Computer Controlled Signal Generators Market Report Scope & Overview:

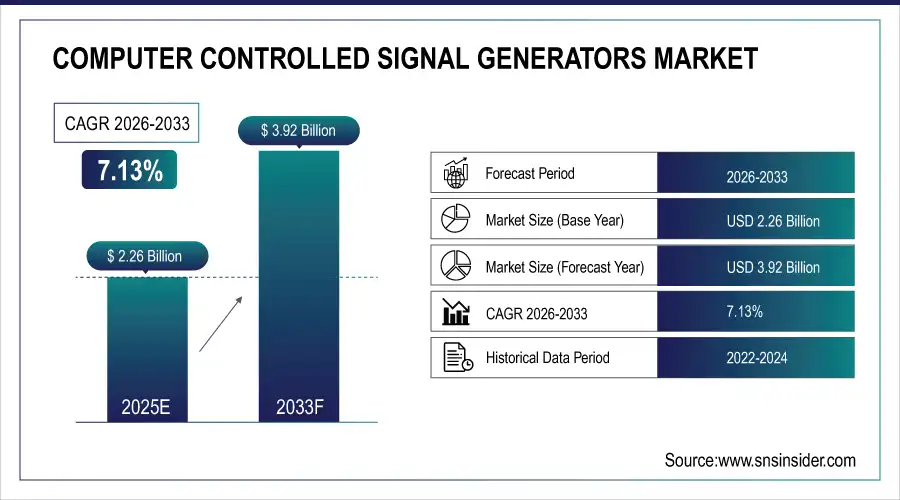

The Computer Controlled Signal Generators Market Size was valued at USD 2.26 Billion in 2025E and is expected to reach USD 3.92 Billion by 2033, growing at a CAGR of 7.13% over the forecast period of 2026-2033.

The Computer Controlled Signal Generators Market is witnessing robust growth, driven by increasing demand for precise testing and measurement solutions across telecommunications, aerospace, and electronics sectors. These generators enable accurate waveform creation and frequency control for product validation, R&D, and manufacturing. Technological advancements enhance automation, signal accuracy, and multi-channel performance efficiency.

Market Size and Forecast:

-

Computer Controlled Signal Generators Market Size in 2025E: USD 2.26 Billion

-

Computer Controlled Signal Generators Market Size by 2033: USD 3.92 Billion

-

CAGR: 7.13% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Computer Controlled Signal Generators Market - Request Free Sample Report

Key Computer Controlled Signal Generators Market Trends

-

Growing demand for high-precision testing solutions in 5G, IoT, and radar communication systems is fueling market growth.

-

Integration of digital control and automation technologies enhances testing accuracy and operational efficiency.

-

Rising adoption of modular and multifunctional signal generators supports flexible R&D and manufacturing workflows.

-

Expanding applications in aerospace, defense, and automotive electronics drive demand for advanced waveform generation.

-

Advancements in frequency synthesis and low-phase-noise design improve signal stability and performance reliability.

-

Increasing focus on compact, software-defined, and cost-efficient instruments caters to diverse end-user requirements.

U.S. Computer Controlled Signal Generators Market Insights

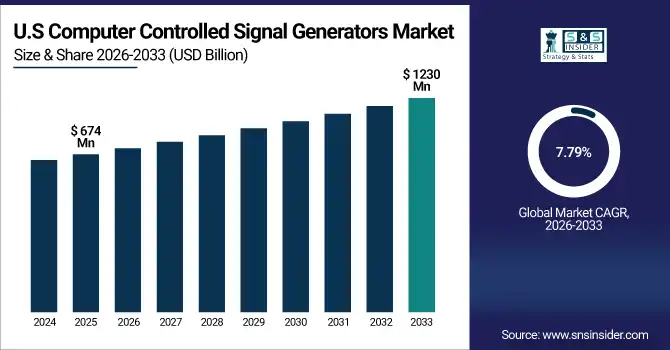

The U.S. Computer Controlled Signal Generators Market size was USD 674 million in 2025 and is expected to reach USD 1230 million by 2033 growing at a CAGR of 7.79% over the forecast period of 2026-2033. The growth is driven by rising demand for high-precision testing across 5G, IoT, and radar systems, coupled with increasing R&D investments in aerospace and defense. Technological advancements in digital automation and low-noise frequency design further enhance testing accuracy, reliability, and operational efficiency.

Computer Controlled Signal Generators Market Growth Driver

-

Growing Adoption of Advanced Testing Solutions in 5G Infrastructure Development Boosts Computer Controlled Signal Generators Market

The rising adoption of 5G technology and the expansion of network testing infrastructure are significantly driving the computer-controlled signal generators market. The need for high-frequency, low-noise, and precise signal generation tools has surged as telecommunication providers focus on ensuring network stability and performance. These generators are essential for testing 5G transceivers, antennas, and base stations, enabling seamless connectivity and efficient data transmission. Additionally, advancements in digital control systems and automated calibration technologies have enhanced measurement accuracy, accelerating demand from telecom R&D facilities and electronics manufacturers.

In June 2024, Keysight Technologies introduced its MXG X-Series signal generator, optimized for 5G FR2 testing and supporting real-time signal modulation up to 44 GHz. This launch strengthened the company’s portfolio in high-frequency testing, catering to next-generation wireless communication systems and reinforcing market growth.

Computer Controlled Signal Generators Market Restraint

-

High Equipment Cost and Calibration Complexity Restrict Broader Adoption of Computer Controlled Signal Generators

The high initial investment and ongoing maintenance costs of computer-controlled signal generators pose a significant restraint to market expansion. These instruments, particularly those supporting frequencies above 20 GHz, require precision components, regular calibration, and software updates, leading to elevated ownership expenses. Small and mid-sized enterprises often face challenges in adopting these high-end systems due to budget constraints. Furthermore, calibration complexity, demanding skilled professionals and advanced testing environments, limits accessibility and slows adoption in emerging regions. This cost-sensitive scenario hinders widespread deployment, particularly in academic and low-volume industrial applications.

For instance, aerospace SMEs in Eastern Europe have delayed integrating high-frequency test solutions into radar development programs due to high calibration and maintenance expenses, reducing overall adoption of premium-grade signal generators in the region.

Computer Controlled Signal Generators Market Opportunity

-

Rising Integration of AI-Based Calibration Systems Creates New Growth Opportunities for Signal Generator Manufacturers

Artificial intelligence and machine learning integration into automated calibration systems are opening new avenues for the Computer Controlled Signal Generators Market. AI-driven calibration minimizes manual intervention, enhances measurement precision, and reduces downtime, thereby improving overall efficiency in testing operations. As industries shift toward smart factories and autonomous testing environments, AI-based solutions are enabling predictive maintenance and real-time data analytics. This transformation not only reduces operational costs but also ensures long-term instrument reliability, encouraging higher adoption across R&D labs, defense, and telecommunication sectors worldwide.

In March 2025, Rohde & Schwarz unveiled its AI-powered AutoCal platform, enabling fully automated, self-correcting calibration for RF and microwave signal generators. This innovation improved test accuracy by 20% and reduced calibration time by nearly 40%, demonstrating the potential of AI in optimizing next-generation test equipment.

Computer Controlled Signal Generators Market Segment Highlights:

-

By Product Type: RF Signal Generators – 42% (largest), Microwave Signal Generators – 25%, Function Generators – 13%, Audio Signal Generators – 10%, Arbitrary Waveform Generators – 10%

-

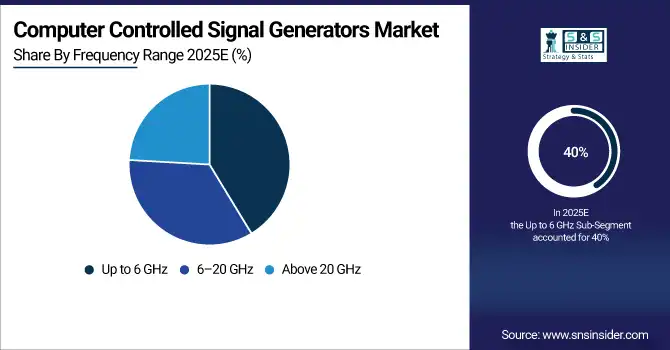

By Frequency Range: Up to 6 GHz – 40% (largest), 6–20 GHz – 35%, Above 20 GHz – 25%

-

By Application: Telecommunications – 38% (largest), Aerospace & Defense – 27%, Electronics Manufacturing – 18%, Automotive – 10%, Research & Development – 7%

-

By End User: Industrial – 45% (largest), Commercial – 25%, Academic & Research Institutes – 18%, Government – 12%

Computer Controlled Signal Generators Market Segment Analysis

By Product Type

The RF Signal Generators segment dominates the market with a 42% share, driven by their widespread use in telecommunications, radar testing, and electronic device calibration. The surge in 5G deployments and wireless connectivity testing continues to strengthen demand. Their flexibility across analog and digital modulation applications further boosts their adoption in R&D and manufacturing. The Microwave Signal Generators segment ranks second with 25%, supported by their growing role in satellite and aerospace applications that require precise, high-frequency signal generation. Increasing investments in defense radar modernization programs are also fueling segment expansion.

By Frequency Range

The Up to 6 GHz segment leads with a 40% share, primarily due to extensive use in consumer electronics, IoT devices, and 5G sub-6 GHz network testing. This range remains ideal for testing Wi-Fi, Bluetooth, and cellular communication devices globally. The 6–20 GHz segment follows with 35%, fueled by its critical use in radar systems, defense applications, and satellite communications requiring accurate frequency performance. Ongoing developments in high-band 5G and advanced radar technologies are enhancing growth.

By Application

Telecommunications dominate with a 38% share, driven by the growing need for 5G, network validation, and RF component testing. Expanding telecom infrastructure and spectrum testing requirements are further stimulating product demand. Aerospace & Defense holds 27%, as rising investments in radar, navigation, and electronic warfare systems boost the use of advanced signal generators. Military-grade testing and the shift toward software-defined radios are contributing to steady segment growth.

By End User

The Industrial segment leads with 45%, driven by widespread adoption in electronic testing, manufacturing, and production line quality assurance. Rising automation in test environments is further improving precision and operational efficiency. The Commercial segment ranks second with 25%, supported by increasing use among OEMs and component manufacturers for system calibration and design validation. The need for reliable signal performance across diverse product lines continues to drive adoption.

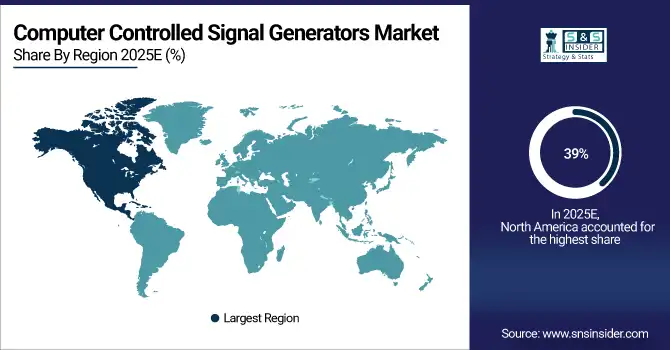

Computer Controlled Signal Generators Market Regional Analysis

North America Computer Controlled Signal Generators Market Insights

North America dominates the Computer Controlled Signal Generators Market with a 39% share in 2025, supported by strong technological innovation and the presence of leading test and measurement equipment manufacturers in the U.S. and Canada. The region’s leadership in 5G, aerospace, and defense R&D drives demand for high-precision signal testing solutions. Widespread adoption of advanced electronics, coupled with government-backed initiatives in semiconductor and communication technology development, further boosts market growth. Strategic collaborations between OEMs, universities, and defense agencies are enhancing design accuracy, calibration standards, and high-frequency performance reliability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Computer Controlled Signal Generators Market Insights

Europe accounts for a 22% share in 2025, fueled by advancements in precision electronics and high-end manufacturing across Germany, the U.K., and France. The region’s focus on quality standards, sustainability, and industrial automation continues to propel demand for signal testing devices. Growing investments in 5G infrastructure, automotive electronics, and aerospace R&D are expanding the adoption of signal generators for testing and validation. Furthermore, the European Union’s Horizon Europe program supports digital innovation, helping strengthen Europe’s position as a key hub for electronic measurement and research technology.

Asia-Pacific Computer Controlled Signal Generators Market Insights

The Asia-Pacific region holds a 28% share in 2025, driven by expanding electronics manufacturing, semiconductor innovation, and strong growth in telecommunications. Major economies such as China, Japan, South Korea, and India are heavily investing in R&D for 5G networks, satellite systems, and electronic testing tools. Increasing production of smartphones, smart devices, and automotive electronics continues to boost demand for cost-efficient and high-accuracy signal generators. Additionally, regional partnerships and government programs promoting semiconductor self-reliance are enhancing domestic capabilities, making Asia-Pacific a crucial growth engine in this market.

Middle East & Africa (MEA) Computer Controlled Signal Generators Market Insights

The Middle East & Africa region represents 6% of the global market in 2025, showing gradual growth due to rising investments in telecommunications, defense modernization, and smart infrastructure. Countries like the UAE, Saudi Arabia, and South Africa are adopting advanced signal testing systems to support 5G rollouts and industrial automation. Increasing collaboration between regional distributors and global technology providers is enhancing market accessibility. Continued economic diversification and digital transformation initiatives are expected to create new opportunities for test and measurement equipment in MEA.

Latin America Computer Controlled Signal Generators Market Insights

Latin America captures a 5% share in 2025, supported by growing demand for consumer electronics and automotive testing systems in Brazil, Mexico, and Argentina. Expanding telecommunication networks and increased adoption of digital broadcast technologies are driving market development. Regional governments are investing in innovation hubs and offering incentives to attract semiconductor and electronics manufacturing. Partnerships with global test equipment suppliers are strengthening local expertise, ensuring gradual but consistent growth in signal generation and calibration technologies across the region.

Competitive Landscape for Computer Controlled Signal Generators Market:

Keysight Technologies Inc.

Keysight Technologies is a global leader in electronic design and test solutions, offering innovative measurement instruments and software platforms for RF, microwave, and digital applications.

-

In March 2025, Keysight introduced the X-Series MXG N5193C Computer Controlled Signal Generator, featuring enhanced vector modulation bandwidth and 6G-ready frequency coverage up to 44 GHz, supporting next-gen wireless and aerospace testing environments.

Rohde & Schwarz GmbH & Co. KG

Rohde & Schwarz is a major provider of electronic test and measurement equipment, focusing on wireless communications, broadcasting, and defense applications.

-

In February 2025, Rohde & Schwarz launched the SMW200B Signal Generator Upgrade, integrating a new waveform synthesis engine and real-time fading simulation to accelerate 5G and satellite communication R&D.

Tektronix, Inc.

Tektronix is a renowned manufacturer of precision test and measurement instruments serving communications, electronics, and research sectors.

-

In April 2025, Tektronix unveiled its AWG5200 Series Computer Controlled Arbitrary Waveform Generator, enabling multi-channel synchronization and ultra-high waveform fidelity for automotive radar and semiconductor device testing.

Computer Controlled Signal Generators Market Key Players

Some of the Computer Controlled Signal Generators Companies

-

Keysight Technologies

-

Rohde & Schwarz

-

Anritsu Corporation

-

Tektronix, Inc.

-

National Instruments Corporation

-

B&K Precision Corporation

-

Berkeley Nucleonics Corporation

-

Tabor Electronics Ltd.

-

Fluke Corporation

-

Rigol Technologies, Inc.

-

Siglent Technologies Co., Ltd.

-

Aim-TTi (Thurlby Thandar Instruments)

-

Teledyne Technologies Incorporated

-

Good Will Instrument Co., Ltd.

-

Yokogawa Electric Corporation

-

Aeroflex Inc. (Cobham plc)

-

Boonton Electronics

-

Anapico AG

-

Keithley Instruments, LLC

-

Giga-tronics Incorporated

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD2.26 Billion |

| Market Size by 2033 | USD 3.92 Billion |

| CAGR | CAGR of7.13% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (RF Signal Generators, Microwave Signal Generators, Audio Signal Generators, Function Generators, Arbitrary Waveform Generators) • By Frequency Range (Up to 6 GHz, 6–20 GHz, Above 20 GHz) • By Application (Telecommunications, Aerospace & Defense, Electronics Manufacturing, Automotive, Research & Development) • By End-User Industry (Industrial, Academic & Research Institutes, Commercial, Government) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Tektronix, Inc., National Instruments Corporation, B&K Precision Corporation, Berkeley Nucleonics Corporation, Tabor Electronics Ltd., Fluke Corporation, Rigol Technologies, Inc., Siglent Technologies Co., Ltd., Aim-TTi (Thurlby Thandar Instruments), Teledyne Technologies Incorporated, Good Will Instrument Co., Ltd., Yokogawa Electric Corporation, Aeroflex Inc. (Cobham plc), Boonton Electronics, Anapico AG, Keithley Instruments, LLC, Giga-tronics Incorporated |