Concrete Floor Coating Market Report Scope & Overview:

Get E-PDF Sample Report on Concrete Floor Coating Market - Request Sample Report

The Concrete Floor Coating Market Size was valued at USD 4.75 Billion in 2023. It is estimated to hit USD 7.61 Billion by 2032 and grow at a CAGR of 5.4% over the forecast period of 2024-2032.

The increasing demand for durable and visually appealing flooring solutions, concrete floor coating market has experienced a surge in popularity. Concrete floor coatings are applied to protect and enhance the surface of concrete floors. These coatings provide a protective layer that safeguards the concrete from wear and tear, chemical spills, and other potential damages.

In accordance with data from the U.S. Census Bureau, the 2021 total value of construction put in place in the United States amounted to approximately USD 1800 Billion. Such a tendency toward the increased investment in the construction of various industrial and commercial buildings is directly followed by the rising demand for concrete flooring solutions. The latter should be of the highest quality to ensure that the surfaces are durable, aesthetically pleasing, and free from related problems.

The concrete floor coating market is driven by the growing construction industry, particularly in developing economies, which has led to an increased demand for durable and aesthetically pleasing flooring solutions. Additionally, the rising awareness about the benefits of concrete floor coatings, such as their ability to improve safety, hygiene, and ease of maintenance, has further fueled market growth. In terms of product types, the concrete floor coating market offers a wide array of options to cater to diverse customer needs. Epoxy coatings, polyurethane coatings, and acrylic coatings are among the most commonly used products in this industry. Each type of coating possesses unique characteristics and benefits, allowing customers to choose the most suitable option based on their specific requirements.

In 2023, Sherwin-Williams, a leading player in the concrete floor coatings market, launched a new line of epoxy floor coatings specifically designed for high-traffic industrial environments. This innovative product features enhanced durability and chemical resistance, making it suitable for facilities such as manufacturing plants and warehouses. The launch is part of Sherwin-Williams’ strategy to meet the growing demand for robust and aesthetically appealing flooring solutions in the industrial sector.

One of the main drivers of the demand of concrete floor coatings is the growing investment in the development of infrastructure, especially in the emerging markets. According to the World Bank, the global infrastructure investment is expected to be around 94 trillion dollars through the year 2040, with a great part of this amount going to the developing regions. Governments acknowledge the urgent need in the new infrastructure all over the world, and it includes not only transportation systems but also public and commercial buildings. For example, in 2021 the U.S. federal government announced the 1.2 trillion dollars infrastructure investment plan.

Coatings of concrete floors are one of examples of such materials which market will grow due to the government strategies and subsidizing, as it allows making construction safer and more durable. Overall, it can be argued that the role of the state is vital for driving the market growth in the case of such materials as the government is one of the main consumers of the infrastructure.

Concrete Floor Coating Market Dynamics

Drivers

-

Increasing popularity of aesthetically appealing and durable flooring solutions

-

Rising construction activities worldwide

The surge in construction activities, ranging from residential buildings to commercial complexes and industrial facilities, necessitates the use of durable and aesthetically appealing flooring solutions. Concrete floor coatings provide an ideal solution, as they offer enhanced durability, resistance to wear and tear, and an attractive finish. Moreover, the increasing urbanization and population growth in many countries have led to a higher demand for housing and commercial spaces. As a result, construction companies are actively engaged in constructing new buildings and renovating existing structures to meet these demands. Concrete floor coatings play a crucial role in enhancing the longevity and visual appeal of these spaces, making them more appealing to potential buyers or tenants.

Restrain

-

High cost associated with the concrete floor coatings hamper the market growth.

-

Fluctuating prices of raw materials

The problem of high costs experiences a lot of floor coating products due to the expensiveness of the materials and further application. It should be noted that the demand for the establishment of flooring products is constantly on the rise, and people keep demanding more modern, aesthetically pleasant, comfortable, and durable tools to cover their floors. At the same time, the majority of such coatings requires more investments in materials and application. Moreover, for high-quality coatings it is necessary to hire qualified personnel, and these services are also honored. In such a way, the product has a number of positive capacities, but the price factor becomes a barrier to its implementation and further growth. It means that if some customers are ready to invest in the most expensive means, the majority in the less developed and more price-sensitive markets will prefer not to buy or to wait for more beneficial periods.

Opportunities

-

Development of advanced coating technologies and the introduction of innovative product

-

Rising demand for decorative and customized flooring options

In recent years, there has been a noticeable shift in consumer preferences towards decorative and customized flooring solutions. Traditional flooring materials such as tiles, carpets, and hardwood are gradually being replaced by concrete floor coatings. This transition can be attributed to several factors, including the durability, versatility, and cost-effectiveness offered by concrete coatings. One of the primary drivers behind this rising demand is the desire for personalized spaces. Homeowners and businesses alike are seeking unique and visually appealing flooring options that reflect their individual styles and tastes. Concrete floor coatings provide an ideal canvas for customization, allowing for a wide range of colors, patterns, and textures to be applied. This versatility enables customers to create truly one-of-a-kind flooring designs that enhance the overall aesthetics of their spaces.

Concrete Floor Coating Market Segmentation Overview

By Product

The epoxy coating segment dominated the concrete floor coating market with the highest revenue share of about 63% in 2022. Epoxy coatings have established themselves as the preferred choice for concrete floor protection and enhancement due to their exceptional qualities. These coatings are renowned for their durability, resistance to chemicals, and ability to withstand heavy foot traffic and machinery. Moreover, epoxy coatings offer a glossy finish that enhances the aesthetic appeal of concrete floors, making them an attractive option for various industries and applications. Furthermore, epoxy coatings provide a protective barrier that safeguards concrete floors against wear and tear, moisture, stains, and other forms of damage.

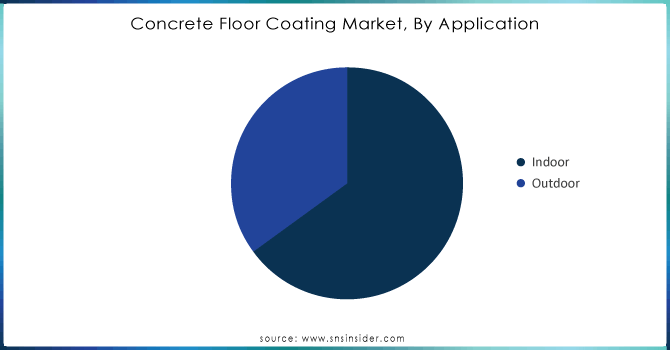

By Application

Indoor segment held the largest market share around 69% in 2023. The rising penetration of sports stadiums in the U.S. and Canada on account of the popularity of such sports as football, rugby, ice hockey, and tennis among others is expected to propel the role of the flooring solutions.

The considerable expansion prospects for the market players from the increasing usage of concrete floor coating solutions as a flavoring agent and acidulant in the food & beverage industry have also been observed. In addition, the product is utilized as an acidity regulator, food preservative, and pharmaceutical excipient apart from being a vital raw material for polyesters and an active ingredient for alkyd resins.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

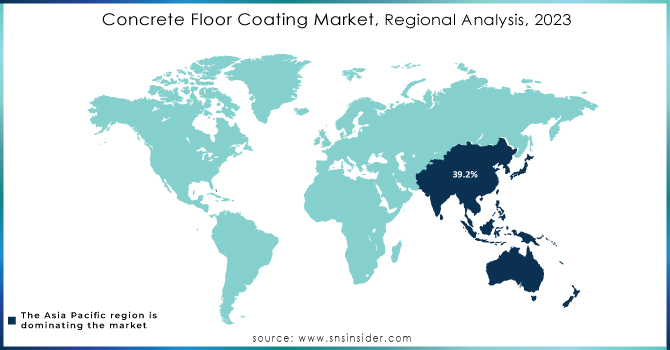

Concrete Floor Coating Market Regional Analysis

Asia Pacific dominated the concrete floor coating market with the highest revenue share of about 39.2% in 2023. This regional growth can be primarily attributed to the booming construction industry in Asia Pacific. The region is currently experiencing significant growth in construction, driven by factors such as rapid urbanization, population growth, and infrastructure development. According to our research, Asia-Pacific is expected to account for USD 7.5 trillion of global construction output by 2030. Furthermore, the Asia Pacific region is also witnessing substantial industrialization, fueled by the rising demand for consumer goods, increased investments in manufacturing industries, and favorable government policies. This industrialization trend is directly contributing to the growth of the concrete floor coatings market, as industrial floors require coatings to enhance durability and safety. Moreover, there is a growing demand for decorative concrete floor coatings in the Asia Pacific region, driven by the expanding middle-class population and rising disposable incomes. Additionally, there is a strong emphasis on green building practices in the region, motivated by increasing environmental concerns, government regulations, and cost savings. As a result, the adoption of eco-friendly coatings is on the rise, further driving the growth of the market.

North America is the second-largest market for the concrete floor coating market and is expected to grow with a CAGR of about 5.7% during the forecast period. The growth of the market in this region is mainly owing to the thriving construction industry. The construction sector in North America is experiencing remarkable expansion with more than 30% market share, fueled by factors such as population growth, infrastructure development, and increased investments in real estate. Moreover, the region is witnessing a surge in demand for eco-friendly coatings due to environmental concerns, government regulations, and heightened awareness among consumers. Additionally, industrialization is on the rise in North America, driven by the growing demand for consumer goods and substantial investments in the manufacturing industry. Furthermore, there is an increasing demand for decorative concrete floor coatings in the region, as disposable incomes rise, the desire for aesthetically pleasing interiors grows, and awareness about the benefits of decorative coatings spreads.

Key Players in Concrete Floor Coating Market

-

Tennant Coatings (Tennant Ecoat)

-

Vanguard Concrete Coating (Vanguard Polyurea Coating)

-

BASF SE (MasterTop 1327)

-

Trucrete Surfacing Systems (Trucrete Epoxy Flooring)

-

PPG Pittsburgh Paints (Pittsburgh Paints & Stains Epoxy Floor Coating)

-

North American Coating Solution (NACS Epoxy Coating)

-

Sherwin-Williams Company, (Sherwin-Williams Epoxy Floor Coating)

-

Elite Crete Systems (Elite Crete Polyurethane Coating)

-

Pratt & Lambert (Pratt & Lambert Epoxy Coating)

-

Florock (Florock FloroCrete)

-

Axalta Coating Systems (Axalta Dura-Plate 1000)

-

Rust-Oleum Corporation (Rust-Oleum EpoxyShield)

-

Sika AG (Sikafloor-265)

-

Krylon (Krylon Industrial Epoxy Coating)

-

Concrete Coatings Inc. (Concrete Coatings Decorative Sealer)

-

ArmorPoxy (ArmorPoxy Epoxy Floor Coating)

-

Epo-Poxy (Epo-Poxy 4100)

-

Nox-Crete Products Group (Nox-Crete Epoxy Coating)

-

Sovereign Chemicals (Sovereign ArmorSeal)

-

Grip-Rite (Grip-Rite Epoxy Floor Coating)

Recent Development:

-

In June 2023, PPG, a leading manufacturer of paints and coatings, made an exciting announcement regarding the expansion of its PPG FLOORING concrete coatings offering. This expansion includes a comprehensive range of integrated systems consisting of primers, base coats, and topcoats. These systems are specifically designed for environments that require electrostatic protection, ensuring the utmost durability and reliability.

-

In Jan 2020, Florock Polymer Flooring, a renowned manufacturer of commercial, industrial, and institutional concrete floor coatings, introduced the FloroStone Decorative Flooring System. This system revolutionizes decorative epoxy flooring by combining a sanitary, high-performance traffic surface with modern and upscale aesthetics. Not only does it provide an attractive appearance, but it also offers an economical and quick-turnaround solution.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.75 Billion |

| Market Size by 2032 | US$ 7.61 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Epoxy, Acrylic, Polyurethanes, Polyaspartic, and Others) • By Application (Indoor and Outdoor) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Tennant Coatings, Vanguard Concrete Coating, BASF SE, Trucrete Surfacing Systems, PPG Pittsburgh Paints, North American Coating Solution, The Sherwin-Williams Company, Elite Crete Systems, Pratt & Lambert, Florock, Axalta Coating Systems, |

| Key Drivers | • Increasing popularity of aesthetically appealing and durable flooring solutions • Increasing demand for protective coatings • Rising construction activities worldwide |

| Market Restraints | • High cost associated with the concrete floor coatings • Fluctuating prices of raw materials |