Telehandler Market Report Scope & Overview:

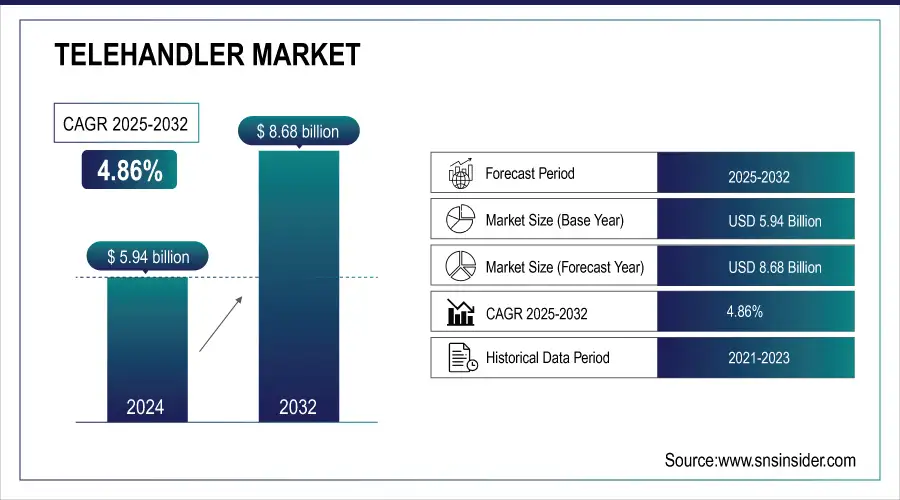

The Telehandler Market size was valued at USD 5.94 Billion in 2024 and is expected to reach USD 8.68 Billion by 2032, growing at a CAGR of 4.86% during the forecast Period of 2025-2032

The telehandler market is witnessing significant growth, especially within the agricultural sector, driven by technological advancements and the rising need for enhanced productivity. Telehandlers, versatile machines known for their ability to lift and transport heavy materials, are increasingly becoming essential in modern farming. Farmers worldwide are adopting these machines for tasks like material handling, loading and unloading, stacking, and storage, which were once labor-intensive and time-consuming. The ease and efficiency offered by telehandlers contribute to significant time savings and reduced manual labor, making them invaluable assets in optimizing farm operations.

Get More Information on Telehandler Market - Request Sample Report

One of the primary benefits telehandlers offers is their ability to streamline agricultural processes such as crop management and palletizing. By automating and simplifying these tasks, telehandlers help farmers reduce labor costs, enabling them to allocate resources more effectively. Studies indicate that mechanized equipment, such as telehandlers, can improve labor efficiency by up to 40%, reducing labor costs by approximately 30%. The result is improved productivity with cost savings, making these machines an attractive investment for farmers looking to maximize output while minimizing operational expenses. The telehandler market, however, remains highly fragmented, with a large number of manufacturers competing on a global scale. This intense competition creates challenges, particularly through frequent price wars and mounting pressure on profit margins.

Key Telehandler Market Trends

-

Smart climate-balancing technologies are being implemented, improving load adjustment, minimizing resource consumption, and extending machinery reliability.

-

Rising shift toward plant-derived insulators and recyclable composites is reinforcing eco-compliant building methods and circular-use frameworks.

-

Virtual modeling adoption is boosting instant equipment assessment, predictive space utilization, and expense-efficiency over operational lifespan.

-

Deployment of detachable wireless command modules is expanding, enabling effortless upgrades, quicker commissioning, and adaptable use in diverse environments.

-

Growing integration of self-directed robotic assistants and aerial inspection drones is safeguarding uninterrupted output, advanced upkeep accuracy, and smooth workflow continuity.

Telehandler Market Growth Drivers:

-

Increased construction activities across residential, commercial, and industrial sectors are boosting the demand for telehandlers due to their versatility in handling heavy lifting tasks

The telehandler market is significantly driven by the rise in construction activities across various sectors, including residential, commercial, and industrial infrastructure. The U.S. construction industry is valued at $1.8 trillion, while the global construction sector reached $8.9 trillion in 2023. As urbanization increases, there is a growing demand for housing, office spaces, and industrial facilities, which, in turn, fuels the need for versatile and efficient construction equipment like telehandlers. These machines are highly valued for their multi-functional capabilities, combining the functions of a forklift, crane, and work platform into one. This versatility makes them indispensable in handling materials, lifting heavy loads, and performing tasks in construction sites where space and accessibility are often constrained. In residential construction, telehandlers are used for tasks such as moving materials to different floors and placing heavy items like windows and roofing components. In commercial projects, telehandlers assist in constructing high-rise buildings, shopping complexes, and office spaces, where the need for vertical material movement is critical. The industrial construction sector further contributes to market growth, with telehandlers playing a key role in the development of warehouses, manufacturing plants, and logistics hubs.

The surge in large-scale infrastructure projects, such as highways, bridges, and airports, especially in developing regions, amplifies the demand for telehandlers. Governments and private investors are pouring resources into these projects, creating a booming construction environment. As a result, the increasing construction activity across these diverse sectors is one of the key factors driving the growth of the global telehandler market.

-

Technological advancements in telehandlers, such as telematics, GPS, and automation, improve operational efficiency and safety, making them more appealing to end-users

Technological advancements have revolutionized the telehandler market, significantly enhancing operational efficiency and safety, thus attracting a broader range of end-users. The integration of telematics and GPS technology in telehandlers allows for real-time monitoring of machine performance, location tracking, and predictive maintenance. These features enable operators and fleet managers to optimize usage, reducing downtime and maintenance costs. Telematics systems can provide insights into fuel consumption, load capacities, and operational hours, allowing for more informed decision-making regarding equipment utilization.

Additionally, the incorporation of automation features, such as self-leveling booms and advanced controls, improves safety by minimizing the risk of operator error during operation. Automated systems can assist in precise load handling and positioning, significantly reducing the likelihood of accidents on job sites. Furthermore, remote control capabilities allow operators to manage telehandlers from a safe distance, enhancing workplace safety in hazardous environments. These technological innovations not only improve the performance and reliability of telehandlers but also align with the growing emphasis on efficiency and safety in the construction and agricultural sectors. As end-users increasingly seek equipment that can streamline operations and reduce operational risks, telehandlers equipped with these advanced technologies are becoming more appealing. Consequently, manufacturers that invest in developing telehandlers with integrated telematics, GPS, and automation features are better positioned to meet market demands and expand their customer base, driving overall growth in the telehandler market.

Telehandler Market Restraints:

-

The significant upfront cost of telehandlers can deter small and medium-sized enterprises (SMEs) in developing regions from investing in this equipment, limiting their operational capabilities.

The high initial costs associated with purchasing telehandlers can pose a significant barrier for small and medium-sized enterprises (SMEs), particularly in developing regions. Telehandlers, being advanced lifting and material handling equipment, often come with substantial price tags that can exceed the financial capabilities of smaller businesses. For SMEs, the capital investment required not only includes the purchase price but also associated costs like maintenance, insurance, and operator training. This financial burden can limit their ability to invest in other critical areas of their operations, hindering growth and competitiveness.

In developing regions, where access to financing options may be limited, SMEs face even greater challenges. Banks and financial institutions may be reluctant to lend to smaller businesses due to perceived risks, resulting in a lack of accessible funding for acquiring such machinery. Furthermore, many SMEs may prioritize immediate operational needs over long-term investments in equipment, especially if they are unsure of their return on investment. As a result, they might opt for renting telehandlers rather than purchasing them, which can lead to higher overall costs in the long run and reduced efficiency on job sites. This dynamic not only affects individual businesses but also impacts the overall growth of the telehandler market, as a significant portion of potential users remains unable to invest in these essential machines. Consequently, addressing the financing and cost barriers for SMEs is crucial to unlocking the full potential of the telehandler market, particularly in regions poised for infrastructure development and agricultural expansion.

Telehandler Market Segment Analysis

-

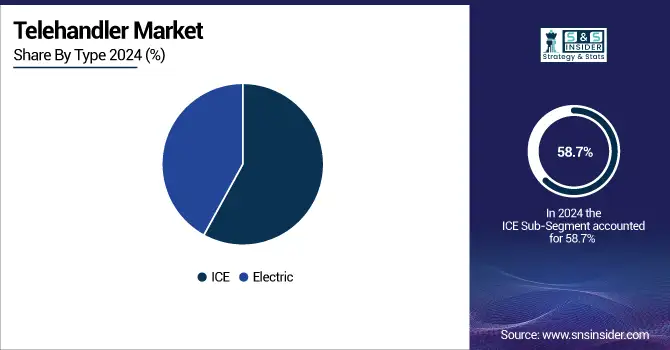

By Type

The internal combustion engine (ICE) dominated the market with a share of around 58.7% in 2024. The engine's high power and torque allow it to handle heavy materials and work in difficult conditions, leading to its dominance. ICEs are preferred for long shifts and remote areas with limited electric charging infrastructure due to their longer operational range and shorter refueling time compared to electric engines. The ICE is a more cost-effective option with a lower initial price compared to electric models, making it a preferred choice.

-

By Lift Capacity

The 3-10 Ton lift capacity dominated the market with a share of around 54.2% in 2024. Its prevalence is due to its utilization in the construction sector, which relies on these adaptable machines to improve efficiency and productivity when moving heavy materials. Additionally, maneuvering in small spaces aids in efficient loading and unloading of goods in logistics and warehouse settings. Additionally, the mining and extraction sectors benefit from transporting materials and equipment across rough terrains.

Telehandler Market Regional Outlook

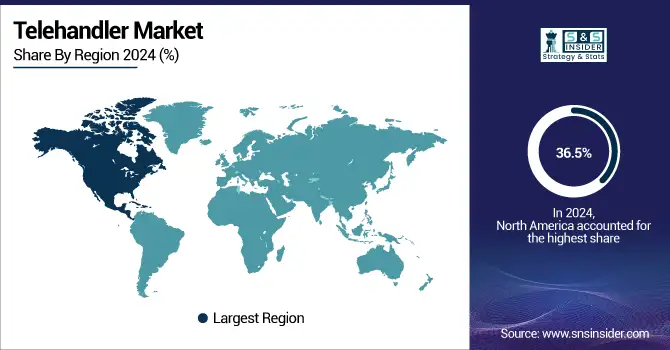

North America Telehandler Market Insights

North America currently dominates the telehandler market, holding approximately 36.5% in 2024. This dominance is primarily driven by the region's robust infrastructure and construction projects, which require efficient and versatile material-handling equipment like telehandlers. According to AGC, the construction sector plays a significant role in the U.S. economy, with over 919,000 construction establishments operating in the first quarter of 2024. The industry employs around 8 million workers and generates nearly USD 2.1 trillion worth of structures annually. Additionally, construction is a major consumer of products from manufacturing, mining, and various service industries. Additionally, the rise of automation across industries such as manufacturing and logistics has further fueled the adoption of telehandlers, as these machines can handle a variety of tasks with ease. Innovations in telehandlers, including enhanced control systems, fuel efficiency improvements, and the integration of telematics, are contributing to their growing popularity in North America, making the region a leader in this market.

Asia-Pacific Telehandler Market Insights

Asia Pacific region is the fastest-growing market holding approximately 22.50% in 2024. Rapid urbanization and significant infrastructure development are driving high demand for telehandlers in this region. As countries in Asia Pacific continue to expand their cities and build new infrastructure, the need for efficient material-handling equipment has surged, positioning the region for rapid growth in the telehandler market.

Do You Need any Customization Research on Telehandler Market - Inquire Now

Europe Telehandler Market:

Europe maintains a steady share, driven by stringent safety standards, sustainable construction practices, and modernization of industrial operations. Countries like Germany, France, and the UK are increasingly deploying telehandlers for construction, agriculture, and logistics. Technological advancements, including automation and fuel-efficient models, support the demand, strengthening Europe’s position as a mature telehandler market.

Middle East & Africa (MEA) Telehandler Market:

MEA’s telehandler market growth is propelled by ongoing infrastructure expansion, oil and gas projects, and urban development in countries like UAE, Saudi Arabia, and South Africa. Telehandlers’ versatility and ability to operate in challenging terrains make them ideal for the region’s construction and industrial applications, fostering steady adoption across the MEA region.

Latin America Telehandler Market:

Latin America is witnessing moderate growth due to infrastructure modernization, mining projects, and industrial expansion in Brazil, Mexico, and Argentina. Demand for efficient material-handling solutions drives telehandler adoption. Additionally, government initiatives to improve urban and rural construction projects, coupled with increasing mechanization in agriculture, contribute to the region’s telehandler market growth.

Telehandler Market Companies:

- AB Volvo: (Telehandlers for construction and agriculture)

- Caterpillar Inc.: (CAT Telehandlers for material handling)

- CNH Industrial N.V.: (CASE and New Holland Telehandlers)

- HAULOTTE GROUP: (HTL Series Telehandlers)

- J C Bamford Excavators Ltd.:(JCB) (Loadall Telehandlers)

- Komatsu Ltd.: (Telehandlers for material lifting and transport)

- L&T Technology Services Limited: (Engineering services for telehandler design and development)

- Oshkosh Corporation: (JLG Telehandlers)

- Terex Corporation: (Terex Telehandlers)

- Wacker Neuson SE: (TH Series Telehandlers)

- Manitou Group: (MT Series Telehandlers)

- Bobcat Company: (Bobcat Telehandlers)

- Doosan Infracore: (Telehandlers for agriculture and construction)

- Merlo S.p.A.: (Panoramic and Turbofarmer Telehandlers)

- Liebherr Group: (Liebherr Telehandlers)

- Skyjack Inc.: (Skyjack TH Series Telehandlers)

- XCMG Group: (XCMG Telehandlers for heavy lifting)

- Pettibone LLC: (Extendo and Traverse Telehandlers)

- Dieci S.r.l.: (Apollo and Icarus Telehandlers)

- Faresin Industries S.p.A.: (Faresin Telehandlers for agriculture and industry)

Competitive Landscape for Telehandler Market:

Pettibone, headquartered in Barre, Wisconsin, USA, was founded in 1881. The company specializes in material handling and construction equipment, notably telehandlers, cranes, and industrial vehicles. Known for innovation and robust design, Pettibone focuses on efficiency, safety, and versatility, serving construction, rental, and industrial sectors worldwide.

- In October 2024: Michigan-based Pettibone introduced its new Extendo 1044X telehandler, which features a unique design allowing it to handle loads of up to 10,000 pounds without the need for outriggers. This innovation enhances operational speed and reduces maintenance needs, making it particularly suitable for construction and rental applications. The telehandler is powered by a 74-horsepower Deutz Tier 4 Final diesel engine and boasts a maximum lift height of 44 feet 6 inches.

Terex Corporation is a global manufacturer of lifting and material-handling equipment, including aerial work platforms, cranes, and telehandlers. Headquartered in Westport, Connecticut, USA, and founded in 1933, Terex serves construction, infrastructure, and industrial sectors, emphasizing innovation, safety, and efficiency across its diverse machinery portfolio.

- In December 2023: Terex Corporation revealed the purchase of Genie Industries, Inc. This acquisition is projected to enhance Terex's presence in the aerial work platform and telehandler sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.94 Billion |

| Market Size by 2032 | USD 8.68 Billion |

| CAGR | CAGR of 4.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Large, Compact) • By Type (ICE, Electric) • By Lift Capacity (Less than 3 ton, 3-10 ton, More than 10 ton) • By End-use (Construction, Agriculture, Manufacturing, Others) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | AB Volvo, Caterpillar Inc., CNH Industrial N.V., HAULOTTE GROUP, J C Bamford Excavators Ltd., Komatsu Ltd., L&T Technology Services Limited, Oshkosh Corporation, Terex Corporation, Wacker Neuson SE, Manitou Group, Bobcat Company, Doosan Infracore, Merlo S.p.A., Liebherr Group, Skyjack Inc., XCMG Group, Pettibone LLC, Dieci S.r.l., Faresin Industries S.p.A. |