Conversation Intelligence Software Market Report Scope & Overview:

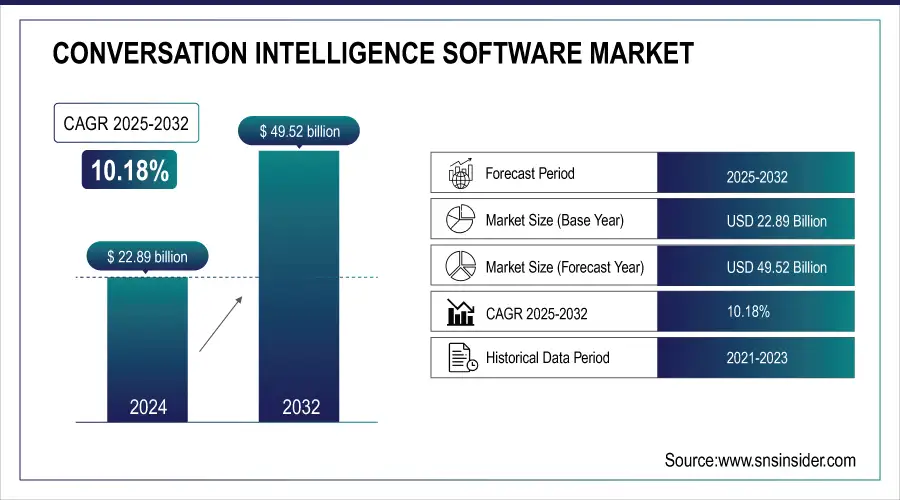

The Conversation Intelligence Software Market size was valued at USD 22.89 billion in 2024 and is expected to reach USD 49.52 billion by 2032, growing at a CAGR of 10.18% over 2025-2032.

The Conversation Intelligence Software Market is expanding owing to expanding requirements for improving customer experience, surging adoption of machine learning and AI technologies, and the necessity of real-time analytics across sales and support. Companies utilize these solutions to enhance decision-making, automate communication, and enhance operational efficiency.

A survey in mid-2024 revealed that 32% of the panel had used generative AI during the previous week, and 24% applied it to a business use. More, 57% of businesses believe that chatbots yield high return on investment with minimal effort, contributing to their growing role in business strategies.

To Get more information on Conversation Intelligence Software Market - Request Free Sample Report

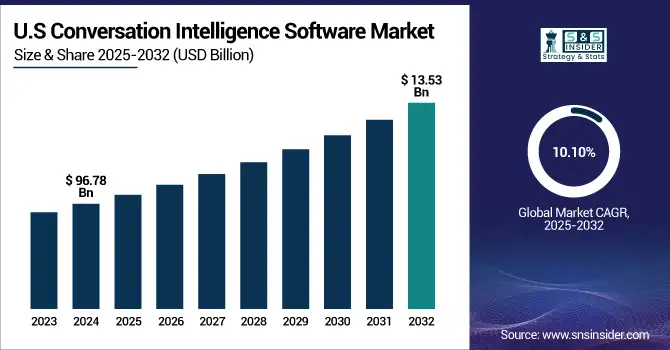

The U.S. Conversation Intelligence Software Market size was valued at USD 96.78 billion in 2024 and is expected to reach USD 13.53 billion by 2032, growing at a CAGR of 10.10% from 2025-2032.

The U.S. Conversation Intelligence Software Market is growing owing to the surging adoption of AI-driven analytics, increased emphasis on customer experience, and rising need for real-time insights to improve sales, marketing strategies, and operational efficiency in industries.

According to a survey conducted by the U.S. Census Bureau's Business Trends and Outlook Survey (BTOS), the utilization of AI has increased from 3.7% to 5.4%, with an expected growth rate of approximately 6.6% by early 2024.

Market Dynamics

Drivers:

-

Customer-centric Insights to Drive Sales Initiatives and Enhance Agent Performance Drive Demand for Conversation Intelligence Software

Surging requirement for customer-focused real-time insights is driving adoption of conversation intelligence technology. Businesses need to maximize sales, enhance call center success, and tailor experiences. The technology translates conversations to reveal patterns, intent, and sentiment and provides teams with actionable insights. Since businesses seek higher conversion rates and decisions, these technologies are essentials. The main advantages are improved agent coaching, performance benchmarking, and customer engagement. Also, growing AI implementation across businesses fuels this market's growth, and thus conversation intelligence becomes a strategic imperative.

For instance, IBM used a virtual assistant based on generative AI, which led to a 99.97% reduction in task completion time (from 1.04 days to 30 seconds), a 55% decrease in call volume to Level 2 support agents, and a 10% boost in full-time equivalent (FTE) productivity.

Similarly, Salesforce's agentic AI has been adopted by Fisher & Paykel that currently resolves 66% of website queries and provide proactive customer recommendations. Internally, Salesforce AI agents resolve 84% of customer complaints, allowing for the release of 2,000 support roles to higher-value work.

Restraints:

-

Data Privacy Issues and Strict Regulatory Controls Restrict the Use of AI-driven Conversational Analytics in High-risk Industries

Adoption of the conversation intelligence tech is circumvented by privacy of data legislations including GDPR, CCPA, and HIPAA. Industries that have to handle sensitive information healthcare, finance, law are more cautious. Stringent consent requirements, secure storage, and openness make deployment difficult. Companies are concerned with compliance risks, abuse of recordings, and data breaches. Anonymization aside, the threat of legal issues is preventing full adoption. These are slowing growth and adding cost of operations for compliance. With AI analytics becoming ever more intrusive, pushback from privacy activists and judicial authorities will increase even more.

Opportunities:

- Growing Emphasis on AI-powered Personalization Opens Avenues for Conversational Analytics to Transform Customer Engagement Strategies Across Industries

As businesses focus on hyper-personalization, conversation intelligence software becomes the core to design tailored engagement strategies. With analysis of voice and text conversations, it reveals behavioral insights that empower marketers, sales, and support to make messages personal. This fuels upselling, retention, and brand loyalty. Sectors including e-commerce, telecommunications, and hospitality immediately adopt these technologies for real-time and dynamic feedback. NLP and machine learning enable predictive interaction, and the software is now a necessity for next-gen customer experience. Personalization trend fuels significant market growth.

For instance, according to a report by Sellers Commerce, 33% of the B2B e-commerce firms in the U.S. have incorporated AI completely in their business operations, and another 47% are considering adopting the technology.

In addition, McKinsey states that 71% of the customers anticipate personalization, with 76% becoming frustrated when they do not get it.

Further, studies by Big Sur AI indicate that product recommendations that are personalized capture as much as 31% of the revenue of online brands.

Challenges:

-

Rising Competition from Embedded Analytics in CRM and Communication Platforms Reduces the Standalone Appeal of Conversation Intelligence Software

With leading CRM and communications platforms such as Salesforce, Microsoft, and Zoom having native conversational analytics, independent vendors are increasingly under threat. These native AI-powered insights are at your fingertips and offer automated workflows on data, eliminating the need to use specialized tools, particularly for small to mid-sized companies. This makes it more difficult for pure-play sellers to stand out by introducing cutting-edge features or domain experience. It is hard to remain relevant as larger platforms bundle analytics into more complete enterprise solutions, compelling specialized players to innovate or risk losing market share.

Segmentation Analysis

By Deployment

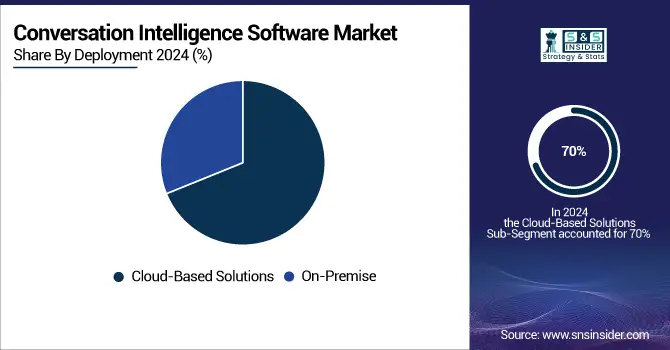

Cloud solutions captured the highest revenue market share of approximately 70% in 2024 and are anticipated to advance at the highest CAGR of 10.59% until 2032. Their accomplishment is due to ease of use, reduced operational expenditure, and smooth scalability, which benefit large enterprises and SMEs equally. Cloud infrastructure can facilitate real-time computation and integration across systems with APIs. Ongoing maintenance, AI model tweaks, and enterprise-level data protection, also, are attractive to organizations that need efficiency, even at the cost of compliance. This deployment model satisfies evolving business operating needs in a digital-first economy.

By Organization Size

Large enterprises led the Conversation Intelligence Software Market with a 65% revenue market share in 2024 due to their big customer-facing business, huge volumes of calls, and complex communications processes that call for elastic, AI-driven insights. These organizations have the budget, infrastructure and compliance infrastructure necessary for enterprise-level analytics. The continued need to improve customer experience, sales performance, and regulatory compliance still leads to widespread adoption of more sophisticated conversational tools across sales, support and even HR functions.

Small and Medium Enterprises (SMEs) are expected to expand at the highest CAGR of 11.41% during 2025-2032 as they continue to invest in digital transformation. With more awareness of AI-driven insights, and having inexpensive, cloud-based solutions readily available, SMEs are leveraging conversation intelligence to compete with larger organizations. The software enables them to improve customer care, monitor staff performance, and streamline sales strategies, without being prohibitively expensive or lacking scalability to suit their evolving business needs.

By Vertical

The BFSI sector dominated the market share with a 30% in 2024 owing to its heavy reliance on call centers, regulatory adherence, and customer interaction metrics. Financial institutions leverage conversation intelligence to maintain proper customer profiling, fraud prevention, and service quality monitoring. Banks and insurers adopt these solutions with stringent regulations and the requirement for real-time analytics to track agent performance, maintain compliance, and propel personalized financial guidance. The industry's data-intensive character renders it an ideal adopter of smart analytics.

The retail industry is poised to grow at a highest CAGR of 12.31% over 2025-2032 due to the call for real-time customer insight, differentiation, and omnichannel engagement. The retailers are using conversation intelligence to analyze voice and chat dialogues of customer service interactions, identify purchasing intent, and power personalization efforts. As more customers’ demands for real-time, personalized experiences, retail brands are using these capabilities to enhance their sales strategy, improved quality support, and loyalty through conversational interaction.

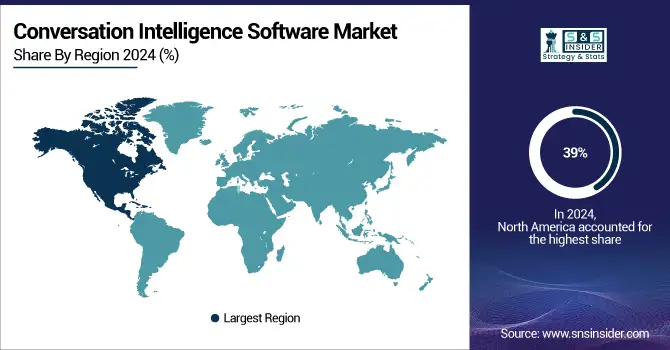

Regional Analysis

North America dominated the Conversation Intelligence Software Market with a 39% revenue share in 2024 due to the digital infrastructure prowess of the region, high adoption rates of enterprise technology, and extensive reach of top-tier software providers. The U.S. and Canadian companies are among the first to adopt AI and analytics technology, using them for optimization, compliance, and customer engagement. Maturity and investment capability of regional regulatory environments influence frequent enterprise adoption across major industry segments as well.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. led the Conversation Intelligence Software Market trend through enterprise tech adoption highness, good vendor presence, and the capability to incorporate sophisticated AI capabilities.

Asia Pacific is projected to grow at the fastest CAGR of 12.02% over 2025-2032, due to swift digitalization, growing call center operations, and an increasing SME base. India, China, and Southeast Asia are also experiencing strong adoption of AI-based tools for enhancing business efficiency and customer care. Growing internet penetration, mobile use, and government support for digitalization also drive the region's surging demand for conversation intelligence software.

China is leading the Conversation Intelligence Software Market in Asia Pacific because of its fast adoption of AI, extensive enterprise ecosystem, and large-scale customer service operations.

Europe’s Conversation Intelligence Software Market is witnessing steady growth owing to rising digital transformation efforts, growing multilingual analytics demand, and demand for improved customer experience across prominent sectors such as finance, retail, and manufacturing.

Germany is dominating the Conversation Intelligence Software Market in Europe due to advanced enterprise infrastructure, strong tech adoption, and a well-established B2B services sector.

In the Middle East & Africa and Latin America, the Conversation Intelligence Software Market growth is due to growing contact center operations, rising penetration of smartphones, and heightened interest in AI-powered customer engagement in emerging enterprise areas.

Key Players:

The Conversation Intelligence Software Market companies that continue to transform customer engagement through advanced AI-driven insights, include Akamai Technologies, Cloudflare, Inc., Amazon Web Services (AWS), Fastly, Inc., Google Cloud CDN, Microsoft Azure CDN, Edgio (formerly Limelight Networks), Imperva, StackPath, and Tencent Cloud CDN.

Recent Developments:

-

2025: Akamai launched Firewall for AI, providing multilayered protection for AI applications against unauthorized queries, adversarial inputs, and large-scale data-scraping attempts

-

2024: Cloudflare enhanced its AI inference platform with powerful GPU upgrades, faster inference, larger model support, and improved observability, enabling developers to build more powerful AI applications.

-

2024: AWS announced the launch of Amazon Bedrock, a fully managed service that provides access to a variety of foundation models, enabling developers to build and scale generative AI applications.

-

2024: Google Cloud expanded access to its Gemini 1.5 Pro model, offering enhanced performance and long-context understanding for generative AI applications, now available in public preview for Cloud customers and developers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 22.89 Billion |

| Market Size by 2032 | USD 49.52 Billion |

| CAGR | CAGR of 10.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premise, Cloud-Based Solutions) • By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises) • By Vertical (IT & Telecommunications, Retail, BFSI, Real Estate, Other Verticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Akamai Technologies, Cloudflare, Inc., Amazon Web Services (AWS), Fastly, Inc., Google Cloud CDN, Microsoft Azure CDN, Edgio (formerly Limelight Networks), Imperva, StackPath, Tencent Cloud CDN |