Computer Vision Systems Market Report Scope & Overview:

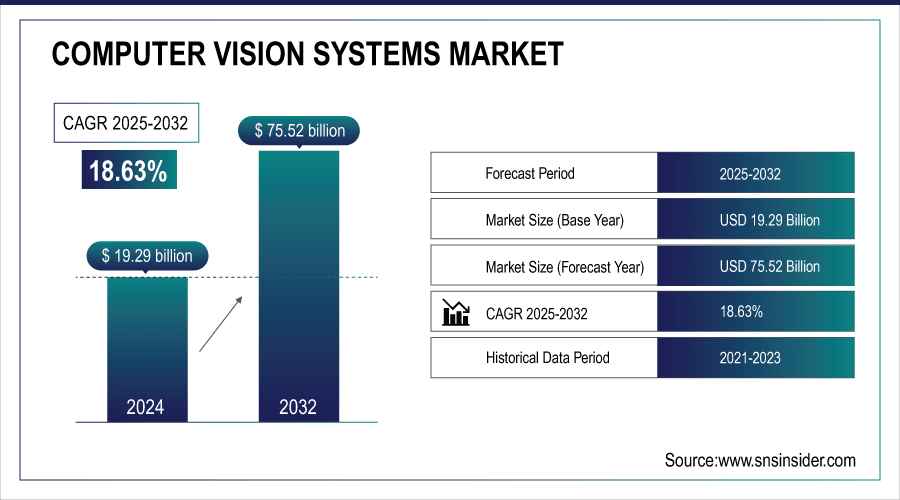

The Computer Vision Systems Market Size was valued at USD 19.29 billion in 2024 and is expected to reach USD 75.52 billion by 2032 and grow at a CAGR of 18.63% over the forecast period 2025-2032.

The Computer Vision Systems Marketis expanding rapidly, where growth is mainly attributed to the increasing adoption of artificial intelligence (AI) and machine learning technologies in various industries. Rising adoption of computer vision on account of automation requirement across manufacturing, quality inspection, healthcare diagnostics and logistics sectors. Some of the significant outcomes include real-time processing enabled by advancements in high-resolution imaging, 3D visions, and synchronized sensors to improve accuracy in areas such as object detection, facial recognition, gesture tracking and automated optical inspection. The growing trend of edge computing and cloud-based deployment models offers organizations the capability to deploy scalable and low-latency computer vision solutions, thereby significantly contributing to industry growth.According to study, Real-time object detection is now deployed in over 1,200 warehouses and logistics centers, improving automated sorting and inventory tracking.

To Get More Information On Computer Vision Systems Market - Request Free Sample Report

Computer Vision Systems Market Trends

-

Widespread adoption of AI-powered computer vision in manufacturing, healthcare, and logistics.

-

Real-time quality inspection and defect detection improving operational efficiency.

-

Growing deployment of computer vision in autonomous vehicles and robotics.

-

Expansion of edge computing for low-latency, real-time data processing.

-

Increased use of IoT-enabled smart devices integrated with computer vision systems.

-

Rising demand for automated anomaly detection and monitoring across retail and industrial sectors.

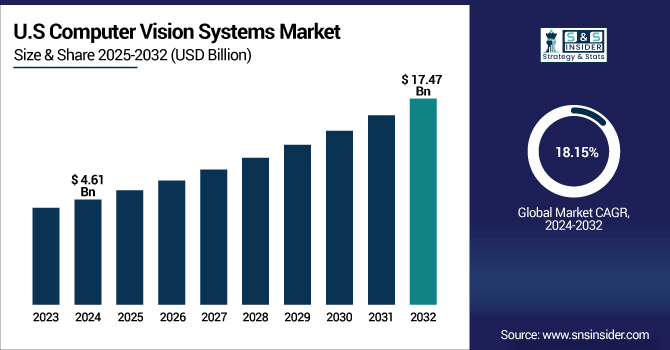

The U.S. Computer Vision Systems Market size was USD 4.61 billion in 2024 and is expected to reach USD 17.47 billion by 2032, growing at a CAGR of 18.15% over the forecast period of 2025-2032. due to early adoption of AI, machine learning, and advanced imaging technologies across industries. High deployment is seen in automotive, manufacturing, healthcare, and retail for automation, quality inspection, and surveillance. Strong presence of major technology players and extensive R&D activities drives innovation and market growth.

Computer Vision Systems Market Growth Drivers:

-

AI-powered automation boosts efficiency, accuracy, and adoption of computer vision.

One of the biggest drivers for growth is the increasing incorporation of artificial intelligence (AI) and machine learning in the computer vision system. Manufacturing, healthcare, logistics, automotive, and other industries are automatically driven by AI-based vision systems. For example, computer vision enables near-real time-quality inspection in manufacturing, defects at micro-levels that human eyes might miss. In the healthcare sector, AI-enabled imagery helps to enable early diagnosis of the diseases such as cancer by analyzing medical scans faster and accurately. Like in logistics, here CV systems use machines to optimize everything such as sorting, packaging, and inventory tracking.

25,000+ smart camera units installed across retail and surveillance sectors for facial recognition and monitoring.

Computer Vision Systems Market Restraints:

-

High complexity and costs slow adoption of computer vision solutions.

Despite its benefits, implementing computer vision systems usually requires high upfront costs and requires complicated integration with the current infrastructure. It requires high-end hardware, including high-resolution cameras, GPS, and sensors, and sophisticated image-processing software. In addition to this, training AI models, embedding it into existing workflows, or sustaining the accuracy of the system creates the demand for trained personnel. This kind of complexity and consequently cost may also be a barrier for SMEs, slowing down adoption. Moreover, data privacy and regulatory compliance issues (for instance facial recognition of surveillance applications) are experienced by some industries as a restraining factor for the growth.

Computer Vision Systems Market Opportunities:

-

Edge computing enables real-time processing, driving computer vision growth.

The computer vision market has a huge opportunity in edge computing, which ensures that maximum data is processed in real-time on the devices instead of being processed fully on the cloud servers. This eliminates latency, speeds up the performance, and enables us to deploy it in low-connectivity situations. Autonomous vehicles are a prime example, as they require immediate object detection and decision-making edge computing means more responsive action. similarly, intelligent cameras in retail or industrial environments can identify deviations from normal behaviour and send notifications without relying on the cloud. Along with the rising utilization of IoT devices and edge AI across industries will also increase the demand for the computer vision systems that offer the edge processing functionality, thus provides a high growth opportunity.

450 industrial robotics sites deployed 3D vision cameras for automated manipulation and navigation.

Computer Vision Systems Market Segment Analysis

-

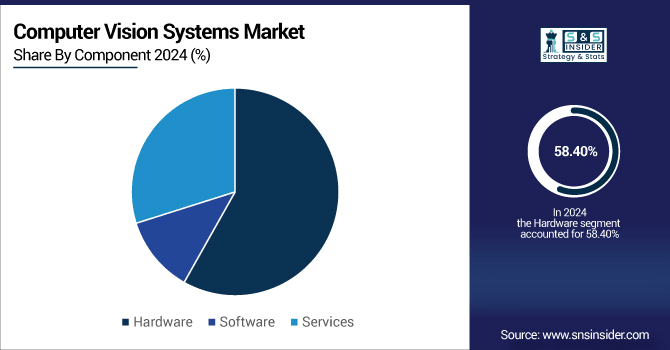

By Component: In 2024, Hardware led the market with share 58.40%, while Services are the fastest-growing segment with a CAGR 20.38%.

-

By Deployment Mode: In 2024, On-premises led the market 65.10%, while Edge computing devices fastest-growing segment with a CAGR 19.96%.

-

By Application: In 2024, Facial recognition led the market with share 25.07%, while Object detection the fastest-growing segment with a CAGR 20.24%%.

-

By Industry Vertical: In 2024, Manufacturing led the market with share 32.03%, while Healthcare is the fastest-growing segment with a CAGR 20.91%.

Segmentation Analysis:

By Component, Hardware Lead Market While Services Fastest Growth

Hardware component segment occupies a majority share in the Computer Vision Systems Market, largely owing to the large-scale deployment of high-resolution cameras, sensors and GPUs across various industrial verticals, such as manufacturing, automotive, healthcare, etc. that require upgradation of several infrastructure for real-time image processing and quality inspection. At the same time, the Services segment is experiencing the highest growth, supported by the growing need for software integration, training and support with AI models, maintenance, consulting, and assistance with cloud-based deploy. It has driven organizations to pour money into services to implement, fine-tune, and optimize computer vision solutions to drive advanced AI-based applications, fast-track edge computing, or help carry out high-speed analytics on a wide variety of sectors.

By Deployment Mode, On-premises Lead Market While Edge computing devices is Fastest Growth

On-premises deployment is leading the Computer Vision Systems Market, as many organizations like to process their sensitive data locally in order to guarantee security and have control over their critical operations, especially in industries such as healthcare, manufacturing, and automotive. On the other hand, Edge computing devices are having the highest growth rate due to the demand for data processing at real time, low latency applications, and AI based decision making at-edge level. Edge solutions are growing in demand over autonomous vehicles, smart factories, retail, and surveillance systems, boosting efficiency, reducing cloud dependence, and enabling scalable and high-performance computer vision applications.

By Application, Facial recognition Lead Market while Object detection Fastest Growth

Facial Recognition application segment continues to dominate the Computer Vision Systems Market worldwide, in which computer vision technology is extensively adopted by the government, retail, and corporate sectors for security, surveillance, access control, and identity verification. On the other hand, Object Detection is growing fastest due to increasing need for real-time tracking, anomaly detection, and process optimization from autonomous vehicles, robotics, industrial automation, smart logistics, etc. Rapid adoption is driven by the need for precise identification and tracking of objects in a wide range of settings, and the constant improvement in AI algorithms and sensor technologies further boosts the performance and scalability of these solutions.

By Industry Vertical, Manufacturing Leads Market While Healthcare Fastest Growth

Manufacturing tops the industry vertical in the Computer Vision Systems Market, as computer vision is increasingly used for factory deployment for quality inspection, defect detection, assembly verification, and automation all over the globe. Currently, however, Healthcare is experiencing the quickest growth, which is attributed to the rise in uptake of diagnostic imaging, surgical assistance, patient monitoring, and medical image analysis powered by AI. The global overhead bite computer vision solution is driven by growing desire for accuracy, efficiency, and automation in healthcare operations and advancement in 3D imaging, ML algorithms, and real-time processing, which stimulates rapid adoption of computer vision solution across hospitals, clinics, and research institutes worldwide.

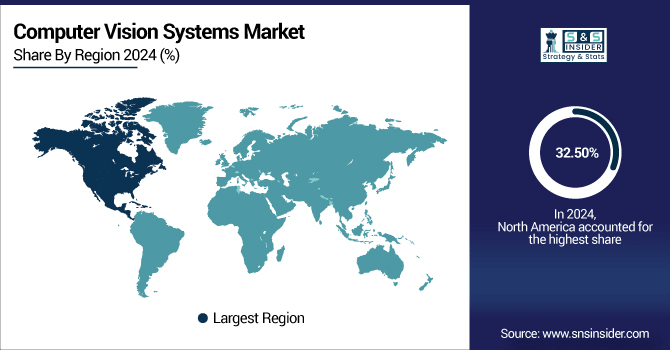

North America Computer Vision Systems Market Insights:

The Computer Vision Systems Market is Propelled by the North America Region as the Market share 32.50%, Owned by the Early Adopters of AI, Machine Learning and Advanced Imaging Technologies for Various Industries High adoption in manufacturing, automotive, healthcare, and retail sectors for automation, quality inspection, and surveillance across the region. The presence of key technology players like NVIDIA, Intel, & Microsoft drives innovation and creates markets. Such increasing investments in smart cities, autonomous automobiles, and robotics also propel the adoption for computer vision solutions. Moreover, favorable government initiatives and R&D activities expedite the growth and delivery of real-time AI-enabled vision applications throughout the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Computer Vision Systems Market with Advanced Technological Adoption

The U.S. dominates the Computer Vision Systems Market due to early adoption of AI, machine learning, and advanced imaging technologies. High deployment across automotive, manufacturing, healthcare, and retail sectors drives innovation and operational efficiency.

Asia-Pacific Computer Vision Systems Market Insights

Asia-Pacific is a key and fast-growing market for Computer Vision System with a CAGR 19.74%, due to the rapid industrialization and urbanization along with the adoption of the latest technologies. Local governments are rapidly adopting more AI-enabled automation, robotics, and smart surveillance systems for enhanced productivity and safety. Rising investments in smart cities, retail analytics, and healthcare imaging are additional factors that help in driving the market growth. Moreover, the rising presence of technology start-ups and local vendors encourage innovation and affordability, further driving adoption in urban and semi-urban areas.

China and India Propel Rapid Growth in Computer Vision Systems Market

The Computer Vision Systems Market is experiencing rapid growth in China and India, driven by the development of the latest technologies required for industrial automation, smart city projects, and the growing AI adoption. These are used in manufacturing, healthcare, retail and surveillance, and deployments in both countries are increasing. Growing investments in research, robotics and IoT enabled vision solutions propel the market growth further.

Europe Computer Vision Systems Market Insights

European has most targeted market position for Computer Vision Systems Market region due to the high level of industrial automation and a number of use cases for AI applications. Computer vision is massively deployed in manufacturing, automotive and healthcare applications in the region. Increasing emphasis on smart infrastructure, surveillance, and quality inspection is anticipated to drive the growth of the market during the forecast period. In addition, presence of supportive government initiatives and strong R&D activities are stimulating innovation and adoption of AI-powered vision solutions across the region.

Germany and U.K. Lead Computer Vision Systems Market Expansion Across Europe

Germany and the U.K. are leading the expansion of the Computer Vision Systems Market across Europe due to early AI and automation adoption. They are driving growth in manufacturing, automotive, and healthcare sectors through advanced computer vision deployments. Strong R&D initiatives and supportive policies further accelerate market development and technology integration.

Latin America (LATAM) and Middle East & Africa (MEA) Computer Vision Systems Market Insights

The Computer Vision Systems Market is growing steadily in the Latin America (LATAM) and Middle East & Africa (MEA) regions, fueled by the increasing adoption of artificial intelligence and automation in sectors such as manufacturing, healthcare, retail, and security. From using computer vision solution for quality inspection, surveillance, and logistics streamlining to governments and enterprises investing in smart city projects and digital infrastructure, this trend is gaining ground. Deployment of computer vision systems in developing regional markets is also being driven by the increasing awareness on operational efficiency, safety and advanced monitoring solutions, along with the growing local technology providers, and startups developing innovative solutions and focusing more on the developing regions.

Computer Vision Systems Market Competitive Landscape

Ambarella is a leading provider of AI vision processing solutions, specializing in low-power, high-performance SoCs (System on Chips) for computer vision applications. Their products support multi-modal vision-language models, advanced AI inference, and edge AI deployment in security cameras, robotics, and automotive systems. Ambarella focuses on power-efficient and cost-effective solutions, enabling real-time analytics and high-resolution imaging for industrial and consumer applications.

-

In May 2024, Ambarella launched the CV75S AI SoC family built on 5nm technology, enabling power-efficient multi-modal vision-language models and AI inference for cameras and robotics.

Intel is a major player in the computer vision market, offering AI accelerators, GPUs, and edge computing solutions for industrial, automotive, and healthcare applications. The company’s Gaudi AI accelerators and vision chips enable high-performance inference and real-time image processing. Intel emphasizes scalable AI platforms for cloud and edge environments, facilitating integration of computer vision in autonomous systems, robotics, and enterprise analytics.

-

In April 2024, Intel announced the Gaudi 3 AI accelerator at Intel Vision 2024, enhancing inference throughput and efficiency for large AI models in data centers and edge devices.

Teledyne Technologies provides advanced computer vision and imaging solutions for industrial automation, inspection, and scientific applications. Their smart cameras, sensors, and AI-enabled platforms enable high-accuracy detection, quality control, and real-time monitoring. Teledyne focuses on integrated vision systems that combine hardware and software, supporting applications across manufacturing, defense, and research sectors.

-

In September 2024, Teledyne Technologies introduced the BOA3 smart camera, leveraging advanced AI inspection and sensor technologies for industrial automation applications.

Computer Vision Systems Market Key Players:

Some of the Computer Vision Systems Market Companies

-

NVIDIA

-

Intel

-

AMD

-

Qualcomm

-

Ambarella

-

Teledyne Technologies

-

Omron Corporation

-

Keyence Corporation

-

Microsoft

-

Amazon Web Services (AWS)

-

Google Cloud

-

IBM

-

OpenCV.ai

-

Roboflow

-

Matrox Imaging

-

Allied Vision Technologies

-

Mobileye (Intel)

-

Tesla

-

Aptiv

-

World Labs

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.29 Billion |

| Market Size by 2032 | USD 75.52 Billion |

| CAGR | CAGR of 18.63% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Hardware, Software, Services) •By Deployment Mode (Cloud-based, On-premises, Edge computing devices) •By Application (Facial recognition, Image classification, Object detection, Object tracking, Optical Character Recognition (OCR), Image Segmentation, Automated optical inspection, 3D vision and depth sensing, Gesture recognition, Others) •By Industry Vertical (Manufacturing, Healthcare, Retail, Automotive, Security and surveillance, Agriculture, Smart cities, Consumer electronics, Energy and utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NVIDIA, Intel, AMD, Qualcomm, Ambarella, Teledyne Technologies, Omron Corporation, Keyence Corporation, Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, OpenCV.ai, Roboflow, Matrox Imaging, Allied Vision Technologies, Mobileye (Intel), Tesla, Aptiv, World Labs, and Others. |