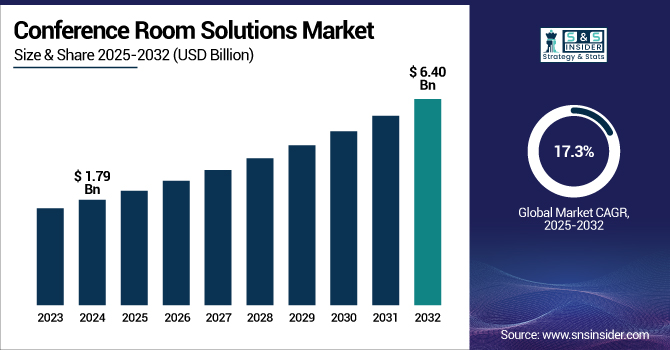

The Conference Room Solutions Market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 6.40 billion by 2032 and grow at a CAGR of 17.3% over the forecast period 2025-2032.

To Get more information on Conference Room Solutions Market - Request Free Sample Report

The Market is expanding fast because of increasing demand for effective collaboration solutions in the face of hybrid and remote work environments. Firms invest in premium AV systems, cloud platforms, and AI-driven real-time transcription, scheduling, and analytics tools. The smart office and digitalization trend are accelerating the adoption of integrated, scalable solutions that enable virtual as much as physical meetings.

As per study, March 2024, conference room solutions space continued to witness growth as businesses adjusted to hybrid work needs. 80% of the staff indicated a liking for hybrid calendars, propelling investment in smart meeting room solutions. solutions such as occupancy sensors, room reservation platforms, and seamless audio-visual equipment became productivity drivers.

The U.S. Conference Room Solutions Market size was USD 0.42 billion in 2024 and is expected to reach USD 1.28 billion by 2032, growing at a CAGR of 14.81% over the forecast period of 2025–2032.

The U.S. leads the market with high usage of advanced technology and strong infrastructure. With more organizations in different industries adopting hybrid and remote working modes, the requirement for effective and hassle-free communication tools has increased. The U.S. hosts giant technology firms such as Microsoft, Zoom, and Cisco, which are spearheading developments in cloud-based conferencing solutions, AI-enabled tools, and high-definition AV systems. Besides, the nation's robust IT environment and emphasis on digital transformation influence the extensive use of integrated conference room solutions industry. This synergy positions the U.S. to stay ahead in the market.

Key Drivers:

Growing Demand for Advanced Audio-Visual Integration Drives Innovation in Conference Room Solutions

The growing need for smooth integration of audio-visual in meeting rooms is one of the foremost drivers driving the conference room solutions market growth. Companies are increasingly using next-generation technologies to stimulate communication and collaboration during meeting sessions. Technologies such as high-definition video conferencing, wireless, and interactive screens are becoming unavoidable to promote workplace productivity improvement. The integration of AI and ML is also enhancing the functionality of such systems by improving resource utilization, ensuring high-quality video and audio streams, and automating meeting processes. The demand is most pronounced in industries such as technology, education, and business services, where uninterrupted communication is essential to operations. As businesses strive to conduct more productive and engaging meetings, the need for sophisticated conference room systems is on the rise, and businesses are responding by redefining and updating these solutions.

Restraints:

High Implementation Costs Hinder Widespread Adoption of Conference Room Solutions

The market has a high level of implementation cost. The cost of setting up a top-notch conference room with equipment such as video conferencing, interactive displays, and integrated AV solutions can be expensive and unattainable for many small to medium-sized companies. Probably the cost of the maintenance is one of the costs that is also charged, and also the cost of upgrading always software and hardware. For other companies, the ROI may not be as clear, particularly for smaller businesses with less capital to spend. These challenges in ensuring that such systems are implemented on a larger scale prevent them from being widely accepted. As technology becomes less expensive over time, however, the market can expect to witness a decline in cost barriers.

Opportunities:

Rise in Remote Work Creates Increased Demand for Collaborative Conference Room Solutions

Transitioning to remote and hybrid work setups has opened up a fantastic opportunity for the conference room solutions market trends. As corporations continue to adopt flexible work arrangements, the demand for solutions that enable seamless collaboration among remote and on-site employees has been at an all-time high. Video conferencing solutions, cloud collaboration platforms, and cooperative whiteboards have become necessary in facilitating successful communication and thinking. The market has been experiencing a rapid growth of solutions that connect the in-office and remote participants, making meetings more accessible.

In April 2025, cloud-based solutions led the market with 73%, emphasizing a trend away from on-premise systems. Large enterprises with more than 1,000 employees spent an average of USD 242,000 a year on video conferencing products and services.

Challenges:

Ensuring Seamless Integration with Existing IT Infrastructure in Conference Room Solutions

The market is allowing new systems to seamlessly connect to existing IT landscapes. Most organizations have already invested in networks, hardware, and software, and thus have a pre-existing technological infrastructure to which new conference room technologies must be added and made compatible. This will result in increased complexity and longer deployment times, something that no business wants to experience.

Moreover, ensuring that differing platforms and devices interoperate without issues hasn’t been solved yet, particularly in a company where employees use a combination of operating systems and hardware setups. Overcoming these integration challenges is essential for enterprises to be able to deploy and enjoy new conference room technology and features without sacrificing their functionality.

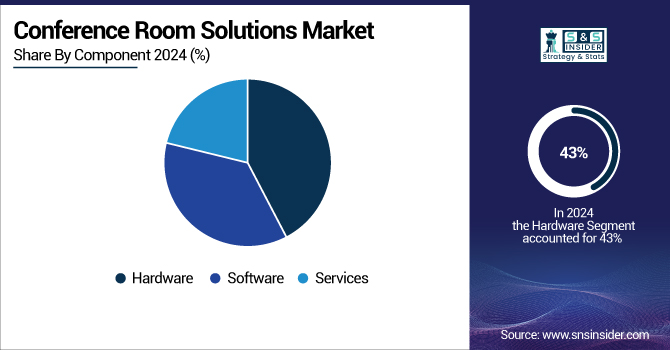

By Component

Hardware was the leading revenue-generating segment in the conference room solutions in 2024, accounting for a 43% share, due to growing installations of smart cameras, displays, and audio solutions. Logitech’s Rally Bar Huddle systems were enhanced, and so too was the meeting-making experience with the introduction of the Room Kit EQX from Cisco. The rise of hybrid meetings led enterprises to invest in solid physical infrastructure in offices around the world.

Software is growing the fastest CAGR of 18.8% in the forecasted period 2025-2032, owing to the rise in demand for AI-based platforms and integrated solutions. In late 2024, Microsoft Teams released Smart Recap, followed by Zoom's AI Companion, further increasing productivity and automation during the meeting process. There is a growing demand for scalable, cloud-based solutions in modern conference rooms, and this surge in smart software innovation reflects that.

By Enterprise Size

Based on size, the Large Enterprises segment held a market share of 55% of the revenue during 2024 due to their enormous IT budgets and requirement for global collaboration. Google scaled up its Meet Series One room kit, and HP Poly solutions gained traction in large multi-nationals. These were companies that invariably had scalable conferencing ecosystems and had established dominion in the conference room solutions market analysis.

The SMES are growing at the fastest pace at 18.03% CAGR with affordable as well as easy-to-deploy conferencing platforms. Startups like Neat released small AI-driven meeting appliances for small groups. Such cloud-based, subscription-based services such as Zoom and Google Meet have become a hit among SMEs, which has turned upper-level conference room equipment into a common presence, driving a robust market expansion.

By Vertical

In 2024 IT and telecom companies dominated with a 33% market share, driven by widespread digital adoption and global workforce collaboration. Firms like Cisco and zoom innovated with secure, scalable conferencing platforms. These companies are also paying to bring ever-improved AV tech and virtual collaboration tools together to support agile workflows, ensuring that their lead in the adoption of the conference room solution is secure.

The BFSI offers a higher CAGR of 18.4% and demonstrates great demand for performing secure and compliant conferencing. This is the segment where the demand right now in this moment is exploding. In 2024, Avaya and Cisco started to provide encrypted video tools to banks. With banks moving more toward digital customer interaction and hybrid teams, we need conference room environments that are secure, reliable, and enable vertical-specific investment.

In 2024, North America dominated the Conference Room Solutions Market share, estimated to hold over 39% of the global revenue. This leadership is the product of early technology adoption, a swift uptake of hybrid work environments, and strong AV solution provider capabilities.

Shure is introducing its IntelliMix Room Kits in April 2025 to the U.S. market. The kits are equipped with AI-enabled Huddly Cameras and premium audio to solve acoustic challenges and deliver exceptional meeting experiences.

Asia Pacific emerged as the fastest-growing region in 2024, with an estimated CAGR exceeding 21.01%. China and India, for instance, spearheaded this growth as they underwent rapid urbanization, government-led digitalization initiatives, and a surge of tech-savvy enterprises. With its technological advancement and massive investment in digital infrastructure, China rules the Conference Room Solutions market. Increasing implementation of smart cities in the country, the government's strong support for digital transformation, and the rising need for hybrid work solutions fuel the demand for advanced conferencing solutions.

In 2024, Europe established strong momentum in the Conference Room Solutions Market, propelled by rapid digital transformation and permanent hybrid work adoption. In 2024, Germany led the European Conference Room Solutions Market due to its advanced technology infrastructure and strong focus on business digitization. German companies consistently invest in smart workplace solutions, including AI-enabled video conferencing and high-end AV systems, to support hybrid work environments.

In 2024, the Middle East & Africa and Latin America regions showed rising demand for conference room solutions, driven by digital transformation efforts across education, government, and corporate sectors. Countries like the UAE and Brazil began adopting cloud-based video conferencing systems and modern AV setups to improve remote collaboration. Though at an earlier adoption stage, increased infrastructure investments and global business integration are supporting steady market expansion in both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

The conference room solutions market companies are Cisco Systems, Microsoft, Zoom Video Communications, Logitech, Poly (formerly Polycom), Crestron Electronics, Google, Barco, Avaya, Huawei, and others.

• In March 2025, Huawei launched its AI-powered conference room solutions in Beijing to boost collaboration and efficiency in hybrid workplaces. The new solutions incorporated smart voice recognition, real-time translation of languages and auto-meeting summary.

• Microsoft today revealed AI-enhanced Microsoft Teams Rooms in 2024 to better serve collaboration and productivity needs in hybrid workplaces. The new features are designed to make meetings flow more smoothly and facilitate better communication across organizations.

• In November 2024, Zoom officially rebranded as “Zoom Communications Inc.” and emphasized an AI-first product outline. The company unveiled the AI Companion, tailored to tasks like summarizing meetings and drafting emails, in a bid to improve productivity and cut down hours in a typical workweek.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.79 Billion |

| Market Size by 2032 | USD 6.40 Billion |

| CAGR | CAGR of 17.3% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises) • By Vertical (IT and Telecom, BFSI, Healthcare, Retail, Media and Entertainment, Transportation and Logistics, Education, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cisco Systems, Microsoft, Zoom Video Communications, Logitech, Poly (formerly Polycom), Crestron Electronics, Google, Barco, Avaya, Huawei, and Others. |

Ans: The Conference Room Solutions Market is expected to grow at a CAGR of 17.3% during 2025-2032.

Ans: The Conference Room Solutions Market size was USD 1.79 billion in 2024 and is expected to reach USD 6.40 billion by 2032.

Ans: The major growth factor of the Conference Room Solutions Market is the increasing demand for seamless hybrid work environments and advanced collaboration technologies.

Ans: The Hardware segment dominated the Conference Room Solutions Market.

Ans: North America dominated the Conference Room Solutions Market in 2024.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Average Setup Time Reduction

5.2 Employee Productivity Index

5.3 BYOD (Bring Your Own Device) Usage Rate in Meetings

5.4 Remote Attendee Satisfaction Score

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Conference Room Solutions Market Segmentation by Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2021-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2021-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2021-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Conference Room Solutions Market Segmentation by Enterprise Size

8.1 Chapter Overview

8.2 Small and Medium Enterprises (SMEs)

8.2.1 Small and Medium Enterprises (SMEs) Market Trend Analysis (2021-2032)

8.2.2 Small and Medium Enterprises (SMEs) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Large Enterprises

8.3.1 Large Enterprises Market Trends Analysis (2021-2032)

8.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Conference Room Solutions Market Segmentation by Vertical

9.1 Chapter Overview

9.2 IT & Telecom

9.2.1 IT & Telecom Market Trends Analysis (2021-2032)

9.2.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 BFSI

9.3.1 BFSI Market Trends Analysis (2021-2032)

9.3.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Healthcare

9.4.1 Healthcare Market Trends Analysis (2021-2032)

9.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Retail

9.5.1 Retail Market Trends Analysis (2021-2032)

9.5.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Manufacturing

9.6.1 Manufacturing Market Trends Analysis (2021-2032)

9.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Media & Entertainment

9.7.1 Media & Entertainment Market Trends Analysis (2021-2032)

9.7.2 Media & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Transportation and Logistics

9.8.1 Transportation and Logistics Market Trends Analysis (2021-2032)

9.8.2 Transportation and Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Education

9.9.1 Education Market Trends Analysis (2021-2032)

9.9.2 Education Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Others

9.10.1 Others Market Trends Analysis (2021-2032)

9.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Conference Room Solutions Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.2.3 North America Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.2.4 North America Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.2.5 North America Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.2.6.2 USA Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.2.6.3 USA Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.2.7.2 Canada Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.2.7.3 Canada Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.2.8.2 Mexico Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.2.8.3 Mexico Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3 Europe

10.3.1 Trends Analysis

10.3.2 Eastern Europe Conference Room Solutions Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.3.3 Eastern Europe Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.4 Eastern Europe Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.5 Eastern Europe Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.6 Germany

10.3.6.1 Germany Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.6.2 Germany Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.6.3 Germany Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.7 France

10.3.7.1 France Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.7.2 France Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.7.3 France Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.8 UK

10.3.8.1 UK Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.8.2 UK Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.8.3 UK Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.9 Italy

10.3.9.1 Italy Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.9.2 Italy Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.9.3 Italy Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.10 Spain

10.3.10.1 Spain Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.10.2 Spain Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.10.3 Spain Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.11 Poland

10.3.11.1 Poland Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.11.2 Poland Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.11.3 Poland Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.12 Turkey

10.3.12.1 Turkey Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.12.2 Turkey Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.12.3 Turkey Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.3.13 Rest of Europe

10.3.13.1 Rest of Europe Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.3.13.2 Rest of Europe Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.3.13.3 Rest of Europe Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.4.3 Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.4 Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.5 Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.6.2 China Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.6.3 China Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.7.2 India Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.7.3 India Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.8.2 Japan Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.8.3 Japan Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.9.2 South Korea Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.9.3 South Korea Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.10 Singapore

10.4.10.1 Singapore Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.10.2 Singapore Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.10.3 Singapore Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.11 Australia

10.4.11.1 Australia Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.11.2 Australia Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.11.3 Australia Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.4.12 Rest of Asia Pacific

10.4.12.1 Rest of Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.4.12.2 Rest of Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.4.12.3 Rest of Asia Pacific Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Trends Analysis

10.5.2 Middle East Conference Room Solutions Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.5.3 Middle East Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.5.4 Middle East Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.5.5 Middle East Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.5.6 UAE

10.5.6.1 UAE Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.5.6.2 UAE Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.5.6.3 UAE Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.5.7 Saudi Arabia

10.5.7.1 Saudi Arabia Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.5.7.2 Saudi Arabia Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.5.7.3 Saudi Arabia Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.5.8 Qatar

10.5.8.1 Qatar Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.5.8.2 Qatar Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.5.8.3 Qatar Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.5.9 South Africa

10.5.9.1 South Africa Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.5.9.2 South Africa Conference Room Solutions Market Estimates and Forecasts by Enterprise Size (2021-2032) (USD Billion)

10.5.9.3 South Africa Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.5.10 Rest of Middle East & Africa

10.5.10.1 Rest of Middle East & Africa Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.5.10.2 Rest of Middle East & Africa Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.5.10.3 Rest of Middle East & Africa Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Conference Room Solutions Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.6.3 Latin America Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.6.4 Latin America Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.6.5 Latin America Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.6.6.2 Brazil Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.6.6.3 Brazil Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.6.7.2 Argentina Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.6.7.3 Argentina Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

10.6.8 Rest of Latin America

10.6.8.1 Rest of Latin America Conference Room Solutions Market Estimates and Forecasts, by component (2021-2032) (USD Billion)

10.6.8.2 Rest of Latin America Conference Room Solutions Market Estimates and Forecasts, by Enterprise Size (2021-2032) (USD Billion)

10.6.8.3 Rest of Latin America Conference Room Solutions Market Estimates and Forecasts, by Vertical (2021-2032) (USD Billion)

11. Company Profiles

11.1 Cisco Systems

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 Microsoft

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 Zoom Video Communications

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 Logitech

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 Poly (formerly Polycom)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 Crestron Electronics

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 Google

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Barco

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 Avaya

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 Huawei

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

Services

By Enterprise Size

Small and Medium Enterprises (SMEs)

Large Enterprises

By Vertical

IT and Telecom

BFSI

Healthcare

Retail

Media and Entertainment

Transportation and Logistics

Education

Manufacturing

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players