Raman Spectroscopy Market Size & Growth Trends:

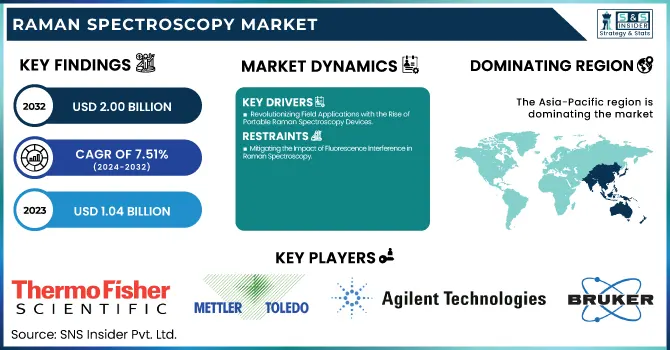

The Raman Spectroscopy Market Size was valued at USD 1.04 billion in 2023 and is projected to reach USD 2.00 billion by 2032, growing at a CAGR of 7.51% from 2024 to 2032. Market growth is driven by the adoption of portable and handheld devices that are preferred in field applications for their convenience and ability to conduct real-time analysis. The market is also driven by the growing demand for regulatory and quality control measures across various industries, including pharmaceuticals, food, and chemicals, as Raman spectroscopy provides efficient and non-destructive testing methods.

To Get more information on Raman Spectroscopy Market - Request Free Sample Report

The market in the U.S. was valued at USD 0.72 billion in 2023, and it is expected to reach USD 1.27 billion by 2032, growing at a CAGR of 6.48%. Growing investments in the Raman spectroscopy technology and its modules have been reported by the vendors to boost the market. Additionally, application-specific customizations and versatility of Raman systems for material science, biotech and healthcare among others, are accelerating adoption of Raman systems in pipeline.

Raman Spectroscopy Market Dynamics:

Drivers:

-

Revolutionizing Field Applications with the Rise of Portable Raman Spectroscopy Devices

The adoption of portable and handheld devices is a major factor driving the Raman spectroscopy market. Fluorescent materials can act as background noise in Raman spectroscopy, emitting light at wavelengths that will interfere with the actual Raman signal, as noted above. This interference may extinguish Raman peaks making it challenge to differentiate Raman signal from the fluorescence backdrop leading to accuracy and trueness of outcomes. This issue is particularly acute for samples with intrinsic fluorescence, such as biological tissues, organic compounds or some chemicals. This can confound data analysis and interpretation processes, particularly within certain applications, including drug analysis, material characterization, or biological studies. While approaches such as time-resolved Raman spectroscopy and spectral filtering are being developed in order to circumvent this limitation, fluorescence interference is still a limiting factor for complex sample types, preventing wider adoption and accuracy for selected applications.

Restraints:

-

Mitigating the Impact of Fluorescence Interference in Raman Spectroscopy

Sensitivity to fluorescence interference is one of the key challenges faced by Raman spectroscopy. Fluorescent materials can act as background noise in Raman spectroscopy, emitting light at wavelengths that will interfere with the actual Raman signal, as noted above. This interference may extinguish Raman peaks making it challenge to differentiate Raman signal from the fluorescence backdrop leading to accuracy and trueness of outcomes. This issue is particularly acute for samples with intrinsic fluorescence, such as biological tissues, organic compounds or some chemicals. This can confound data analysis and interpretation processes, particularly within certain applications, including drug analysis, material characterization, or biological studies. While approaches such as time-resolved Raman spectroscopy and spectral filtering are being developed in order to circumvent this limitation, fluorescence interference is still a limiting factor for complex sample types, preventing wider adoption and accuracy for selected applications.

Opportunities:

-

Enhancing Raman Spectroscopy with AI and Machine Learning for Advanced Data Analysis

The integration of AI and machine learning with Raman spectroscopy is creating significant opportunities for the market. With the help of AI machine-learning algorithms, the data analysis methodology can benefit through repetitive pattern recognization and more accurate results in less time of period. They benefit from deep learning algorithms that assist in interpreting incomprehensible data sets, notably improving both efficiency & human errors. Moreover, machine learning models can augment their predictive capabilities over time, enhancing the effectiveness of Raman spectroscopy across a range of applications. Raman systems are being increasingly adopted across various industries including pharmaceuticals, biotechnology, materials science, and food safety due to the improvements in accuracy and real-time insights offered. Furthermore, the integration of artificial intelligence enables the development of systems that are increasingly more advanced and user-friendly and can be used across various industries, driving the market growth.

Challenges:

-

Overcoming Fluorescence Interference in Raman Spectroscopy for Accurate Results

Fluorescence interference is a significant challenge in Raman spectroscopy. When certain materials, particularly organic compounds, are exposed to the laser light used in Raman spectroscopy, they can emit fluorescence that overlaps with the Raman signals. This overlap can obscure important spectral features, making it difficult to differentiate between the Raman signal and the fluorescence background. As a result, the accuracy and reliability of the analysis are compromised, especially in complex samples like biological tissues, food products, and certain chemicals. The presence of fluorescence can complicate data interpretation and requires advanced techniques, such as time-resolved Raman spectroscopy or spectral filtering, to mitigate its effects. Addressing fluorescence interference is crucial for expanding the scope and precision of Raman spectroscopy in various applications.

Raman Spectroscopy Industry Segment Analysis:

By Instrument

The Microscopy Raman segment dominated the Raman spectroscopy market, accounting for approximately 45% of the total revenue in 2023. This dominance is driven by its widespread adoption in life sciences, pharmaceuticals, materials science, and nanotechnology for high-resolution molecular analysis. Raman microscopy combines the capabilities of optical microscopy with Raman spectroscopy, enabling non-destructive, label-free chemical imaging at microscopic levels. It is particularly valuable for analyzing biological cells, semiconductor materials, and advanced nanomaterials, where precise molecular characterization is essential. The growing demand for drug discovery, disease diagnostics, and material identification has further fueled its adoption. Additionally, advancements in confocal Raman microscopy have enhanced spatial resolution, improving analytical accuracy. The increasing integration of AI and automation in Raman microscopy is also making it more efficient, expanding its use across various industries and solidifying its leadership in the market.

The FT-Raman (Fourier Transform Raman) segment is the fastest-growing segment in the Raman spectroscopy market over the forecast period 2024–2032. This growth is driven by its ability to eliminate fluorescence interference, a major challenge in conventional Raman spectroscopy. FT-Raman uses near-infrared (NIR) excitation, significantly reducing background noise and making it highly effective for analyzing organic compounds, pharmaceuticals, and biological samples. Its application is expanding in drug development, polymer analysis, and material science, where precise molecular identification is crucial. Additionally, advancements in laser technology and AI-driven spectral analysis are enhancing its efficiency and accuracy. The increasing adoption of non-destructive testing methods in industries such as healthcare, food safety, and environmental monitoring is further driving demand, positioning FT-Raman as a key growth driver in the Raman spectroscopy market.

By Sampling Technique

The Tip-Enhanced Raman Scattering (TERS) segment is expected to dominate the Raman spectroscopy market of around 59% in 2023. TERS is the combination of scanning probe microscopy and Raman spectroscopy, providing extremely high spatial resolution on the order of a few nanometers. This renders it suitable for nanomaterial characterization, surface analysis, and single-molecule detection. Its capability to be conducted with unprecedented sensitive for chemical and structural information has driven its application in semiconductors, material science, life sciences, and pharmaceuticals. Further, the increasing need for nanoscale imaging in the field of drug discovery, 2D materials research, and advanced coatings is further accelerating its growth. Moreover, advances in plasmonic tip design and enhancement of laser excitation, as well as machine learning-based analysis of spectral data are increasing sensitivity and accuracy. With the continuing trends of miniaturization and high-resolution molecular analysis across industries, the TERS-based products will lead in revenue contribution in world TERS equipment market.in revenue contribution within the Raman spectroscopy market.

The Surface-Enhanced Raman Scattering (SERS) segment is the fastest-growing segment in the Raman spectroscopy market over the forecast period 2024–2032. The nanostructured metallic surfaces utilized by SERS drastically enhance Raman signals, allowing for highly sensitive detection of low-concentration analytes. Thanks to its increasing adoption in biomedical diagnostics, environmental monitoring, food safety, and forensic science. Its capacity for ultra-sensitive, label-free molecular detection has proven invaluable in cancer diagnostics, pathogen detection, and chemical analysis. With the advent of nanotechnology and plasmonic materials, SERS performance has improved significantly, paving the way for its application in various industries. Furthermore, increasing demand for portable and handheld Raman configurations with SERS capabilities is also driving the market growth. Since the SERS technology provides high-sensitivity and real-time analytical solutions, it is progressively becoming the main force for promoting the innovation and market procurement of Raman spectroscopy in various industries.

By Application

The pharmaceuticals segment is expected to dominate the Raman spectroscopy market in terms of revenue over the forecast period 2024–2032. Raman spectroscopy is widely used in the pharmaceutical industry for drug development, quality control, and counterfeit detection due to its non-destructive, real-time molecular analysis capabilities. It enables precise identification of active pharmaceutical ingredients (APIs), polymorphic forms, and contaminants, ensuring compliance with regulatory standards such as those set by the FDA and EMA. The increasing adoption of process analytical technology (PAT) and the growing demand for biopharmaceuticals and personalized medicine further drive market growth. Additionally, advancements in handheld Raman devices allow rapid on-site drug analysis, enhancing efficiency in production and distribution. As pharmaceutical companies continue to focus on quality assurance and regulatory compliance, Raman spectroscopy remains a critical tool, solidifying its dominance in this sector.

The life sciences segment is the fastest-growing in the Raman spectroscopy market over the forecast period 2024–2032. Due to its universal, non-invasive, label-free molecular imaging capabilities, Raman spectroscopy is being deployed increasingly in biomedical research, disease diagnostics, and cellular analysis. It is indispensable for detection of cancers, stem cell research, and biomarker discovery, providing high sensitivity in the readouts of proteins, lipids, and nucleic acids. Further development of Raman based imaging and diagnostics will be enhanced by the introduction of artificial intelli geng (AI) and the new advanced data analytics. Moreover, In drug discovery and development, its adoption is being propelled by the increasing demand for personalized medicine and biopharmaceuticals. High-resolution and portable Raman systems are already being used for point-of-care diagnostics and real-time analysis in medical applications, allowing for rapid market growth in life sciences.

Raman Spectroscopy Market Regional Overview:

The Asia-Pacific region dominated the Raman spectroscopy market, accounting for approximately 40% of total revenue in 2023. This growth is driven by the region’s expanding pharmaceutical, biotechnology, and semiconductor industries, where Raman spectroscopy plays a crucial role in quality control, material characterization, and research applications. Countries like China, Japan, and India are investing heavily in drug development, nanotechnology, and environmental monitoring, further boosting demand. Additionally, rapid advancements in AI-integrated Raman systems, portable spectroscopy devices, and SERS technology are accelerating adoption across multiple industries. The increasing focus on food safety, forensic science, and biomedical diagnostics is also contributing to market expansion. Government initiatives supporting scientific research, smart manufacturing, and healthcare innovation are further strengthening the market. With continued investments in advanced analytical techniques, the Asia-Pacific region is expected to maintain its leadership in Raman spectroscopy adoption.

The North America region is the fastest-growing market for Raman spectroscopy over the forecast period 2024–2032, driven by advancements in pharmaceuticals, biotechnology, and semiconductor industries. The region's strong focus on drug discovery, personalized medicine, and quality control has increased the adoption of Raman spectroscopy in pharmaceutical analysis and biomedical research. Additionally, the rising demand for miniaturized, portable Raman devices in forensic science, environmental monitoring, and food safety is accelerating market growth. The integration of AI and machine learning with Raman systems is further enhancing analytical capabilities, expanding applications in clinical diagnostics and material science. Supportive government funding and regulatory frameworks in the U.S. and Canada are fostering innovation and commercialization. With ongoing technological advancements and a strong research ecosystem, North America is set to experience significant growth in the Raman spectroscopy market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Raman Spectroscopy Market Key Players:

Some of the Major Players in Raman Spectroscopy Market along with products:

-

Thermo Fisher Scientific Inc. (USA) – Offers DXR3 Raman Microscope, DXR3xi Imaging Microscope, and TruScan™ RM Handheld Raman Analyzer.

-

Mettler Toledo (Switzerland) – Provides ReactRaman in-situ Raman analyzers for real-time process monitoring.

-

Agilent Technologies Inc. (USA) – Manufactures Agilent RapID Raman System and Resolve Handheld Raman Spectrometer.

-

Bruker (Germany) – Produces SENTERRA II Raman Microscope and BRAVO Handheld Raman Spectrometer.

-

Renishaw Plc (UK) – Offers inVia™ Raman Microscope and Virsa™ Raman Analyzer.

-

Rigaku Corporation (Japan) – Develops Xantus-2 and Progeny Handheld Raman Spectrometers.

-

Oxford Instruments (UK) – Provides WITec Alpha300 Raman Imaging System.

-

Endress+Hauser Group Services AG (Switzerland) – Specializes in Raman Rxn analyzers for process control.

-

HORIBA Ltd. (Japan) – Manufactures XploRA PLUS, LabRAM HR Evolution, and MacroRAM Raman Spectrometers.

-

PerkinElmer Inc. (USA) – Offers Spectrum Two and RamanStation 400 Spectrometers.

-

Hamamatsu Photonics K.K. (Japan) – Produces miniature Raman spectrometers and Raman-compatible detectors.

-

Metrohm AG (Switzerland) – Provides Mira P and Mira DS Handheld Raman Spectrometers.

-

Anton Paar GmbH (Austria) – Develops Cora Raman Spectrometers for laboratory and industrial applications.

List of Suppliers who provide raw material and component for Raman Spectroscopy Market:

-

Changchun New Industries Optoelectronics Technology Co., Ltd. (CNI Laser)

-

HÜBNER Photonics (Cobolt Lasers)

-

Electro Optical Components, Inc. (EOC)

-

IDIL Fibres Optiques

-

Ocean Optics

-

Wasatch Photonics

Recent Development:

-

March 27, 2025, Thermo Fisher Scientific discussed the MarqMetrix All-In-One Raman Analyzer, which uses a 785-nanometer diode laser for process monitoring in industries like pharma, biopharma, and oil & gas. The device enables in situ, non-invasive analysis by capturing molecular fingerprints through Raman scattering.

-

January 7, 2025, Endress+Hauser, a global leader in measurement instrumentation, offers solutions for industries like chemical, oil & gas, and life sciences, focusing on process optimization for efficiency, safety, and environmental impact.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.04 Billion |

| Market Size by 2032 | USD 2.00 Billion |

| CAGR | CAGR of 7.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Instrument (Microscopy Raman, FT Raman, Handheld & Portable Raman, Others) • By Sampling Technique (Surface-enhanced Raman Scattering, Tip-enhanced Raman Scattering) • By Application (Life Sciences, Pharmaceuticals, Material Science, Carbon Materials , Semiconductors) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc. (USA), Mettler Toledo (Switzerland), Agilent Technologies Inc. (USA), Bruker (Germany), Renishaw Plc (UK), Rigaku Corporation (Japan), Oxford Instruments (UK), Endress+Hauser Group Services AG (Switzerland), HORIBA Ltd. (Japan), PerkinElmer Inc. (USA), Hamamatsu Photonics K.K. (Japan), Metrohm AG (Switzerland), and Anton Paar GmbH (Austria) |