Blockchain in Manufacturing Market Report Scope & Overview:

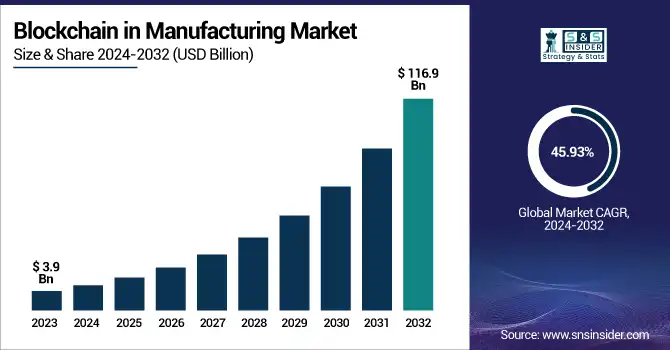

The Blockchain in the Manufacturing Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 116.9 billion by 2032, growing at a CAGR of 45.93% from 2024-2032.

To Get more information on Blockchain in the Manufacturing Market - Request Free Sample Report

The statistical insights reflect a significant rise in blockchain adoption across manufacturing sectors, particularly in automotive, electronics, and pharmaceuticals. Regional investments are led by North America and Europe, emphasizing advanced economies' push toward supply chain transparency. Manufacturers are using blockchain to improve logistics efficiency, traceability, and meet compliance requirements. Additionally, the report highlights emerging applications such as blockchain-based digital twins, automated quality checks using smart contracts, and integration with IoT devices for real-time asset monitoring—signaling a shift toward intelligent, self-auditing manufacturing systems. These developments are transforming legacy systems into secure, data-driven networks with improved accountability and process optimization.

The U.S. Blockchain in the Manufacturing Market was valued at USD 1.0 billion in 2023 and is expected to reach USD 28.7 billion by 2032, growing at a CAGR of 45.54% from 2024-2032. driven by increasing demand for supply chain transparency, regulatory compliance, and automation. Government initiatives supporting digital infrastructure and innovation further fuel adoption. The market is projected to witness robust growth through 2032, with a strong CAGR as blockchain becomes integral to smart manufacturing.

Blockchain in Manufacturing Market Dynamics

Driver

-

The rising need for supply chain transparency and traceability is accelerating blockchain adoption in manufacturing.

The increasing complexity of global supply chains has made real-time transparency a top priority for manufacturers. Blockchain’s immutable ledger enables seamless tracking of goods, components, and raw materials from origin to delivery. This helps detect counterfeiting, ensure product authenticity, and improve recall processes. Sectors like automotive and food & beverage rely heavily on blockchain for tracing part provenance and meeting regulatory mandates. Moreover, consumers are increasingly demanding visibility into how products are made, driving manufacturers to adopt transparent systems. The technology reduces fraud, boosts accountability among suppliers, and enables data sharing without compromising confidentiality—making it a foundational tool for next-generation supply chain management.

Restraint

-

Lack of standardization and interoperability is hindering seamless blockchain integration across manufacturing systems.

Despite blockchain’s potential, a major restraint is the lack of universal standards and interoperability across platforms and systems. Different blockchain networks operate in silos, hindering collaboration between manufacturers and their supply chain partners. Without clear protocols for data exchange and consensus mechanisms, integrating blockchain into existing enterprise resource planning (ERP) or manufacturing execution systems (MES) becomes complex and costly. This inconsistency also slows regulatory acceptance and delays enterprise-wide deployment. Additionally, concerns over data privacy, latency, and technology fragmentation make many manufacturers hesitant to invest at scale. Addressing these gaps through cross-industry standards will be key to unlocking the full potential of blockchain in manufacturing.

Opportunity

-

The Integration of blockchain with IoT, AI, and digital twins offers transformative potential for smart manufacturing.

The integration of blockchain with IoT, AI, and digital twins can revolutionize the manufacturing industry. This allows for predictive maintenance, quality assurance, and asset tracking through secure, tamper-resistant records of IoT data using blockchain. In combination with AI, it helps with decision-making by ensuring that training data is both factual and auditable. Simulating, monitoring, and optimizing with digital twins powered by blockchain enables real-time visibility into product lifecycles. This confluence of digital innovations creates new smart manufacturing ecosystems defined by hyper security, hyper transparency, and hyper efficiency — the foundation for self-managing, data-driven production landscapes that respond to shifting market conditions.

Challenge

-

High implementation costs and technical complexity limit blockchain adoption, especially for small and mid-sized manufacturers.

The adoption of blockchain in manufacturing setups is not without its challenges. Technical obstacles, high upfront expenses, and workforce readiness are among the many challenges that the adoption of such solutions face. Most small- and mid-sized manufacturers don’t have the cash or the IT that allows them to integrate blockchain with their legacy systems. Moreover, it also requires specialized skills in blockchain architecture, cybersecurity, and cryptography, which is a high learning curve as well. Scalability problems, transaction validation delay, and energy usage are also barriers to adoption. Because the business cases have to be strong enough to warrant the transition away from conventional systems to decentralized models, with measurable ROI. To overcome these challenges, vendor support, ecosystem partnerships, and government incentives will be necessary to make blockchain more accessible and affordable.

Blockchain in Manufacturing Market Segmentation Analysis

By Provider

The Infrastructure and Protocols Providers segment dominated the market in 2023 and accounted for 61% of revenue share due to their role in establishing the foundational blockchain frameworks that support secure, decentralized data exchange in manufacturing. These providers offer essential tools and protocols enabling interoperability, smart contract execution, and system scalability. With manufacturers prioritizing end-to-end security and seamless network operations, demand for robust infrastructure remains high.

The Applications and Solution Providers segment is expected to witness the fastest CAGR from 2024 to 2032, driven by increasing demand for blockchain-powered use cases such as product traceability, compliance monitoring, and inventory automation. As manufacturers shift from pilot projects to full-scale deployments, there is a growing need for customized solutions that integrate blockchain with existing enterprise software. These providers offer platforms tailored for quality control, warranty management, and smart manufacturing.

By Application

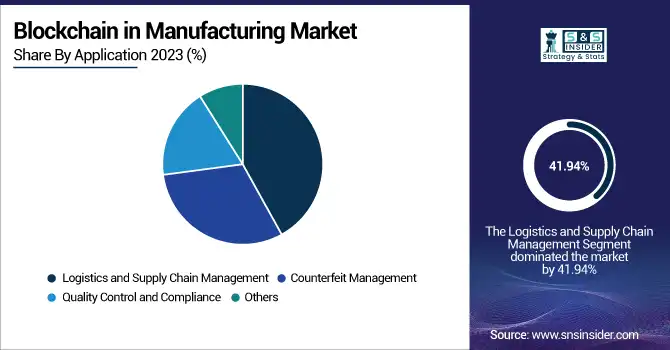

The Logistics and Supply Chain Management segment dominated the market due to blockchain's ability to enhance transparency, traceability, and efficiency across manufacturing supply chains. Manufacturers increasingly rely on blockchain to track raw materials, verify authenticity, and streamline logistics operations in real time. This segment benefits from growing regulatory requirements and consumer demand for product provenance. With supply chain disruptions and fraud being key industry challenges, blockchain adoption in this segment is expected to remain strong through 2032, enabling manufacturers to achieve better cost control, agility, and trust across multi-tiered networks.

The Counterfeit Management segment is expected to register the fastest CAGR from 2024 to 2032, driven by rising concerns over product authenticity, especially in industries like pharmaceuticals, automotive, and electronics. Blockchain offers a tamper-proof solution for verifying product origins, production details, and certifications, helping manufacturers combat the increasing threat of counterfeits. As global trade expands and e-commerce accelerates, the demand for secure, verifiable product information is surging. This has prompted manufacturers to adopt blockchain-based serialization, labeling, and authentication systems, positioning this segment for rapid growth in the coming years.

By End-Use

The Electronics and Semiconductor segment dominated the market in 2023 and accounted for significant revenue share, owing to the critical need for traceability, counterfeit prevention, and secure supplier collaboration in highly complex global supply chains. Blockchain ensures component authenticity, monitors production history, and facilitates tamper-proof recordkeeping. With increasing pressure to comply with regulatory and quality standards, manufacturers in this sector are leveraging blockchain for real-time visibility and fraud prevention.

The Pharmaceutical segment is expected to register the fastest CAGR from 2024 to 2032, fueled by the urgent need for product traceability, cold-chain monitoring, and regulatory compliance. Blockchain provides end-to-end visibility across drug manufacturing and distribution, helping combat counterfeiting and ensuring safety from origin to consumer. The introduction of mandates like the U.S. Drug Supply Chain Security Act is accelerating adoption across the industry.

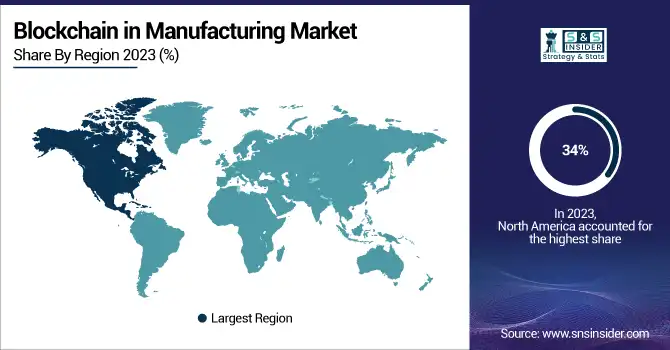

Regional Landscape

North America dominated the blockchain in the manufacturing market in 2023 and accounted for a 34% of revenue share due to its advanced digital infrastructure, early technology adoption, and strong presence of major blockchain solution providers. Manufacturers in the U.S. and Canada are heavily investing in blockchain for supply chain optimization, compliance, and quality assurance. Government support, combined with increasing partnerships between tech firms and manufacturers, continues to drive adoption. With established industries like automotive, aerospace, and electronics embracing blockchain solutions, the region is projected to maintain a leading market share through 2032, supported by favorable regulations and innovation-driven demand.

Asia Pacific is expected to register the fastest CAGR from 2024 to 2032, driven by rapid industrialization, rising government initiatives for smart manufacturing, and increasing digital transformation in countries like China, India, Japan, and South Korea. The region's growing electronics, automotive, and pharmaceutical sectors are adopting blockchain to tackle counterfeiting, improve traceability, and enhance operational transparency. As local manufacturers aim to compete globally and comply with international standards, blockchain is becoming integral to supply chain modernization. Moreover, supportive policies, tech-savvy startups, and investments in Industry 4.0 are accelerating blockchain deployment across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM Corporation – IBM Blockchain

-

Microsoft Corporation – Azure Blockchain Service

-

Amazon Web Services (AWS) – Amazon Managed Blockchain

-

Oracle Corporation – Oracle Blockchain Platform

-

SAP SE – SAP Blockchain

-

Huawei Technologies Co., Ltd. – Huawei Blockchain Service

-

Infosys Limited – Infosys Blockchain Suite

-

Intel Corporation – Intel Sawtooth

-

Siemens AG – Siemens Blockchain Lab

-

Wipro Limited – Blockchain as a Service (BaaS)

-

Deloitte Touche Tohmatsu Limited – Deloitte Blockchain Solutions

-

Accenture Plc – Accenture Blockchain Services

-

Capgemini SE – Capgemini Blockchain Applications

-

TIBCO Software Inc. – TIBCO Blockchain Solution

-

Chainstack – Chainstack Blockchain Platform

Recent Developments

-

April 2024: IBM announced enhancements to its IBM Blockchain Platform, focusing on improved interoperability and scalability to support complex manufacturing supply chains.

-

February 2024: Microsoft expanded its Azure Blockchain Service to include advanced analytics tools, aiming to provide manufacturers with deeper insights into their supply chain operations.

-

March 2024: AWS introduced new features to its Amazon Managed Blockchain, enhancing support for Hyperledger Fabric and Ethereum, facilitating more flexible deployment options for manufacturers.

-

January 2024: Oracle upgraded its Oracle Blockchain Platform with enhanced identity management capabilities, aiming to strengthen security and compliance in manufacturing processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.9 Billion |

| Market Size by 2032 | US$ 116.9 Billion |

| CAGR | CAGR of 45.93 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) By Application (Social Media Advertising, Search Engine Marketing, Virtual Assistant, Content Curation, Sales & Marketing Automation, Analytics Platform, Others) • By Technology (Machine Learning, Natural Language Processing, Computer Vision, Others) • By End-User (BFSI, Retail, Consumer Goods, Media & Entertainment, IT & Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), Oracle Corporation, SAP SE, Huawei Technologies Co., Ltd., Infosys Limited, Intel Corporation, Siemens AG, Wipro Limited, Deloitte Touche Tohmatsu Limited, Accenture Plc, Capgemini SE, TIBCO Software Inc., Chainstack |