Digital Rights Management Market Report Scope & Overview:

Get more information on Digital Rights Management Market - Request Sample Report

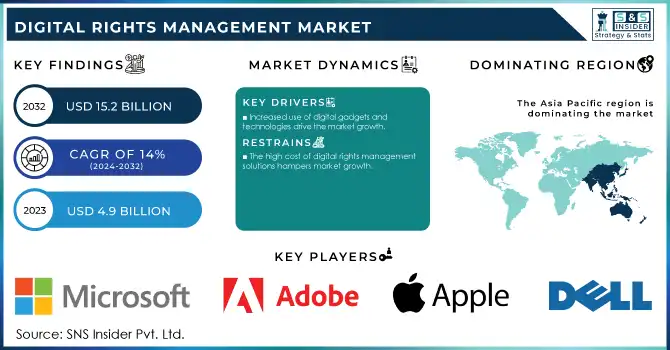

The Digital Rights Management Market Size was valued at USD 4.9 Billion in 2023. It is expected to grow to USD 15.2 Billion by 2032 and grow at a CAGR of 14% over the forecast period of 2024-2032.

Cloud-based DRM solutions are witnessing a rise in demand because they provide scalability, affordability, and flexibility which is ideal for the ever-changing requirements of modern business and content providers. Cloud-based DRM, in contrast to traditional on-premises solutions, enables real-time protection of digital assets across devices and geographies for seamless content delivery. This has made them an appealing prospect for high-growth sectors like media, entertainment, and education, where consumption of digital content is accelerating. Cloud infrastructure helps an organization by availing more security protocols, quick updates, and integration of DRM with the rest of the cloud services to bring down the operational complexity for example. Moreover, a Digital Rights Management in cloud solution also acts as a powerful countermeasure against piracy and unauthorized access, allowing content providers to comply with tough copyright rules and safeguard their intellectual property in an increasingly online world.

Additionally, the European Union Intellectual Property Office (EUIPO) estimates that digital piracy costs the EU economy over USD 52.56 billion annually, driving organizations to adopt cloud-based DRM solutions to safeguard their assets.

Moreover, due to the rise of internet users and the high rate of smartphone penetration, digital content consumption is at an all-time high, from music and video to games and software. As a result of this strong growth, there has been a strong move towards Digital Rights Management (DRM) solutions to protect IP from being misused or copied. DRM is the backbone of this monetization activity and is a crucial element of getting content to customers while protecting it from piracy and unauthorized distribution. In addition, as streaming services, online gaming platforms, and software as a service (SaaS) applications flourish, the need for efficient DRM systems to combat piracy intensifies in a connected world. This trend highlights the spreading footprint of the digital economy and the necessity for DRM to protect digital assets and remain within regulatory compliance. According to the International Telecommunication Union (ITU), global internet users reached 5.3 billion in 2022, reflecting rapid digital adoption.

Digital Rights Management Market Dynamics

Drivers

-

Increased use of digital gadgets and technologies drive the market growth.

The growth of the global digital rights management (DRM) market is primarily due to the rising adoption of digital devices and advanced technologies. There have never been more devices that are either smart or connected (or both), each of which provide consumers with ever-more digital content. Now with the further expansion of technology, there is an urgent demand for strong DRM solutions to safeguard digital property from illegal access and dissemination of rights holders. Also, new device features, including faster processors and better displays, have raised consumer expectations for higher-quality digital content which makes DRM increasingly important for content creators and distributors to protect intellectual property rights, provide entitlement tracking, and enforce copyright laws. The adoption of these technologies in everyday life continues to influence the digital ecosystem, further accelerating the DRM market.

Restraint

The high cost of digital rights management solutions hampers market growth.

The high cost of Digital Rights Management (DRM) solutions especially for SMEs and independent content creators hamper the market growth. Strong DRM systems on the other side bring high costs in the form of software licenses, infrastructure, and integration services, adding weight to the balance sheet of the smaller players. Moreover, the budget is further squeezed with continuous expenses associated with maintaining, updating, and scaling systems to cater to growing content needs. Such a financial hurdle restricts the UD adoption of DRM technologies across the board (cost-sensitive markets in developing regions only make this worse). Additionally, for organizations that hold large libraries of digital content, the complexity and cost of rights management across diverse platforms and geographies add to the total cost of ownership. Although this newer generation of cloud-based and subscription-based solutions helps alleviate the cost to some extent, upfront and operational cost barriers make it out of reach for many content creators and companies entering the market at a variety of sizes and, thus, levels of scale.

Digital Rights Management Market Segmentation Analysis

By Deployment Mode

Cloud held the largest market share around 64% in 2023. It is mainly because loan origination is the first and the most important step of the lending process where a borrower applies for loans and lenders determine whether they qualify for a loan. Moreover, digital lending has greatly eased this process as it automates processes to a good extent, minimizes human intervention, and provides an enhanced experience. A digital loan origination platform helps in faster application, approval, and disbursement for loans, and eliminates quite a few hassles created for borrowers and lenders. So, the response of most financial institutions/lenders is in the form of adopting digital loan origination systems for better customer experience, operational efficiency, and lower costs.

By Enterprise

Large Enterprise held the largest market share around 68% in 2023. This is owing to large digital content repositories and the importance of protecting intellectual property across diverse platforms and geographies. From media conglomerates to multinational corporations and educational institutions, these organizations create and disseminate large volumes of high-value digital content that need effective DRM solutions to prevent exploitation and misuse of their assets. In contrast, large enterprises are well-equipped with funds to incorporate state-of-the-art DRM technologies which help them implement scalable and advanced solutions suitable for their intricate operations. Moreover, strict compliance pressures, such as following copyright regulations and data protection laws like the GDPR and DMCA also push these players to adopt DRM. Big companies use strong DRM systems, that can protect the distribution of content, protect revenue streams, and keep the competitive advantage and position in the market in the globally Microsoft-driven economy.

By Application

Video-on-Demand held the largest market share around 42% in 2023. This is due to the rapid expansion of streaming platforms as well as the increasing consumption of video content around the world. Netflix, Amazon Prime Video, and Disney+ have all grown their user bases dramatically, thanks to the continuous and ever-increasing internet adoption along with smartphone and smart TV penetration in various corners of the world. The size of the VoD segment is immense more than $85 billion in global subscription video-on-demand revenues in 2023 as per the Motion Picture Association (MPA).

DRM solutions are crucial for securing premium content, preventing unauthorized access, and protecting revenue streams for VoD platforms. This becomes important in the fight against piracy, which is particularly a factor in the video streaming industry as well. Meanwhile, governments around the world, as exemplified by the European Union for instance with its Audiovisual Media Services Directive, have reinforced the copyright enforcement mechanism in a way that also promotes the use of DRM in this arena. Given the prevalence of video streaming in online entertainment, the VoD segment will continue to lead in the DRM market.

Digital Rights Management Market Regional Overview

The Asia Pacific region held the largest revenue share around 48% in 2023. It is due to the increased demand of businesses in need of financing and digital rights management which drive the market growth in the region. Furthermore, Asia Pacific is undergoing a remarkable digital transformation, including rising internet penetration rates, smartphone prevalence, and population familiarity with technology, all of which facilitate the adoption of digital financial services. Meanwhile, government initiatives and regulatory frameworks for encouraging digital lending and financial inclusion are creating a conducive environment in nations such as China, India, and Southeast Asian countries. The expanding middle class and rising consumer appetite for personal loans and credit only add to the urgency for digital lending solutions.

Need any customization research on Digital Rights Management Market - Enquiry Now

Key Players in Digital Rights Management Market

-

Microsoft Corporation (Azure Rights Management, Microsoft PlayReady)

-

Adobe (Adobe Digital Editions, Adobe Primetime)

-

Apple Inc. (FairPlay, iTunes DRM)

-

Dell Inc. (Dell Data Protection | Access, Dell Encryption)

-

DivX, LLC. (DivX DRM, DivX Pro)

-

Fasoo (Fasoo Enterprise DRM, Fasoo File Security)

-

IBM Corporation (IBM Security Identity Governance and Intelligence, IBM Cloud Pak for Security)

-

Oracle Corporation (Oracle Digital Rights Management, Oracle Content Management)

-

Sony Corporation (PlayStation Network, Sony DRM for Media Content)

-

Google LLC (Widevine DRM, Google Play Store DRM)

-

SAP SE (SAP Digital Rights Management, SAP Content Server)

-

Verimatrix (Verimatrix Secure Delivery, Verimatrix Streamkeeper)

-

Widevine Technologies (Widevine DRM, Widevine Modular)

-

Irdeto (Irdeto Control, Irdeto Rights Management)

-

SecureMedia (SecureMedia Encryptonite, SecureMedia DRM)

-

Anevia (Anevia Velocix, Anevia DRM solutions)

-

Vobile (Vobile DRM, Vobile Video ID)

-

Nexguard (Nexguard Watermarking, Nexguard DRM Solutions)

-

Kaltura (Kaltura Video Platform, Kaltura DRM)

-

Cegedim (Cegedim DRM, Cegedim Health Data Solutions)

Recent Development:

-

In 2023, Microsoft announced the integration of its Microsoft PlayReady DRM with Azure Media Services, enabling seamless streaming and secure content delivery for both live and on-demand content. This move supports media companies in securing premium content and enhancing user experience across a variety of devices.

-

In 2023, Adobe introduced updates to its Adobe Primetime platform, adding enhanced support for 4K content protection and dynamic watermarking features. This allows content providers to better secure high-value content like movies and live sports broadcasts against piracy.

-

In 2023, Fasoo released a new version of its Fasoo Enterprise DRM platform, introducing enhanced features for cloud security and real-time content monitoring. This development aimed to provide enterprises with improved protection of intellectual property as they adopt hybrid cloud environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.95 Billion |

| Market Size by 2032 | USD 15.2 Billion |

| CAGR | CAGR of 13.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component( Software, Services, Consulting, Integration, Operation and Maintenance) • By Deployment( On-premise, Cloud) • By Industry Vertical( Healthcare, BFSI, Government, Media & Entertainment, Retail & Consumer, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe Systems Inc., Apple Inc., Microsoft Corporation, Google LLC, Sony Corporation, IBM Corporation, Amazon Web Services (AWS), Oracle Corporation, Cisco Systems, Inc., SAP SE, Verimatrix, Symantec Corporation, Seclore Technology, Digimarc Corporation, FileOpen Systems Inc., ContentArmor, Rovi Corporation (TiVo), DRM Inside Co., Ltd., Kudelski Group, Vobile Group Ltd. |

| Key Drivers | • The Rising Need for Digital Rights Management Amid Increasing Cybersecurity Threats in the Digital Age |

| Restraints | • Overcoming the Challenges of Integrating Digital Rights Management into Digital Ecosystems |