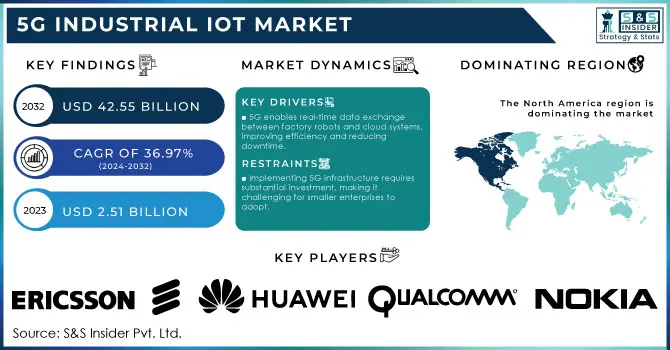

5G Industrial IoT Market Key Insights:

The 5G Industrial IoT Market size was valued at USD 2.51 billion in 2023 and is expected to reach USD 42.55 Billion by 2032, with a growing CAGR of 36.97% over the forecast period of 2024-2032.

The 5G Industrial IoT Market is rapidly expanding as industries leverage next-generation connectivity for automation, smart operations, and real-time data monitoring. With its ultra-low latency and high bandwidth, 5G enhances the potential of Industrial IoT by supporting applications such as predictive maintenance, remote monitoring, and autonomous operations across sectors like manufacturing, energy, transportation, and healthcare.

To Get More Information on 5G Industrial IoT Market - Request Sample Report

This surge intensifies the need for the faster, more reliable connectivity that 5G provides. For example, 5G facilitates seamless communication between robots on factory floors and cloud systems in manufacturing, enabling real-time data analysis and production adjustments. Bosch, a leader in industrial automation, reported a 15% reduction in equipment downtime in 2023, thanks to 5G-enabled IoT, which allowed for real-time monitoring and faster responses to equipment issues.

Another key driver of 5G Industrial IoT adoption is the emphasis on smart cities and infrastructure improvements. Globally, government initiatives and investments are fueling the use of 5G-enabled technologies in urban planning and management. In the U.S., a USD 65 billion investment in smart infrastructure through the Infrastructure Investment and Jobs Act promotes IoT applications in urban traffic, public safety, and energy systems, significantly driving demand for 5G-powered IoT devices.

The rise of Industry 4.0 is also accelerating interest in 5G-enabled IoT. As factories advance in automation and digitalization, 5G is vital in supporting autonomous systems. For instance, the energy sector leverages 5G IoT for enhanced monitoring in remote or challenging locations, such as European wind farms, where 5G sensors optimize turbine performance and environmental monitoring, maximizing energy output and reducing maintenance costs. Furthermore, industries are increasingly adopting private 5G networks to enhance security and control over their data. According to a recent report, over 30% of manufacturing and logistics firms have adopted private 5G networks to secure data and improve operational efficiency as of 2024.

Overall, growth in the 5G Industrial IoT Market is propelled by the rapid expansion of connected devices, government-backed initiatives, Industry 4.0 developments, and private network adoption, with 5G delivering the low-latency, high-bandwidth connectivity essential for advanced industrial applications.

Market Dynamics

Drivers

-

5G enables real-time data exchange between factory robots and cloud systems, improving efficiency and reducing downtime.

-

5G IoT enables efficient monitoring in remote and hazardous locations, optimizing asset performance and reducing maintenance costs.

-

Supports automation and digitalization, particularly for remote monitoring and autonomous systems in manufacturing and energy.

The 5G Industrial IoT Market plays a pivotal role in advancing automation and digital transformation across industries, particularly in manufacturing and energy. In manufacturing, the ultra-low latency and high bandwidth of 5G provide seamless connectivity between machines, sensors, and cloud systems, enabling real-time communication and automated adjustments in production. For example, industrial robots and assembly-line equipment can instantly transmit operational data to cloud servers, where AI-driven analytics deliver immediate insights. This supports predictive maintenance, reducing downtime by identifying and addressing issues early. Moreover, real-time monitoring empowers factory managers to make swift, data-driven decisions, optimizing production speed, and quality, and minimizing waste.

In the energy sector, 5G significantly enhances the monitoring and management of remote and challenging locations, such as offshore oil rigs, wind farms, and solar fields. The need for rapid, reliable data transfer in these environments makes 5G essential for Industry 4.0 initiatives. By equipping energy infrastructure with IoT sensors connected via 5G, companies can continuously monitor equipment performance, environmental conditions, and safety metrics in real-time. For instance, European wind farms now leverage 5G-enabled IoT systems to track turbine efficiency, weather conditions, and maintenance needs, maximizing energy output. This approach minimizes manual intervention in difficult or hazardous areas, reducing both operational costs and personnel risks.

Furthermore, 5G’s support for autonomous systems is transformative. As energy companies work to reduce carbon emissions and manufacturers strive for greater productivity, 5G-enabled autonomous vehicles and robots are becoming integral. These machines can manage hazardous tasks, safely operate in challenging environments, and perform complex processes with precision—all while being remotely monitored and controlled. As 5G networks expand, these autonomous systems will facilitate a shift toward more sustainable, secure, and efficient industrial operations.

5G empowers the manufacturing and energy sectors with enhanced automation, digitalization, and autonomy, driving efficiency gains, improving safety, and enabling real-time decision-making in industrial settings.

Restraints

-

Implementing 5G infrastructure requires substantial investment, making it challenging for smaller enterprises to adopt.

-

5G-enabled IoT devices often require more power, posing challenges for remote or off-grid applications.

-

Integrating 5G with existing legacy systems and infrastructure can be technically challenging and time-consuming.

The 5G Industrial IoT Market report emphasizes that integrating 5G with legacy systems can be challenging due to the presence of outdated infrastructure in many industrial environments, which may not be fully compatible with 5G standards. These were legacy systems that had not prepared themselves to the speed and low-latency data transfer capabilities available with 5G, so integration with new 5G-enabled devices requires complex upgrades or overhauls. For instance, old manufacturing equipment might not be able to communicate data in real-time, something 5G IoT applications need. To mitigate this problem, enterprises usually have to deploy additional hardware like IoT gateways for translating the data from the 5G networks and legacy devices, making it an expensive and a more cumbersome integration process.

In addition, legacy systems often use proprietary protocols and architectures that may not be well suited for 5G networks. The integration of legacy systems is particularly challenging due to this lack of standardization, as each system may require a tailored adaptation approach. Moving data from such legacy systems to 5G platforms can also take time, as many times, reformatting and compliance with new standards are needed for the data; thus adding to the deployment timescales and costs. However, industries that rely on continuous operations, such as manufacturing and energy, may face possible disruptions or downtime during their transition to 5G — which is why some stakeholders have been slow to adopt the technology.

In addition, the requirement of cloud computing and edge processing for high-quickness 5G further complicates the integration process. Since legacy systems are not powerful enough to process all the data demands from 5G IoT applications, companies may need to also invest in edge computing infrastructure in tandem with their 5G upgrades and deploy high-throughput performance closer to its source — like on factory floors or even in remote areas.

Potential 5G customers outside the tech industry also face a host of technical and logistical hurdles that continue to slow its adoption, especially in industries with higher capital outlays for legacy systems. However, although 5G holds the potential to revolutionise industrial IoT, the immediate limitations of connecting with existing systems imposes a major barrier which will require careful formulation and considerable investment. Therefore, a transition to better industrial connectivity is likely to be progressive and piecemeal rather than instantaneous.

Segment Analysis

By Component

The hardware segment dominated the market and represented significant revenue share in 2023, owing to the growing demand for a wide range of hardware required at different levels of operation including devices with 5G capabilities alongside infrastructure activities like routers, gateways, sensors, etc. Industries have focused mainly on upgrading their previously established networks and introducing new 5G devices, which makes this segment expected to remain its frontrunner status. Organizations opt for better connectivity and greater automation and thus will increase the demand for reliable hardware solutions such as IoT gateways and sensors. In addition, due to the increasing trend of smart manufacturing and real-time analytics, sales of hardware will also probably grow with stable pace throughout the forecast period.

The service segment – especially professional services – is expected to grow at the highest CAGR from 2024-2032. The growth in demand for 5G systems, particularly integration consulting and support services is driving this trend. Upskilling and professional services will be a growing sector in general — organizations will need guidance on how to timely link the new 5G technology with existing legacy systems. The single biggest expectation in managed services will be high demand, as enterprises prefer to outsource 5G deployment and upkeep complexities. This segment will continue to grow and benefit from increasing digital transformation across industries, resulting in a more dominant market position and a focus on end-to-end service offerings.

By Organization Size

In 2023, the large enterprise segment led the 5G Industrial IoT market, driven by significant investments in advanced technologies and an urgent need for improved operational efficiency. These enterprises swiftly adopt 5G to support complex applications such as real-time analytics, automation, and smart manufacturing. The extensive scale of their operations demands robust connectivity solutions, making 5G an appealing choice for enhancing productivity and lowering costs. Furthermore, the growing integration of IoT devices in large operations is anticipated to sustain strong demand for 5G solutions. To maintain a competitive advantage, these enterprises are expected to continue investing heavily in 5G technology, ensuring ongoing growth in this segment throughout the forecast period.

The small and medium enterprise (SME) segment is expected to register the highest CAGR in the 5G Industrial IoT market from 2024 to 2032. This growth is mainly driven by the increasing accessibility and affordability of 5G technology, allowing SMEs to utilize advanced connectivity for a variety of applications. With a strong emphasis on digital transformation, SMEs are adopting 5G to boost operational efficiency, enhance customer experiences, and enable remote monitoring and control. Additionally, the rise of cloud-based solutions and managed services is simplifying the integration of 5G technology for SMEs without significant upfront investments. As more SMEs become aware of the advantages of 5G, including improved data processing and real-time communication, this segment is projected to experience rapid growth in the years ahead.

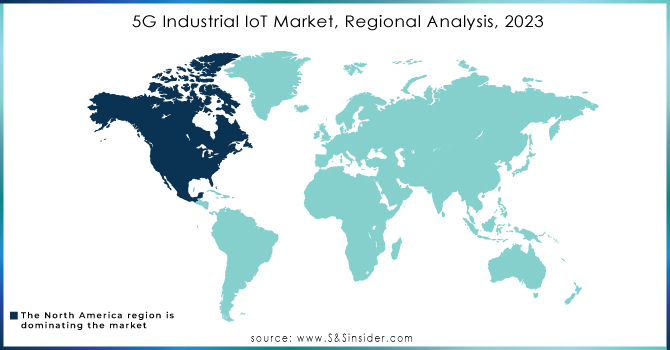

Regional Analysis

In 2023, North America solidified its position as the top region in the 5G Industrial IoT market, backed by substantial investments in cutting-edge technologies and a robust industrial foundation. The presence of major industry players, coupled with a strong focus on digital transformation and smart manufacturing, has facilitated the broad deployment of 5G solutions. Additionally, government initiatives promoting the 5G rollout and an increasing demand for low-latency communication in industries such as manufacturing, energy, and logistics are expected to reinforce this leadership in the years ahead.

The Asia-Pacific region is forecasted to achieve the highest CAGR from 2024 to 2032. This growth is primarily driven by rapid urbanization, rising smartphone adoption, and a surge in IoT applications across multiple sectors. Countries such as China and India are investing heavily in 5G infrastructure, fostering advancements in industrial automation and smart city projects. The region’s commitment to enhancing connectivity and operational efficiency is propelling the adoption of 5G, resulting in significant market growth.

Do You Need any Customization Research on 5G Industrial IoT Market - Inquire Now

Key Players

The major key players are

-

Cisco Systems, Inc. - Cisco Ultra-Reliable Wireless Backhaul

-

Nokia Corporation - Nokia Digital Automation Cloud

-

Ericsson - Ericsson Private 5G

-

Huawei Technologies Co., Ltd. - Huawei 5G Industrial Router

-

Qualcomm Technologies, Inc. - Qualcomm 5G NR Modem

-

IBM Corporation - IBM Watson IoT Platform

-

Siemens AG - Siemens MindSphere

-

General Electric (GE) - Predix Platform

-

Zebra Technologies Corporation - Zebra ZD620 Industrial Printer

-

Schneider Electric - EcoStruxure IoT-enabled solutions

-

Dell Technologies Inc. - Dell Edge Gateway 3000 Series

-

Keysight Technologies, Inc. - Keysight 5G Network Emulation Solutions

-

Palo Alto Networks - Prisma Access for 5G

-

Bosch Rexroth AG - Smart Automation Solutions

-

Rockwell Automation - FactoryTalk Edge Gateway

-

Honeywell International Inc. - Honeywell Connected Plant

-

Amazon Web Services, Inc. (AWS) - AWS IoT Greengrass

-

Fujitsu Limited - Fujitsu 5G Open RAN Solution

-

Mitsubishi Electric Corporation - MELFA Robot Series

-

Samsung Electronics Co., Ltd. - Samsung 5G vRAN (Virtualized Radio Access Network)

Recent Developments

-

August 2024: Honeywell announced the rollout of its Connected Plant solutions, which now include support for 5G connectivity to enhance operational insights and efficiency.

-

June 2024: Rockwell Automation launched a new edge device that leverages 5G connectivity to improve machine learning capabilities in manufacturing settings.

-

April 2024: Samsung unveiled its new 5G vRAN solutions, designed to support industrial IoT applications with low latency and high reliability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.51 Billion |

| Market Size by 2032 | USD 42.55 Billion |

| CAGR | CAGR of 36.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Hardware, Solution, Service) • By Organization Size (Large Enterprise, SMEs) • By Application (Predictive Maintenance, Business Process Optimization, Asset Tracking & Management, Logistics & Supply Chain Management, Real-time Workforce Tracking & Management, Automation Control & Management And Emergency, Incident Management & Business Communication) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Nokia Corporation, Ericsson, Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., IBM Corporation, Siemens AG, General Electric (GE), Zebra Technologies Corporation, Schneider Electric |

| Key Drivers | • 5G enables real-time data exchange between factory robots and cloud systems, improving efficiency and reducing downtime. • 5G IoT enables efficient monitoring in remote and hazardous locations, optimizing asset performance and reducing maintenance costs. |

| RESTRAINTS | • Implementing 5G infrastructure requires substantial investment, making it challenging for smaller enterprises to adopt. • 5G-enabled IoT devices often require more power, posing challenges for remote or off-grid applications. |