Condominiums And Apartments Market Report Scope & Overview:

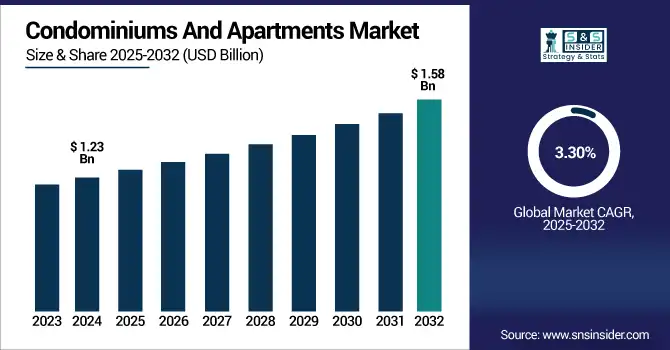

Condominiums And Apartments Market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.58 billion by 2032, growing at a CAGR of 3.30% from 2025-2032.

To Get more information on Condominiums And Apartments Market - Request Free Sample Report

The Condominiums and Apartments Market growth is driven by several key factors. Rapid urbanization is leading to higher demand for multi-family dwellings in densely populated cities. Affordability is a major attraction, especially among young professionals and small families. Government housing initiatives and favorable financing options are encouraging homeownership. Developers are increasingly incorporating amenities like 24/7 security, fitness centers, and smart home features, making such properties more desirable. Moreover, investment in rental properties is rising due to stable returns.

-

In the U.S., as of May 2025, the median home price across all housing types reached USD 440,910 an increase of 0.6% year-over-year while the total number of homes sold declined by 4.5% to 483,602.

-

Meanwhile, inventory surged by 16.2%, with over 2 million homes listed for sale. Notably, “prime” condominium transactions in New York City rose by 14% year-over-year, fueled by returning office workers and renewed urban migration. L

imited land availability and shifting preferences toward community living further support the continued market expansion through the forecast period.

U.S. Condominiums And Apartments Market size was valued at USD 0.34 billion in 2024 and is expected to reach USD 0.43 billion by 2032, growing at a CAGR of 2.97% from 2025-2032.

Growth in the U.S. Condominiums and Apartments Market is driven by urban population growth, demand for affordable housing, rising rental investments, and preference for amenity-rich, low-maintenance living spaces in metropolitan areas with limited land availability.

Market Dynamics

Drivers

-

Rapid Urbanization And Shrinking Household Sizes Are Fueling Demand For Vertical Living In Urban Centers Globally

In Expanding urban areas and with fewer members in homes, particularly in sun-scorched urban districts, ever-increasing necessities remain for condos and pads. Compact and affordable living spaces near workplaces and other facilities are the preferred option for young professionals and nuclear families. Rapid urban migration drives high-rise construction in developing economies, while older housing complexes are replaced with news ones in advanced economies. As lifestyles change and urbanization continues, condominiums and apartments appeal to a wide range of demographics looking for ease and practicality.

-

Over 55% of the world’s population resides in urban areas, a figure expected to grow to around 68% by 2050, with roughly 2.5 billion more urban dwellers added by mid-century.

-

As of late 2023, the U.S. had a housing shortage estimated between 3.9 and 4.9 million units, driven by new households forming faster than construction.

Restraints

-

High Maintenance Fees And Homeowners Association Rules Are Discouraging Potential Buyers From Opting For Condominium Living

Potential condo buyers are shying away from monthly maintenance fees and restrictive HOA rules. The costly burden of these fees, particularly in high-end homes, can be a financial burden on penny-pinching residents. Also, stringent HOA regulations that limit personalization, rentals or pet ownership frequently do not align with lifestyle choice. Ad-hoc evaluations and sporadic fee increases create further financial ambiguity. The idea that a potential slash unit could not provide any level of autonomy and also be a perceived burden to someone over a long period of time has driven many prospective purchasers toward an alternative housing choice, fueling decreased demand for condominium in certain markets as well as a differential investment appeal.

-

Average monthly HOA fees in the U.S. range from USD 300–USD 400, with outliers like Missouri (USD 469/month) and Alabama (USD 458/month), while South Carolina reports one of the lowest at USD 310/month.

-

Increasing costs are widespread 91% of communities report unexpected expense increases, prompting 71% of HOA boards to consider fee hikes of up to 10% annually, with another 19% planning 11–25% increases.

Opportunities

-

Growing Demand For Sustainable And Smart Apartment Complexes Is Opening New Growth Avenues For Tech-Integrated Housing Solutions

With an increase in awareness on sustainability and digital integration, the condominium and apartment market is gaining new opportunities. The preference among buyers today is for green-certified buildings, energy-efficient appliances, and smart features, such as automated lighting and keyless entry. Use of green green materials and smart technologies by developers offer them a competitive edge and prices end up higher. Demand is also driven by incentives by the government to promote green construction. Those changing tastes are changing home design, drawing more eco-minded, tech savvy urbanites, and aligning development practices with large-scale climate objectives and sustainable living benchmarks.

Challenges

-

Regulatory Complexities And Zoning Restrictions Are Delaying Project Approvals And Escalating Development Costs In Urban Cores

Condominium and apartment development are also hampered by bureaucratic and red tape hurdles, antiquated zoning laws and a patchwork of local regulations, particularly in city centers. Delays in the approval process,overly strict floor-area ratios, and parking mandates contribute to the expense. Such barriers impede innovation, scalability, and high-density housing options. In turn, fragmented municipal code makes expansion challenging to national and international developers. These inefficiencies in regulations limit supply in places where people want to live. We must streamline and modernize approval processes to incentivize viable, timely apartment construction within these infrastructure-limited, fast-growing urban zones.

Segment Analysis

By Type

Affordable Condominiums led the market in 2024 with a 28% revenue share due to their widespread appeal among middle-income and first-time homebuyers. These provide the best price-to-basic-amenities ratio and hence are affordable both in developed as well as emerging markets. Their uptake grew even further with government associate affordable housing projects and city housing deficits. Designers continue to develop efficient and compact layouts to accommodate increasing demand in cost-effective urban markets.

Studio Apartments are projected to grow at the fastest CAGR of 5.08% from 2025 to 2032, owing to lifestyle choices of live-in-association residents, students and working youth. Added to their reduced size, lower running costs, and location in or near city centers or transport nodes, they make urban sense. Soaring rent prices and growing passion for minimalistic lifestyle will also further boost the growth of this segment in mature as well as emerging housing markets.

By Target Audience

Families dominated the market in 2024 with a 36% revenue share as they continue to drive demand for multi-bedroom condominiums and larger apartment units. Familiar Security, Community Facilities, Close to School & Workplace so that families can be involved in residential projects including full service boasts. Developers have responded with projects that are family friendly, though they do not include the amenities and sports and play areas common in some of the high-end buildings in the north, the latter of which helped maintain that segment’s supremacy.

Young Professionals are expected to grow at the fastest CAGR of 4.34% from 2025 to 2032, An increase in the urban migration, the trend of double-income nuclear families and increased preference for modern and well-located property. This group is looking for living that is lifestyle-oriented, convenient to transit, entertainment and work centers. This mobile, career-focused segment is driving rapid growth in a major metro market for technologically integrated, all-in-one spaces.

By Amenities

Fitness Centers led amenities in 2024 with a 22% revenue share, owing to the increasing demand for fitness and health in residential society. Convenient access to gyms and fitness centres, based on shifting wellness eager lifestyles, will continue to be important for residents. Fitness centers are becoming a more prevalent inclusion to any development, adding value and retaining tenants. Inspiration for wellness-centric living has established fitness amenities as a key selling point in contemporary housing.

Rooftop Gardens are expected to grow at the fastest CAGR of 6.20% from 2025 to 2032, owing to urban green space and conscious living. These public spaces can offer relaxation, socializing and environmental variables like thermal insulation and cleaner air. Particularly in densely populated cities, they provide premium lifestyle benefit and can work toward sustainability certifications, becoming more and more desirable to investors, buyers and developers who care about environmental impact.

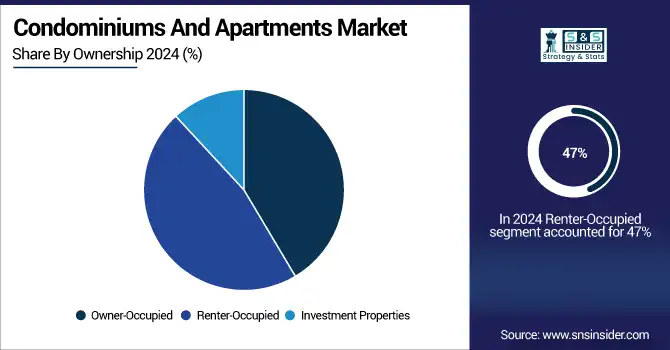

By Ownership

Renter-Occupied units led the condominiums and apartments market in 2024 with a 47% revenue share and are projected to grow at a CAGR of 4.13% from 2025 to 2032. This dominance is largely correlated with the rising unaffordability of housing in urban centers, creating more incentive for consumers to seek rental opportunities instead of ownership. Low upfront investment and higher relocation flexibility make rental suitable for any young professionals, mobile workers and migrants. In addition, rise of institutional investments in build to rent and managed rental communities are also continuing to spur growth with renter-occupied units likely to emerge as one of the greater growth drivers of the global residential market.

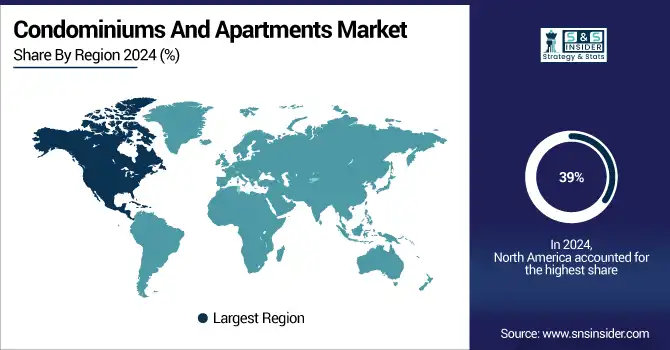

Regional Analysis

North America accounted for the largest revenue share of 39% in 2024 due to advancing rates of urbanization, matured real estate markets and high purchasing power among consumers. Demand for amenities, security, and proximity to workplaces has created a preference for condominium living in key cities in this region such as New York, Toronto, and Los Angeles. The presence of institutional investment and mature legal frameworks only further enhances the region's dominance in housing.

Asia Pacific is projected to grow at the fastest CAGR of 4.81% from 2025 to 2032, due to urbanization, population growth, and the increase in the middle-class income. There is an enormous appetite for low-cost and mid-range flat products in nations like India, China, and Southeast Asia. New movements are being fueled by government subsidized lodging programs, extension of framework, and a move towards nuclear family models – making the area a center point for citizen lodging opportunities and improvement.

China is dominating the condominiums and apartments market driven by rapid urbanization, massive population density, and extensive residential construction in major metropolitan areas.

Europe’s condominiums and apartments market is driven by increasing urban population, limited land availability, and growing demand for rental housing. Countries like Germany, France, and the UK are leading due to strong infrastructure, investment stability, and urban housing reforms.

Germany is dominating the condominiums and apartments market due to its strong economy, high rental demand, and consistent urban housing development across major cities.

The Middle East & Africa market is growing steadily, supported by urban development and rising demand for modern housing, especially in the Gulf region. In Latin America, urban migration and affordable housing initiatives are fueling apartment and condominium development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Condominiums And Apartments Market Companies Are Greystar Real Estate Partners, Brookfield Asset Management, CBRE Group, Inc., Equity Residential, AvalonBay Communities, Inc., CapitaLand Group, China Vanke Co., Ltd., Sun Hung Kai Properties, Lendlease Group, Emaar Properties PJSC, Mitsui Fudosan Co., Ltd., D.R. Horton, Inc., Taylor Morrison Home Corp., Tridel Group, Sekisui House, Ltd., Bouygues Immobilier, Mahindra Lifespace Developers Ltd., Gecina, UOL Group Limited, Orascom Development Holding and others.

Recent Developments:

2025- Greystar formed an exclusive strategic partnership with Trilogy Real Estate Group, adding management of Trilogy’s 2,845 apartments and leveraging Greystar’s scale and operational capacity

2024 – Greystar acquired Wood Partners’ property management division, transferring 625 employees and integrating over 140 communities, boosting its portfolio to 3,200+ communities and nearly 895,000 units.

2024- Greystar announced expansion into infrastructure sectors like transportation, clean power, data centers and logistics, extending beyond multifamily real estate.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.23 Billion |

| Market Size by 2032 | USD 1.58 Billion |

| CAGR | CAGR of 3.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Luxury Condominiums, Affordable Condominiums, Studio Apartments, Two-Bedroom Apartments, Three-Bedroom Apartments) • By Ownership (Owner-Occupied, Renter-Occupied, Investment Properties) • By Amenities (Swimming Pools, Fitness Centers, Rooftop Gardens, 24/7 Security, Parking Facilities) • By Target Audience (Young Professionals, Families, Retirees, Students) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Greystar Real Estate Partners, Brookfield Asset Management, CBRE Group, Inc., Equity Residential, AvalonBay Communities, Inc., CapitaLand Group, China Vanke Co., Ltd., Sun Hung Kai Properties, Lendlease Group, Emaar Properties PJSC, Mitsui Fudosan Co., Ltd., D.R. Horton, Inc., Taylor Morrison Home Corp., Tridel Group, Sekisui House, Ltd., Bouygues Immobilier, Mahindra Lifespace Developers Ltd., Gecina, UOL Group Limited, Orascom Development Holding |