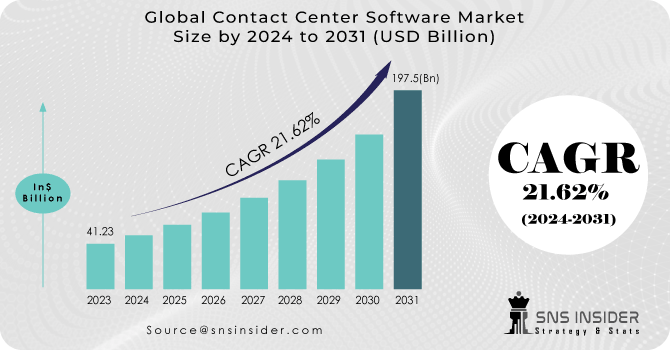

Contact Center Software Market Size was valued at USD 41.23 Billion in 2023 and is expected to reach USD 197.5 Billion by 2031 and grow at a CAGR of 21.62 % over the forecast period 2024-2031.

The growth of the contact center software market is Driven by the integration of AI/ML solutions, seamless CRM integration, and leveraging social media for operations. Opportunities abound with the growing demand for AI, automation, and self-service interactions to meet dynamic customer expectations. Emerging technologies like AI, cloud computing, and predictive analytics are enhancing contact center capabilities, driven by increased consumer awareness and inquiries. Industries focused on customer service, including retail, healthcare, and BFSI, are investing in contact centers for improved experiences. Omni-channel solutions facilitate seamless customer interactions across various platforms, exemplified by Capital One's use of Amazon Connect for intelligent service delivery. The market's momentum is driven by the competitive drive to retain customers through multi-channel interactions and AI-powered tools such as chatbots and predictive analytics, enhancing operational efficiency and customer satisfaction.

Get More Information on Contact Center Software Market - Request Sample Report

Market Dynamics

KEY DRIVERS:

The Growing adoption of digital technologies by businesses to enhance customer engagement and experience is driving the demand for advanced contact center software.

Increased preference for cloud-based contact center software due to benefits like scalability, cost-effectiveness, and easy deployment is fueling market growth.

There is a growing need for omnichannel solutions to reduce the effort required to reach end customers.

Continuous migration to cloud-based call centers

To achieve high customer satisfaction, there is an increasing desire for individualized and simplified client interactions.

Businesses are increasingly shifting towards digital technologies to elevate their customer engagement and overall experience. This trend helps to drive a strong demand for advanced contact center software solutions that can integrate seamlessly with these digital channels. Companies are recognizing the importance of leveraging technology to meet evolving customer expectations and deliver personalized interactions across multiple touchpoints. There is a growing emphasis on implementing robust contact center software that offers features such as omnichannel communication, AI-driven analytics, and automation to enhance efficiency and customer satisfaction.

RESTRAINTS:

Data security and privacy concerns related to storing and processing customer data in contact center software.

High Initial Costs associated with implementing contact center software.

The Shortage of skilled professionals capable of managing and optimizing contact center software solutions.

In emerging economies, insufficient network capacity limits the use of VoIP and cloud-based telephony.

PRI phone services have high fees and long-term commitments.

The Data security and privacy concerns regarding customer data storage and processing are significant restraints faced by contact center software providers. With the increasing volume of sensitive customer information handled by these systems, ensuring security measures is paramount. Issues such as data breaches, unauthorized access, and compliance with data protection regulations such as GDPR and CCPA are top priorities. Contact center software vendors must implement encryption, access controls, and regular audits to safeguard customer data and maintain trust. These concerns can result in reputational damage, legal repercussions, and loss of customer confidence, underscoring the critical need for stringent data security practices in the industry.

OPPORTUNITY:

The demand for personalized customer experiences through data analytics, AI-driven insights, and contextual communication channels.

The growing industry-specific contact center software solutions tailored to the unique needs of sectors such as healthcare, finance, and e-commerce.

Integrating collaboration tools such as video conferencing and screen sharing within contact center software to support remote teams and enhance productivity.

Customer needs for powerful self-service interactions are changing.

Shifting corporate focus toward work-from-home culture.

CHALLENGES:

The Obstacles to migrating contact centers to cloud infrastructures.

Meeting evolving customer expectations for seamless, personalized, and consistent experiences across multiple channels requires continuous innovation and investment.

Impact of Russia-Ukraine War:

The Russia-Ukraine war has disrupted supply chains and heightened geopolitical tensions, impacting the contact center software market. Businesses face challenges with software updates, hardware procurement, and data security due to potential cyber threats. Market growth may slow temporarily as companies navigate uncertainties and prioritize risk management strategies amidst global economic repercussions.

Impact of Economic Downturn:

Economic downturns often lead to reduced spending by businesses, impacting their budgets for contact center software investments. Companies may delay upgrading or implementing new contact center software solutions due to financial constraints during downturns. Organizations become more cost-sensitive during economic downturns, prioritizing solutions that offer maximum value and efficiency. A focus on cost-effectiveness may drive increased adoption of cloud-based contact center software due to its scalability and lower upfront costs. Businesses scrutinize the return on investment (ROI) of contact center software more closely during economic downturns, favoring solutions that demonstrate tangible benefits and quick ROI.

Market segmentation

By Component

Solution

Automatic Call Distribution

Call Recording

Computer Telephony Integration

Customer Collaboration

Interactive Voice Responses

Others

Service

Integration & Deployment

Support & Maintenance

Training & Consulting

Managed Services

By Deployment

Hosted

On-premises

On the basis of deployment, the on-premises segment dominates the contact centre software market with a holding revenue share of more than 55%. On-premises deployment involves setting up all necessary hardware and software at the customer's location, offering integrability and customizability but often requiring significant investment in professional services. The hosted segment is expected to grow with the fastest growth, driven by the preference for cloud-based solutions due to scalability benefits and enhanced connectivity for agents and executives. Cloud solutions enable centralized applications, secure collaboration and in-depth analytics, surpassing the capabilities of traditional on-premise setups.

By Enterprise Size

Large Enterprise

Small & Medium Enterprise

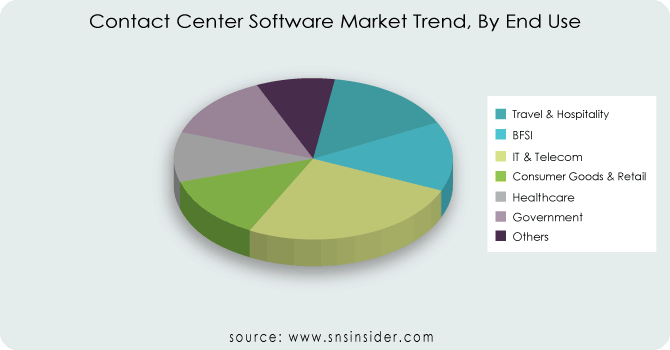

By End Use

BFSI

Consumer Goods & Retail

Government

Healthcare

IT & Telecom

Travel & Hospitality

Others

On the basis of end user, the IT & telecom sector dominated the market with holding revenue share of more than 23%, relying heavily on contact centre software for customer support and exceptional service delivery. These solutions streamline communication, automate processes, and integrate CRM, aiding efficient management of customer interactions. The consumer goods and retail segment is expected to growing with Rapid CAGR during forecast Period, driven by the shift to digital channels and the need for personalized customer experiences. Contact centre software facilitates automated, high-quality service, allowing agents to focus on revenue generation and brand enhancement with AI assistance.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Analysis

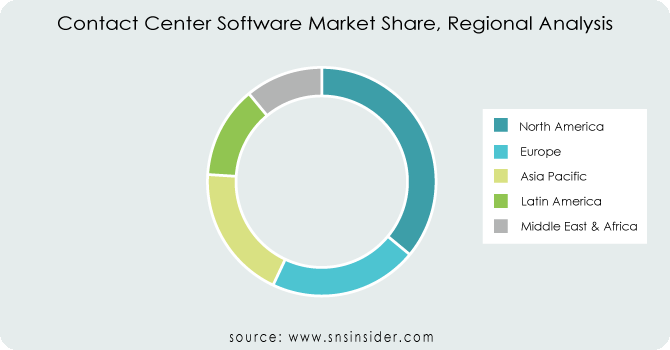

North America led the contact center software market with a revenue share of more than 36%, driven by its advanced business landscape and significant investments in customer experience solutions. The US, particularly, stands as a major market due to its robust IT infrastructure, technological prowess, and high readiness for cloud adoption.

The Asia Pacific region is growing with the fastest growth rate during forecast period, driven by the presence of numerous IT and IT-enabled services companies, growing adoption by enterprises, and supportive government initiatives promoting cloud and automation technologies. This regional growth trajectory is attracting global investments, further boosting market expansion.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key Players

The major key players are Avaya, inc., Cisco Systems, inc., Genesys, Huawei technologies co., ltd., Microsoft corporation, Mitel corporation, NEC Corporation, Nice systems ltd., Oracle corporation, SAP SE, and other players mentioned in the final report.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 41.23 Billion |

| Market Size by 2031 | US$ 197.5 Billion |

| CAGR | CAGR 21.62 % From 2024 to 2031 |

| Base Year | 2022 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Solution and services) • by Deployment (Hosted and On-premise) • by Enterprise Size (Large Enterprise and Small & Medium Enterprise) • by End Use (BFSI, Consumer Goods & Retail, Government, Healthcare, IT & Telecom, Travel & Hospitality, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avaya, inc., Cisco Systems, inc., Genesys, Huawei technologies co., ltd., Microsoft corporation, Mitel corporation, Nec Corporation, Nice systems ltd., Oracle corporation, SAP SE |

| Key Drivers | • The Growing adoption of digital technologies by businesses to enhance customer engagement and experience is driving the demand for advanced contact center software. • Increased preference for cloud-based contact center software due to benefits like scalability, cost-effectiveness, and easy deployment is fueling market growth. |

| Market Restraints | • Data security and privacy concerns related to storing and processing customer data in contact center software. • High Initial Costs associated with implementing contact center software. • The Shortage of skilled professionals capable of managing and optimizing contact center software solutions. |

Ans. The Compound Annual Growth rate for the Contact Center Software Market over the forecast period is 21.62%.

Ans. The projected market size for the Contact Center Software Market is USD 197.5 billion by 2031.

Ans: The On-premises deployment segment dominated the Contact Center Software Market.

Ans: The US dominates in North America regions Contact Center Software Market.

Ans:

There is a growing need for omnichannel solutions to reduce the effort required to reach end customers.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.9 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Contact Center Software Market Segmentation, by Component

9.1 Introduction

9.2 Trend Analysis

9.3 Solution

9.3.1 Automatic Call Distribution

9.3.2 Call Recording

9.3.3 Computer Telephony Integration

9.3.4 Customer Collaboration

9.3.5 Interactive Voice Responses

9.3.6 Others

9.4 Service

9.4.1 Integration & Deployment

9.4.2 Support & Maintenance

9.4.3 Training & Consulting

9.4.4 Managed Services

10. Contact Center Software Market Segmentation, by Deployment

10.1 Introduction

10.2 Trend Analysis

10.3 Hosted

10.4 On-premises

11. Contact Center Software Market Segmentation, by Enterprise Size

11.1 Introduction

11.2 Trend Analysis

11.3 Small and Medium Enterprise

11.4 Large Enterprise

12. Contact Center Software Market Segmentation, by End Use

12.1 Introduction

12.2 Trend Analysis

12.3 BFSI

12.4 Consumer Goods & Retail

12.5 Government

12.6 Healthcare

127 IT & Telecom

12.8 Travel & Hospitality

12.9 Others

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Eastern Europe

13.3.1.1 Poland

13.3.1.2 Romania

13.3.1.3 Hungary

13.3.1.4 Turkey

13.3.1.5 Rest of Eastern Europe

13.3.2 Western Europe

13.3.2.1 Germany

13.3.2.2 France

13.3.2.3 UK

13.3.2.4 Italy

13.3.2.5 Spain

13.3.2.6 Netherlands

13.3.2.7 Switzerland

13.3.2.8 Austria

13.3.2.9 Rest of Western Europe

13.4 Asia-Pacific

13.4.1 China

13.4.2 India

13.4.3 Japan

13.4.4 South Korea

13.4.5 Vietnam

13.4.6 Singapore

13.4.7 Australia

13.4.8 Rest of Asia Pacific

13.5 The Middle East & Africa

13.5.1 Middle East

13.5.1.1 UAE

13.5.1.2 Egypt

13.5.1.3 Saudi Arabia

13.5.1.4 Qatar

13.5.1.5 Rest of the Middle East

13.5.2 Africa

13.5.2.1 Nigeria

13.5.2.2 South Africa

13.5.2.3 Rest of Africa

13.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Colombia

13.6.4 Rest of Latin America

14. Company Profiles

14.1 Avaya, inc.

14.1.1 Company Overview

14.1.2 Financials

14.1.3 Products/ Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Cisco Systems, inc.

14.2.1 Company Overview

14.2.2 Financials

14.2.3 Products/ Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Genesys

14.3.1 Company Overview

14.3.2 Financials

14.3.3 Products/ Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 Microsoft corporation

14.4 Company Overview

14.4.2 Financials

14.4.3 Products/ Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 Mitel corporation

14.5.1 Company Overview

14.5.2 Financials

14.5.3 Products/ Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 NEC Corporation

14.6.1 Company Overview

14.6.2 Financials

14.6.3 Products/ Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 Nice systems ltd.

14.7.1 Company Overview

14.7.2 Financials

14.7.3 Products/ Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 Oracle corporation

14.8.1 Company Overview

14.8.2 Financials

14.8.3 Products/ Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 SAP SE.

14.9.1 Company Overview

14.9.2 Financials

14.9.3 Products/ Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 Huawei technologies co., ltd.

14.10.1 Company Overview

14.10.2 Financials

14.10.3 Products/ Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. USE Cases and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Embedded Hypervisor Market size was valued at USD 11.13 billion in 2022 and is projected to reach USD 20.47 billion in 2030 with a growing CAGR of 7.92% Over the Forecast Period of 2023-2030.

The 5G Industrial IoT Market Size was valued at USD 2.87 Billion in 2023 and is expected to reach USD 298.5 Billion by 2031 and grow at a CAGR of 78.6 % over the forecast period 2024-2031.

The Cloud Security Market size was USD 38.7 billion in 2022 and is expected to Reach USD 78.8 billion by 2030 and grow at a CAGR of 9.3% over the forecast period of 2023-2030.

The Web Content Management Market size was USD 9.26 billion in 2023 and is expected to Reach USD 17.39 billion by 2031 and grow at a CAGR of 15.9 % over the forecast period of 2024-2031.

The Digital banking market was worth USD 18.94 billion in 2022 and is expected to increase at a CAGR of 12.1% from 2023 to 2030, reaching USD 47.24 billion by 2030.

The Application Security Market size was valued at USD 8.04 Bn in 2022 and is expected to reach USD 27.85 Bn by 2030, and grow at a CAGR of 16.79 % over the forecast period 2023-2030.

Hi! Click one of our member below to chat on Phone