Proteinase K Market Size & Overview:

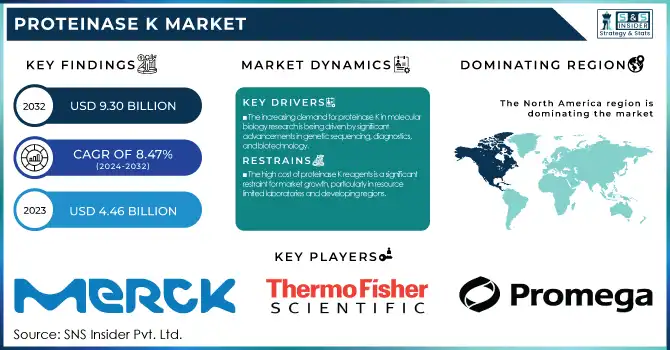

The Proteinase K Market was valued at USD 4.46 billion in 2023 and is projected to grow to USD 9.30 billion by 2032, with a CAGR of 8.47% from 2024 to 2032.

To get more information on Proteinase K Market - Request Free Sample Report

This report presents a global proteinase k market analysis using original statistical data on the incidence and prevalence of conditions in which Proteinase K is indicated, including genomic research, infectious disease, and oncology. It identifies research trends by geographic region in terms of Proteinase K adoption and volume usage across applications from research studies to diagnostics. Moreover, the report outlines healthcare expenditures by region, segmenting government, private, and commercial investment in Proteinase K-related diagnostics and molecular biology research. The information helps develop a better insight into the market's regional forces and application-centric growth.

Proteinase K Market Dynamics

Drivers

-

The increasing demand for proteinase K in molecular biology research is being driven by significant advancements in genetic sequencing, diagnostics, and biotechnology.

Growing demand for proteinase K in research in molecular biology is spurred by tremendous growth in genetic sequencing, diagnostics, and biotechnology. Proteinase K finds extensive use in procedures such as DNA isolation, RNA purification, and proteomics, thus becoming a critical reagent for laboratories engaged in genomic studies and disease identification. The fast-growing increase in genomics, which is being driven by advanced technologies such as CRISPR, is leading to a significant increase in the application of proteinase K. The genomic research industry resulted in increased demand for high-quality molecular biology reagents such as proteinase K, thereby supporting its market growth. In addition, the rising use of personalized medicine and precision diagnostics is a compelling demand for improved methods of extraction, in which Proteinase K features prominently.

-

The global biopharmaceutical industry is a major driver for the Proteinase K market, with the enzyme being instrumental in the production of therapeutic proteins, vaccines, and biologics.

The worldwide biopharmaceutical market is a prime driver for the Proteinase K market, and the enzyme has a pivotal role to play in the manufacturing of therapeutic proteins, vaccines, and biologics. With the rising rates of chronic diseases and the never-ending demand for new vaccines, the use of enzymes such as proteinase K is on the rise for key points in production and quality control. The biopharmaceutical industry is expected to exceed in the coming years, with the Asia Pacific market indicating strong growth opportunities. This expansion is driven by advancements in biotechnology infrastructure, public spending on healthcare, and increasing research activities that further establish the position of proteinase K in drug manufacturing, thus propelling the market growth of the enzyme. Moreover, the increasing application of cell-based therapies, biologics, and monoclonal antibodies for the treatment of numerous diseases has contributed to the augmented use of proteinase K in the drug development process, supporting its market demand.

Restraint

-

The high cost of proteinase K reagents is a significant restraint for market growth, particularly in resource-limited laboratories and developing regions.

The expensive nature of proteinase K reagents is a major deterrent to market expansion, especially for resource-constrained laboratories and emerging markets. Although proteinase K is a crucial enzyme in molecular biology, its high price point can be prohibitive for smaller research institutions, schools, and startups with tight budgets. The expense of obtaining proteinase K, particularly in large bulk volumes, might become too costly to be within their budget of running their business, slowing the entry of this enzyme in some sectors of the market. Further, competition from lower-priced substitutes would drive the aggregate demand for proteinase K downward as scientists search for more inexpensive components to utilize in their workflow. The necessity for affordable alternatives continues to be a persistent problem for expanding its use around the world, particularly in small-scale or nascent research activities.

Opportunities

-

One of the significant opportunities in the Proteinase K Market lies in the growing demand for genomic research, particularly in fields such as personalized medicine, forensic analysis, and genetic testing.

As technology in molecular biology evolves, demand for high-quality enzymes such as proteinase K for DNA/RNA isolation and tissue sample treatment is increasing. The growing genomics industry is driving the uptake of proteinase K in applications like next-generation sequencing (NGS), PCR, and microarray. With pharmaceutical and biotechnology companies putting more resources into research and development (R&D) on genetic therapeutics and diagnostics, demand for proteinase K will also keep growing in the coming years, opening huge market prospects. Further, as governments continue to support more genomic studies and the field of CRISPR advances further, proteinase K is also poised to become a critical enzyme in the new era of gene editing and targeted medicine.

Challenges

-

A major challenge facing the Proteinase K Market is the variability in the quality and availability of proteinase K from different suppliers.

Although proteinase K is a commonly employed enzyme, variability in its performance in terms of different enzymatic activities or purities can harm research results. This is particularly so in demanding applications such as DNA/RNA extraction for sequencing or diagnostics, where accuracy and reproducibility are critical. Even if high-quality proteinase K is available in a particular area or under specific conditions, it could be in short supply, potentially hampering the effectiveness of researchers in conducting projects, particularly in developing economies where supply chains are less developed. Additionally, a lack of consistent quality control from different manufacturers could result in inconsistent batch-to-batch quality, which is risky for users working in high-pressure research settings. Resolution of these issues of quality is important for maintaining the growth of the market and reducing interruptions in scientific advancement.

Proteinase K Market Segmentation Analysis

By Form

The powder segment dominated the proteinase K market with a 56.23% market share in 2023 because of its stability, extended shelf life, and convenience of storage and transportation. Powder proteinase K is most commonly sought after for multiple laboratory uses, particularly in genomic studies, molecular biology, and protein analysis, where it may be stored at room temperature and reconstituted upon demand. Its cost-effectiveness and the fact that it can be used in bulk amounts are also reasons to further reinforce its market dominance. Researchers and labs prefer the powder form because it is convenient, particularly in large-scale DNA extraction and other enzymatic operations, and it is the most preferred in a lot of regular applications.

The liquid form segment of the proteinase k market will experience the fastest growth with 8.83% CAGR during the forecast period as a result of growing use in clinical and diagnostic laboratory environments where convenience, ease of use, and accuracy are paramount. Liquid products have greater solubility, which provides faster and more efficient enzymatic reactions, something of high value in high-throughput and time-sensitive applications like next-generation sequencing (NGS) and gene expression profiling. The increasing need for liquid proteinase K in clinical diagnostics, coupled with its incorporation into automated systems and platforms, is fuelling the rapid growth of the segment. In addition, technological improvements in liquid-based technologies, such as ready-to-use solutions and formulations that meet particular applications, are also fuelling the rising popularity and uptake of liquid proteinase K in the market.

By Therapeutic Area

The infectious diseases segment dominated the proteinase k market with a 31.15% market share in 2023 because of the widespread application of proteinase K in the detection, extraction, and analysis of pathogens such as viruses, bacteria, and fungi. Proteinase K plays a critical role in molecular diagnostics because it helps to recover DNA or RNA from proteinaceous material-contaminated samples, enabling precise identification of infectious agents. Its function in uses like PCR and sequencing for infectious disease pathogen detection has been pivotal, particularly in the continuous management of infectious disease outbreaks such as COVID-19. The increasing spread of infectious diseases across the globe has also fueled the need for proteinase K in research and clinical laboratories, further cementing its supremacy in this therapeutic segment. The demand for effective, rapid, and efficient infectious disease diagnostics has made proteinase K a must-have reagent in infectious disease research, thus making the segment market-leading in 2023.

By Application

Isolation and purification of genomic DNA and RNA segment dominated the proteinase K market with a 60.23% market share in 2023 owing to the indispensable role played by proteinase K in nucleic acid extraction processes. Proteinase K is a commonly employed enzyme in molecular biology for the digestion of contaminating proteins from DNA and RNA while isolating, thus making it a must-have in laboratories globally. This segment is especially important for genomics, diagnostics, and research applications where the high-quality extraction of genetic material is required for downstream applications such as PCR, sequencing, and cloning. The demand for genetic research, personalized medicine, and the increasing emphasis on genomics have fueled the dominance of this application, which is the dominant segment in 2023.

The In Situ Hybridization (ISH) segment is anticipated to grow at the fastest rate in the forecast period with 9.49% CAGR because of the increasing application of proteinase K and enhancing the efficiency of ISH procedures. ISH is a very useful tool for the identification of certain nucleic acid sequences in tissue or cells, and proteinase K is usually used to permeabilize tissue preparations and facilitate optimal hybridization conditions. With increasing research in molecular pathology, cancer genomics, and diagnostics, the demand for accurate tissue-based nucleic acid detection techniques such as ISH has increased. Additionally, the growing emphasis on early disease detection, personalized medicine, and the need for sophisticated diagnostic tools in research and clinical applications are likely to propel the growth of the ISH segment in the future.

By End-use

The biotechnology companies segment dominated the proteinase k market in 2023 with a 37.45% market share, primarily because of the widespread use of proteinase K across a wide range of biotechnology applications such as genetic research, molecular diagnostics, and drug development. Biotechnology firms utilize proteinase K for efficient nucleic acid extraction, an important process in genomics, proteomics, and clinical diagnostics research. With the global biotechnology industry continuing to grow, particularly with the emergence of biopharmaceuticals and gene therapies, the use of proteinase K in these fields has increased dramatically. The sheer amount of research and product development in biotechnology companies has positioned this market as the leading sector in 2023, as proteinase K is critical for quality control and accuracy in their molecular testing.

The academic institutions segment is anticipated to witness the fastest growth during the forecast period on account of growing investments in research and development in sciences and developments in genomics, microbiology, and molecular biology. Academic research institutions are also innovation leaders when it comes to genetics and molecular methods and typically demand efficient and effective enzymes such as proteinase K to isolate and purify nucleic acids. With the increasing interest in academic research collaborations, biotech innovation, and state-sponsored research financing, academic institutes are expected to enhance their usage of proteinase K for seminal studies, most notably in research areas like genetic engineering and disease research. Such an increased trend toward research-oriented use will propel the exponential growth of the academic institutes segment in future years.

Proteinase K Market Regional Insights

North America dominated the proteinase k market with a 44.26% market share in 2023 because of its established biotechnology and pharmaceutical industries, large research infrastructure, and significant investment in genomic and life sciences research. The region has top-ranked academic institutions, government-sponsored research institutes, and large pharmaceutical firms that generate demand for high-quality reagents such as proteinase K in their genomics, molecular biology, and diagnostics research. Moreover, the extensive use of next-generation sequencing (NGS) and advances in precision medicine also drive the market for proteinase K in North America. With a great number of clinical trials, R&D processes, and an increasing emphasis on personalized medicine, North America remains at the forefront of demand and innovation in the proteinase K market.

Asia Pacific will witness the fastest growth in the proteinase k market with 9.81% CAGR throughout the forecast period because the life sciences and biotechnology sectors in the region are expanding at a rapid pace, particularly in China, India, Japan, and South Korea. Growing emphasis on research and development and huge investments in healthcare infrastructure are fueling the demand for proteinase K, especially in genomics research, diagnostics, and clinical use. In addition, the increasing number of biotechnology and pharmaceutical companies in the region and the rising usage of advanced molecular biology technologies are driving the market growth. The region's rapidly developing economies, huge population base, and improving awareness of genetic studies are anticipated to drive the high demand for proteinase K products in the future. Also, government programs and support for genomic studies in developing nations will continue to drive market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Proteinase K Market

-

Merck KGaA (Proteinase K Solution, Proteinase K Lyophilized)

-

Thermo Fisher Scientific, Inc. (Invitrogen Proteinase K, Pierce Proteinase K)

-

Qiagen N.V. (QIAgen Proteinase K, QIAzol Lysis Reagent)

-

F. Hoffmann-La Roche Ltd. (Roche Proteinase K, High Purity Proteinase K)

-

Promega Corporation (Proteinase K, DNA IQ Proteinase K)

-

New England Biolabs (NEB) (NEB Proteinase K, Monarch Proteinase K)

-

Bio-Rad Laboratories, Inc. (Bio-Rad Proteinase K, PureProteome Proteinase K)

-

Takara Bio Inc. (Takara Proteinase K, Nuclease-Free Proteinase K)

-

Abcam plc (Abcam Proteinase K, Abcam Recombinant Proteinase K)

-

Eurofins Scientific (Eurofins Proteinase K, Genomics Proteinase K)

-

Biorbyt Ltd. (Biorbyt Proteinase K, Biorbyt Enzyme Grade Proteinase K)

-

Sekisui Diagnostics, LLC (Sekisui Proteinase K, Diagnostic Grade Proteinase K)

-

Zymo Research Corporation (Zymo Proteinase K, ZR Proteinase K)

-

GenScript Biotech Corporation (GenScript Proteinase K, Molecular Biology Grade Proteinase K)

-

Creative Enzymes (Creative Enzymes Proteinase K, Recombinant Proteinase K)

-

Amano Enzyme Inc. (Amano Proteinase K, Microbial Proteinase K)

-

Biovision Inc. (Biovision Proteinase K, Biovision Ultrapure Proteinase K)

-

Enzo Life Sciences, Inc. (Enzo Proteinase K, Enzo Diagnostic Proteinase K)

-

Worthington Biochemical Corporation (Worthington Proteinase K, Research Grade Proteinase K)

-

MedGenome Labs Ltd. (MedGenome Proteinase K, Clinical Grade Proteinase K)

Suppliers (These suppliers provide raw materials, bulk enzymes, and customized solutions to manufacturers in the Proteinase K Market)

-

Sigma-Aldrich (a subsidiary of Merck KGaA)

-

Thermo Fisher Scientific, Inc.

-

Qiagen N.V.

-

New England Biolabs (NEB)

-

Bio-Rad Laboratories, Inc.

-

Takara Bio Inc.

-

Abcam plc

-

Eurofins Scientific

-

Zymo Research Corporation

-

GenScript Biotech Corporation

Recent Development

-

In 2024, Merck KGaA started integrating Chromabolt single-use columns in bioprocessing plants in both the United Kingdom and Singapore. This is an expansion towards a more flexible batch production, extending the company's protein purification and isolation capabilities further.

-

In 2024, Thermo Fisher introduced the ProPac Elite Ion Exchange columns, designed to deliver enhanced resolution separation for applications in antibody engineering. This fits the company's commitment to providing innovative solutions in protein purification and analysis.

-

In 2024, there was a significant spike in the utilization of Proteinase K kits among proteomic laboratories in Germany, especially those researching novel zoonotic viruses. The trend underlines the huge contribution of Qiagen to the growth of proteomic research and diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.46 Billion |

| Market Size by 2032 | US$ 9.30 Billion |

| CAGR | CAGR of 8.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Form (Powder, Liquid) •By Therapeutic Area (Infectious diseases, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune diseases, Neurology, Others) •By Application (Isolation and Purification of Genomic DNA & RNA, In Situ Hybridization, Mitochondria isolation) •By End-use (Contract Research Organization, Academic Institutes, Biotechnology Companies, Diagnostic Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA, Thermo Fisher Scientific, Inc., Qiagen N.V., F. Hoffmann-La Roche Ltd., Promega Corporation, New England Biolabs (NEB), Bio-Rad Laboratories, Inc., Takara Bio Inc., Abcam plc, Eurofins Scientific, Biorbyt Ltd., Sekisui Diagnostics, LLC, Zymo Research Corporation, GenScript Biotech Corporation, Creative Enzymes, Amano Enzyme Inc., Biovision Inc., Enzo Life Sciences, Inc., Worthington Biochemical Corporation, MedGenome Labs Ltd., and other players. |