Consumer Drones Market Report Scope and Overview:

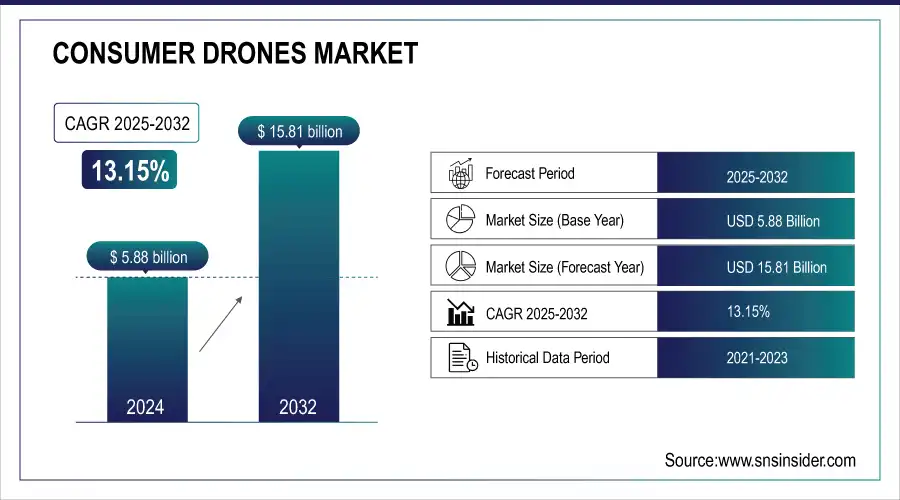

The Consumer Drones Market size was valued at USD 5.88 Billion in 2024. It is estimated to reach USD 15.81 Billion by 2032, growing at a CAGR of 13.15% during 2025-2032.

Get more information on Consumer Drones Market - Request Sample Report

Advancements in technology, affordability, and a growing number of uses have fueled significant growth in the consumer drones market in recent years. As drone technology has advanced, these devices have changed from being specialized tools for hobbyists and experts to convenient gadgets for the general public. The increasing demand for aerial photography and videography is a major driver behind the growth of the consumer drones industry. The field of photography is set to experience substantial expansion, with an estimated 17% rise in photography-related job opportunities expected by 2023. Every year, around 12,700 job opportunities are expected, indicating a high need for experts in this industry. In the year 2023, approximately 110,500 professional photographers were working in the United States, with 68% of them working for themselves. In 2023, the United States held a majority share of approximately 56% in the worldwide photography market, showcasing its leadership in this industry. Enthusiasts and hobbyist photographers have welcomed drones as a way to capture amazing aerial shots that were once hard or impossible to get. Due to the arrival of small, easy-to-use drones that come with top-notch cameras, people can effortlessly produce professional-level content for personal enjoyment or sharing on social media.

Consumer Drones Market Size and Forecast:

-

Market Size in 2024: USD 5.88 Billion

-

Market Size by 2032: USD 15.81 Billion

-

CAGR: 13.15% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Consumer Drones Market Highlights:

-

Precision farming adoption is rising, with ~20% of U.S. farmers using drones for crop monitoring, soil analysis, and irrigation management.

-

Around 70% of farmers report increased efficiency and cost savings from drone usage.

-

Consumer drone growth is driven by the popularity of aerial photography and videography, fueled by social media platforms.

-

E-commerce expansion and last-mile delivery needs are boosting demand for consumer drones in logistics.

-

Limited flight time/battery life (20–30 minutes) remains a key restraint, affecting adoption and operational efficiency.

-

Advanced camera technology, gimbal stabilization, and HDR capabilities enhance drone appeal and market growth potential.

Farmers and agricultural experts are relying more on drones for precision farming techniques. In 2023, around 20% of American farmers have started using drone technology for tasks such as crop monitoring, soil analysis, and precision agriculture. Studies have shown that roughly 70% of these farmers have mentioned increased efficiency and cost savings as a result of using drones. Additionally, more than 1,800 agricultural drone operators have been approved by the FAA, indicating an increasing acknowledgment of their importance in improving efficiency and sustainability in agriculture. Farmers can utilize drones with multispectral cameras to take precise crop images for evaluating plant health, tracking irrigation requirements, and enhancing fertilizer usage. This method based on data allows for more effective agriculture, resulting in higher outputs and decreased expenses. Drones are crucial in modernizing agriculture and boosting productivity by giving immediate updates on crop conditions.

Consumer Drones Market Drivers:

-

The rise of consumer drones fueled by aerial photography trends.

The prime driver of the consumer drones market is the growing popularity of aerial photography and videography. Affordable drones with high-resolution cameras have become increasingly widespread, and many people use them to explore the possibilities for creating unique types of footage. Arguably, the primary factor explaining such developments is the influence of social media platforms, notably Instagram and YouTube. Many amateur photographers and videographers seek to emulate the stunning visuals they encounter online, and drones have enabled them to take the kinds of shots that used to require professionals and highly expensive equipment. In that way, the products of the consumer drones market were relatively novel. Notably, many other features have also contributed to the popularity of drones, such as the advancement of camera technology that enables higher resolution, gimbal stabilization, and HDR capabilities. As more people begin appreciating how drones can be used to create unique types of content, this trend will also likely drive market growth.

-

E-commerce expansion fuels growth in the consumer drones market.

The expansion of the e-commerce industry and the rising demand for delivery services are driving the growth of the consumer drone market. At the same time, many companies are experimenting with drones as an optimal solution for Autonomous last-mile delivery, as the shipping time can be shortened considerably. Currently, Amazon and Google are actively developing drone delivery systems and improving their logistics with the appropriate tools. Overall, drones offer an opportunity to send cargo by aerial routes, and their delivery duration can be as little as 30 minutes, which would directly contribute to higher customer satisfaction and enable companies to increase their revenue. In the context of increased urbanization and demand for fast delivery, it becomes clear that the logistics and e-commerce sectors will largely benefit from such technologies, and drones’ application values broaden. Thus, the growing application of drones for delivery calls for the growth of the consumer drone market.

Consumer Drones Market Restraints:

-

The challenge of limited flight time in consumer drones.

Consumer drones are faced with many constraints, some of which pertain directly to their limited flight time/battery life. Unfortunately, flight duration on the average consumer drone is usually limited to about 20 to 30 minutes – something that can be disadvantageous to the user desiring extended drone capabilities. It is a mere inconvenience, but after about 30 minutes of flight, the designed average batteries come to a stop. As users, a limited battery life is likely to have a whole lot of people becoming frustrated by the setback of not being able to run applications that require longer drone operational periods. The inconveniences of charging them or even replacing the battery costs time and money. Advanced features and increased flight duration, therefore, reduce efficiency and denigrate the effectiveness of drones on serious users. This case causes a significant challenge to manufacturers and limits the extent of drones’ adoption. Notably, increased flight time and battery power are becoming consumer demands and thus a feature that suppliers must include in their products. The effect of current batteries not sustaining the two core aspects of their operation is, therefore, acting as a limiter to their adoption, and customers are likely to seek alternatives to primary and non-performing drones.

Consumer Drones Market Segment Analysis:

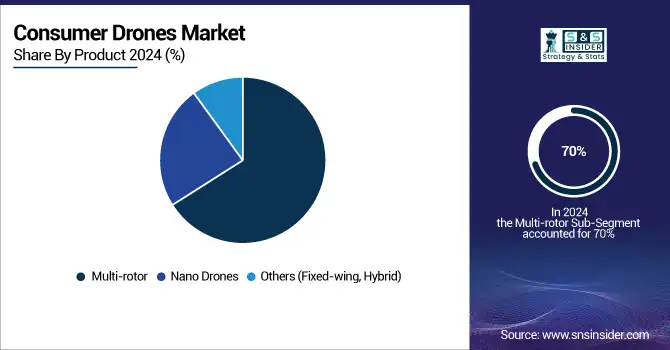

By Product

Multi-rotor drones dominated the consumer drone market in 2024 with a 70% market share because of their versatility and ease of use. These drones usually have four or more rotors, which help with stability and control, making them perfect for a range of uses such as aerial photography, videography, and leisurely flying. The increasing use of social media has also driven up the need for multi-rotor drones, as people want top-notch pictures to post online. DJI, a top player in the drone sector, provides drone models such as the DJI Phantom and Mavic series that are suitable for both beginners and experienced users.

Nano drones are supposed to have a faster CAGR during 2025-2032, due to their compact size and growing accessibility. These miniature drones are made for indoor flying and often come with simple functionalities, which make them attractive to beginners and kids. Their lightweight design permits easy transportability, allowing users to fly them in tight spaces without needing advanced piloting abilities. Parrot and Ryze Tech have released drones like the Parrot MiniDrone and Tello, great for education, beginners, and enjoyment.

By Application

The Toy/Hobbyist sector led the market in 2024 with a 42% market share. Known for inexpensive and user-friendly drones, this sector appeals to a wide range of people, such as kids, parents, and amateur enthusiasts. These drones are commonly equipped with simple cameras or are made for racing and fun activities, making them suitable for users without prior drone experience. Brands like Holy Stone and Potensic are well-known in this category, providing affordable models that are created for enjoyment, like the Holy Stone HS210 Mini Drone with headless mode and altitude hold.

The prosumer segment is accounted to experience the fastest CAGR during 2025-2032, as it is fueled by the increasing desire for top-notch aerial photography and videography among enthusiasts and semi-professionals. Prosumer drones come equipped with features like 4K cameras, GPS capabilities, and automated flight modes, perfect for users who want top-notch quality and user-friendly functions. Companies such as DJI have taken advantage of this trend by offering products like the Mavic Air 2, which blends easy-to-use controls with high-quality camera features, making it popular among prosumers.

Consumer Drones Market Regional Analysis:

North America Consumer Drones Market Trends:

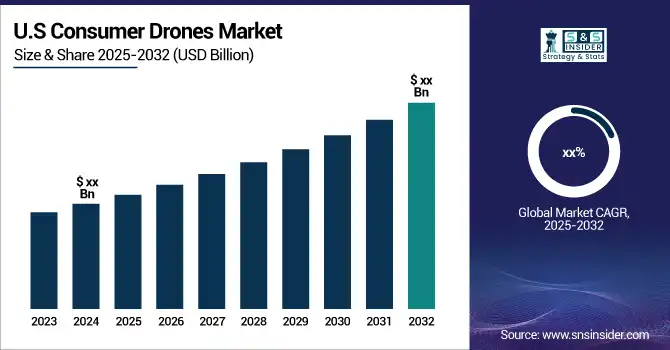

North America dominated the market with a 37.18% market share due to advanced technology usage and strong regulations. The area is home to important companies like DJI, Parrot, and Yuneec, leading the way in innovation and developing new products. The rise in consumer drone usage for photography, videography, and leisure activities has driven market expansion. Furthermore, improvements in drone technology, like better battery longevity and upgraded camera functions, are still appealing to customers.

To Get Customized Report as Per Your Business Requirement - Request For Customized Report

Asia-Pacific Consumer Drones Market Trends:

The APAC region is to become the fastest-growing region during the forecast period 2025-2032, due to fast urbanization and rising disposable income among consumers. Nations such as China and Japan are at the forefront, with DJI being a frontrunner in both innovation and large-scale manufacturing. The rise of social media and the increasing popularity of creating content have led to a higher demand for drones, especially among millennials and younger age groups. Possible uses of drones are personal photography, recreational flying, and delivery services, particularly in urban locations where conventional delivery methods might not be as effective.

Europe Consumer Drones Market Trends:

Europe holds a significant share of the consumer drones market, driven by strict safety regulations, technological adoption, and growing interest in aerial photography and recreational flying. Countries such as Germany, France, and the UK are key contributors, with companies like Parrot and Yuneec leading innovation. The demand is fueled by hobbyists, professional photographers, and small businesses leveraging drones for creative and commercial purposes. Continuous improvements in drone navigation, battery life, and camera technology are also supporting market growth.

Latin America Consumer Drones Market Trends:

The Latin America market is witnessing steady growth, with countries like Brazil and Mexico leading in adoption. Increasing consumer interest in recreational drone use, photography, and emerging commercial applications, such as agricultural monitoring, is driving the market. Government initiatives to regulate and promote safe drone usage are encouraging adoption. Improved affordability of drones and rising social media usage are also key factors supporting the expansion of the consumer drone segment in the region.

Middle East & Africa (MEA) Consumer Drones Market Trends:

The MEA region is experiencing moderate growth in consumer drones, driven by rising urbanization, technological adoption, and interest in photography, entertainment, and recreational flying. Countries like the UAE, Saudi Arabia, and South Africa are leading the adoption curve. Increasing investments in smart city projects and tourism-driven experiences are promoting drone usage. Additionally, awareness about drone regulations and safety compliance is improving, which is expected to support market growth in both recreational and professional consumer segments.

Consumer Drones Market Key Players:

-

Walkera – F210 Racing Drone, Vitus 320

-

Potensic – D80, Drones for Kids with Camera

-

Sky Viper – V2450, V2400

-

3D Robotics – Solo Drone, Iris+

-

Cheerson – CX-10, CX-20

-

Parrot S.A – Anafi, Bebop 2

-

DJI – Mavic Air 2, Phantom 4 Pro

-

Yuneec – Typhoon H, Breeze

-

EHang – 184, Falcon

-

Airdog – ADII, AD1

-

GoPro – HERO10 Black, MAX

-

Guangdong Cheerson Hobby Technology – CX-30, CX-33

-

Hobbico – NexSTAR EP RTF, Mini Super Cub

-

Shenzhen Hubsan Technology – H501S X4, H107D

-

Horizon Hobby – E-flite Timber X, Blade 230 S

-

Guangdong Syma Model Aircraft Industrial – X5C, X8G

-

ZEROTECH – Dobby, ZERODRONE

-

Autel Robotics – EVO II, EVO Nano

-

Skydio – Skydio 2, Skydio X2

-

BetaFPV – Beta95X, Beta75X

Consumer Drones Market Competitive Landscape:

Autel Robotics is a Chinese drone manufacturer founded in 2014 by Maxwell Lee and Li Hongjing. Headquartered in Shenzhen, China, the company specializes in unmanned aerial vehicles (UAVs) for both commercial and consumer applications. Autel gained prominence with its EVO series and has expanded its product line to include the Dragonfish series. In 2025, Autel announced its exit from the consumer drone market, discontinuing models like the EVO Nano and EVO Lite series to focus on professional and enterprise solutions.

-

February 2024: Autel Robotics launched EVO Lite+. The compact aircraft boasts 6K video resolution and a bonus of an extended flight time of maximum up to 40 minutes. It is tailored to cater to both hobbyists and professionals, offering features, which allow for customizable shooting settings.

Skydio, established in 2014, is a U.S. drone manufacturer entering India through a partnership with Aeroarc to locally produce UAVs for defense. Initially focused on defense, Skydio plans to expand into commercial sectors, including public safety and infrastructure inspection, supported by an R&D center in Bengaluru.

-

January 2024: Skydio launched the X2, an all-purpose drone designed with the needs of both the commercial and consumer markets in mind. The drone’s distinctive feature is that it is built on an AI platform, which allows it to be free of no-fly zones and suited for even the most dynamic environments.

DJI, established in 2006, is a leading Chinese drone manufacturer headquartered in Shenzhen. Renowned for innovation in consumer and enterprise UAVs, DJI offers products for aerial photography, mapping, inspection, and emergency response. The company’s commercial solutions, including the Matrice 400 series and autonomous drone systems, support industries like energy, infrastructure, and public safety, making DJI a global leader in drone technology.

-

May 2023: DJI launched the DJI Mini 3 Pro, a compact drone, which has been enhanced and powered with a 48MP camera and 4K video recording features. The device is marketed as being perfect both for beginners and gurus, offering the most advanced camera capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.88 Billion |

| Market Size by 2032 | USD 15.81 Billion |

| CAGR | CAGR of 13.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Multi-rotor, Nano, Others (Fixed-wing, Hybrid)) • By Application (Prosumer, Toy/Hobbyist, Photogrammetry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Walkera; Potensic; Sky Viper; 3D Robotics; Cheerson; Parrot S.A; DJI; Yuneec; EHang; Airdog; GoPro; Guangdong Cheerson Hobby Technology; Hobbico; Shenzhen Hubsan Technology; Horizon Hobby; Guangdong Syma Model Aircraft Industrial; ZEROTECH; Autel Robotics; Skydio; BetaFPV. |