Atom Thin Transistor Market Size & Trends:

The Atom Thin Transistor Market size was valued at USD 165.56 million in 2024 and is expected to reach USD 1442.99 million by 2032, growing at a CAGR of 31.18% over the forecast period of 2025-2032. Growing demand for miniaturization of electronic devices, development of nanomaterials such as graphene and TMDs, rising R&D spending, and penetration in healthcare, automotive, and flexible electronics applications are also factors heating the market.

To Get More Information On Atom Thin Transistor Market - Request Free Sample Report

The Atom Thin Transistor market is expanding due to the demand for high-performance, energy-efficient, small-sized electronic devices. Ultra-thin, flexible transistors are made possible by the development of nanomaterials like graphene, transition metal dichalcogenides (TMDs), and black phosphorus. Increasing R&D expenditure, increasing penetration in emerging applications such as wearable medical devices and flexible displays, and increasing demand for miniaturization in electronic applications for consumers, automotive, and aerospace industries, are stimulating market growth and technological innovation.

-

The U.S. National Nanotechnology Initiative (NNI) has allocated over $1.8 billion annually towards nanomaterials research and development, accelerating innovations in atom-thin materials like graphene and TMDs.

The U.S. Atom Thin Transistor Market size is estimated to be valued at USD 39.62 million in 2024 and is projected to grow at a CAGR of 32.31%, reaching USD 369.92 million by 2032. The US Atom Thin Transistor Market growth is booming mainly because of the continuous improvement in nanotechnology, heavy investment in semiconductor research and development, as well as the rising need for energy-efficient, high-performance electronics.

Atom Thin Transistor Market Dynamics:

Key Drivers:

-

Rising Demand for Miniaturized High Performance Atom Thin Transistors Drives Innovation Across Multiple Industries

The Atom Thin Transistor market trends are the rising demand for miniaturized, high-performance, and low-power-consuming electronic devices in consumer electronics, healthcare, automotive, and aerospace. Emerging materials, like graphene, TMDs, or black phosphorus, can be used to fabricate ultra-thin, flexible, and robust transistors of vital importance for future generation wearable displays, medical sensors, or sensory devices. Increasing investments in R&D and government programs such as the U.S. CHIPS Act will push the envelope even further on technology innovation and semiconductor manufacturing capabilities.

-

The U.S. CHIPS and Science Act has allocated USD 52.7 billion to bolster domestic semiconductor manufacturing and R&D. Notably, TSMC received USD 6.6 billion to build a 2nm fab in Arizona, expected to commence construction in 2028

Restraints:

-

Challenges in Large Area Defect Free Synthesis and Integration of Atomically Thin Materials Hinder Commercialization

The problems are stemming from the challenge of the large-area, defect-free synthesis of atomically thin materials, such as graphene and transition metal dichalcogenides (TMDs). The quality of materials can vary, which can cause inconsistent electrical performance and compromise the reliability of the device. It also remains a challenge to integrate these fragile materials with conventional silicon-based semiconductor manufacturing processes, and the advanced fabrication processes and specialized equipment still play a role. Such an integration challenge may prolong commercialization as well as scale-up.

Opportunities:

-

Emerging Applications and APAC Growth Drive Atom Thin Transistor Market Expansion with AI and 5G Integration

The opportunities are in emerging applications such as implantable medical devices, flexible electronics, internet of things (IoT) devices, and electric vehicles that demand high-power-density, compact, and efficient components. APAC emerging markets will follow with high adoption due to rising electronics manufacturing and smart devices penetration. Further down the road, the combination of atom-thin transistors with AI, 5G, and other advances boosts device speed and connectivity and raises the prospect of continued market expansion.

-

As of October 2024, there are approximately 17 billion IoT devices connected globally, with projections reaching 30 billion devices by 2025, indicating rapid growth in smart device adoption.

Challenges:

-

Stability Challenges and Lack of Standards Limit Atom Thin Transistor Adoption Across Key Industry Applications

Major limitation is the lack of stability and environmental-sensitivity of some of these atom-thin materials, like black phosphorus, that can decompose in air, or be highly in moisture. Achieving long-term stability and good encapsulation techniques is, however, a work in progress. Even so, no one would buy a cupcake at a bake sale if they yesterday found a finger in it, and the atomic-scale transistor devices are hampered by both no standards for testing protocols and no regulations as to what constitutes a marketable end product. By pushing down these engineering walls, it will be possible to fully exploit the usefulness of atom-thin transistor technologies in consumer electronics, healthcare, automotive, and aerospace applications.

Atom Thin Transistor Market Segmentation Outlook:

By Material Type

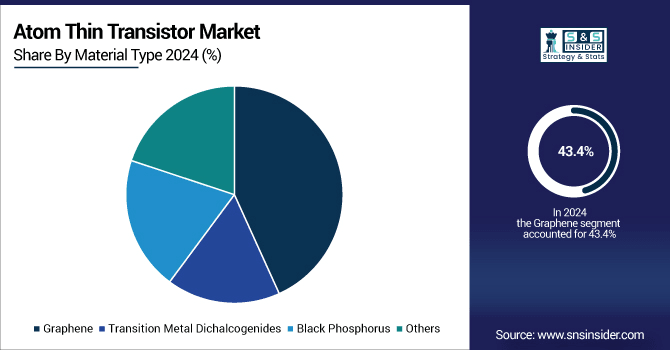

Graphene emerged as the leading material in the Atom Thin Transistor market with an impressive 43.4% share in 2024, owing to its excellent electrical conductivity, high mechanical strength, and superb flexibility. These enhanced characteristics also make graphene a great candidate for developing ultra-thin, high-performance transistors that can be used in flexible displays, wearable electronics, and high-speed electronics. The established ways to produce it and the increasing tendency in the local industry to adopt it have reinforced their leadership.

Transition Metal Dichalcogenides (TMDs) will have the highest expected growth rate (CAGR) between 2025 and 2032. Due to their tunable bandgap and enhanced semiconducting properties, TMDs provide unique features required for the transistor technologies of the future. This rapid growth is driven by their compatibility with existing semiconductor processes and their scalability in low-power, high-efficiency devices. While graphene has dominated the market up until now, TMDs are likely to take a larger share of the market in the upcoming years as both R&D and fabrication processes continue to advance.

By Application

The Atom Thin Transistor market was led by consumer electronics, which accounted for 47.3% of market share in 2024, owing to the increasing need for small-sized, efficient, and energy-saving consumer devices, including smartphones, tablets, and other portable devices. Metal-insulator transition and ion gating in two-dimensional materials: toward lighter, thinner, and faster electronics enabled by atom-thin transistors to meet consumer desire for skinny, rapidly styled gadgets. This segment holds the largest market share because graphene and other 2D material transistors have contributed significantly towards improving device functionalities without compromising on robustness and device performance.

From 2025 to 2032, the fastest-growing segment is anticipated to be medical devices. The uptake of diverse, flexible, implantable, and wearable health-monitoring technologies is driving this boom. Atom-thick transistors provide the building blocks for ultra-sensitive biosensors and intelligent medical devices that can adapt to the human body to perform real-time diagnostic and long-term health monitoring. Increasing investments in digital health and various innovative bioelectronics are accelerating growth in this emerging space.

By End-User

The electronics segment accounted for the largest share in the Atom Thin Transistor market and was valued at 47.6% in 2024, owing to the wide usage of Atom Thin Transistor in consumer electronics, computing devices, and industrial applications. Due to their ultra-thin thickness, high speed, and energy efficiency, they can be used for flexible displays, next-generation processors, and super miniaturized electronic circuits. Lightweight, small-sized, and high-functioning types of electronic components are expected to boost the market share of this segment.

The fastest CAGR growth from 2025 to 2032 is expected to be in the healthcare segment. This expansion comes on the heels of the technical combining of atom-thick transistors into cutting-edge clinical therapeutic devices, including wearable biosensors, implantable health monitor chips, and high-resolution and dynamic diagnostic systems. Due to biocompatibility and flexibility, as well as effective performance on various curves of the human body, they are important for individualized, long-term, in vivo patient monitoring.

Atom Thin Transistor Market Regional Overview:

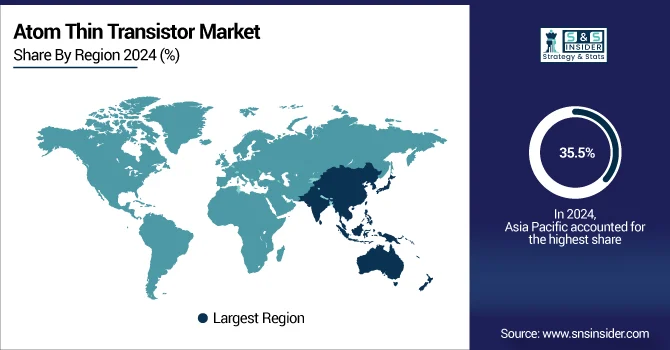

The Atom Thin Transistor market in Asia Pacific held the largest share of 35.5% in 2024 due to high demand from electronics manufacturing, technology innovations, and increasing usage of flexible and miniaturized devices. The well-established semiconductor ecosystem, volume R&D, and high density of consumer electronics production in the region facilitate atomically-thin transistor integration at scale. Solid growth is to be driven by growing investments in next-generation semiconductor technologies, increasing demand for high-performance and energy-efficient components, and burgeoning penetration of smart devices across consumer, automotive, and industrial applications. In addition, the move towards the development of flexible electronics, wearables, and Internet of Things (IoT) infrastructure is further supporting the growth of the market in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China was the leading country in the Asia Pacific Atom Thin Transistor market owing to huge electronics manufacturing base, massive R&D investments, and swift adoption of advanced semiconductor and flexible electronics technologies.

The Atom Thin Transistor market share of North America is projected to grow at the highest CAGR of 31.9% from 2025 to 2032, due to advanced technological innovation, increasing investments in nanotechnology, and enhanced semiconductor research. The focus of the region towards next-generation electronics, ultra-thin and energy-efficient devices, targeting consumer, medical, automotive, and aerospace applications, is facilitating adoption. Growth is being driven by government support for domestic semiconductor production and increasing demand for flexible, high-performance components in IoT and AI-enabled systems. Partnerships between universities and tech giants are also making strides in the integration of atom-thin materials and manufacturing techniques that can be applied at scale.

The North American Atom Thin Transistor industry was dominated by the U.S on the back of development of state-of-the-art R&D infrastructure, a key concentration of semiconductor companies, government funding, mostly due to early adoption of nanotechnology and flexible electronics.

The market in Europe is driven by initiatives to maintain a sustainable economy, along with continuous innovation supported by Government programs based on Research on advanced materials. There are collaborative arrangements between research institutions and industry, especially in the areas of flexible electronics and medical devices, in the region. The robot-assisted surgical devices market is boosted by a higher demand for miniaturized III-V semiconductor-based technologies with lower power consumption within the healthcare, automotive, and aerospace sectors, and an increase in investment in nanotechnology and future semiconductor devices development throughout the region.

With the availability of an extensive semiconductor manufacturing base, advanced research facilities, and huge investments in nanotechnology, flexible electronics, and automotive innovations, Germany led the Atom Thin Transistor market in Europe.

The Atom Thin Transistor market includes both emerging markets, such as Latin America and Middle East & Africa (MEA), which will grow steadily in the forecast period, due to the increasing digital transformation and growing lack of high-performance electronic devices. In these regions, there is growing interest in flexible, energy-efficient technologies for a range of healthcare and consumer applications. However, in both regions, Government initiatives, foreign investments, along with increasing adoption rate of IoT, and smart devices offer a promising outlook for market growth, despite infrastructure and R&D capabilities limitations.

Key Players:

Some of the major Atom Thin Transistor Companies are Samsung Electronics, Intel, TSMC, IBM, GlobalFoundries, Applied Materials, Micron Technology, NXP Semiconductors, Texas Instruments, and STMicroelectronics and others.

Recent Developments:

-

In December 2024, Intel's Foundry Technology Research team unveiled advancements in 2D transistor technology using beyond-silicon materials, including atomically thin 2D transistors, at the IEEE International Electron Devices Meeting (IEDM) 2024.

-

In March 2024, TSMC announced plans to commence mass production of its 2-nanometer process (N2) in 2025, utilizing gate-all-around (GAA) transistor structures to enhance performance and energy efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 165.56 Million |

| Market Size by 2032 | USD 1442.99 Million |

| CAGR | CAGR of 31.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Graphene, Transition Metal Dichalcogenides, Black Phosphorus, and Others) • By Application (Consumer Electronics, Medical Devices, Automotive, Aerospace, and Others) • By End-User (Electronics, Healthcare, Automotive, Aerospace, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Electronics, Intel, TSMC, IBM, GlobalFoundries, Applied Materials, Micron Technology, NXP Semiconductors, Texas Instruments, and STMicroelectronics. |