurants, and convenience stores. AHT focuses on sustainable cooling technologies, energy-efficient compressors, and smart temperature control, ensuring reduced operational costs and environmental impact. Its role in the commercial refrigeration market is vital, providing reliable, high-performance solutions that maintain food quality, extend product shelf life, and meet the growing demand for eco-friendly refrigeration.

-

In 2024, AHT Cooling Systems launched an advanced plug-in refrigerated display cabinet series, featuring intelligent climate control and 30% energy savings compared to conventional units.

Ali Group S.r.l. a Socio Unico

Ali Group S.r.l. a Socio Unico is an Italy-based global leader in foodservice and commercial refrigeration equipment, specializing in ice makers, blast chillers, and refrigerated counters. With extensive expertise, the company develops innovative solutions for restaurants, hotels, and catering services, emphasizing energy efficiency, durability, and modular design. Ali Group’s role in the commercial refrigeration market is significant, as it enables businesses to enhance operational efficiency, maintain optimal food storage conditions, and meet strict hygiene standards while addressing sustainability goals.

-

In 2024, Ali Group introduced a next-generation blast chiller with rapid cooling technology, reducing energy consumption by 25% while preserving food quality.

Carrier

Carrier, headquartered in the U.S., is a global provider of commercial refrigeration solutions, offering refrigeration display cases, cold rooms, and large-scale food retail systems. The company combines advanced cooling technology, smart system integration, and energy-efficient design to support supermarkets, convenience stores, and industrial food facilities. Carrier plays a central role in the commercial refrigeration equipment market, enabling businesses to optimize storage, ensure food safety, and reduce operational costs through cutting-edge temperature control and monitoring solutions.

-

In 2024, Carrier unveiled a new range of cold rooms with IoT-enabled monitoring, improving energy efficiency by 28% and operational reliability.

Daikin Industries Ltd

Daikin Industries Ltd, a Japan-based company, specializes in packaged refrigeration units and refrigeration condensing systems for commercial and industrial applications. With a focus on energy efficiency, low environmental impact, and advanced system controls, Daikin provides sustainable solutions for supermarkets, restaurants, and industrial cold storage. The company’s role in the commercial refrigeration equipment market is crucial, supporting businesses in reducing energy consumption, maintaining optimal cooling performance, and complying with environmental regulations, thereby enhancing operational sustainability and cost efficiency.

-

In 2024, Daikin launched high-efficiency refrigeration condensing units, cutting power usage by 32% and enabling eco-friendly cold chain management.

Commercial Refrigeration Equipment Market Key Players:

-

AHT Cooling Systems GmbH

-

Ali Group S.r.l. a Socio Unico

-

Carrier

-

Daikin Industries Ltd

-

Electrolux AB

-

Hussmann Corporation

-

Illinois Tool Works Inc.

-

Lennox International Inc.

-

Panasonic Corporation

-

Whirlpool Corporation

-

Danfoss A/S

-

True Manufacturing Co., Inc.

-

United Technologies Corporation

-

The Manitowoc Company, Inc.

-

Blue Star Limited

-

GE Appliances, a Haier company

-

Frigoglass SAIC

-

Standex International Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 45.1 Billion |

| Market Size by 2032 | US$ 67.9 Billion |

| CAGR | CAGR of 5.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

•By Product Type (Refrigerator & Freezer, Transportation Refrigeration, Refrigerated Display Cases, Beverage Refrigeration, Ice Cream Merchandiser, Refrigerated Vending Machine) •By Refrigerant Type (Fluorocarbons, Hydrocarbons, Inorganics) •By Application (Hotels & Restaurants, Supermarkets & Hypermarkets, Convenience Stores, Bakeries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AHT Cooling Systems GmbH, Ali Group S.r.l. a Socio Unico, Carrier, Daikin Industries Ltd, Dover Corporation, Electrolux ABm,Hussmann Corporation, Illinois Tool Works Inc, Johnson Control, Lennox International Inc.,Panasonic Corporation: , Whirlpool Corporation, Danfoss A/S, True Manufacturing Co., Inc.,United Technologies Corporation, The Manitowoc Company, Inc., Blue Star Limited, GE Appliances, a Haier company, Frigoglass SAIC, Standex International Corporation |