Construction Equipment Rental Market Report Scope & Overview:

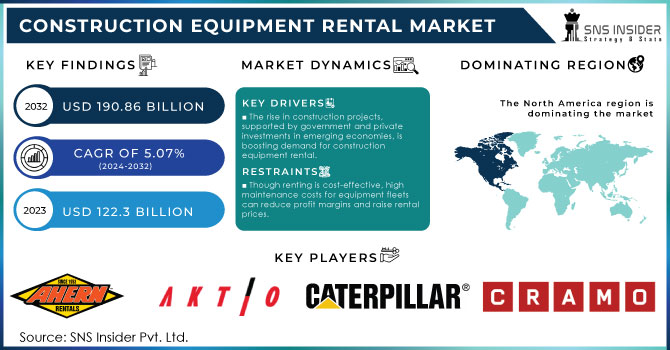

The Construction Equipment Rental Market size was valued at USD 122.3 Billion in 2023 and is projected to reach a valuation of USD 190.86 Billion by 2032, expanding at a CAGR of 5.07% during the forecast period of 2024-2032.

To Get More Information on Construction Equipment Rental Market - Request Sample Report

The Construction Equipment Rental Market growth is expected to grow during the forecast period owing to an increase in infrastructure development and construction activities globally. This market comprises heavy machinery and equipment rental, such as loaders, excavators, cranes, and aerial work platforms. The surging urbanization, especially in the developing economies, has raised the demand for construction services that has augmented the growth for construction equipment rental market.

Renting equipment is highly preferred by businesses over purchasing owing to the benefits, such as cost-effectiveness, operational flexibility, and decreased reduced maintenance expenses. This construction equipment rental market trend is specifically prevalent among the small and medium-sized enterprises (SMEs), which may have a low capital to invest in expensive machinery. Additionally, the ongoing shift toward sustainable construction practices has boosted the rental services' adoption globally, as they facilitate access to eco-friendly and advanced equipment without giving any long-term commitment of ownership. The primary driver boosting the market growth is the surging government investments in infrastructure projects.

For instance, several initiatives focused on the development of smart cities and improving transportation networks are encouraging construction companies to rapid expand their operations globally. This boost necessitates specialized equipment rental, which might not be viable for organizations to purchase outright. Furthermore, the growing emphasis of the construction industry on decreasing carbon footprints has led to a high demand for equipment, which meets the strict environmental regulations that are largely offered by the companies.

Recent construction equipment rental market trends highlight the growing reliance on technology within the rental sector. The incorporation of Internet of Technology (IoT) and telematics in the construction equipment helps users in real-time monitoring, predictive maintenance, and also improving the operational efficiency. Several players are buying technologies to decrease downtime, optimizing fleets, enhance workers' safety on job sites. The construction companies are largely looking for various rental options, which include low-emission and energy-efficient equipment, propelled by the regulatory pressures and a societal shift toward environmentally friendly practices. Rental companies are responding by updating their fleets with the latest green technologies, thereby enhancing their competitive edge.

Construction Equipment Rental Market Dynamics:

Drivers:

-

Rising Number of Construction Projects in Residential, Commercial, and Infrastructure Sectors Drive Market Expansion

One of the main factors that has been driving demand for construction equipment rentals is the substantial rise in construction activities taking place in residential, commercial and infrastructure sectors. Emerging economies have long prioritized infrastructure development as a critical enabling factor of economic growth and social progress, with significant funds being (eroded) into the sector by their respective governments. Projects, such as building roads, bridges, schools and health clinics are essential in raising living standards but also generating employment and stimulating local economies.

Meanwhile, and private sector funds are investment in real estate construction and market as the shopping centers, offices buildings office buildings were land established estate developments. This has led to a dramatic increase in demand for ever more specialised construction machinery, much of which is only made by one company. Equipment rental is still a significant trend among contractors including small and medium-sized companies, as they experience high CAPEX associated with ownership of machines, along with the drag of maintenance costs. This is where hiring comes into focus for these businesses as it allows them to gain access to the latest equipment without actually owning them and focusing more on their project execution.

In addition to this, rapid pace of urbanization further boosts the residential construction activities which triggers the need for renting different types of construction equipment. Rapid population growth and urbanization in cities across the globe are forcing the construction industry to keep up with infrastructure and housing requirements, fueling demand in the rental sector. All in all, the constantly growing construction sector, backed by heavy state and private investments is working well for the construction equipment rental market.

-

Technological Advancements in Construction Equipment, Featuring Improved Fuel Efficiency and Enhanced Safety Features, Propel Market Growth

Technological advancements in construction equipment play a pivotal role in driving the demand for rentals. Innovations such as advanced machinery equipped with improved fuel efficiency, enhanced safety features, and cutting-edge automation capabilities have transformed the construction landscape. These modern machines not only reduce operational costs but also improve overall project efficiency and safety on job sites. As construction companies seek to stay competitive, they increasingly prefer renting the latest models rather than investing in outdated equipment that may lack these enhancements.

Renting allows businesses to access state-of-the-art machinery without the financial burden of purchasing and maintaining it. Furthermore, many rental companies regularly update their fleets, ensuring that clients have access to the most efficient and technologically advanced equipment available. This trend highlights the industry's shift toward maximizing productivity and safety, solidifying the growing preference for construction equipment rentals in an ever-evolving market.

Restraints:

-

Rental Companies Encounter Substantial Maintenance and Repair Costs for Their Equipment Fleets Can Hamper Market Growth

High maintenance costs represent a significant challenge for construction equipment rental companies. While renting equipment can be a cost-effective solution for many customers, rental firms must continuously manage the upkeep and repair of their fleets to ensure operational efficiency and safety. Regular maintenance is essential to minimize equipment downtime and prolong asset lifespan, but it also incurs substantial expenses. These costs include routine servicing, parts replacement, and repairs due to wear and tear.

If rental companies fail to effectively manage these maintenance expenses, they risk eroding their profit margins, which can lead to increased rental prices for customers. Higher costs may discourage potential clients from renting equipment and push them towards alternative solutions, such as purchasing their own machinery. Consequently, maintaining a delicate balance between affordability for customers and sustainable profitability for rental companies is crucial to thrive in this competitive market.

Construction Equipment Rental Market Segmentation Analysis:

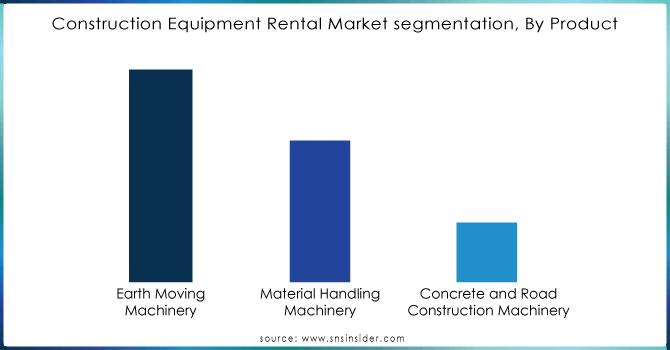

By Product

The earthmoving machinery segment accounted for a major construction equipment rental market share of over 56.72% in 2023. Growing earthmoving excavator demand from key end-use industries such as agriculture, mining and construction is enabling industries to continue their operations. Its other earthmoving equipment’s backhoe loaders, crawler excavators, skid-steer loaders and mini excavators are having heavy load capacity with high engine performance. Earthmoving equipment such as Crawler or Bulldozer has these features making it able to used even in very tough and worst working environment.

Do You Need any Customization Research on Construction Equipment Rental Market - Inquire Now

Construction Equipment Rental Market Regional Outlook:

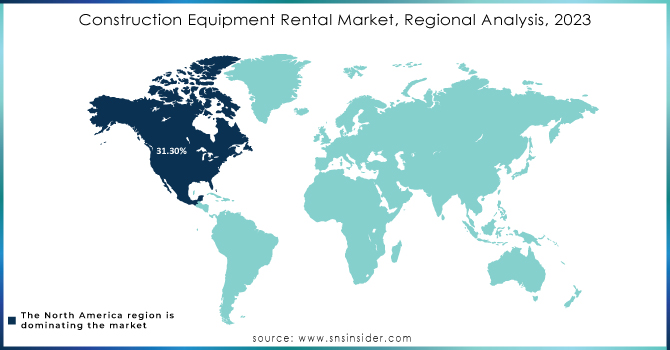

North America is currently dominating the market, and was valued at approximately 31.3% in 2023. The region is expected to hold a leading market position throughout the forecast period. Increased application-specific advanced machinery at competitive cost is one of the major growth drivers for construction equipment companies in the region. It is greatly preferred for the specialized equipment as it cuts down the operation time, idling time and as a result overall construction or mining activity has been optimized.

Asia Pacific is expected to witness fastest growing during the forecast period. To enhance the connectivity for Home to be established between countries in order to do more trade and make the economy better Governments of Asian emerging economies are investing very large on construction of highways, airports, dams, and SEZs. As a result, these initiatives have caught the eye of construction equipment companies abroad on a large scale as they are encouraged to pour in substantial funds and establish their companies there.

Some of the major players in Construction Equipment Rental Market are:

-

Ahern Rentals Inc.: (Scissor Lifts, Boom Lifts)

-

AKTIO Corporation: (Excavators, Bulldozers)

-

Caterpillar Inc.: (Excavators, Loaders, Generators)

-

Byrne Equipment Rental: (Generators, Portable Toilets)

-

Cramo Plc: (Scaffolding, Aerial Work Platforms)

-

Finning International Inc.: (Skid Steer Loaders, Compact Track Loaders)

-

Liebherr-International AG: (Cranes, Excavators, Dump Trucks)

-

Kanamoto Co., Ltd.: (Excavators, Aerial Work Platforms)

-

Maxim Crane Works, L.P.: (Crawler Cranes, All-Terrain Cranes)

-

United Rentals, Inc.: (Telehandlers, Backhoe Loaders)

-

Boels Rental: (Forklifts, Scaffolding)

-

H&E Equipment Services Inc.: (Excavators, Aerial Lifts)

-

Sunbelt Rentals: (Generators, Compactors)

-

Riwal: (Boom Lifts, Telehandlers)

-

Loxam: (Mini Excavators, Power Generators)

-

Terex Corporation: (Articulated Dump Trucks, Cranes)

-

Hilti Corporation: (Power Tools, Diamond Tools)

-

Neff Rental: (Excavators, Light Towers)

-

Linde Material Handling: (Forklifts, Warehouse Equipment)

-

Apex Tool Group: (Hand Tools, Power Tools)

RECENT TRENDS

In June 2023: H&E Equipment Services Inc. (H&E) inaugurated its 22nd rental location in Texas with the opening of a new branch in Houston South, catering to various construction and general industrial equipment needs.

In April 2023: Boels Rental acquired BAS Maskinutleie, a Norwegian company, thereby expanding its Nordic subsidiary Cramo and extending its rental services across the Nordic region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 122.3 Billion |

| Market Size by 2032 | USD 190.86 Billion |

| CAGR | CAGR of 5.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Earth Moving Machinery, Material Handling Machinery, Concrete and Road Construction Machinery) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ahern Rentals Inc., AKTIO Corporation, Caterpillar Inc, Byrne Equipment Rental, Cramo Plc, Finning International Inc., Liebherr-International AG, Kanamoto Co., Ltd, Maxim Crane Works, L.P., United Rentals, Inc, Boels Rental, H&E Equipment Services Inc,Sunbelt Rentals,Riwal,Loxam,Terex Corporation,Hilti Corporation,Neff Rental, Linde Material Handling,Apex Tool Group |

| Key Drivers | • The rising number of construction projects in residential, commercial, and infrastructure sectors, bolstered by substantial investments from governments and private sectors in emerging economies, is driving demand for construction equipment rental. • Technological advancements in construction equipment, featuring improved fuel efficiency and enhanced safety features, encourage rentals as customers prefer accessing the latest models rather than investing in outdated machinery. |

| RESTRAINTS | • While renting is generally cost-effective, rental companies encounter substantial maintenance and repair costs for their equipment fleets, which, if not effectively managed, can diminish profit margins and result in increased rental prices. |