Membrane Bioreactor Market Report Scope & Overview:

Get More Information on Membrane Bioreactor Market - Request Sample Report

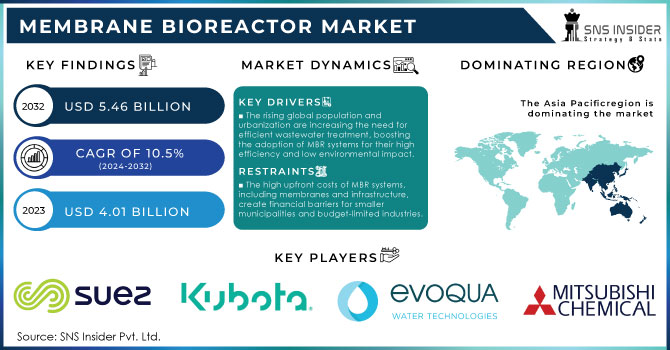

The Membrane Bioreactor Market Size was esteemed at USD 4.01 billion in 2023 and is supposed to arrive at USD 5.46 billion by 2032 and develop at a CAGR of 10.5% over the forecast period 2024-2032.

The Membrane Bioreactor (MBR) market is experiencing significant growth, driven primarily by the increasing demand for efficient wastewater treatment solutions. MBR technology integrates biological treatment processes with membrane filtration, resulting in superior contaminant removal and producing high-quality effluent compared to traditional methods. This technology is particularly effective for managing complex wastewater streams, including municipal and industrial waste, adeptly handling a variety of pollutants such as pathogens, nutrients, and suspended solids.

Recent trends indicate a notable shift towards the adoption of advanced MBR systems in response to rising environmental concerns and regulatory pressures regarding water quality. As global water scarcity becomes an urgent issue, MBRs are increasingly recognized as essential components of sustainable water management strategies, especially in urban areas that are grappling with rapid population growth. The compact and modular design of MBR systems makes them ideal for retrofitting existing wastewater treatment plants, facilitating more efficient upgrades without the need for extensive infrastructure changes. Technological advancements play a crucial role in enhancing the performance and cost-effectiveness of MBR systems. Innovations in membrane materials and configurations, particularly in hollow fiber membranes, are improving fouling resistance and extending operational longevity. This reduces maintenance costs and enhances system reliability, making MBR technology an attractive option for various applications. Furthermore, the growing emphasis on water reuse and recycling is spurring investments in MBR technology, as it allows for the production of high-quality treated water suitable for diverse applications, including irrigation and industrial processes.

Membrane Bioreactor Market Dynamics

DRIVERS

- The rising global population and urbanization are increasing the need for efficient wastewater treatment, boosting the adoption of MBR systems for their high efficiency and low environmental impact.

The rising demand for wastewater treatment is being driven by population growth and rapid urbanization, particularly in developing countries. As urban populations expand, more wastewater is generated, putting pressure on existing treatment infrastructure. According to the United Nations, over 2 billion people live in countries experiencing high water stress, and it is projected that by 2050, more than 68% of the global population will live in urban areas. This surge in urbanization necessitates efficient and sustainable wastewater management solutions to ensure public health and environmental protection.

Membrane Bioreactor (MBR) systems are emerging as a key technology in addressing this demand due to their high treatment efficiency and reduced environmental footprint. MBR systems combine biological treatment processes with membrane filtration, which allows for the effective removal of both organic and inorganic pollutants, producing high-quality effluent that can be reused. These systems are particularly suited for municipalities and industries looking for advanced solutions that meet stringent water quality regulations. The ability of MBR systems to treat wastewater in a smaller footprint compared to traditional methods makes them ideal for urban settings where space is limited. Additionally, with rising concerns about water scarcity, MBR systems play a crucial role in facilitating water reuse, helping municipalities and industries achieve sustainability goals while meeting the rising demand for clean water.

- Technological advancements in membrane materials and filtration efficiency have reduced costs, improved system performance, and extended the lifespan of MBR systems.

Technological advancements in membrane bioreactor (MBR) systems have significantly contributed to their growing adoption in wastewater treatment. Innovations in membrane materials, such as the development of more durable and efficient polymers, have improved the overall filtration performance. For instance, recent breakthroughs in materials like ceramic membranes and enhanced polymeric membranes have increased resistance to fouling, reduced energy consumption, and extended the lifespan of membrane modules by up to 50%.

Filtration efficiency has also improved, with newer membranes achieving higher permeate flux rates and requiring less frequent cleaning. Ultrafiltration (UF) and microfiltration (MF) membranes, commonly used in MBR systems, can remove up to 99.99% of suspended solids and reduce contaminants such as bacteria and viruses, making treated water suitable for reuse. In addition to material enhancements, automation, and process control technologies have optimized the operation of MBR systems. Advanced monitoring tools can detect fouling earlier, adjusting operational parameters to extend membrane life. This has resulted in a 10-20% reduction in operating costs for industries and municipalities adopting MBR technology.

RESTRAIN

- The significant upfront costs of installing MBR systems, including membranes and infrastructure, pose a financial barrier for smaller municipalities and budget-constrained industries.

The high initial capital investment is a significant challenge for the adoption of Membrane Bioreactor (MBR) systems. MBR technology, though efficient, requires substantial upfront costs for its installation, including the price of membrane modules, supporting infrastructure, pumps, blowers, and other associated components. These costs can be prohibitive, especially for smaller municipalities and industries with limited financial resources.

On average, the capital cost of an MBR system ranges between USD 500,000 to USD 2 million per million gallons per day (MGD) of treatment capacity, depending on the scale and complexity of the system. This can be 30-50% higher than traditional wastewater treatment systems such as activated sludge processes. Additionally, the costs associated with civil works, installation, and commissioning further add to the total capital expenditure. For municipalities or industries in regions with limited funding, this high initial outlay can be a deterrent, pushing them toward more affordable but less efficient alternatives. Although operational efficiencies and long-term cost savings (such as reduced land footprint and higher effluent quality) are realized over time, the significant upfront investment remains a barrier for broader adoption. Financing mechanisms, subsidies, or government incentives are often necessary to encourage adoption in such cost-sensitive sectors.

Membrane Bioreactor Market Segmentation Analysis

By Product

In 2023, the hollow fiber segment accounted for more than 54.06% of the total revenue share. Hollow fiber membranes have reduced operational and maintenance expenses compared to multi-tubular and flat sheet membrane bioreactors. In addition, hollow fiber bioreactors are frequently utilized in a range of applications including desalination, filtration, biochemical reactions, and gas separation.

By Configuration

In 2023, the submerged segment dominated with more than 78.12% due to its reduced energy consumption, improved biodegradation efficiency, and lower fouling rate in comparison to side stream membrane bioreactors. Furthermore, the increasing utilization of sunken bioreactors within the industrial field is expected to drive growth within the segment.

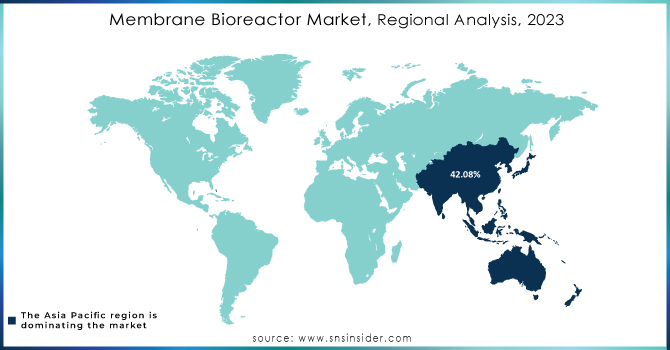

Membrane Bioreactor Market Regional Outlook

Asia Pacific dominated with a revenue share exceeding 42.08% in 2023. An increase in the industrial sector, particularly in chemicals, food & beverages, pharmaceuticals, and oil & gas industries, is expected to drive up the need for membrane bioreactors for treating wastewater.

North America will experience a compound annual growth rate of 6.2% during the predicted time frame. The expansion is credited to advancements in pharmaceutical, chemical, and automotive production plants. The market in the region is being driven by a rise in the need for wastewater treatment, higher levels of immigration, and advancements in technology.

Need any customization research on Membrane Bioreactor Market - Enquiry Now

KEY PLAYERS

Some of the major key players of Membrane Bioreactor Market

- SUEZ: (MBR ZeeWeed technology)

- Kubota Corporation: (Kubota MBR Membrane Units)

- Evoqua Water Technologies LLC: (MemPulse MBR system)

- Mitsubishi Chemical Corporation: (STERAPORE MBR Membrane Modules)

- TORAY INDUSTRIES, INC.: (Toray Membranes for MBR)

- CITIC Envirotech Ltd.: (Memstar MBR system)

- Koch Separation Solutions” (PURON MBR Modules)

- ALFA LAVAL: (MBR Membranes and Solutions)

- Veolia: (Biostyr and AnoxKaldnes MBBR)

- Aquatech International LLC: (BioMOD MBR systems)

- GEA Group: (MBR Filtration Systems)

- Pentair:(X-Flow MBR Membranes)

- Hitachi Zosen Corporation: (Hitachi MBR Systems)

- HUBER SE: (Membrane Filtration Systems for MBR)

- Siemens AG: (MBR Solutions for Industrial and Municipal Wastewater)

- Hydranautics (Nitto Group): (Hydranautics Membranes for MBR)

- GE Water & Process Technologies: (ZeeWeed Membrane Bioreactor Systems)

- Ovivo: (Ovivo MBR technology)

- Degremont Technologies: (SUEZ) (Ultrafiltration and Membrane Bioreactor Systems)

- LG Chem: (LG Water Solutions for MBR)

RECENT DEVELOPMENTS

In May 2023: Veolia Water Technologies launched a new MBR solution with an enhanced membrane module that has better resistance to fouling and a longer lifespan, designed to improve industrial wastewater treatment procedures.

In February 2023: SUEZ Water Technologies & Solutions introduced a new advanced MBR system for treating municipal wastewater. This system utilizes advanced membrane filtration technology to increase effectiveness and lower operating expenses.

In August 2023: Xylem Inc. launched a new MBR technology that combines AI-powered monitoring and control systems to offer real-time analytics for improved system performance and quality effluent assurance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.01 billion |

| Market Size by 2032 | USD 5.46 billion |

| CAGR | CAGR of 10.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Hollow Fiber, Flat Sheet, Multi-Tubular) • By Configuration (Submerged, Side Stream) • By Application (Municipal, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SUEZ, Kubota Corporation, Evoqua Water Technologies LLC, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., CITIC Envirotech Ltd., Koch Separation Solutions, ALFA LAVAL, Veolia, Aquatech International LLC, GEA Group, Pentair, Hitachi Zosen Corporation, HUBER SE, Siemens AG, Hydranautics (Nitto Group), GE Water & Process Technologies, Ovivo, Degremont Technologies (SUEZ), LG Chem. |

| Key Drivers | • The rising global population and urbanization are increasing the need for efficient wastewater treatment, boosting the adoption of MBR systems for their high efficiency and low environmental impact. • Technological advancements in membrane materials and filtration efficiency have reduced costs, improved system performance, and extended the lifespan of MBR syste |

| Restraints | • The significant upfront costs of installing MBR systems, including membranes and infrastructure, pose a financial barrier for smaller municipalities and budget-constrained industries. |