Self Compacting Concrete Market Report Scope & Overview:

Get more information on Self Compacting Concrete Market - Request Sample Report

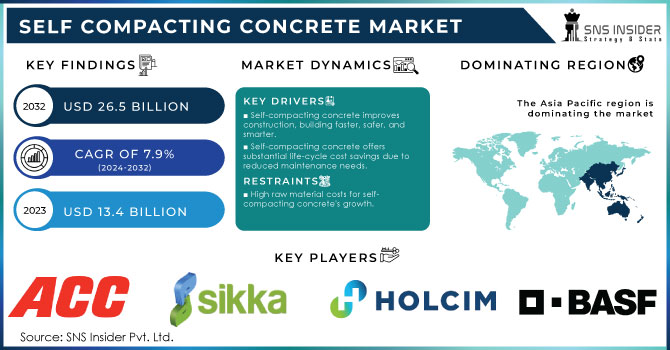

The Self Compacting Concrete Market Size was valued at USD 13.4 billion in 2023 and is expected to reach USD 26.5 billion by 2032 and grow at a CAGR of 7.9% over the forecast period 2024-2032.

Advances in construction technology, increasing demand for efficient and sustainable building materials, and high flow and self-leveling characteristics have fueled growth in the self compacting concrete market. The unique feature of self compacting concrete, that is its ability to flow and settle under its weight, thereby not requiring any mechanical vibration, has captured popularity across residential, commercial, and infrastructure projects for high-performance and time-efficient solutions. There are growing demands due to increasing urbanization and the necessity for strong materials for complex architectural designs. Innovations in admixtures and concrete formulations have enhanced self compacting concrete's attraction further, permitting its use under a variety of conditions and delivering superior finish and durability. Advanced technologies are now being used to engineer customized solutions in response to a variety of needs of end-users to meet contemporary construction challenges. Recent trends signify that the biggest players are active and proactive while scaling up their Self Compacting Concrete adoption.

Additionally, in September 2021, Ambuja Cements opened the Concrete Futures Laboratory, advanced technology for enhancing applications of special concretes such as Super-Workability-Concrete; Bangur Cements, lastly, brought forward Bangur Concrete in March 2024 that emphasizes not just quality, but also reliability for modern construction application. In like manner, Nuvoco Vistas commissioned its second ready-mix plant in Patna in February 2024, thus increasing its capacity for advanced concrete mixes, such as self compacting concrete. Economical foamed concrete, introduced in November 2022, has demonstrated budget-friendly alternatives for limited financial scopes, thus providing alternatives for self compacting concrete in resource-constrained projects. Further, in May 2024, developments in eco-friendly self compacting concrete formulations were reported, which have shown progress in carbon emissions reduction in concrete production. These developments underline the industry's focus on sustainability and innovation to meet evolving construction demands effectively.

Market Dynamics:

Drivers:

-

Increasing Adoption of High-Performance Materials in Modern Construction Drives the Self Compacting Concrete Market

The construction industry is increasingly moving toward high-performance materials, such as self compacting concrete, in the design of modern architectural forms. Self compacting concrete is used because it flows and settles freely without the need for mechanical vibration, providing a uniform and strong structure for complex forms. It is best suited for high-rise buildings, bridges, tunnels, and other infrastructure that demands precision and strength. Self compacting concrete also reduces labor requirements and accelerates construction timelines, resulting in significant cost savings. Countries experiencing rapid urbanization, such as China, India, and Brazil, are now seeing increased utilization of Self Compacting Concrete in smart city developments and infrastructure upgrades. The enhanced finish and reduced porosity further contribute to the growing acceptance of the material in projects demanding high aesthetic and structural quality. In line with the global construction sector's commitment to efficient and sustainable practices, the adoption of self compacting concrete is anticipated to increase significantly in regions with significant urban transformation.

-

Rise in Government Investments in Infrastructure Development Enhances the Adoption of Self Compacting Concrete

-

Growing Demand for Sustainable and Eco-Friendly Building Materials to Mitigate Environmental Impact

In response to the mounting pressure on the construction industry to minimize its environmental footprint, self compacting concrete is gaining recognition as a sustainable building material. Compared to traditional concrete, self compacting concrete generally requires fewer resources and emits less carbon dioxide in its production process. Furthermore, the use of recycled materials like fly ash and slag in self compacting concrete formulations further enhances the sustainability profile. Governments and regulatory bodies are making incentives for environmentally friendly construction materials and strict environmental guidelines that are forcing builders to use self compacting concrete solutions in many green buildings and projects that are looking for LEED certification. Additionally, the introduction of eco-friendly admixtures has made it possible for manufacturers to produce self compacting concrete solutions that don't reduce their performance in regards to the set sustainability goals. The global market is generating considerable opportunities for self compacting concrete due to this increasing attention to green construction practices.

Restraint:

-

High Initial Cost of Self Compacting Concrete Limits Adoption Among Cost-Sensitive Users

Opportunity:

-

Expansion of Smart City Projects and Urban Infrastructure Development Presents Growth Opportunities for Self Compacting Concrete

The surge in smart city initiatives and urban infrastructure projects is creating a robust market for self compacting concrete. Smart city projects emphasize efficient construction practices and durable materials, making self compacting concrete a preferred choice for building modern urban landscapes. Its ability to meet the complex requirements of smart infrastructure, including energy-efficient buildings and sustainable urban layouts, presents lucrative opportunities for manufacturers. As urbanization continues to accelerate, the demand for advanced construction materials like Self Compacting Concrete is expected to grow significantly.

-

Rising Focus on Precast Concrete Manufacturing Opens New Avenues for Self Compacting Concrete Market Growth

-

Emergence of Innovative Sustainable Construction Practices Drives New Applications of Self Compacting Concrete

Raw Material Insights for Self Compacting Concrete Market

The raw materials availability, cost, and properties will dictate the self-compacting concrete market, and therefore, knowing what these materials are and where the trends lie becomes important for a proper analysis of the market.

|

Raw Material |

Role in Self Compacting Concrete |

Current Trend |

Impact on Self Compacting Concrete Market |

Key Players |

|

Cement |

Primary binder providing strength |

Increasing use of low-carbon cement |

Reduced environmental impact, slight cost increase |

LafargeHolcim, HeidelbergCement |

|

Aggregates |

Provide volume and reduce shrinkage |

Shift towards recycled aggregates |

Enhanced sustainability, lower raw material costs |

Cemex, Breedon Group |

|

Chemical Admixtures |

Enhance workability, flowability, and setting time |

High demand for advanced superplasticizers |

Improved performance and higher adoption of Self Compacting Concrete |

BASF SE, Sika Group |

|

Fly Ash |

Supplementary cementitious material improving durability |

Growing availability of fly ash from power plants |

Cost-effective and eco-friendly alternative to cement |

CRH Plc, Ultratech Cement |

|

Silica Fume |

Increases strength and reduces permeability |

Used in high-performance Self Compacting Concrete formulations |

High demand in infrastructure and specialized projects |

Saint-Gobain, Roadstone Ltd |

Self-compacting concrete markets depend on crucial raw materials including cement, aggregates, and chemical admixtures to achieve unique properties of high flowability and strength. The critical component, cement, remains in the same light, while the development of low-carbon cement is fast taking center stage with sustainability targets. Aggregates, recycled aggregates, in particular, are experiencing higher adoption as costs and environmental footprint continue to decline. Advanced superplasticizers continue to propel performance, allowing self compacting concrete to offer improved workability and durability. Supplementary materials fly ash and silica fume allow for cost effectiveness and superior mechanical properties. Such a combination of trends supports not only the growth of the self compacting concrete market but also aligns it with evolving environmental and performance standards.

Key Market Segments

By Type of Deign

In 2023, the Combination Type segment dominated the self-compacting concrete market, with a market share of 45%. The combination type self compacting concrete provides the best of both viscosity agent and powder types, ensuring high flowability, cohesiveness, and reduced segregation. This adaptation allows concrete to flow smoothly into complex molds, filling small areas without vibrations that might be considered an overexertion. It is best suited for constructing complex structures such as large buildings and bridges. Flexibility in satisfying the various needs of contemporary construction work - high-quality workability with excellent surface finish quality - certainly explains why this segment leads in its class. For instance, in mega construction projects, the combination design saves time and labor in compaction. Overall, it becomes more efficient in the construction process. Moreover, it provides a higher durability aspect, which is critical for critical infrastructure to have a longer life. All these benefits make combination type Self Compacting Concrete a favorite in the industry, and its usage in mega construction projects worldwide has positioned it as a market leader.

By Raw Material

Cement dominated raw materials in 2023 self compacting concrete with a market share of 40%. Cement is primarily a binder to all self compacting concrete mixes; its involvement ensures the supply of strength and, therefore durability which in self compacting concrete, especially cannot do without. Although supplementary cementitious materials like fly ash and silica fume are gaining popularity, cement remains the most used material in self-compacting concrete because of its reliability and availability. Its role in enhancing the mechanical properties of concrete, such as compressive strength, ensures that self compacting concrete can meet the demanding structural and aesthetic requirements of modern construction projects. Cement dominates large-scale applications, particularly in terms of performance and value. Additionally, a constant flow of innovations in producing more environment-friendly cement continues to make this material even less detrimental to the environment, which further positions cement as the material of choice for the base matrices of self compacting concrete formulations.

By Application

The Concrete Frames segment dominated and captured the largest share of about 30% in the self-compacting concrete market in 2023. Concrete frames are integral parts of structures because they are important in buildings; these support loads and distribute them throughout the building evenly. Self compacting concrete is highly favored for use in concrete frames because of its excellent flowability, which allows the concrete to easily fill complex molds and tight spaces, ensuring a smooth and void-free finish. The use of self compacting concrete in concrete frames significantly reduces labor costs and construction time by eliminating the need for mechanical vibration during placement. This has proved especially useful for big construction work involving high-rise buildings, commercial buildings, and other infrastructure work, like bridges, where strength along beauty are prime considerations. Self compacting concrete can easily be placed into mold designs with high intricacy without affecting its strength or surface finish, making it very popular for such an application. The demand for more complex and taller buildings continues to fuel the preference for self compacting concrete in concrete frames.

By End-User

In 2023, the Building & Construction segment dominated the self compacting concrete market, thereby capturing about 55% of its market share. The building and construction sector remains one of the biggest consumers of self compacting concrete because its high-performance needs are always outpaced by these increasing demands within residential, commercial, and industrial construction. Self compacting concrete has excellent workability and flowability while offering a smooth finish with fewer voids, so it is suitable for all types of buildings, including residential buildings and large commercial buildings, highways, and bridges. The demand for Self Compacting Concrete is likely to increase, especially in urbanization, mainly in developing nations, where aesthetically appealing and high-strength concrete is also in demand; thus, its market is booming. For instance, large infrastructures like skyscrapers and bridges use self compacting concrete owing to its ability to offer excellent placement efficiency with a higher-quality surface finish than other mix designs. With such complexity and high scale construction occurring globally, building and construction stand as the leading end-user and will continue in the market dominated by self compacting concrete.

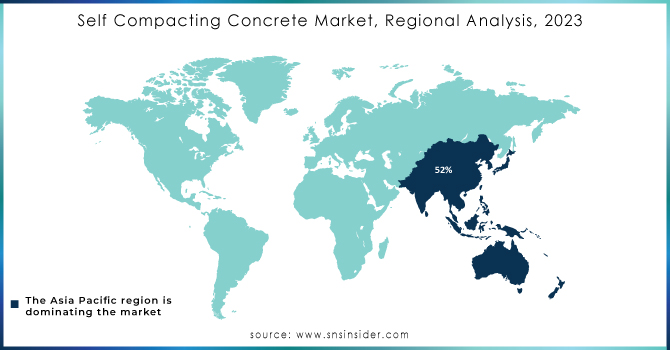

Regional Analysis

Asia-Pacific (APAC) region dominated the self-compacting concrete market in 2023 with a market share of 45%. The main reason for its dominance is that construction activity in countries like China, India, and Japan has been very high due to urbanization and the fast development of infrastructure. The country that most significantly consumes self compacting concrete is China. Its urbanization continues to boom and large infrastructural projects in terms of the construction of bridges, highways, and high-rise buildings are done in the country. There is also increased demand for self compacting concrete in India on residential and commercial constructions due to time-saving property and superior quality of finish. Japan is also a good market for self compacting concrete owing to the rigorous construction standards and rising seismic consciousness. APAC Region: This market is further driven by modern construction material usage across the region and the increasing adoption of self-compacting concrete owing to its efficiency, durability, and associated environmental benefits. For instance, China's Belt and Road Initiative is one such large infrastructure development project that is driving demand for high-performance construction materials like self compacting concrete. Meeting this increasing demand for infrastructure and residential development in the region will only continue to entrench the region's status as the world's largest self compacting concrete market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

ACC Limited (ACC Self Compacting Concrete, ACC Concrete)

-

BASF SE (MasterFlow 928, MasterGlenium)

-

Breedon Group (Breedon SCC, Breedon Flow)

-

Cemex (Cemex Flowable Concrete, Cemex Self-Compacting Concrete)

-

HeidelbergCement AG (HeidelbergCement SCC, CEM II/A-S)

-

Kilsaran (Kilsaran Self Compacting Concrete, Kilsaran Flowcrete)

-

LafargeHolcim Limited (LafargeHolcim SCC, ECOPact)

-

Roadstone Ltd. (Roadstone SCC, Roadstone Flowable Concrete)

-

Sika Group (Sika® SCC, Sika® ViscoCrete)

-

Tarmac (Tarmac SCC, Tarmac Flowing Concrete)

-

Ultratech Cement Limited (Ultratech Self Compacting Concrete, Ultratech Flowcrete)

-

Unibeton Ready Mix (Unibeton SCC, Unibeton Flowcrete)

-

Buzzi Unicem (Buzzi Unicem Self Compacting Concrete, Buzzi Unicem Flowcrete)

-

China National Petroleum Corporation (SCC Cement, CNPC High Flow Concrete)

-

CRH Plc (CRH SCC, CRH Flowcrete)

-

Fosroc International Ltd. (Fosroc Conbextra, Fosroc Conplast)

-

James Hardie Industries (Hardie Plank, Hardie Concrete)

-

Lafarge (Lafarge Self Compacting Concrete, Lafarge Flowcrete)

-

Saint-Gobain (Saint-Gobain Flowcrete, Saint-Gobain SCC)

-

Taiwan Cement Corporation (Taiwan Self Compacting Concrete, Taiwan High Flow Concrete)

Recent Developments

-

January 2023: The People's Republic of China issued a new standard, GB/T 50450-2022, which defined production, testing, and application specifications for Self Compacting Concrete within the country. This shows the country's intentions to regulate and promote Self Compacting Concrete application.

-

February 2023: The American Concrete Institute (ACI) issued a technical report titled ACI 232R-19, that provided information about the application of Self Compacting Concrete in specific applications. It shows that the industry is putting efforts into furthering the use of Self Compacting Concrete.

-

March 2023: The European Union published its new standard called EN 206-1:2023, which states the more defined requirements for producing, testing, and using Self Compacting Concretes. This again is a measure by the European Union to get the best high-quality Self Compacting Concrete available throughout the regions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.4 Billion |

| Market Size by 2032 | US$ 26.5 Billion |

| CAGR | CAGR of 7.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type of Deign (Viscosity Agent Type, Powder Type, Combination Type, Others) •By Raw Material (Cement, Admixtures, Fibers, Aggregates, Additions, Others) •By Application (Drilled Shafts, Columns, Metal Decking, Concrete Frames, Others) •By End-User (Oil & Gas, Infrastructure, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ACC Limited, Sika Group, LafargeHolcim Limited, HeidelbergCement AG, BASF SE, Kilsaran, Breedon Group, Ultratech Cement Limited, Unibeton Ready Mix, Cemex, Tarmac, Roadstone Ltd. and other key players |

| Key Drivers | •Rise in Government Investments in Infrastructure Development Enhances the Adoption of Self Compacting Concrete •Growing Demand for Sustainable and Eco-Friendly Building Materials to Mitigate Environmental Impact |

| RESTRAINTS | •High Initial Cost of Self Compacting Concrete Limits Adoption Among Cost-Sensitive Users |