Content Intelligence Market Report Scope & Overview:

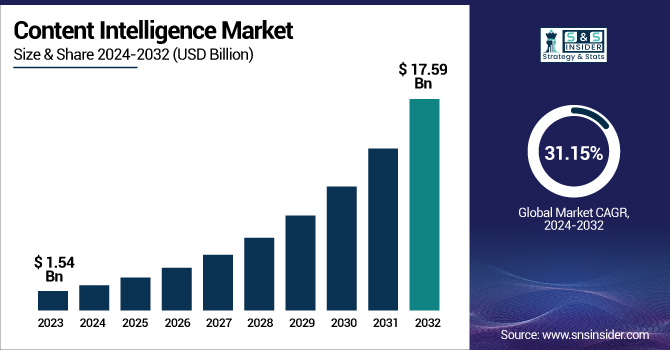

The Content Intelligence Market was valued at USD 1.54 billion in 2023 and is expected to reach USD 17.59 billion by 2032, growing at a CAGR of 31.15% from 2024-2032.

To Get more information on Content Intelligence Market - Request Free Sample Report

The report covers significant trends that are driving the respective market such as the increasing data volume processed, leaps in AI-powered human content creation, and the accuracy of automated sentiment analysis for customers. The latest highlights how organizations are embracing augmented intelligence into their workflows, how data privacy and compliance has changed, the ongoing connection of content intelligence tools with adjacent technologies, and the quantifiable decrease in cost for content operations. In addition, the data points to the increasing power of content intelligence over UGC. With organizations now looking for more impactful strategic content decisions and enhanced understanding of the audiences they serve, content intelligence is quickly becoming less of a competitive differentiation, and more of a strategic operational requirement across industries.

U.S. Content Intelligence Market was valued at USD 0.43 billion in 2023 and is expected to reach USD 4.88 billion by 2032, growing at a CAGR of 30.87% from 2024-2032.

This remarkable growth is driven by rising demand across industries for bespoke data-based content strategies. With enterprises looking to facilitate the best possible engagement and conversion, the infusion of AI and machine learning in content workflows is a strategic necessity. Increasing omnichannel marketing, the requirement for quicker customer sentiment analysis and the compulsory nature of evolving data privacy regulations, are all contributing to accelerating adoption. Its role in driving market growth across the U.S. is further fueled by the need for operational efficiency and increasing influence of user-generated content.

Content Intelligence Market Dynamics

Drivers

-

Explosion in digital content creation demands scalable tools to manage and derive insights across platforms and formats

The massive volume of digital content on web, social, and mobile platforms is drowning conventional content management systems. Organizations today need smart solutions to filter through large amounts of unstructured data and identify valuable insights. Content intelligence allows automation in classification, tagging, and performance monitoring, cutting down labor by a large margin. As content gets more and more multimedia-rich, spanning from blogs and video to podcasts and AR/VR experiences—the demand for scalable tools of analysis becomes imperative. These platforms enable marketers to know what works, why it works, and how to repeat success. With remote working speeding up content creation on decentralized teams, businesses are emphasizing systems that integrate creative processes with analytical frameworks. This drive for efficiency and data-driven storytelling is driving demand for content intelligence technologies across industries from publishing to retailing and finance.

Restraints

-

Data privacy concerns and compliance requirements pose barriers to widespread use of content intelligence solutions

As content intelligence solutions base insights on user data, they raise significant privacy, consent, and data governance concerns. Organizations must be sure that their data processing and collection practices are compliant with global laws such as GDPR, CCPA, and other local data protection laws that are also constantly changing. The dual regulation creates compliance costs and complexity for business. Activating Personal Data Any manipulation (wrong) of personal data can cause a loss of reputation and legal consequences. Further, since consumers are constantly becoming more careful on how their information is used, organizations have to introduce sharper anonymization and opt-in approaches on data. Such controls might restrict the insights content intelligence tools can deliver, in terms of depth and breadth. In addition, firms that operate across jurisdictions struggle to align practices, creating friction in deploying platforms. Overall, legal and moral barriers is a great party pooper to fluid content intelligence adoption.

Opportunities

-

Integration of generative AI technologies opens new frontiers in automated, intelligent content creation and optimization

The fusion of generative AI and content intelligence is facilitating opportunities for terms like just-in-time content generation. AI tools like GPT-based language models and image generators enable marketers to quickly brainstorm, create and edit content while matching it to audience interests. Cleverly layered over intelligence platforms, generative tools can, therefore, tailor tone, format, and messaging to real-time performance analytics, audience behaviour and sentiment trends. Such synergy cuts down the content lifecycle by a wide margin and reports better engagement metrics. Additionally, connecting with CRM and martech stacks for hyper-targeted campaigns, which adapt dynamically to various data inputs.

In 2024, M-Files expanded its Partner Program by collaborating with Dyanix, enhancing data management and AI capabilities across the UK, Benelux, and Spain. Industries such as e-commerce, education, and entertainment are exploring AI co-creation as a scalable, cost-effective solution. As generative AI becomes more accessible, content intelligence will drive smarter, faster, and more personalized content experiences at scale.

Challenges

-

Lack of standardization in content performance metrics limits comparability and hinders cross-platform decision-making

Despite the rising adoption of content intelligence tools, there is no standardised framework for assessing content effectiveness. Metrics are usually platform-specific likes, shares, time-on-page, click-through rate and interpreting them across various channels is inconsistent. This inconsistency results in fractured data sets and it becomes challenging for marketers to create holistic insights or compare content success. Decision-makers are at a loss in getting KPIs across departments to align, resulting in siloed reporting and less-than-optimal strategy creation. Additionally, as more platforms and formats of content emerge, measurement complexity grows only stronger. Without unifying the way, organizations lose sight of tying content creation back to ROI. This analytical dissonance does not only erode performance evaluation but also eats away at confidence in AI-powered recommendations. Until the market coalesces around standard measures and approaches, content intelligence's full strategic potential will be hard to achieve.

Content Intelligence Market Segment Analysis

By Component

The software segment led the Content Intelligence Market in 2023 with a dominant revenue share of approximately 71% because of its vital function of providing scalable, automated, and data-driven content solutions for creation, analysis, and optimization. Businesses are investing heavily in AI-based platforms that optimize content workflows, facilitate performance monitoring in real time, and provide actionable insights. Software solutions also offer adaptable integrations with current digital infrastructure, and thus they are a central part of digital transformation strategies in various industries.

The services segment is projected to grow at the fastest CAGR of 32.55% from 2024 to 2032, due to growing demand for customization, implementation support, and strategy consulting. With organizations opting for content intelligence platforms to reap the most from their investment, they seek expert advice on implementing them. The mass adoption of AI tools by companies creates knowledge voids that is filled with professional services to bring companies up to speed, provides seamless introduction to produce content intelligence, and implements content intelligence in scale but tailored to individual companies operational needs

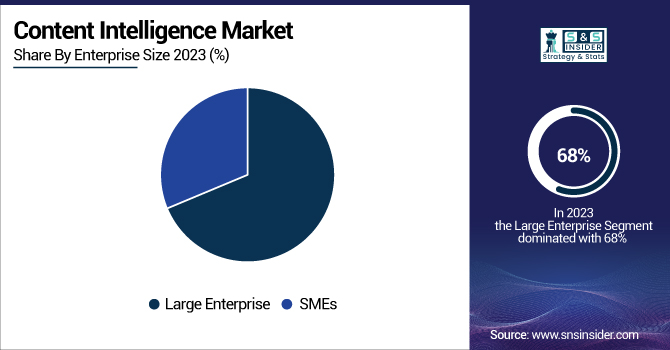

By Enterprise Size

Large enterprises dominated the Content Intelligence Market in 2023 with a 68% revenue share, mainly because of their extensive content businesses and intricate data ecosystems. They have the financial means and digital maturity to invest in next-generation analytics tools, artificial intelligence platforms, and integration frameworks. With large customer bases and numerous digital touchpoints, they need scalable intelligence solutions to produce personalized, omnichannel content strategies. Their focus on brand consistency, compliance, and measurable impact further reinforces adoption.

SMEs are expected to experience the fastest CAGR of 32.89% between 2024 and 2032, spurred by growing access to affordable, cloud-based content intelligence solutions. With competitive pressure rising, small enterprises are leveraging AI-powered solutions to maximize limited resources and make messaging unique. Cloud-based solutions have reduced entry barriers, enabling SMEs to implement intelligent content strategies without incurring huge infrastructure costs. This democratization is contributing to faster adoption in the retail, technology, and service industries.

By Deployment

The cloud segment held the largest revenue share of approximately 51% in 2023 due to its flexibility, scalability, and ease of deployment. Cloud-based content intelligence platforms facilitate real-time collaboration, centralized access to data, and effortless updates, which make them suitable for dynamic content environments. Enterprises prefer cloud models more and more to prevent the overhead of on-premises systems, enhance agility, and combine with other cloud-native tools. This transition has made cloud the deployment mode of choice for the majority of digital-first companies.

The hybrid segment is expected to grow at the fastest CAGR of 33.41% from 2024 to 2032, as enterprises find a balanced medium between data control and operational flexibility. Hybrid deployments enable organizations to keep sensitive content and data in private environments whilst benefiting from the cloud-scale capabilities for processing and analytics. For the industries with strict compliance-related requirements, this model provides a customized offering, which addresses the need for agility and governance for content intelligence.

By End-use

Media & Entertainment led the Content Intelligence Market in 2023 with a commanding 25% revenue share, reflecting the industry's focus on high-volume, real-time content creation. Streaming services, digital publishers, and broadcasters are all embracing content intelligence to analyze viewer tastes, personalize viewing, and maximize content placement across platforms. Data-driven storytelling, improved engagement, and advertising targeting have made AI-driven insights a necessity. In addition, the industry is continuously evolving with new content formats such as interactive video, podcasts, and AR/VR, all of which are supported by smart content optimization. With increased competition, media companies leverage content intelligence to optimize content lifecycle value, enhance monetization strategies, and maintain creative relevance. The convergence of technology and entertainment has rendered content intelligence the central driver of operational efficiency and viewer retention in this data-driven industry.

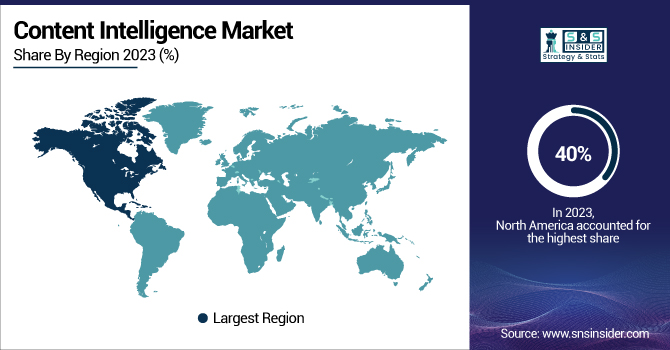

Regional Analysis

North America led the Content Intelligence Market in 2023 with a dominant 40% revenue share supported by advanced digital infrastructure, high adoption rate of AI technologies, and presence of leading content intelligence market vendors. Many enterprises, especially in media, retail, and tech are exploiting content intelligence to differentiate and engage customers. These investment pools are bolstered further by the region's well-established marketing ecosystems, emphasis on data-driven strategies and favorable and supportive regulatory frameworks. Furthermore, North American firms have the money and technical means to make AI part of their content operations at scale.

Asia Pacific is projected to register the fastest CAGR of 33.55% between 2024 and 2032, due to accelerated digitalization, increasing internet penetration, and increased interest in local content in various markets. China, India, and Southeast Asia are witnessing a content consumption boom, particularly on social and mobile platforms. Increased investments in AI, expanding e-commerce ecosystems, and the spread of digital-first startups are driving the adoption of content intelligence solutions. Government-driven digital initiatives and data-driven marketing awareness also fuel the region's explosive growth path.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Adobe (Adobe Experience Manager, Adobe Sensei)

-

M-Files (M-Files Intelligent Information Management, M-Files Workflow Automation)

-

OpenText (OpenText Content Suite, OpenText Magellan)

-

Curata (Curata Content Curation, Curata Content Marketing Platform)

-

Scoop.it (Scoop.it Content Curation, Scoop.it Insights)

-

Social Bakers (Social Media Marketing, Social Media Analytics)

-

Atomic Reach (Atomic AI, Atomic Insights)

-

OneSpot (OneSpot Personalization, OneSpot Content Delivery)

-

Vennli (Vennli Content Strategy, Vennli Insights)

-

Messagepoint Inc. (Messagepoint, Messagepoint Composer)

-

IBM (IBM Watson Content Hub, IBM Watson Media)

-

ChapsVision (ChapsVision Insights, ChapsVision Personalization)

-

Brain Corp (BrainOS, BrainOS Content Intelligence)

-

Google Cloud (Google Cloud AI, Google Cloud BigQuery)

-

MarketMuse (MarketMuse Content Optimization, MarketMuse Research)

-

Idio (Idio Content Personalization, Idio Marketing Automation)

-

Acrolinx (Acrolinx Content Governance, Acrolinx AI-Driven Writing)

-

Salsify (Salsify Product Experience Management, Salsify Content Hub)

-

Cognitivescale (Cognitivescale AI-powered Insights, Cognitivescale Cortex)

-

Yseop (Yseop Compose, Yseop Business Automation)

-

BrightEdge (BrightEdge SEO, BrightEdge Content Performance)

-

ABBYY (ABBYY FineReader, ABBYY FlexiCapture)

-

Concured (Concured Content Optimization, Concured Insights)

-

Emplifi Inc. (Emplifi Social Media Analytics, Emplifi Engagement Platform)

-

Progress Software Corporation (Progress Sitefinity, Progress Telerik)

Recent Developments:

-

At Adobe Summit 2024, Adobe announced the expansion of Content Credentials, enhancing transparency and trust in digital content for enterprises, brands, and consumers. The initiative strengthens content authenticity across creative workflows and AI-generated media.

-

OpenText introduced Titanium X with Cloud Editions 25.2, empowering enterprises to create AI-driven digital workforces. The platform integrates over 100 AI agents, enhancing productivity and compliance across multi-cloud environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.54 Billion |

| Market Size by 2032 | US$ 17.59 Billion |

| CAGR | CAGR of 31.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-premises, Hybrid) • By Enterprise Size (Large Enterprises, SMEs) • By End-use (BFSI, IT & Telecommunication, Manufacturing, Media & Entertainment, Retail & Consumer Goods, Travel & Hospitality, Government & Public Sector, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe, M-Files, OpenText, Curata, Scoop.it, Social Bakers, Atomic Reach, OneSpot, Vennli, Messagepoint Inc., IBM, ChapsVision, Brain Corp, Google Cloud, MarketMuse, Idio, Acrolinx, Salsify, Cognitivescale, Yseop, BrightEdge, ABBYY, Concured, Emplifi Inc., Progress Software Corporation. |