Electric 3-Wheeler Market Report Scope & Overview:

Get more information on Electric 3-Wheeler Market - Request Free Sample Report

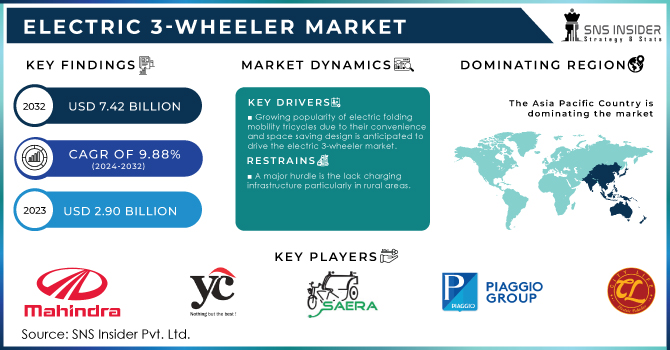

The Electric 3-Wheeler Market size was valued at USD 2.90 billion in 2023, and is expected to reach USD 7.42 billion by 2032, and grow at a CAGR of 9.88% over the forecast period 2024-2032.

As a result of increasing awareness of pollution globally, sustainable transportation solutions are getting common and 72% of the world population now views air pollution as a serious public health problem. The 40% of countries apply tax incentives or give discounts to their citizens for purchasing electric cars shows that governments have embraced this innovation on a large scale. As such, electric cars offer greater financial benefit with operating costs that are about half the cost when compared to traditional fuel-driven 3-wheelers, making them more attractive both for private and commercial users. Moreover, battery technology’s progress deals with one of major concerns among buyers – range anxiety.

Recently lithium-ion batteries which power the 3-wheeler electric vehicles can last up to 30% longer than they did only several years ago so now it is possible to use them for longer trips and deliveries. Besides, with an increase in demand for efficient last-mile delivery solutions, electric bicycles are also being adopted by many consumers hence this market is rapidly growing in popularity. The reason for this is that about 70% of people residing in the United States are not within counties that meet federal air quality standards is one of the main reasons for stringent government regulations aimed at reducing air pollution while combined with rising public awareness of environmental damages caused by conventional gasoline powered vehicles, strong demand for cleaner transportation solutions among Americans who highly or moderately worry about climate change stands at 60%. Also, there is no doubt that electric 3-wheelers are economically beneficial. Additionally, it is evident that electric 3-wheeler adoption makes economic sense for companies involved in last mile delivery business which accounts for more than 40% of all deliveries in the US and they expect their operating costs would be 60% lower than those recorded with the petrol-based options.

Market Dynamics:

Drivers:

-

Growing popularity of electric folding mobility tricycles due to their convenience and space saving design is anticipated to drive the electric 3-wheeler market.

-

With expanding e-commerce sector and increasing demand for quicker deliveries, electric 3-wheelers provide a sustainable and cost-effective alternative to traditional delivery vehicles.

-

A significant potential for electric 3-wheelers with projections suggesting that up to 40% of all last mile deliveries could be shifted to full electric vehicles by 2030.

Being compact in size and thus enabling them to navigate through congested urban environments is one of the unique features of electric 3-wheelers, making them appropriate for last-mile deliveries. This results in huge savings for logistics firms due to reduced operating costs which include lighter fuel bills as well as simpler maintenance and repair procedures. The stringency in environmental legislation coupled with an increased preference by consumers towards sustainable business practices is forcing companies to adopt cleaner transportation alternatives. Additionally, battery technology improvements have dealt with the issue of range anxiety that hindered the growth of electric vehicles at first.

Restrain:

-

Initial costs are often 20-30% higher than traditional equivalents which discourage likely buyers specifically small-scale operators who depend on reasonable prices.

-

Distance continues due to limited battery capacity. Traditional tricycles can do long distances on a single tank while their counterparts lack such capabilities going at most 100-120 kilometers.

-

A major hurdle is the lack charging infrastructure particularly in rural areas.

This indicates that “range anxiety” is a major factor preventing them from switching to electric vehicles as confirmed by a recent survey which revealed that about 79% of potential customers of electric tricycles in India are worried about the availability of charging stations, especially for long distance travel. A case in point is rural areas where only 28% of respondents have said that they can be sure to find an outlet for charging, when necessary, compared to 56% in urban centers. Hence, diffusion of these vehicles into the huge rural market is hampered thereby stalling the industry’s overall growth.

Future Outlook:

One such major driver has been government policies aimed at achieving a cleaner future with environmental issues being one such motivation. For instance, according to SNS Insider research, there is an increasing trend towards electric vehicles with India targeting 65-75% electric 3-wheeler sales by 2031.The move towards green thinking has become a thing due to economics as much as regulation. Electric rickshaws appeal to drivers because they require little maintenance unlike other types of rickshaws.

Further, there are upcoming advances in battery technology. Although range anxiety is still an issue, new approaches aim at addressing it through better performance and design. Consequently, the electric 3-wheeler market could be well on its way to usurping the position of sustainable urban mobility in terms of range and user experience as a dominant force in this domain.

Electric 3-Wheeler Market Segmentation Analysis:

By Battery Type:

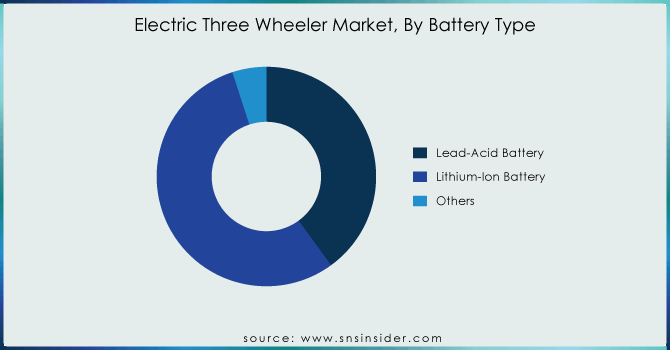

Currently Lead acid batteries have a significant share estimated at around 40% by 2023 but their dominance is expected to weaken due to limitations such as lower energy density, shorter lifetime and longer charging time. Meanwhile, Lithium-ion batteries are quickly gaining ground – they will have a market share of about 55% in 2023 given their excellent operating range, faster charging and lighter weight. This means that those who own fleets can expect more efficiency and savings. However, others might not buy them because they incur high initial costs. Besides, “other” segment which includes emerging techs like solid-state batteries has potential for future applications. Even though their contribution is presently minimal with further research breakthroughs these may become a viable alternative with greater mileage and safety benefits.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End Use:

The market for passenger transport operators, commonly referred to as e-rickshaws or auto-rickshaws, is projected to be ruled by them with a 65% market share. This is driven by factors such as rising levels of urbanization which result in the need for electric tricycles, last-mile connectivity throughout highly congested cities, and affordability compared to regular cab or ride-hailing services. On the other hand, cargo racking segment including electric mini and cargo vehicles will have an approximate market share of 35%. This segment provides efficient and sustainable intra-city freight solutions which are needed particularly for online retailing and small business deliveries.

Electric 3-Wheeler Market Regional Analysis:

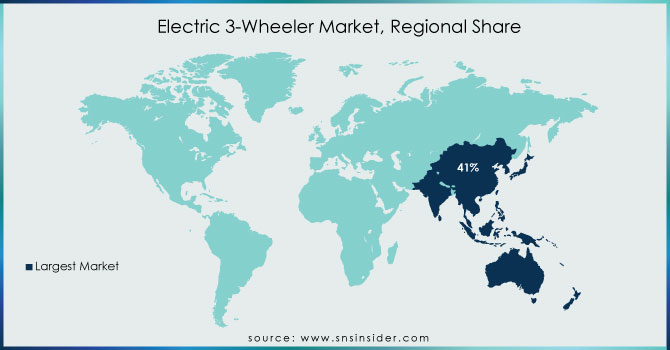

Asia Pacific with its growth-oriented zones accounted for 41% of the global market for electric 3-wheelers in 2023. Why? One reason that causes this dominance is that these places have started experiencing increased air pollution hence they find it necessary to embrace electric 3-wheeler because it operates cleanly. The second reason in line with why middle-class customers are attracted to the value proposition of a 3-wheeler is that they look forward to low cost and effective means of transport which makes about 65% of population. Lastly but not least government initiatives matter in all aspects.

For instance, India has a high percentage of sales of electric 3-wheelers at about 70% due to substantial subsidies and enabling legislation that promote the use of electric cars. In contrast with traditional fuel-based equivalents, Electric 3-Wheelers have got shorter journey distances; which implies that up to 42% of potential consumers experience range anxiety. However, the capital outlay for an electric version may be around 12% more expensive than its traditional counterpart; although reducing running costs in future may help close this gap. By doing so, it would become possible to tackle these challenges through technological advancements as well as continuous government support hence development of electric 3-wheeler markets in these regions will require these factors.

Key Players:

Mahindra&Mahindra Ltd, YC Electric Vehicle, Saera Electric Auto, Piaggio Group, Citylife Electric vehicles, Terra Motors, Kinetic Green Energy Solutions, Bodo EV International and others.

Recent Developments:

-

The Japanese company Terra Motors Corporation has signed a Memorandum of Understanding (MoU) with the Government of Tamil Nadu-State for investing USD 41.66bn in creating charging infrastructure.

-

Under a contract worth USD 2.4 million, Omega Seiki Mobility and Kissan Mobility will supply 500 electric tricycles for last-mile delivery.

-

Atul Auto Ltd is launching an electric 3-wheeler cargo truck that meets increasing demands for sustainable last mile delivery solutions.

-

Piaggio Vehicles Pvt. Ltd. (PVPL), in partnership with Auto and General, has rolled out Piaggio Ape electric tricycles onto Kenya’s market. The Ape E-City FX Max serves passenger traffic while the Ape E-Xtra FX Max targets freight.