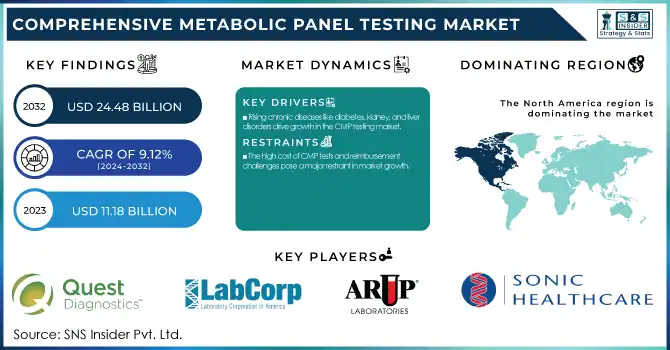

Comprehensive Metabolic Panel Testing Market Size & Overview:

The Comprehensive Metabolic Panel Testing Market Size was valued at USD 11.18 Billion in 2023 and is expected to reach USD 24.48 Billion by 2032 and grow at a CAGR of 9.12% over the forecast period 2024-2032.

To Get more information on Comprehensive Metabolic Panel Testing Market - Request Free Sample Report

This report emphasizes the prevalence and incidence of metabolic and chronic diseases by region, driving demand for CMP testing. Further, technological innovations and automation adoption are enhancing test accuracy and efficiency, while at-home and direct-to-consumer (DTC) CMP testing is transforming consumer access. The research examines the regulatory and policy environment, determining its influence on market growth and compliance. In addition, artificial intelligence (AI) and machine learning augment diagnostic functionality, simplify data analysis, and enable personalized care. Price trends and cost evaluation by region are also analyzed in the report, demonstrating the accessibility and affordability of CMP testing in various healthcare systems.

Comprehensive Metabolic Panel Testing Market Dynamics

Drivers

-

The growing prevalence of chronic diseases, such as diabetes, kidney disorders, and liver diseases, is a significant driver for the Comprehensive Metabolic Panel (CMP) Testing Market.

As per the International Diabetes Federation (IDF), more than 537 million adults globally had diabetes in 2023, reflecting the growing demand for regular metabolic monitoring. The growing prevalence of chronic kidney disease (CKD), impacting about 850 million individuals worldwide, also drives demand for CMP testing to evaluate kidney function. Advances in diagnostic technology, including automated analyzers, point-of-care (PoC) testing, and AI-assisted lab solutions, have increased the efficiency and accuracy of CMP testing. For instance, AI-assisted diagnostic solutions are enabling labs to process large volumes of tests with greater precision, boosting early disease detection rates. In addition, the trend towards preventive medicine and wellness check-ups is also boosting test adoption, with various insurance payers covering routine CMP tests among high-risk populations. In addition, the growing popularity of home testing kits and the growth of direct-to-consumer (DTC) laboratory testing services are also contributing to market growth. Quest Diagnostics and LabCorp are making it easier by offering online health platforms where consumers can order CMP tests without the need for physician referrals.

Restraints

-

The high cost of CMP tests and reimbursement challenges pose a major restraint in market growth.

Although laboratory-based CMP testing is common, out-of-pocket costs for the uninsured are a problem, especially in low- and middle-income countries (LMICs). The cost of a CMP test in private laboratories can be as high as USD 50 to USD 150, which might be prohibitive for most uninsured individuals. Furthermore, reimbursement practices differ greatly from one region to another, with strict regulations curbing coverage for routine CMP testing. For example, in the United States, Medicare and Medicaid only pay for CMP tests when they are medically necessary, limiting access to preventive health screening. In addition, most private insurers have complex documentation requirements before reimbursing, placing administrative burdens on healthcare providers and patients. One more challenge is high operational expenses relating to sophisticated diagnostic machines and automated laboratories, posing a challenge to small and mid-sized diagnostic laboratories to compete against established players. Developing nations are also confronted by other challenges like limited government investments in diagnostic procedures and poor health infrastructure, thus limiting the practice on a larger scale. Such factors cumulatively limit the market potential, especially in less developed regions with low diagnostic rates and affordability limits.

Opportunities

-

The growing adoption of point-of-care (PoC) and at-home CMP testing presents a significant opportunity for market expansion.

With the advancement of portable diagnostic equipment and telemedicine integration, healthcare professionals are moving towards quicker, decentralized testing options. PoC testing removes the requirement for conventional lab-based diagnostics, providing real-time metabolic analysis in clinics, emergency rooms, and home care. For instance, firms such as Abbott and Nova Biomedical are creating small handheld analyzers that provide quick CMP results, enhancing decision-making in critical care scenarios. In addition, the growth of direct-to-consumer (DTC) healthcare is driving demand for in-home CMP test kits to enable individuals to track metabolic health without going to a clinic. Companies like EverlyWell and LetsGetChecked are using e-commerce websites to offer CMP testing kits, along with online physician visits to interpret results. Finally, digital innovations in health, including artificial intelligence (AI)-powered risk assessment tools and wearable biosensors, are transforming the preventive healthcare landscape. The combination of CMP test results with electronic health records (EHRs) also supports remote patient monitoring, especially for diabetes and chronic kidney disease patients. These technological innovations, combined with growing consumer awareness of preventive diagnostics, are anticipated to provide significant growth opportunities for the CMP testing market.

Challenges

-

One of the key challenges in the CMP testing market is ensuring standardization and regulatory compliance across different healthcare systems.

Testing methodologies, reagent quality, and standards of reporting vary between laboratories and impact the accuracy and comparability of results. For example, differences in reference values for metabolic markers such as glucose, creatinine, and enzymes of the liver between labs can cause delayed treatment or misdiagnosis. Regulatory agencies like the FDA, European Medicines Agency (EMA), and Clinical Laboratory Improvement Amendments (CLIA) implement rigorous standards for diagnostic testing involving extensive validation and quality control measures. Smaller labs and emerging markets, though, tend to find it challenging to comply with these strict regulatory standards, creating inconsistencies in the reliability of tests. Another challenge is the growing scrutiny of laboratory-developed tests (LDTs), with regulators tightening policy to guarantee test accuracy and clinical validity. In addition, the fast pace of diagnostic technology development poses compliance challenges, as regulatory clearances for new PoC devices and AI-based testing solutions are time-consuming and expensive. Moreover, cybersecurity threats in digital diagnostics and EHR integration raise concerns about patient data privacy and test result security. Meeting these standardization and regulation issues is essential for the large-scale take-up and confidence in CMP testing solutions worldwide.

Comprehensive Metabolic Panel Testing Market Segmentation Insights

By Analytes

The glucose segment led the CMP testing market in 2023 with a revenue share of 13.2%. Its lead is a result of the increased incidence of diabetes globally and the growing requirement for regular glucose testing in outpatients and inpatients. Its market position is also supported by the increased focus on early diagnosis and treatment of hyperglycemia and complications associated with diabetes.

Conversely, the potassium (K⁺) segment is anticipated to grow at the highest rate during the forecast period. The rising knowledge of electrolyte disturbances, especially in kidney disease and cardiovascular patients, is stimulating demand for potassium testing. Increased point-of-care (PoC) and routine hospital-based electrolyte monitoring adoption are also boosting market growth.

By Disease

The kidney disease segment dominated the largest market share of 32.8% in 2023 due to the increasing cases of chronic kidney disease (CKD) and acute kidney injury (AKI). CMP tests are crucial for determining kidney function based on the measurement of vital analytes including creatinine, blood urea nitrogen (BUN), and electrolytes. The growing prevalence of kidney disorders, especially in elderly populations and diabetic patients, has further strengthened its leadership in the market.

The diabetes segment is anticipated to exhibit the fastest growth, driven by the increasing prevalence of diabetes worldwide and the necessity for recurring metabolic monitoring. CMP tests are critical to monitor glucose levels, renal function, and liver function among diabetic patients, enabling timely intervention and disease management. The surge in awareness programs and government initiatives for diabetes screening also continues to drive the uptake of CMP testing in this segment.

By End-Use

In 2023, the laboratory segment was the leading end-use category, occupying 60.1% market share. The wide application of CMP tests in hospital-based and stand-alone diagnostic labs, as well as their potential to conduct large volumes of tests with high efficiency, has bolstered this segment's leadership position. Well-settled reimbursement mechanisms and higher automation in laboratory environments have added to the growth of the segment's market share.

The point-of-care (PoC) segment will record the highest growth as demand increases for quick and decentralized testing solutions. The trend toward immediate diagnosis in emergency departments, outpatient clinics, and home healthcare settings has more than accelerated the use of PoC CMP testing. With improvements in the miniaturization of compact analyzers and handheld systems, market growth in this segment is also being fueled.

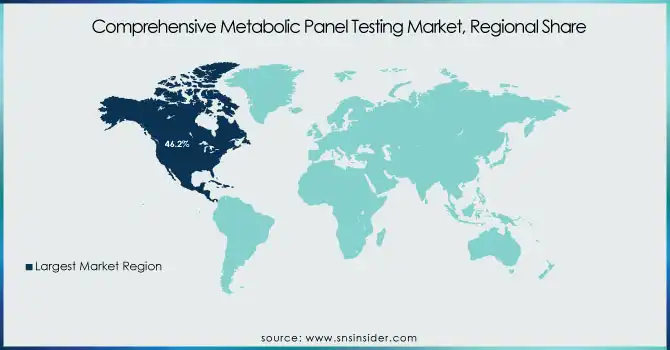

Comprehensive Metabolic Panel Testing Market Regional Analysis

North America led the Comprehensive Metabolic Panel (CMP) Testing Market with a revenue share of 46.2% in 2023. This is mainly attributed to the high incidence of chronic diseases such as diabetes, kidney diseases, and liver diseases that require regular metabolic screening. The established healthcare infrastructure, extensive insurance coverage, and the availability of premier diagnostic companies like Quest Diagnostics, Labcorp, and ARUP Laboratories are additional factors supporting market dominance in the region. The increased focus on preventive care and routine health check-ups has also stimulated demand for CMP testing in clinical labs and point-of-care.

Europe is next in line as a large market, backed by growing healthcare spending, government policies favoring early disease diagnosis, and the expanding geriatric population. The availability of diagnostic service providers like SYNLAB and Sonic Healthcare makes it easier to access CMP testing.

The Asia-Pacific is anticipated to be the fastest-growing region because of the increasing disease burden of metabolic disorders, increasing healthcare infrastructure, and growing networks of diagnostic laboratories. China, India, and Japan are increasing investments in lab automation and adding insurance coverage, which is causing increased test volume.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ARUP Laboratories

-

Sonic Healthcare Limited

-

SYNLAB International GmbH

-

Unipath

-

Abbott Laboratories

-

Charles River Laboratories Inc.

-

NeoGenomics Laboratories Inc.

-

Genoptix Inc.

-

CENTOGENE AG

-

Abaxis Inc. (Zoetis)

-

TCG Corp.

-

Scion Lab Services LLC

Recent Developments

In Oct 2022, SYNLAB, a leading provider of medical diagnostics in Europe, expanded its strategic partnership with Microba Life Sciences to enhance the availability of the myBIOME microbiome test across Europe and Latin America. This collaboration aims to strengthen market reach and advance microbiome analysis in diagnostic services.

In Jan 2022, Quest Diagnostics launched a virtual preventive care service through QuestDirect, enabling individuals to take charge of their health. This first-of-its-kind service offers a range of diagnostic tests, biometric screening, and a health risk assessment with a trackable Health Quotient Score.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.18 billion |

| Market Size by 2032 | USD 24.48 billion |

| CAGR | CAGR of 9.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Analytes [K+, Na+, Cl-, CO2, Glucose, BUN, Creatinine, Ca++, Albumin, Total Protein, ALP, ALT, AST, Total Bilirubin] • By Disease [Kidney Diseases, Liver Diseases, Diabetes, Others] • By End-Use [Laboratories (Emergency Departments, Hospital Wards, Primary Care, Pharmacy, Telemedicine), PoC (Emergency Departments, Hospital Wards, Primary Care, Pharmacy, Telemedicine), PoC (Instruments) (Piccolo Xpress, Skyla-HB1, DRI-CHEM NX500, Others)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Quest Diagnostics, Laboratory Corporation of America Holdings, ARUP Laboratories, Sonic Healthcare Limited, SYNLAB International GmbH, Unipath, Abbott Laboratories, Charles River Laboratories Inc., NeoGenomics Laboratories Inc., Genoptix Inc., CENTOGENE AG, Abaxis Inc. (Zoetis), TCG Corp., Scion Lab Services LLC. |