Automotive Conformal Coatings Market Size:

Get More Information on Automotive Conformal Coatings Market - Request Sample Report

Automotive Conformal Coatings Market Overview

The Automotive Conformal Coatings Market size is expected to reach USD 2.69 billion by 2032, and was valued at USD 1.35 billion in 2023. The CAGR projected for the forecast period of 2024-2032 is 7.23%.

The driving force behind this is the increasing use of electronics, which by 2025 will represent 40% of total costs. As a result, there are more exposed circuit boards that can be damaged by moisture, vibration and extreme temperatures. The electric vehicle (EV) revolution is also a major growth driver. Furthermore, compared to traditional gasoline-powered vehicles, EVs’ battery management systems and power electronics necessitate 30% more conformal coatings. Also, strict government guidelines for emission standards have been expedited and are now boosting EV adoption as per the research that shows it may reach about one quarter of global car sales in 2031. This upsurge in EVs directly means a higher demand for conformal coatings to protect their vital electronic parts from the elements; in addition, parylene conformal coatings stand out for their thinness and excellent protection making them suitable for automotive conformal coatings market where they provide high-performance insulation on delicate electronics.

Conformal coating requirements in the vehicle industry are increasingly stringent, focusing on reliability, safety and environmental performance. Silicone still dominates the automotive conformal coatings market; however, Parylene’s thinness and superior barrier properties make it a niche player for high-performance electronics. These coverings protect Printed Circuit Boards (PCBs) – the “brain” of modern cars-from such harsh conditions as dampness, vibration and very cold or hot temperatures that cause malfunctions and jeopardize safety. For instance, strict regulations for Electronic Control Units (ECUs) are enforced by the European Union. These regulations demand that ECUs must be able to withstand exposure to various environmental stresses that require their covering with conformal coating materials. Furthermore, government initiatives promoting electric vehicles (EVs) indirectly benefit the conformal coatings market. EVs who depend heavily on electronics to manage batteries, controls motors as well as advance driver assistance systems (ADAS). The projected 32% of global car sales being electric by 2031 will drive up the demand for conformal coatings in EVs.

Market Dynamics:

Drivers:

• by 2032, the need for swift curing UV-based coatings may acquire a market share of 40% by reason of their efficacy and environmental advantages.

• The main driving force lies in increasing complexity of modern vehicles.

The demand for ADAS (Advanced Driver Assistance Systems) and In-Car entertainment has made it necessary to increase the number of electronic components within a car by 75% in comparison with those present in it ten years ago. Therefore, this growth means having better protection from environmental factors such as moisture or vibration. The other trend is an electrification revolution. Electric vehicles, however, have more tightly packed electronics for battery management and power controls. For EVs alone, estimates have it that conformal coatings are used at a rate which is about 20% higher than that in conventional gasoline-run cars.

Restrains:

-

Further hurdles to overcome include downsizing automobile electronic components.

As chip sizes decrease so does the ease with which conformal coating can be applied thinly and evenly on them. It is important to understand that these thin layers are aimed at preventing electrical shorts while maintaining the functionality of chips. According to industry estimates, rejection rates resulting from non-uniform coating can rise up to 15%, thus necessitating novel application procedures suitable for miniature components.

By Component

Modern vehicles’ brains, Electronic Control Units (ECUs), have a 35% share because they play a crucial role and are exposed to hard conditions. The reason behind this is that silicone conformal coatings can be tailor-made to meet the requirements of electronics based on their extensive temperature range characteristics, resistance to chemicals and moisture as well as vibration. At 30%, Printed Circuit Boards (PCBs) are second in importance since they help process information for different systems. In terms of proportion, sensors that includes temperature, pressure and collision detection parts account for 20%, while contaminant protection and vibration are necessary. In terms of fast growth, there is also battery casings at 10% – these need thermal shock- and electrolyte leakage-proof coatings for use in electric vehicles batteries. Additionally, LED lights (2.5%) and infotainment systems (2.5%) require conformal coatings with improved durability against UV degradation and moisture attack

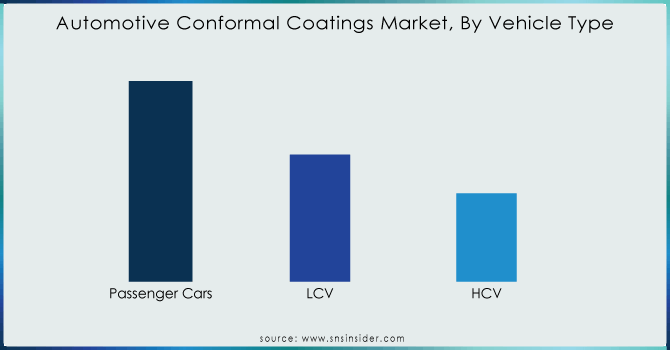

By Vehicle Type

The business of passenger cars dominates and is expected to capture an approximate 60% of market share. This domination arises from the huge number of passenger cars produced across the world coupled with an increasing demand by consumers for vehicles furnished with modern gadgets. Light Commercial Vehicles (LCVs) such as pickups and vans are likely to hold almost one fourth of market share. The reason behind this growth in LCVs sector stems from increased urbanization and growing e-commerce that result in higher delivery van requirement.

Heavy Commercial Vehicles (HCVs) including trucks and buses which represent a small slice at about 15% cannot be ignored. Tight emission regulations, automotive electronics landscape and expanding electric vehicle revolution have promoted the adoption of intricate electronic packages in HCVs necessitating robust conformal coating protection.

Need any customization research on Automotive Conformal Coatings Market - Enquiry Now

Automotive Conformal Coatings Market Regional Analysis:

The automotive conformal coatings market will be dominated by Asia Pacific during the forecast period, APAC region held around 41% global share in 2023. This is because the region has the largest production of vehicles in the world, coupled with increasing attention to both safety requirements and comfort measures inside these cars. This contributes to a substantial increase in electronic components such as ECUs, PCBs and sensors that would all require conformal coating protection.

Moreover, Europe is at the forefront of technological innovation. Here, well-known car manufacturers like Daimler or BMW are always challenging limits of vehicle performance. The constant search for new-fangled technology generates demand for sophisticated conformal coatings which can withstand increasingly tough environments. In contrast, North America exhibits a strong market driven by its high uptake of advanced automotive features e.g GPS systems.

Key Players:

Dow, Henkel AG & CO. KGAA, Chase Corporation, H.B. Fuller, Shin-etsu Chemical Co Ltd, Dymax Corp, Electrolube, M.G. Chemicals and other.

Recent Developments:

Henkel AG & Co. KGaA, a major player, acquire Seal for Life Industries, a provider of advanced coating solutions. This acquisition expands Henkel's offerings and strengthens their position in the market.

Henkel launched their Loctite Stycast CC 8555 coating, boasting exceptional protection for electronics in harsh environments. This focus on extreme durability reflects a key trend as electric and autonomous vehicles become more prevalent, their complex electronics require even more robust protection.

PCB (Printed Circuit Board) protection is another area witnessing significant growth, projected to be the fastest-growing segment at over 10% annually. This aligns with the increasing number of PCBs used in modern vehicles for everything from LED lighting to advanced driver-assistance systems.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.35 billion |

| Market Size by 2032 | US$ 2.69 Billion |

| CAGR | CAGR of 7.23 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Material (Acrylic, Silicone, Parylene, Epoxy, Polyurethane) By Component(ECU, PCB, Sensors, Battery Casting, LED, Infotainment System) By Vehicle Type (Passenger Car, LCV, HCV) By EV Type (BEV, PHEV/HEV) By Application Method (Brush Coating, Dipping, Spray Coating, Selective Coating, Vapor Deposition) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dow, Henkel AG & CO. KGAA, Chase Corporation, H.B. Fuller, Shin-etsu Chemical Co Ltd, Dymax Corp, Electrolube, M.G. Chemicals and other. |

| Key Drivers | The main driving force lies in increasing complexity of modern vehicles. |

| RESTRAINTS | The hurdles to overcome include downsizing automobile electronic components. |