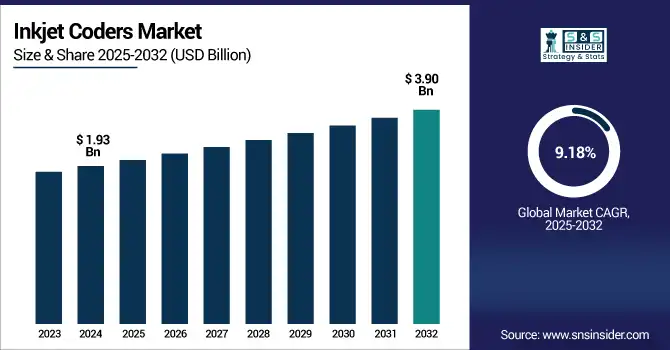

Inkjet Coders Market Size & Growth:

The Inkjet Coders Market size was valued at USD 1.93 Billion in 2024 and is projected to reach USD 3.90 Billion by 2032, growing at a CAGR of 9.18% during 2025-2032.

To Get more information on Inkjet Coders Market - Request Free Sample Report

The Inkjet coders market is witnessing strong growth, driven by increasing demand for high-speed, high-resolution coding in industries such as food, pharmaceuticals, construction, and packaging. Manufacturers require solutions that can handle large data volumes, including 2D codes and regulatory information, without compromising production speed. The market is shifting toward compact, cost-efficient continuous inkjet (CIJ) printers capable of delivering high-quality codes while minimizing downtime and maintenance. Advanced features such as dual-jet printing, intelligent ink systems, and Industry 4.0 compatibility are becoming key differentiators, enabling seamless integration into automated production lines. As traceability, compliance, and sustainability demands rise, the adoption of efficient, high-performance CIJ coding technologies is expected to accelerate, offering manufacturers greater flexibility and operational efficiency.

Markem-Imaje launches the 9712 bi-jet CIJ printer, enabling double coding speed or data output with a single machine. The innovation slashes CAPEX and OPEX while enhancing production line efficiency across industries like food, pharma, and construction.

The U.S Inkjet Coders Market size was valued at USD 0.58 Billion in 2024 and is projected to reach USD 0.96 Billion by 2032, growing at a CAGR of 6.54% during 2025-2032, The inkjet coders market growth is primarily influenced by spreading demand for high-speed and a reliable product marking on the goods across industries like food & beverage, pharmaceuticals, and packaging. The adoption is further propelled by increased regulatory mandates related to traceability and expiration labeling along with migration towards automation & Industry 4.0. Besides, the trend of the inkjet coders market favors the technological advancement in inkjet coders provides better print quality, low-maintenance, and compatibility with various substrates, which is likely to drive the market over the forecast period.

Inkjet Coders Market Dynamics:

Drivers:

-

Demand for High-Speed, High-Volume Digital Printing Accelerates Inkjet System Adoption

The growing need for high-speed, high-volume digital printing is primarily driven by the growing need for high-speed, high-volume digital printing. As more and more industries migrate from offset to digital printing, the demand for solutions with unparalleled productivity, flexibility, and print quality is on the rise. To overcome these challenges, continuous feed inkjet solutions offer benefits such as reducing turnaround times, increasing printing variable data and lowering costs of operation. These devices are also ideal for publishing, direct mail, and transaction printing where the need to cope with high volumes of commercial print runs efficiently is greater. The ability to offer a blend of automation, increased ink technologies and, sustainable solutions are driving growth also, making these systems essential for both scalability and precision of today print service providers.

Ricoh placed first in the U.S. and Canada in overall market share for continuous feed inkjet systems in 2024, bolstered by early adoption of the high-volume Pro VC40000 and VC80000 presses. The firm commands 37.7% share in the U.S. and 60% in Canada, where it has held the top spot for the second year at the top.

Restraints:

-

High Maintenance Costs and Substrate Limitations Constrain Inkjet Coders Market Growth

The growth of the inkjet coders market faces key restraints due to high maintenance costs and limitations in printing on certain substrates. Continuous inkjet (CIJ) systems often require frequent servicing, ink replenishment, and parts replacement, leading to increased operational expenses. Additionally, ink compatibility issues with specific materials such as flexible plastics, glass, or oily surfaces can reduce print quality and durability, limiting use in specialized applications. Environmental concerns regarding VOC emissions from solvent-based inks also pose compliance challenges, especially in regions with strict regulations. Furthermore, the emergence of alternative coding technologies like laser marking offering lower long-term maintenance and better precision may divert potential adopters, especially in highly automated or high-speed production environments where uptime and reliability are critical.

Opportunities:

-

Rising Demand for Flexible Case Coding Drives Growth Opportunity for Inkjet Coders Market

The growing need for flexible, high-resolution coding on corrugated cases and cartons is creating significant opportunities in the inkjet coders market. Manufacturers and distributors are shifting toward on-demand, direct-to-box printing to reduce inventory, minimize waste, and enhance responsiveness to changing production needs. This shift is fueled by the need for efficient variable data printing, including barcodes, lot numbers, and date codes, across diverse packaging formats. Innovations like self-cleaning print heads, dual-sided coding, and wireless connectivity as seen in the latest solutions make inkjet coders increasingly attractive for modern production lines. The ability to quickly adapt print content while reducing maintenance, operator error, and operational costs.

Videojet launched the 2380 high-resolution large character inkjet printer, offering on-demand, dual-sided coding for cartons and cases with advanced self-cleaning, connectivity, and cost-saving features.

Challenges:

-

High Costs and Technical Constraints Limit Inkjet Coders Market Expansion

The inkjet coders market faces significant challenges due to high operational and maintenance costs, as this increases overall expense incurred by manufacturers. Regular maintenance and refills would often drive production efficiency into the ground, and that is unlikely to be very attractive to some prospective users. Inkjet systems are also restricted to certain types of substrates such as flexible plastics & glass and occasionally oily surfaces and post-print coatings can impose more limits on the use of inkjet systems. Environmental matters (in particular, again VOCs from solvent-based inks) pose a further regulatory headache — especially in the stricter parts of the world. It can be extremely costly and complex to run inkjet coders on different production lines. In addition, the market is escaping the competition from other alternative marking technologies, such as laser coding which is lower maintenance and more accurate hampering the market for larger adoption of date coder in the industries.

Inkjet Coders Market Segmentation Analysis:

By Type

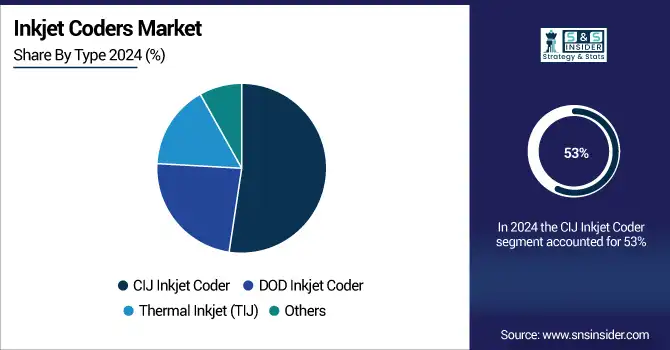

The CIJ Inkjet Coder segment held a dominant Inkjet Coders Market share of around 53% in 2024, owing to versatile application, high-speed printing, and ability of CIJ inkjet coder to print alphanumeric characters in real-time in a clear, legible, and durable fashion on a wide range of substrate surfaces. Demand for post plant has been bolstered by its wide adoption in major industrial verticals such as food, pharmaceuticals, and packaging, complemented by ongoing technological advancements aimed at making operations more efficient and reducing maintenance needs.

The Thermal Inkjet (TIJ) segment is expected to experience the fastest growth in the Inkjet Coders Market over 2025-2032 with a CAGR of 16.76%. The thermal inkjet (TIJ) segment is expected to experience the fastest growth in Inkjet Coders. The increasing penetration of superior print quality, low maintenance, and cost-effectiveness for high-resolution coding has further stimulated the market growth in electronic, pharmaceutical, and consumer goods packaging industries, indicating its strong demand where precision and reliability are vital.

By Application

The Food Industry segment held a dominant Inkjet Coders Market share of around 38% in 2024, This leadership is driven by rising demand for high-resolution printing on food packaging for traceability, regulatory compliance, expiry labeling, and brand identification. Additionally, increasing automation in food processing and the need for efficient, non-contact, and fast-drying coding solutions are further propelling segment growth.

The Packing Industry segment is expected to experience the fastest growth in the Inkjet Coders Market over 2025-2032 with a CAGR of 15.45%. The Packing Industry will register the fastest growth during 2025-2032. The demand for product traceability, brand protection, and regulatory compliance continues to grow, causing this booming trend. The market growth in this segment can also be associated with increasing consumer trend towards personalized packaging and the advancing inkjet technologies that offer high speed, accuracy, and the ability to print on wide variety of packaging materials.

Inkjet Coders Market Regional Outlook:

In 2024, North America dominated the Inkjet Coders market and accounted for 44% of revenue share, by increasing demand from food, beverage and pharmaceutical application sectors. Several factors contributing to the growth of the market in this region include the high regulatory requirements pertaining to product traceability and labeling, high-end manufacturing infrastructure, and increasing adoption of automation and Industry 4.0 technologies.

Asia-Pacific is expected to witness the fastest growth in the Inkjet Coders Market over 2025-2032, with a projected CAGR of 10.89%, due to rapid industrialization, growth in packaging and manufacturing industry, and growing requirement for product traceability. The advancement of printing technologies combined with stimulating government initiatives, investments in automation as well as smart factory is further stimulating growth across the developing nation, such as China, India, Japan and South Korea.

In 2024, Europe emerged as a promising region in the Inkjet Coders Market, driven by stringent regulations on product labeling and traceability across industries such as pharmaceuticals, food, and cosmetics. Growing focus on sustainability, technological advancements, and increasing adoption of automation in manufacturing processes are also fueling market growth, positioning Europe as a key player in the global inkjet coders landscape.

LATAM and MEA regions are experiencing steady growth in the inkjet coders market, supported by expanding manufacturing industries in these regions and increasing need for product traceability and brand protection. Market development in these emerging markets is spurred on by growing infrastructure investments, growing adoption of automation technologies, and relatively easier governmental policies and initiatives focused on improving industrial productivity.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Inkjet Coders companies are ANSER Coding Inc., Hitachi Industrial Equipment Systems, ITW Diagraph, KGK Jet India, Kiwi Coders, Linx Printing Technologies (Danaher), Markem-Imaje, Rottweil Handyware, Videojet Technologies, Xaar plc. and Others.

Recent Developments:

-

In July 2024, ANSER Smart Printhead by InkJet offers compact, high-resolution printing with advanced connectivity for automated production lines. Its Xonnect software enables real-time monitoring and data-driven efficiency improvements.

-

In May 2025, Domino launched the Cx150i piezo inkjet printer, offering high-resolution, durable UV-curable printing for non-porous, shelf-ready packaging with low energy use and Industry 4.0 connectivity.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.93 Billion |

| Market Size by 2032 | USD 3.90 Billion |

| CAGR | CAGR of 9.18% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (CIJ Inkjet Coder, DOD Inkjet Coder, Thermal Inkjet (TIJ), Others) • By Application(Food Industry, Medical Application, Cosmetic Industry, Automobile Industry, Pipes, Wire & Cables, Tobacco Industry, Packing Industry, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Inkjet Coders companies are ANSER Coding Inc., Hitachi Industrial Equipment Systems, ITW Diagraph, KGK Jet India, Kiwi Coders, Linx Printing Technologies (Danaher), Markem-Imaje, Rottweil Handyware, Videojet Technologies, Xaar plc. and Others. |