Contextual Advertising Market Report Scope and Overview:

Get More Information on Contextual Advertising Market - Request Sample Report

The Contextual Advertising Market Size was valued at USD 171.6 Billion in 2023 and is expected to reach USD 608.3 Billion by 2032, growing at a CAGR of 15.1% over the forecast period 2024-2032.

The contextual advertising market is being propelled by an increasing focus on personalized marketing strategies, with government statistics reflecting significant trends. In a 2023 report from the U.S. Federal Trade Commission (FTC), 68% of companies deploying digital marketing, have incorporated contextual advertising initiatives as part of their overall promotion schemes. It is a concerted action to the increasing number of data privacy regulations (similar to GDPR in Europe and CCPA in the U.S) that are restricting targeted ads by blocking third-party cookies. These types of regulations have been created to push advertisers towards using less invasive types of advertising, such as contextual ads (where the ad does not depend on personal data but is placed based upon the relevance of the surrounding material. The Ministry of Information Technology in India even released data that by 2023, more than 42% of digital advertisements spending has been contextual advertising, demonstrating a huge turn towards the privacy-aware marketing solutions across the globe. Similarly, the U.K. government better caught on to this as the report in 2022 showed that more than 70% of the marketers think contextual ads will rule over in a span of five years from now, which is again expected to propel the market growth path further upward.

Contextual advertising distributes advertisements based on the keywords, context or interests of users to make them more relevant and help you increase clickthrough and conversion rates. Contextual ads are created as industries have begun to adapt digital transformation, driven by real-time data analysis providing insights with machine learning (ML) algorithms which allow optimal ad placements and user experience predictions. They assist in optimizing targeting, making adjustments to bids and increasing campaign efficiency to generate personalized effective ads. By analysing web content and user behaviour, advanced platforms enable dynamic, context-driven ad placements, meeting consumer demand for tailored, relevant experiences and driving better results for advertisers.

Contextual Advertising Market Dynamics

Drivers

-

AI and ML technologies enhance the precision of contextual ad placements, making campaigns more effective by analysing user behaviour and content context.

-

The rise in programmatic ad buying, which leverages real-time data to serve more personalized and relevant ads, is driving the growth of contextual advertising.

-

The increasing consumption of mobile and video content is driving advertisers to use context-based strategies, leading to higher engagement and conversion rates.

The use of artificial intelligence and machine learning in contextual advertising has completely changed the way advertisements are served, and as a result, it has become much more precise and personalized. With the help of such technologies, advertisers are able to analyse enormous datasets in real-time to understand the patterns of user behaviour, the relationship between users and content, and the context in which users interact with content. The algorithms based on artificial intelligence processing analyse the data on individual users, such as their internet browsing history, browsing patterns, or the kind of content that sparks their interest, to generate more specialized algorithms for placing ads. As a result, the click-through rate increases, and the conversion rate after clicking an advertisement is also higher. The examples of such algorithms include the ones used by Google Ads, which use artificial intelligence to determine which advertisements to place when, based on the probability of them being clicked by users, and generate higher ROI by improving the efficiency of such campaigns.

ML models also help in dynamic content generation, ensuring that ads are adjusted based on user responses, improving performance over time. Companies that invest in AI-driven ads also see a 15-30 percent ROI advantage. AI was successfully used in contextual advertising by IBM Watson Ads, advertising units that employ artificial intelligence to understand users’ natural language responses and deliver contextually relevant ads across different channels. The use of AI in this case scene to make the ads less annoying to users and more relevant to the situation in which they were displayed. Since AI will continue to develop in the future, making it more accurate and faster, its applications in the advertising industry will be ever more widespread and precise.

Restraints:

-

The growing use of ad-blocking software reduces the reach of online ads, including contextual advertising, hindering market growth.

-

Despite advancements, some platforms still struggle to accurately match ads with the appropriate context, leading to irrelevant ad placements and lower engagement.

-

Contextual ads face strong competition from dominant advertising platforms like social media and search engines, which attract a large share of marketing budgets.

One significant restraint in the Contextual Advertising Market is the rise in adoption of ad-blocking technologies. This makes the users more concerned about increasing ad intrusion and they resort to using tools like ad blockers which remove ads from their browsing experience. This trend is particularly concerning for contextual advertisers, as ad blockers indiscriminately prevent all types of ads, including those strategically placed based on the surrounding content.

While contextual advertising is designed to be less intrusive and more relevant to the user’s current experience, ad blockers do not differentiate between intrusive and non-intrusive ads. This reduces the reach and effectiveness of contextual ad campaigns. As a result, advertisers face challenges in engaging potential customers, especially in regions or demographic segments where ad-blocking software is widely adopted. This creates a barrier for marketers looking to maximize the visibility and impact of their contextual ad efforts.

Contextual Advertising Market Segmentation Overview

By Approach

The mass contextual advertising segment accounted for the largest share of revenue 35% in 2023, and this dominance is attributed to its broad reach, power in the ability that can be done without breaking our personal data. Brands going with mass contextual strategies due to compliant with privacy laws, especially in the European Union, grew 45% year-over-year by governments and offered another way for advertisers to comply with rules while driving reach.

From 2024 to 2032, contextual behavioural advertising is expected to be the fastest-growing segment. Advances in AI and machine learning are fuelling this growth, allowing ads to be placed more intelligently based on user behaviour without breaking privacy regulations. A 38% surge in the adoption of AI-powered contextual advertising solutions, highlighting how behaviour-based tactics are not only key to relevant advertising, but now also essential for staying onside with new data privacy laws that continue to be legislated. This is why the governments have also claimed that AI clutch based self-decided ads boost engagement rates by 25% higher in relation to old school mass techniques of intervention, building its growth rate exponential running.

By Industry Vertical

The retail and consumer goods segment represent the leading revenue share in the context advertising market due to the high level of customer interaction and the demand for advertising tailored to individual needs. In this connection, the U.S. Department of Commerce stated that in 2023 the retail sale in the U.S. towards digital ads reached $7.1 trillion, accounting for 28% of total retail spending. According to the government, the decision to choose context advertising as a form of public engagement became increasingly popular among retailers, who used this type of advertisement for storing targeted pay-per-click ads in cross-company marketing. In this way, agencies encode website visitors’ identities and fine-tune ads for target audiences, make it easy to sand up. In this respect, the consumer report by the Government Media compares with the European Commission’s statistics, where the main information stated that more than 60.0% of retailers in the EU currently used targeted ads that take into account consumers’ browsing behaviour, needs, and customer tastes. In addition to this, the benefits of context ads are also high customer retention, visitor engagement, and the average purchase value of customers for retailers. As a result, due to the high citizen demand for home privacy and the lack of vision problem-solution techniques, the use of context advertising in retail outlets brings a 20% higher revenue than the digital advertising considered among retail.

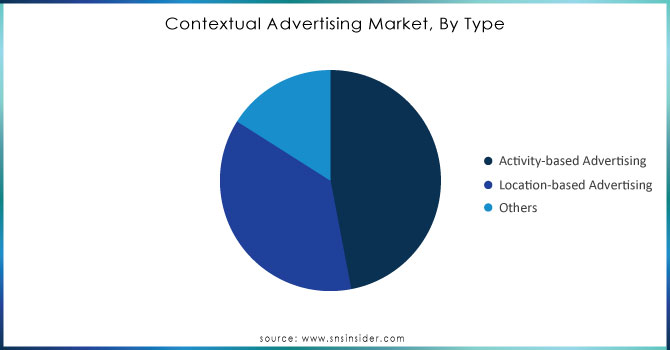

By Type

In 2023, the activity-based advertising segment dominated the market with 47% revenue share. Its Dominance in this segment is due to the capability of here in serving Ads on real time and user activities, according to government statistics from the U.S. Federal Communications Commission (FCC), advertisers in the U.S. saw a 30% higher engagement rate with activity-based ads in 2023 compared to other ad formats. This approach allows advertisers to reach consumers at the most opportune moments, leading to improved ad performance and return on investment (ROI).

Activity-based advertising is also gaining traction due to its compliance with evolving data privacy regulations. The Australian Communications and Media Authority reported in 2023 that activity-based ads are considered less intrusive than traditional data-driven methods, making them a preferred option for businesses aiming to maintain user trust while adhering to stringent privacy standards. Meanwhile, the U.K.'s Office of Communications (Ofcom) pointed out that activity-based ads made up 25% of all digital ad impressions in 2023 as more and more advertisers move toward this user-centric and relevant form of advertising.

Need Any Customization Research On Contextual Advertising Market - Inquiry Now

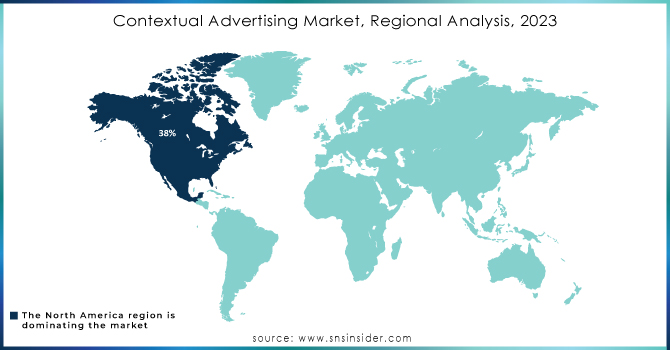

Contextual Advertising Market Regional Analysis

North America dominated the market and accounted largest revenue share 38% of the contextual advertising market. It is driven by the regions well-developed digital infrastructure and stringent data privacy regulations. The government reports that 70% of advertisers in North America have shifted toward contextual advertising as a consequence of privacy legislation, such as the California Consumer Privacy Act. The market in the region is stimulated by the presence of a strong digital ecosystem, massive advertising budgets and a high penetration of large technology companies, including Google, Meta, and Amazon. Additionally, the U.S. Federal Trade Commission reported that 55% of digital advertising in the U.S. is now delivered through contextual advertising methods, highlighting the domineering presence of the region in the market.

Asia-Pacific APAC is expected to be the fastest-growing region from 2024 to 2032. The growth is expected to be driven by the increasing internet penetration and e-commerce usage and subsequent growth in digital marketing spending. The context of this advertising form is also particularly emphasized by states data security and privacy regulation measures in the region, particularly in countries, such as China and India, which are further fostering adoption alternatives to data-driven approach. As such, the Ministry of Electronics and Information Technology reported a growth of 22% of contextual advertising in India in 2023, and the country is anticipated to lead growth in the region due to its large digital population and growing online retail market. The digital advertising market in China is also changing rapidly, and in 2023, government figures showed that the adoption of context advertising is growing by 25% as brands switch to advertising alternatives that are more compliant with privacy laws.

Recent Development

In August 2024, Google launched advanced AI-driven contextual advertising features, as part of its general enhancements aiming at providing more relevant, timely, and topical ads. The U.S. Federal Communications Commission confirmed that the update aimed at ad targeting based on the content and users’ activities remaining within the privacy legislation conditions. The agency added that the new contextual ad features helped increase engagement levels by 30% over the first month.

In July 2024. Meta announced the expansion of its contextual advertising tools with the needs of the advertisers to remain within the bounds of the global privacy regulations. According to the European Commission, the company tried to reduce reliance on the third-party cookies while making the ads more relevant and effective and meeting the GDPR standards further. The source confirmed a 20% increase in advertiser adoption of this tool in the first month.

In June 2024. Amazon introduced a set of contextual ad services for e-commerce retailers. The U.S. Department of Commerce confirmed that the company aimed at better ad targeting based on the content and consumer activities, as a part of its overall increased emphasis on contextual advertising. The source posted a 15% rise in the click-through rates in the first month.

Key Players in Contextual Advertising Market

-

Google LLC (Google Ads, AdSense)

-

Microsoft Corporation (Microsoft Advertising, Bing Ads)

-

Amazon.com, Inc. (Amazon DSP, Sponsored Ads)

-

Facebook, Inc. (Meta Platforms, Inc.) (Facebook Ads, Instagram Ads)

-

Yahoo! Inc. (Yahoo Native Ads, Yahoo Gemini)

-

Twitter, Inc. (Twitter Ads, Promoted Tweets)

-

Adobe Inc. (Adobe Advertising Cloud, Marketo)

-

Oracle Corporation (Oracle Data Cloud, BlueKai)

-

Verizon Media (Verizon Native Ads, Yahoo DSP)

-

Taboola (Taboola Feed, Taboola Ads)

-

Outbrain Inc. (Outbrain Amplify, Outbrain Engage)

-

Criteo S.A. (Criteo Dynamic Retargeting, Criteo Sponsored Products)

-

The Trade Desk, Inc. (The Trade Desk Platform, Unified ID)

-

InMobi (InMobi Exchange, InMobi DSP)

-

Sizmek (by Amazon) (Sizmek Ad Suite, Peer39)

-

PubMatic (PubMatic Cloud, OpenWrap)

-

Integral Ad Science (IAS) (IAS Context Control, IAS Pre-bid Solution)

-

DoubleVerify (DV Authentic Ad, DV Publisher Suite)

-

Pinterest, Inc. (Pinterest Ads, Promoted Pins)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 171.6 Billion |

| Market Size by 2032 | USD 608.3 Billion |

| CAGR | CAGR of 15.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Approach (Mass Contextual Advertising, Focused Contextual Advertising, Contextual Behavioural Advertising, Contextual Billboard Advertising) • By Type (Activity-based Advertising, Location-based Advertising, Others) • By Deployment (Mobile Devices, Desktops, Digital Billboards) • By Industry Vertical (Retail & Consumer Good, Media & Entertainment, IT & Telecommunication, Automotive & Transportation, Banking, Financial Services, & Insurance (BFSI), Healthcare, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google LLC, Microsoft Corporation, Amazon.com, Inc., Facebook, Inc., Yahoo! Inc., Twitter, Inc., Adobe Inc., Oracle Corporation, Outbrain Inc., The Trade Desk, Inc. |

| Key Drivers | • AI and ML technologies enhance the precision of contextual ad placements, making campaigns more effective by analysing user behaviour and content context. • The rise in programmatic ad buying, which leverages real-time data to serve more personalized and relevant ads, is driving the growth of contextual advertising. |

| RESTRAINTS | • The growing use of ad-blocking software reduces the reach of online ads, including contextual advertising, hindering market growth. • Despite advancements, some platforms still struggle to accurately match ads with the appropriate context, leading to irrelevant ad placements and lower engagement. |