Digital Banking Market Size & Overview:

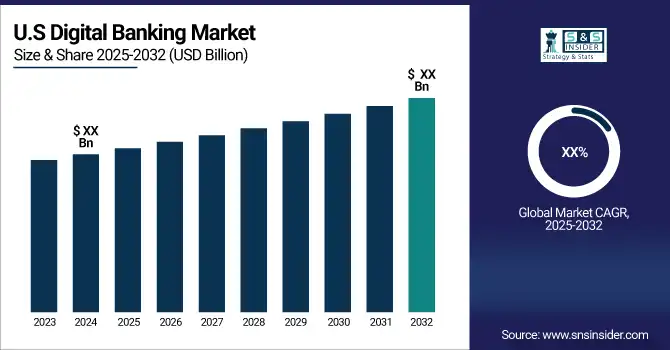

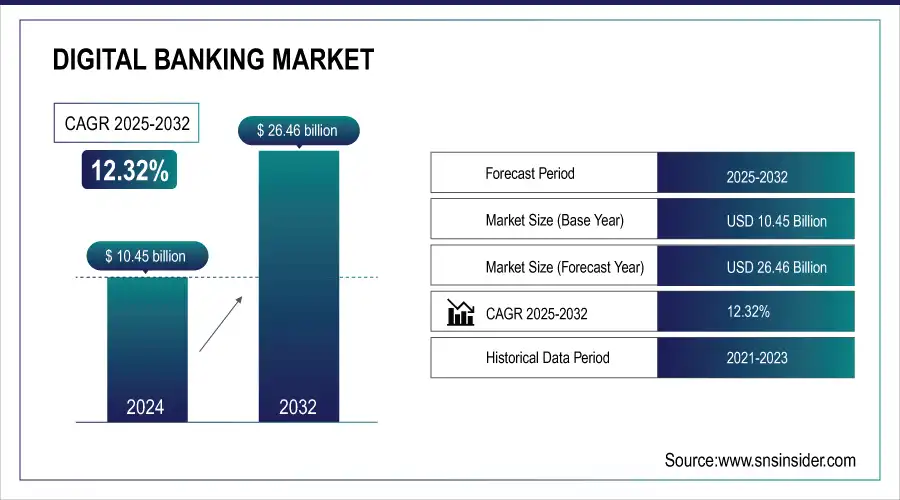

The Digital Banking Market was valued at USD 11.74 billion in 2025E and is expected to reach USD 29.73 billion by 2033, growing at a CAGR of 12.32% from 2026-2033.

The digital banking market is undergoing a significant transformation, propelled by technological advancements, shifting consumer preferences, and increased internet access. Consumers are increasingly seeking convenient and efficient banking solutions, which has encouraged both traditional banks and fintech companies to innovate their digital offerings.

A major growth factor is the rising smartphone usage, which has dramatically changed how consumers engage with financial services. Recent government data shows that over 300 million individuals in the U.S. utilize smartphones, significantly enhancing access to mobile banking applications. Additionally, the growing popularity of digital wallets and contactless payment methods is reshaping payment processes, increasing the demand for seamless banking experiences.

Get more information on Digital banking market - Request Sample Report

Government initiatives are also critical to the advancement of the digital banking sector. For instance, the Federal Reserve's "Faster Payments Task Force" focuses on improving the efficiency and speed of payment systems in the U.S. In Europe, the EU's PSD2 regulation encourages competition and innovation by permitting third-party providers secure access to bank data, which enhances consumer choices and enriches the digital banking landscape. According to a report from the World Bank, more than 1.7 billion adults worldwide remain unbanked, highlighting the potential for digital banking solutions to drive financial inclusion, especially in developing regions.

Here's a table that outlines different types of digital banking platforms, reflecting the various offerings in the Digital Banking Market:

| Type of Digital Banking Platform | Description |

|---|---|

| Mobile Banking Apps | Applications that allow users to manage their finances on mobile devices, offering features like balance checks, transfers, and bill payments. |

| Digital Wallets | Services that allow users to store and manage payment information securely for online and in-store purchases. |

| Cryptocurrency Exchanges | Platforms where users can buy, sell, or trade cryptocurrencies and manage digital assets. |

| Digital Insurance Platforms | Platforms that provide digital insurance solutions alongside banking services, often allowing for seamless integration. |

Digital Banking Market Size and Forecast:

-

Market Size in 2025E: USD 11.74 billion

-

Market Size by 2033: USD 29.73billion

-

CAGR (2025–2032): 12.32%

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Digital Banking Market Highlights:

-

Rising mobile and internet adoption is driving digital banking, making financial services more accessible, especially in developing regions

-

Digital banking enables account opening, cashless transactions, and 24/7 access, helping unbanked populations integrate into the formal financial system

-

Low transaction costs and remote access through mobile and online platforms make banking more affordable and convenient

-

Digital platforms provide educational tools that improve financial literacy and empower users to manage their finances effectively

-

Rising cyber threats and data breaches create concerns around the security of digital transactions, requiring robust cybersecurity measures

-

Compliance with diverse regulations and limited digital literacy in certain populations hinder adoption and market growth

Digital Banking Market Drivers:

-

Increased smartphone usage makes mobile banking more accessible to a larger population.

-

Growing internet penetration provides better access to digital financial services.

-

Digital banking is a key tool for reaching unbanked populations, especially in developing countries.

Digital banking is pivotal in promoting financial inclusion by offering access to vital banking services for unbanked populations, especially in developing nations. Traditional banking infrastructure often falls short in rural and underserved areas, restricting access to financial services. Digital banking addresses these challenges by utilizing mobile devices and internet connectivity, allowing individuals to open accounts, transfer funds, and manage finances without needing physical branches. Mobile banking apps and digital payment solutions provide a convenient, affordable means to integrate previously excluded individuals into the formal financial system.

| Aspect of Financial Inclusion | Contribution of Digital Banking |

|---|---|

| Access to Accounts | Enables account opening via mobile devices, even in remote areas. |

| Reduction in Banking Costs | Low transaction costs compared to traditional banking, making it more affordable. |

| Convenience and Reach | Provides 24/7 access to banking services without physical limitations. |

| Financial Education | Digital platforms offer educational tools to improve financial literacy. |

| Cashless Transactions | Promotes digital payments, reducing reliance on cash and enabling secure transactions. |

The rapid rise in smartphone use and internet access in developing regions is driving digital banking adoption, empowering millions with financial independence. Moreover, partnerships between governments and financial institutions are leading to digital identity programs, making it easier for unbanked individuals to join the formal financial sector. By bridging the gap between unbanked communities and financial services, digital banking fosters economic development and enables individuals to participate more actively in their economies.

Digital Banking Market Restraints:

-

Compliance with varying regulations across different countries creates operational complexities for digital banking providers.

-

Limited digital literacy among certain demographics, especially in developing regions, hampers the adoption of digital banking services.

-

Increasing cyber threats and data breaches raise concerns about the security and privacy of digital transactions.

The digital banking market is increasingly challenged by rising cyber threats and data breaches, heightening concerns about the security and privacy of digital transactions. With more financial services moving online, banks and fintech firms have become prime targets for cyberattacks. In 2023, IBM reported that the financial sector experienced the highest average cost of data breaches, estimated at $5.72 million globally. A notable example is the 2022 cyberattack on fintech company Revolut, which compromised the personal data of around 50,000 customers, impacting consumer trust in digital banking. Similarly, phishing attacks are escalating, with the FBI noting a 60% rise in SMS phishing scams targeting financial transactions in the U.S. in 2023.

These incidents emphasize the need for improved cybersecurity and increased customer awareness to safeguard digital transactions. Without confidence in data security, consumers may hesitate to adopt digital banking, which could hinder market growth. Thus, investments in advanced security measures and adherence to regulatory compliance are essential to maintain customer trust and support the ongoing expansion of digital banking.

Limited digital literacy among specific populations, particularly in developing regions, significantly hinders the adoption of digital banking services. Many individuals in these areas lack the essential skills to navigate online platforms, leading to hesitance in utilizing digital banking solutions. According to the International Telecommunication Union (ITU), around 2.9 billion people worldwide are still offline, mainly in developing countries where digital literacy levels are particularly low. For instance, a 2022 survey in rural India revealed that only 25% of respondents felt confident using mobile banking applications. Many expressed concerns about their ability to carry out transactions or manage accounts online due to their unfamiliarity with technology. Additionally, the World Bank estimates that approximately 1.7 billion adults globally are unbanked, with a significant number lacking the digital skills needed to effectively access financial services. This lack of digital literacy not only prevents individuals from obtaining essential banking services but also exacerbates financial exclusion, limiting their participation in the economy.

Digital Banking Market Segment Analysis:

By Deployment

In 2025, the on-premise segment dominated the market and accounted for 74.2% of the revenue share which is expected to grow at the highest CAGR during the forecast period. It is preferred for its enhanced security, allowing IT and security teams direct access to the software within their network, giving them complete control over its configuration, management, and security.

The cloud segment, which held the second-largest revenue share in 2025, is anticipated to grow at the highest CAGR during the forecast period. Cloud and SaaS solutions are key to promoting inclusive banking, as they offer accessible and flexible financial services to underserved communities.

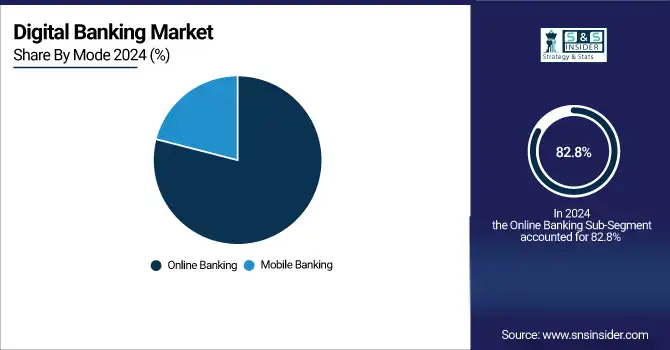

By Mode

In 2025, the online banking segment led the digital banking platform market and captured 82.8% of revenue. As the most recent way of delivering retail banking services, online banking provides features like inter-account transfers, balance reporting, and other common retail banking activities. These services allow customers to access information and conduct transactions, such as bill payments, through telecommunications networks, without leaving their homes or workplaces.

The mobile banking segment is anticipated to grow at a CAGR of 12.1% during the forecast period, driven by increasing smartphone adoption, expanding internet access, and growing customer preference for convenient, on-the-go banking solutions. Reduced service fees, enhanced user experience through intuitive app interfaces, and improved security features have also contributed to its growth. Additionally, rising financial inclusion efforts, particularly in emerging markets, and the integration of value-added services like payments, investments, and lending further boost mobile banking adoption.

By Component

In 2025, the platform segment led the digital banking platform market which captured 60.6% of the revenue share. The expansion of the platform segment in the digital banking platform market is propelled by banks which increasingly embracing digital transformation to adapt to changing customer needs and enhance their service offerings. The rise of fintech and technological innovations has led to the development of more advanced digital platforms. Factors contributing to this growth include integration with cloud services, improved scalability, cost efficiency, and a heightened focus on user experience. Additionally, the growing demand for seamless and secure banking solutions is driving further adoption of these platforms.

The services segment is anticipated to grow at the highest CAGR during the forecast period. Since the rise of fintech, driven by tech giants introducing new business platforms, banks have accelerated digital transformation efforts. To meet customer needs and proactively introduce new products, banks are increasingly leveraging digital technologies. The shift of financial services to the cloud supports a customer-centric approach by reducing barriers to entry and expanding access to banking solutions. This transition also enables the creation of new service offerings that leverage scale, data, and technology, facilitating faster and more efficient access to data for regulatory compliance, risk mitigation, and detecting anomalies in risk management.

By Service

The professional service segment dominated the market with a revenue share of 65.01% in 2025. The professional services segment in the digital banking market is experiencing growth driven by several factors like increasing regulatory compliance requirements necessitating expert guidance and support, prompting banks to seek professional services for compliance management.

The managed service segment is expected to experience the highest CAGR during the forecast period. Managed data center services can optimize corporate operations in a hybrid IT environment by enhancing business automation and management. With the rise in cyberattacks, the adoption of managed security services across various industries is expected to increase.

Managed security services are widely used in business operations to protect sensitive data. The demand for these services is driven by the significant challenges associated with growing network complexity, which complicates effective data security management. Consequently, the need for managed security services has surged, as they help businesses automate compliance monitoring and identify and mitigate risks through comprehensive security audits.

By Type

The retail banking segment dominated the market and represented over 31.4% of revenue in 2025 and is anticipated to grow at a CAGR of 11.2% during the forecast period. The growth of digital banking, advancements in technology, integration of industrial ecosystems, and an increased emphasis on innovation pose both challenges and opportunities for the banking sector. Customers are progressively adopting digital platforms and fintech solutions, which are disrupting traditional relationships in essential financial services like deposits, loans, payments, and investments. As of July 2024, the Unified Payments Interface (UPI) in India has seen significant growth, with a total transaction volume of 14.44 billion, reflecting a year-on-year increase of 45%. The total transaction value reached ₹20.64 lakh crore (approximately USD 2.5 trillion), which is a 35% increase compared to the previous year

On the other hand, the investment banking segment held a significant revenue share in 2024. The reopening of international markets and government stimulus initiatives have led to a notable increase in investment banking activities. Many investment banks have resumed office operations and are conducting limited in-person client meetings. Furthermore, to enhance and streamline deal origination processes, investment banks are implementing hybrid conference strategies alongside the latest technologies.

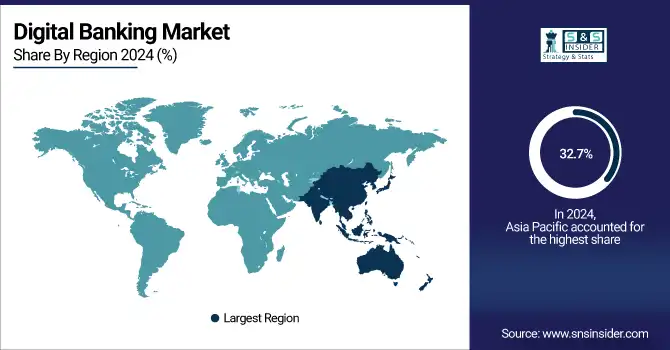

Digital Banking Market Regional Analysis:

Asia-Pacific Digital Banking Market Trends:

The Asia Pacific region led the digital banking market with a 32.7% share in 2025. This growth is driven by increasing demand for mobile and online banking services. New digital firms are revolutionizing the sector for both consumers and businesses, creating significant opportunities for established companies and newcomers as regulators broaden licensing and set new standards.

Need any customization research on Digital banking market - Enquiry Now

North America Digital Banking Market Trends:

North America held the second-largest market share at 29.2% in 2025. The region is seeing a rise in the adoption of cloud-based solutions across multiple sectors, including banking and finance. As banks increasingly adopt cloud-based digital banking platforms, this trend is likely to continue due to benefits like reduced startup costs and rapid updates.

Europe Digital Banking Market Trends:

Europe accounted for approximately of the market in 2025. Growth is driven by increasing adoption of digital payments, fintech partnerships, and open banking initiatives. Regulatory support under PSD2 encourages secure, customer-centric digital banking services, fostering innovation in both retail and corporate banking.

Latin America Digital Banking Market Trends:

Latin America held around a share of the market in 2025. Expansion of mobile banking is supported by increasing smartphone penetration and fintech startups targeting underserved populations. Government initiatives promoting digital financial inclusion are further fueling market growth.

Middle East & Africa (MEA) Digital Banking Market Trends:

The MEA region accounted for about of the market in 2025. Growth is driven by adoption of digital wallets, mobile banking apps, and government-led financial inclusion initiatives. Investments in fintech infrastructure are enhancing accessibility, security, and efficiency across the region.

Digital Banking Market Key Players:

-

Ant Group - (Alipay, MyBank)

-

PayPal - (PayPal Digital Wallet, Venmo)

-

Square, Inc. - (Cash App, Square Payments)

-

Revolut - (Revolut Banking, Cryptocurrency Trading)

-

N26 - (N26 Bank Account, N26 Business Account)

-

Chime - (Chime Spending Account, Chime Savings Account)

-

Robinhood - (Stock Trading App, Cash Management Account)

-

Monzo - (Monzo Current Account, Monzo Business Account)

-

Starling Bank - (Starling Personal Account, Starling Business Account)

-

Sofi - (SoFi Invest, SoFi Money)

-

Stripe - (Stripe Payments, Stripe Atlas)

-

LendUp - (LendUp Loans, LendUp Credit Card)

-

Zelle - (Zelle Payment Service, Zelle App)

-

NuBank - (NuConta, NuPay)

-

Varo Bank - (Varo Bank Account, Varo Savings Account)

-

Fidor Bank - (Fidor Smart Account, Fidor Business Account)

-

Tink - (Tink API, Tink Payments)

-

Curve - (Curve Card, Curve Money Management)

-

TransferWise - (Wise) (Wise Currency Exchange, Wise Multi-Currency Account)

-

Klarna - (Klarna Pay Later, Klarna Checkout)

Digital Banking Market Competitive Landscape:

nCino, founded in 2012, is a U.S.-based cloud banking software provider that enhances digital banking operations for financial institutions. Its solutions streamline consumer banking, commercial lending, treasury management, and deposit account opening. By leveraging cloud technology, nCino improves efficiency, compliance, and customer experience, enabling banks to accelerate processes, reduce costs, and deliver innovative, customer-centric financial services.

-

In April 2024, nCino enhanced its consumer banking solution for banks and credit unions by expanding its omnichannel functionality, and streamlining multi-product origination workflows for bankers and customers.

nCino partnered with Saikyo Bank, Ltd. in Japan to enhance the bank’s digital banking capabilities. Through this collaboration, Saikyo Bank leverages nCino’s cloud-based solutions to streamline consumer and commercial banking operations, improve customer experience, and accelerate loan and account processing. The partnership aims to drive efficiency, compliance, and innovation in Japan’s banking sector.

-

In February 2024, nCino partnered with Saikyo Bank, Ltd. in Japan to improve operational efficiencies and customer convenience by simplifying its mortgage business processes, from reception to loan execution. These developments aim to enhance the overall efficiency and user experience in the banking sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 11.74 billion |

| Market Size by 2033 | USD 29.73 billion |

| CAGR | CAGR of 12.32% from 2026-2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Platforms, Services) • By Deployment(On-Premise, Cloud) • By Mode(Online Banking, Mobile Banking) • By Service(Professional Service, Managed Service) • By Type(Retail Banking, Corporate Banking, Investment Banking) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ant Group, PayPal, Square, Inc., Revolut, N26 , Chime , Robinhood, Monzo, Starling Bank, Sofi, Stripe, LendUp, Zelle, NuBank, Varo Bank, Fidor Bank, Tink, Curve, TransferWise, Klarna |