Laser Cutting Machines Market Report Scope & Overview:

To Get More Information on Laser Cutting Machines Market - Request Sample Report

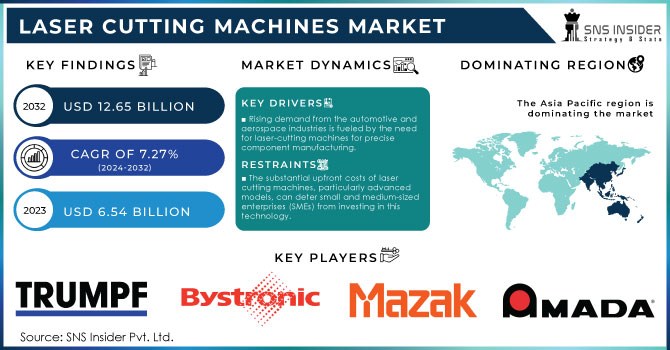

The Laser Cutting Machines Market Size was valued at USD 6.54 Billion in 2023 and is expected to reach USD 12.65 Billion by 2032 and grow at a CAGR of 7.27% over the forecast period 2024-2032.

Laser cutting machines are essential tools in modern manufacturing, offering precision in cutting a wide range of materials like metal, wood, acrylic, and more. The cost of these machines varies significantly depending on their type, size, and capabilities. For example, CO2 laser cutters are more affordable and are commonly used for non-metallic materials, with prices ranging from USD 500 to USD 10,000. Fiber laser machines, known for their precision in cutting metals, are more expensive, ranging from USD 10,000 to over USD100,000. Additional costs may include maintenance, software, and operation fees.

The laser cutting machines market is expanding rapidly due to increasing automation and demand for efficient manufacturing processes. Laser cutters offer precision and reduced material waste, making them indispensable in industries such as automotive, aerospace, and electronics. Recent technological advancements, such as AI integration for better automation, have made laser cutting machines more efficient and adaptable to various industrial needs.

The market for laser cutting machines continues to grow globally, driven by the demand for high-speed cutting, better precision, and reduced production time. More businesses, particularly small- to medium-sized enterprises, are investing in lower-cost machines, while large corporations seek high-end, advanced laser cutters for more specialized applications. Manufacturers are focusing on developing machines with enhanced capabilities, such as multi-axis cutting and compatibility with various materials. The need for energy-efficient and environmentally friendly machines is also shaping the market, with companies developing solutions that reduce power consumption and offer greener options.

MARKET DYNAMICS

DRIVERS

- Rising demand from the automotive and aerospace industries is driven by their need for laser-cutting machines to achieve precise component manufacturing, fueled by the increasing global production of vehicles and aircraft.

The rising demand from the automotive and aerospace industries is driving the growth of laser cutting technology, which has become integral to their manufacturing processes. Both sectors rely on precision-engineered components to ensure performance, safety, and efficiency. In the automotive industry, laser cutting machines are used for fabricating intricate parts like car body panels, engine components, and exhaust systems, all of which require a high degree of accuracy. With the global automotive market expanding and the shift towards electric vehicles (EVs), the need for precise and efficient manufacturing solutions is growing rapidly.

Similarly, in the aerospace industry, laser cutting plays a crucial role in the production of aircraft parts, including fuselage panels, turbine blades, and interior components. Given the stringent safety and performance standards in aerospace, manufacturers are adopting laser cutting for its ability to produce lightweight, durable, and high-quality components with minimal material waste. The ongoing growth in commercial aviation, space exploration, and defense sectors is further fueling the demand for laser cutting technologies. The precision and speed offered by laser cutting machines are essential for meeting the increasingly complex design requirements in these industries. Moreover, laser cutting reduces production times, lowers operational costs, and enhances overall product quality. As a result, the continued expansion of the automotive and aerospace sectors is likely to drive sustained growth in the global laser cutting market, making it an indispensable tool in modern manufacturing.

- Advancements in laser technology, like fiber and CO2 lasers, are boosting the efficiency, precision, and versatility of laser cutting machines, increasing their appeal across various industries.

Advancements in laser technology have significantly enhanced the capabilities of laser cutting machines, making them more efficient, accurate, and versatile for industrial applications. Technologies such as fiber lasers, CO2 lasers, and ultrafast lasers are at the forefront of these innovations. Fiber lasers are known for their high energy efficiency, low maintenance, and ability to cut reflective metals like aluminum and copper, making them a preferred choice in industries like automotive, aerospace, and metal fabrication. They also offer superior beam quality and faster cutting speeds, which contribute to increased productivity. CO2 lasers, traditionally used for cutting non-metal materials like wood, plastic, and textiles, have seen improvements in power and precision, allowing them to cut through thicker materials with greater accuracy. These lasers remain popular in industries that rely on the cutting of organic and synthetic materials due to their versatility.

Ultrafast lasers, which operate on a picosecond or femtosecond scale, offer unprecedented precision, enabling extremely fine cuts with minimal heat damage to surrounding materials. This makes them ideal for applications in electronics, semiconductors, and medical device manufacturing, where precision is paramount. These advancements allow laser cutting machines to meet the growing demand for high-precision manufacturing in diverse industries, from electronics to heavy engineering. As these technologies continue to evolve, they are reducing operating costs and energy consumption while improving output quality, further driving their adoption in both large-scale and small-scale manufacturing sectors.

RESTRAIN

- The substantial upfront costs of laser cutting machines, particularly advanced models, can deter small and medium-sized enterprises (SMEs) from investing in this technology.

The adoption of laser cutting machines requires a substantial initial investment, particularly for advanced models like fiber lasers or ultrafast lasers. These machines offer high precision, speed, and efficiency, but their sophisticated technology comes at a premium. The cost includes not only the machinery itself but also additional expenses such as software, training, installation, and integration into existing production lines. For small and medium-sized enterprises (SMEs), this high upfront cost can be a significant barrier. Unlike large corporations with ample capital, SMEs often operate with tighter budgets and limited financial flexibility. The considerable investment needed for laser cutting technology may deter these businesses from adopting it, as they may prioritize immediate, lower-cost solutions like plasma or waterjet cutting, which have lower entry points.

Additionally, the longer return on investment (ROI) period for laser cutting machines might further dissuade SMEs, as these businesses typically seek quicker payback periods to sustain cash flow. Moreover, maintenance and operational costs, though lower in the long run, still contribute to the overall investment consideration. As a result, despite the long-term benefits of efficiency, precision, and reduced waste that laser cutting offers, the high initial investment is a major limiting factor for smaller businesses. This can slow the wider adoption of laser cutting technology in certain sectors of the market, especially those driven by cost-sensitive SMEs.

KEY SEGMENTATION ANALYSIS

By Technology

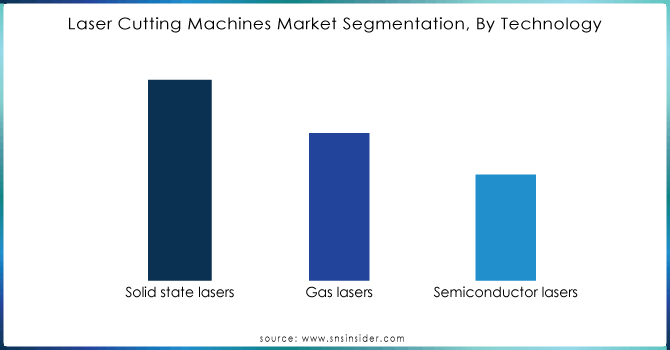

In 2023, the solid-state laser cutting machine sector dominated with a market share of 43.8%. The rise in solid-state lasers cutting machine usage in industries like automotive, pharmaceutical, and optical industry is responsible for the growth.

Do You Need any Customization Research on Laser Cutting Machines Market - Inquire Now

By Process

In 2023, flame cutting dominated the market share over 43.10%. Improved finish, precise cutting, and high cutting speeds are the factors contributing to the rise of flame-based laser cutting machines. It is anticipated that the rise in demand for small steel and carbon alloy timing will drive an increase in the use of flame cutting process in the coming period.

REGIONAL ANALYSIS

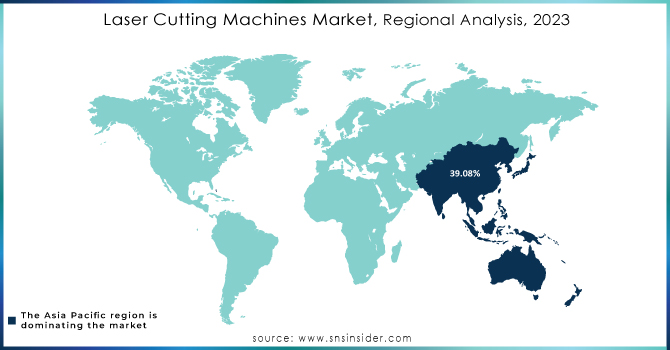

The Asia Pacific region dominated with a market share of over 39.08% in 2023. It is anticipated that the increasing number of consumer electronics and automotive companies in the area will continue to drive market expansion. The increasing use of automation in laser-cutting equipment is also contributing to the growth of the laser cutting machine market.

In 2023, North America accounted for over 25.08% of the share. The United States has played a part in the development of the region and serves as a center for leading automotive and aerospace companies like GM, Ford, Chevrolet, Chrysler, and Boeing, which heavily rely on laser-cutting equipment. Key factors driving product demand in the U.S. and supporting regional growth include the emphasis on smart home automation, new product advancements, and the rapid expansion of the consumer electronics market.

KEY PLAYERS

Some of the major key players of Laser Cutting Machines Market

- Trumpf: (TruLaser Series)

- Bystronic: (ByStar Laser)

- Mazak: (OPTIPLEX Series)

- Amada: (Vega Series)

- Coherent: (AVIA Series)

- IPG Photonics: (YLR Series)

- Prima Power: (Laser Genius)

- Mitsubishi Electric: (ML Series)

- Han's Laser Technology: (HSL Series)

- Hypertherm: (HPRXD Series)

- LVD Group: (Phoenix Series)

- KUKA: (KUKA Laser Cutting Systems)

- Bodor: (Bodor Laser Cutting Machine)

- Trotec Laser: (Speedy Series)

- Epilog Laser: (Zing Series)

- Rayjet: (Rayjet 50)

- Cincinnati Incorporated: (CLX Series)

- FANUC: (Laser Cutting Robot Systems)

- LaserStar Technologies: (LaserStar Cutting Systems)

- Acyc: (ACYC Laser Cutting Machines)

RECENT DEVELOPMENTS

In January 2024: Novanta Inc. finalized the purchase of Motion Solutions. This purchase allows for the possibility of creating innovative intelligent subsystems by leveraging our combined technology

In February of 2023: Kern Lasers Systems revealed the introduction of their latest CO2 laser cutting machines, the KT300 and KT500. Kern's previous models had lower output power and slower cutting speeds compared to these machines.

In November 2023: IPG Photonics partnered with Miller Electronics Mfg. LLC is dedicated to innovative, high-quality, and reliable laser technologies for the handheld welding market. The partnership will revolutionize welding tools to offer powerful, efficient, and accurate solutions that cater to the needs of contemporary welding tasks.

In June 2023: Fanuc introduced the iRVision 3D, a new 3D vision system aimed at enhancing the precision and productivity of laser cutting machines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.54 Billion |

| Market Size by 2032 | USD 12.65 Billion |

| CAGR | CAGR of 7.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Solid state lasers,Gas lasers, Semiconductor lasers) • By Process (Fusion cutting, Flame cutting, Sublimation cutting) •By Application (Automotive, Consumer electronics, Defense and aerospace, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trumpf, Bystronic, Mazak, Amada, Coherent, IPG Photonics, Prima Power, Mitsubishi Electric, Han's Laser Technology, Hypertherm, LVD Group, KUKA, Bodor, Trotec Laser, Epilog Laser, Rayjet, Cincinnati Incorporated, FANUC, LaserStar Technologies, Acyc |

| Key Drivers | • Rising demand from the automotive and aerospace industries is driven by their need for laser cutting machines to achieve precise component manufacturing, fueled by increasing global production of vehicles and aircraft. • Advancements in laser technology, like fiber and CO2 lasers, are boosting the efficiency, precision, and versatility of laser cutting machines, increasing their appeal across various industries. |

| RESTRAINTS | • The substantial upfront costs of laser cutting machines, particularly advanced models, can deter small and medium-sized enterprises (SMEs) from investing in this technology. |