Construction And Demolition Waste Management Market Report Scope & Overview:

The Construction and Demolition Waste Management Market size was estimated at USD 162.02 Billion in 2023 and is expected to reach USD 261.20 Billion by 2032 at a CAGR of 5.50% during the forecast period of 2024-2032.

To Get More Information on Construction and Demolition Waste Management Market - Request Sample Report

The Construction and Demolition (C&D) Waste Management Market has gained significant attention as governments and organizations recognize the environmental challenges posed by increasing construction and demolition activities. This sector contributes heavily to global waste, accounting for approximately 30-40% of total waste generated in many countries, highlighting the urgent need for effective waste management practices. Effective C&D waste management not only helps mitigate the negative environmental impact but also promotes resource recovery and recycling, with the European Union achieving a recycling rate of about 70% for C&D waste, and some nations exceeding 90%. Recent initiatives by the Ministry of Environment, Forest and Climate Change (MoEFCC) in India emphasize stricter regulations for C&D waste management. The 2024 notification aims to enhance the efficiency of waste disposal and recycling processes, encouraging stakeholders to adopt sustainable practices. Such regulations drive investments in advanced technologies and infrastructure for waste management, fostering innovation in the sector.

Technological advancements play a crucial role in transforming C&D waste management. The adoption of innovative recycling techniques and equipment enables the recovery of valuable materials from waste streams. The use of mobile crushing plants allows for onsite processing of waste, reducing transportation costs and carbon footprints. Furthermore, digital solutions such as waste tracking systems and data analytics enhance transparency and efficiency in waste management operations.

Landfilling C&D waste is a major environmental concern, generating up to 50% of greenhouse gas emissions from waste management activities. Implementing effective C&D waste management can lead to cost savings of up to 30% on construction projects and create jobs estimates suggest that recycling 10,000 tons of waste can generate approximately 1.17 jobs. In India reinforces the need for waste management plans for significant waste generators, underscoring a shift towards responsible industry practices. Public awareness and collaboration among various stakeholders are essential for successful C&D waste management, fostering a culture of sustainability within the construction industry and leading to a substantial reduction in waste generation.

MARKET DYNAMICS

DRIVERS

- Rapid urbanization and infrastructure development result in increased construction activities, generating more construction and demolition (C&D) waste, which drives the demand for efficient waste management solutions.

Increasing urbanization and infrastructure development significantly impact the Construction and Demolition (C&D) Waste Management Market. As global urbanization continues, the UN projects that 68% of the world's population will live in urban areas by 2050, leading to unprecedented construction activities. This surge in construction generates substantial amounts of C&D waste, which includes materials such as concrete, wood, metals, and plastics. In the United States alone, C&D debris accounted for approximately 600 million tons, representing about 25% of the country’s total waste stream.

To address this growing issue, effective waste management solutions are becoming essential. Governments and regulatory bodies are implementing stricter guidelines and policies aimed at reducing landfill disposal and promoting recycling. The European Union's Waste Framework Directive encourages member states to recycle 70% of construction waste by 2020, highlighting the shift towards sustainable practices in the construction industry. Moreover, the construction sector is embracing innovative technologies to improve waste management efficiency. Techniques such as automated sorting and recycling systems are enhancing the ability to recover valuable materials, reducing the environmental impact of construction activities.

- Technological advancements in automated sorting and recycling processes enhance efficiency in managing construction and demolition waste, driving market growth.

Technological advancements in automated sorting and recycling processes are significantly enhancing efficiency in managing construction and demolition (C&D) waste, thereby driving market growth. Innovations such as robotics, artificial intelligence (AI), and machine learning are being increasingly adopted to streamline waste management operations. These systems utilize advanced sensors and algorithms to identify and separate various materials, ensuring higher recycling rates. Research indicates that automation can increase sorting efficiency by up to 80%, drastically reducing labor costs and processing times.

Moreover, the integration of AI in waste management systems enables predictive analytics, allowing companies to optimize waste collection schedules and improve resource allocation. This technology can analyze data to forecast waste generation trends, helping construction firms to implement more sustainable practices. In addition, mobile applications and digital platforms are facilitating better communication between stakeholders, enabling real-time tracking of waste disposal and recycling processes.

As a result, the adoption of these advanced technologies not only enhances operational efficiency but also supports environmental sustainability initiatives. By increasing recycling rates, companies can significantly reduce landfill contributions, addressing the pressing global issue of waste management. In fact, it is estimated that effective recycling of construction waste can lower greenhouse gas emissions by approximately 50%, illustrating the substantial environmental benefits of technological advancements in this sector. Thus, the continued investment in and development of these technologies will play a crucial role in shaping the future of C&D waste management.

RESTRAIN

- High disposal costs for construction and demolition waste can be a significant burden, especially for smaller firms, discouraging them from using proper waste management services.

High disposal costs present a significant challenge for effective construction and demolition (C&D) waste management, particularly for smaller construction firms. These companies often operate on tight budgets and may find it difficult to allocate sufficient resources for proper waste disposal and recycling. Statistics indicate that disposal fees can vary widely, ranging from USD 40 to USD 150 per ton, depending on local regulations and landfill costs. This variance can create financial strain, especially when projects generate large volumes of waste. It is estimated that construction projects can produce between 20% to 30% of total waste generated in urban areas, significantly increasing the potential disposal costs. Smaller firms may also lack the negotiating power that larger contractors possess, leading to higher per-ton disposal fees. Additionally, these companies might be less familiar with recycling programs or initiatives that could mitigate costs. As a result, they may resort to cheaper, less sustainable options, such as illegal dumping or landfilling, which can lead to legal repercussions and fines.

Moreover, the increasing complexity of waste management regulations can further complicate compliance for smaller firms. As they face escalating costs and regulatory hurdles, the incentive to invest in proper waste management diminishes. This cycle ultimately undermines the overall effectiveness of C&D waste management practices, hindering efforts to promote sustainability and environmental responsibility within the construction industry. Addressing high disposal costs is therefore crucial to encourage the adoption of better waste management solutions among all construction firms.

KEY SEGMENTATION ANALYSIS

By Material

In 2023, the soil, sand, and gravel segment dominated the market share over 35.02%, driven by the extensive use of these materials in construction activities. These resources serve critical functions, including filling materials for foundations, underfloor support, and trench work. The construction sector is one of the largest consumers of soil, sand, and gravel, with approximately 40% of all extracted materials utilized for building and infrastructure projects. However, the substantial waste generated during construction and demolition often comprises leftover soil, sand, and gravel, which poses a significant challenge for waste management.

By Service

In 2023, the collection segment dominated the market share over 61.9%. This segment's significance lies in its critical role in efficiently managing waste from construction sites. Effective collection involves specialized vehicles and vessels to transport waste from the point of origin to designated transport stations. The collection process can include door-to-door or site-to-site services, ensuring comprehensive waste management solutions. This segment not only emphasizes logistical efficiency but also represents a substantial portion of total waste management expenditures, reflecting its importance in the overall waste management framework. With growing construction activities, especially in urban areas, the demand for reliable and efficient waste collection services is expected to increase.

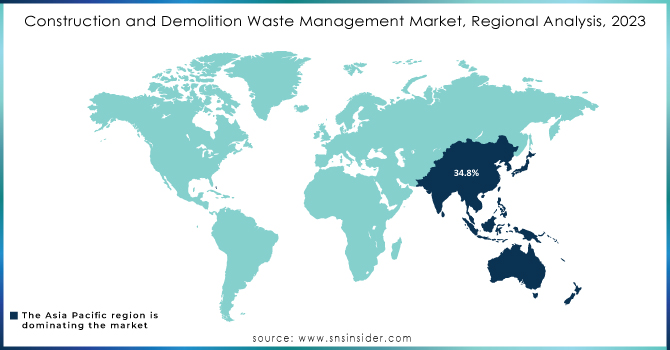

KEY REGIONAL ANALYSIS

The Asia Pacific region dominated the market share over 34.8% in 2023. Major countries like China and India are leading in construction activities, with China's construction output expected to reach approximately USD 6.8 trillion by 2025. This surge in construction is generating an enormous volume of waste; for instance, it is estimated that construction and demolition activities produce around 1.3 billion tons of waste annually in the Asia Pacific. Additionally, an increasing focus on sustainability and regulatory frameworks is encouraging the adoption of waste recycling and management practices, with some countries aiming to recycle over 50% of their C&D waste by 2025. This combination of high waste generation and regulatory initiatives is expected to drive the market's growth in the coming years.

The North America Construction and Demolition (C&D) Waste Management Market is poised for growth, driven by a rising population and increased construction activities. In 2023, the region generated approximately 600 million tons of construction and demolition debris, reflecting the substantial volume of waste produced due to ongoing infrastructure development. As urban areas expand, the demand for sustainable waste management solutions has intensified. Awareness of sustainability and resource management is prompting countries like the U.S. and Canada to implement stricter regulations and encourage recycling practices.

Do You Need any Customization Research on Construction and Demolition Waste Management Market - Inquire Now

KEY PLAYERS

Some of the major key players of Construction and Demolition Waste Management Market

-

Veolia Environnement S.A. (France): (Waste collection, recycling, and resource recovery services)

-

Waste Connections (U.S.): (Waste management and recycling services for construction debris)

-

Clean Harbors, Inc. (U.S.): (Environmental and hazardous waste disposal services)

-

Remondis (Germany): (Construction waste recycling, resource recovery)

-

Republic Services (U.S.): (Construction and demolition waste collection, recycling services)

-

FCC Environment Limited (U.K.): (Construction waste recycling, waste management services)

-

WM Intellectual Property Holdings, L.L.C. (U.S.): (Waste management, recycling, landfill operations)

-

Kiverco (Northern Ireland): (Recycling equipment for construction and demolition waste)

-

Daiseki Co., Ltd. (Japan): (Industrial and construction waste treatment services)

-

Windsor Waste (U.K.): (Construction waste collection and recycling services)

-

Casella Waste Systems, Inc. (U.S.): (Recycling and disposal services for construction debris)

-

Renewi plc (U.K.): (Sustainable waste management solutions, construction waste recycling)

-

SUEZ Recycling & Recovery (France): (Recycling services and resource recovery from construction waste)

-

Biffa Group (U.K.): (Waste management services for construction and demolition waste)

-

Cleanaway Waste Management Limited (Australia): (Construction waste management, recycling)

-

Waste Management, Inc. (U.S.): (Collection and recycling of construction debris)

-

EnviroWaste Services Ltd. (New Zealand): (Construction and demolition waste collection, recycling)

-

Doppstadt (Germany): (Machinery for recycling construction waste)

-

Zanker Recycling (U.S.): (Recycling of construction and demolition debris)

-

Advanced Disposal Services, Inc. (U.S.): (Construction waste disposal and recycling services)

Suppliers for recycling, waste-to-energy, and innovative waste treatment services for construction and demolition materials of Construction and Demolition Waste Management Market:

-

Veolia Environmental Services

-

Waste Management Inc.

-

Republic Services, Inc.

-

Clean Harbors, Inc.

-

SUEZ Recycling & Recovery

-

FCC Environment

-

Biffa Group

-

Covanta Holding Corporation

-

Remondis SE & Co. KG

-

Casella Waste Systems, Inc.

RECENT DEVELOPMENTS

-

In 2024: The revised draft Construction and Demolition (C&D) Waste Management Rules, set to take effect on April 1, 2025, aim to enhance recycling of construction debris and curb illegal dumping, significantly reducing flooding risks in urban areas. The rules introduce "extended producer responsibility" for large construction waste generators, promoting lifecycle management of waste and improving coordination among government agencies to support a circular economy in the construction sector.

-

In February 2024: Iowa-based Vermeer Corp. introduced the LS3600TX, a low-speed shredder designed to efficiently process light construction and demolition waste, offering enhanced shredding capabilities

-

In March 2023: leading waste management provider WM completed the acquisition of Specialized Environmental Technologies, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 162.02 Billion |

| Market Size by 2032 | USD 261.20 Billion |

| CAGR | CAGR of 5.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Waste Type (Hazardous, Non-Hazardous) •By Material (Soil, Sand, & Gravel, Concrete, Bricks & Masonry, Wood, Metal, Others) •By Source (Residential, Commercial, Industrial) •By Service (Collection, Transportation, Disposal) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Milacron, Barnes Group, Husky Injection Molding Systems Ltd, Incoe, Seiki Corporation, Gunther, EWIKON, Ingless S.p.A., Synventive, THERMOPLAY S.p.A., YUDO, Oerlikon HRSflow, Fast Heat, HASCO, Athena Automation, Caco Pacific, Meusburger, Polyshot, Mold Hotrunner Solutions (MHS), HRSflow (Oerlikon). |

| Key Drivers | • Rapid urbanization and infrastructure development result in increased construction activities, generating more construction and demolition (C&D) waste, which drives the demand for efficient waste management solutions. • Technological advancements in automated sorting and recycling processes enhance efficiency in managing construction and demolition waste, driving market growth. |

| RESTRAINTS | • High disposal costs for construction and demolition waste can be a significant burden, especially for smaller firms, discouraging them from using proper waste management services. |