Drilling Waste Management Market Report Scope & Overview:

Get more information on Drilling Waste Management Market - Request Sample Report

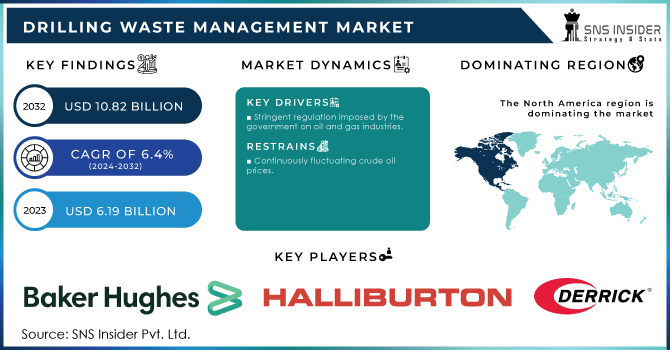

The Drilling Waste Management Market size was valued at USD 6.19 billion in 2023 and is expected to grow to USD 10.82 billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

Drilling waste management is an important aspect of the oil and gas industry. It involves the proper handling, treatment, and disposal of waste generated during drilling operations. This waste can include drilling mud, cuttings, and other materials that may contain hazardous substances. Effective drilling waste management is essential to protect the environment and ensure compliance with regulatory requirements. It also helps to minimize the impact of drilling operations on local communities and wildlife.

There are various methods of drilling waste management, including on-site treatment, off-site disposal, and recycling. Each method has its advantages and disadvantages, and the choice of method will depend on factors such as the type and volume of waste generated, the location of the drilling site, and the applicable regulations.

Overall, drilling waste management is a complex and challenging task that requires careful planning, monitoring, and execution. By implementing best practices and using the latest technologies, the oil and gas industry can minimize its environmental impact and ensure the safety of its workers and the public.

Market Dynamics

Drivers

-

Increasing environmental concerns regarding waste management

-

Stringent regulations imposed by the government on oil and gas industries

-

Rapid technological advancement

-

Increasing offshore exploration activities

The waste (drilling rings and fluids) produced due to exploration activities of oil and gas is hazardous to the environment. To reduce the impact of this waste on the environment, effective disposal and treatment is necessary. For this purpose, drilling waste management is adopted by various countries which propels the growth of this market significantly.

Restrain

-

Lack of skilled workers

-

Continuously fluctuating crude oil prices

The volatility of crude oil prices poses a challenge to the management of drilling waste. This issue can impact the ability of companies to invest in the necessary equipment and technology to properly manage waste. As a result, it is crucial for companies to develop innovative solutions to address this challenge and ensure that drilling waste is managed in a safe and sustainable manner. By doing so, companies can not only protect the environment but also improve their bottom line.

Opportunities

-

Growing production and exploration activities

Challenges

-

High capital initial investment associated with drilling waste management

Impact of Covid-19:

The outbreak of coronavirus also impacted the drilling waste management market. The pandemic has caused a disruption in the supply chain, leading to a decrease in demand for drilling waste management services. Furthermore, the restrictions on travel and social distancing measures have resulted in a decrease in drilling activities, leading to a reduction in waste generation. This has further impacted the drilling waste management market, as companies are now focusing on cost-cutting measures and postponing their drilling activities. However, the pandemic has also presented opportunities for the drilling waste management market. With the increased focus on health and safety measures, there is a growing demand for environmentally friendly waste management solutions. This has led to increased adoption of technologies such as bioremediation and thermal treatment, which offer sustainable and cost-effective solutions for managing drilling waste.

Impact of Recession:

The recent and ongoing recession has had a significant impact on the drilling waste management market. The downturn in the global economy has led to a decrease in demand for oil and gas, resulting in a reduction in drilling activities. This, in turn, has had a direct impact on the drilling waste management market. As drilling activities have decreased, the amount of waste generated has also decreased. This has led to a reduction in the demand for drilling waste management services.

Key Market Segmentation

By Product

-

Treatment & Disposal

-

Containment & Handling

-

Solids Control

By Application

-

Onshore

-

Offshore

Regional Analysis

North America Region is anticipated to dominate the market during the forecast period owing to the stringent environmental laws imposed by the government and rising investment in production and exploration activities. Increasing well intervention activities and rapidly rising investment in the E&P domain are further driving the market of drilling waste management in this region.

The market of the Asia-Pacific region is the second region which is estimated to grow at the highest CAGR during the predicted period. This is attributed to the increase in the number of construction industries and huge natural gas reserves off the coast of China and India. A rise in the demand for natural gas due to its low emission level is expected to contribute to this market growth in the future.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Baker Hughes Company, Halliburton, GN Solids Control, Derrick Corporation, National Oilwell Varco, Inc., Nuverra Environmental Solutions, Inc., Ridgeline Canada, Inc., Schlumberger Limited., Scomi Group Bhd, Secure Energy Services Inc., Tervita, TWMA, Weatherford, KOSUN Machinery Co., Ltd., and other key players will be included in the final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.19 Bn |

| Market Size by 2032 | US$ 10.82 Bn |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Treatment & Disposal, Containment & Handling, and Solids Control) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baker Hughes Company, Halliburton, GN Solids Control, Derrick Corporation, National Oilwell Varco, Inc., Nuverra Environmental Solutions, Inc., Ridgeline Canada, Inc., Schlumberger Limited., Scomi Group Bhd, Secure Energy Services Inc., Tervita, TWMA, Weatherford, KOSUN Machinery Co., Ltd. |

| Key Drivers | • Increasing environmental concerns regarding waste management • Stringent regulation imposed by the government on oil and gas industries |

| Market Opportunities | • Growing production and exploration activities |