Anti-Money Laundering Market Size & Overview:

Get more information on Anti-Money Laundering Market - Request Sample Report

Anti-money Laundering Market was valued at USD 2.53 Billion in 2023 and is expected to reach USD 9.35 Billion by 2032 and grow at a CAGR of 15.67% from 2024-2032.

The Anti-Money Laundering (AML) market has seen substantial growth in recent years, fueled by stricter regulatory scrutiny, a rise in financial crimes, and innovations in digital payment systems, all boosting demand for advanced AML solutions. Financial institutions worldwide are increasingly adopting technologies like artificial intelligence, machine learning, and blockchain to streamline AML operations, strengthening their ability to detect and prevent suspicious activities. With global digital transactions nearing 1.3 trillion in 2023, addressing money laundering risks has become more urgent, creating a need for AML systems capable of real-time, high-volume transaction analysis to meet international compliance standards. An example of this trend is HSBC’s USD 800 million investment in AML infrastructure in 2023 to comply with tighter regulations and enhance fraud detection. Similarly, Deutsche Bank recently launched an AI-driven AML platform that can analyze over 10 million transactions daily, greatly improving its anomaly detection capabilities. These examples underscore the role of advanced AML technology in meeting regulatory demands and handling the surge in digital transactions.

With AML regulations tightening, companies are urged to upgrade or replace legacy systems. The European Union, for instance, introduced stricter regulations, including mandatory Know Your Customer (KYC) protocols, which will become even more stringent by 2025, driving additional growth in the AML market. Data from the Financial Crimes Enforcement Network (FinCEN) reveals a 20% increase in AML non-compliance fines in 2023 compared to 2022, highlighting stricter enforcement and motivating firms to enhance their AML systems. As regulatory pressures mount, alongside technological advancements and a rise in cyber-enabled financial crimes, the AML market is poised for continued growth. Key technologies like real-time data analytics, AI-powered monitoring, and blockchain-based verification are expected to be central to AML’s evolution, establishing it as a fundamental component of risk management for financial institutions worldwide.

Anti-money Laundering Market Dynamics

Drivers

-

Growth in cyber-enabled fraud and complex financial crimes drives demand for sophisticated AML solutions.

-

Financial institutions leverage AI to streamline AML processes, improve accuracy, and reduce false positives.

-

Stricter Know Your Customer (KYC) requirements globally increase the need for comprehensive AML measures.

One of the significant factors fueling the growth of the global AML market is increasing stringent Know Your Customer (KYC) requirements across the globe. Know Your Customer ( KYC ), or Know Your Client, is a procedure of categorizing customers and other entities financial institutions must follow to know the identities of their clients, their coping patterns, and whether they are linked to organized crime. In a bid to put an end to money launderers and terrorist financiers, regulators are tightening the noose around KYC mandates which is putting increasing pressure on financial institutions to implement AML solutions in line with continuously changing standards.

Rigorously enforced KYC regulations force companies to carry out extensive verification of customers that not only requires the collection and storage of vast amounts of data but also necessitates thorough background checks and real-time transaction monitoring. Financial institutions must collect and verify identification documents and source-of-wealth information for customers, as well as monitor account activity for suspicious behavior on an ongoing basis. This broadened know-your-customer KYC model exists to ensure that criminal actors or any other groups do not gain access to the financial system, which is very common under AML initiatives.

The rapid growth of digital payments and the increasing speed of transactions require financial institutions to deploy AML solutions capable of processing large volumes of data in real time. In order to tackle this issue, next-gen technologies like artificial Intelligence, machine learning, and blockchain are being combined into anti-money laundering solutions so as to automate KYC processes with greater accuracy and compliance. AI can, for example, scrutinize large data sets to detect trends and patterns signaling financial crime; machine learning limits the false positive rate in all monitoring.

In addition, KYC standards in many parts of the world including the European Union are subject to constant updates, which means financial institutions must be able to respond quickly to avoid hefty non-compliance fines. As EU KYC regulations are expected to become even stricter by 2025, institutions need a solid plan to either upgrade or replace stale AML systems to remain compliant. Such a shift is substantially affecting the AML market, as organizations are focusing on innovative, flexible, and compliance-driven solutions to meet new KYC standards. In conclusion, the changing landscape of KYC further highlights the importance of effective and flexible AML solutions that scale with these changes to maintain compliance with regulators and protect organizations from financial crime globally.

Restraints

-

Stricter data protection regulations can limit the ability of financial institutions to collect and analyze customer data necessary for effective AML processes.

-

Legacy systems often pose integration difficulties with new AML technologies, hindering efficient data flow and compliance.

-

A lack of skilled personnel with expertise in AML technologies and regulatory compliance can impede the effective implementation of AML strategies.

One of the barriers to the successful implementation of AML in the financial sector will be the unavailability of personnel with subject matter expertise about AML technologies and regulatory compliance. With growing regulation and money laundering methods constantly changing, the need for skilled individuals to handle this has never been higher in financial services. AML specialists are also onboarding AML solutions; they have the skills to help develop, run, and improve systems that identify, limit, and prosecute financial crime.

To gear up for the pace of change that new anti-money laundering technologies, specifically artificial intelligence and machine learning as a whole and more exciting blockchain technologies set before our very eyes: AI needs to be understood but also calendared in should all epochs to come from this point outwards. Sadly, the supply of this talent rarely meets demand creating a skills gap in the market. This discrepancy may lead to poor governance and oversight of AML systems, increasing the potential for compliance failures and ultimately leaving institutions subject to large financial penalties. With regulators tightening AML requirements and revising standards, financial institutions need to continuously adjust their strategies and technologies. The rapidly evolving AML landscape underscores the demand for professionals who can interpret new regulations, institute requisite changes and ensure that AML systems comply with compliance requirements. Without a talented pool of Human Capital, institutions find themselves poorly positioned to respond proactively to regulatory discontinuity and consequently vulnerable to criminal exploitation. And, the absence of experts cannot be covered only by technology. While a plethora of alarm bells can be run by automated systems, without the presence of trained analysts able to assess those alarms, sophisticated suspicious behaviors will likely go undetected. Therefore, both the AML strategies in practice and readiness to tackle unexpected changes or instabilities due to regulatory pressures or privacy policies can be ensured by catering to this skill shortage which is a huge step toward strengthening financial systems against the risk of money laundering and financial crime. Getting smarter about the AML landscape we navigate, institutions should also be investing in programs that both develop and share, fundamental business principles to build beneficial ways of working for success in fighting financial crime.

Anti-money Laundering Market Segment Analysis

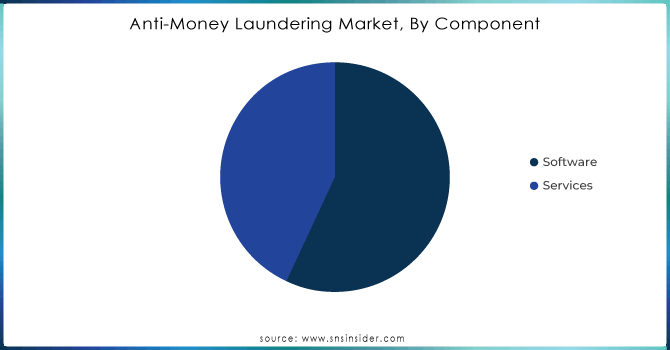

By Component

In 2023, the software segment dominated the market and represented over 63.1% of revenue share. This growth can be attributed to the increasing demand for anti-money laundering solution among banks and payment solution providers to identify suspicious activities and minimize the risks of genuine transaction rejection. Widespread Adoption of AI/ML and Big Data — Technologies like artificial intelligence, machine learning, and big data analytics have been incorporated into increasingly sophisticated AML software that makes it possible to analyze massive volumes of information in seconds. Apart from this, it improves the efficiency of AML programs/measures and also relieves operational cost pressure from manual compliance processes.

The services segment is anticipated to register significant growth between 2024 to 2032. As AML compliance has become more complicated, financial institutions have sought specialists which in turn has attracted attention in this area. Many companies in the world develop and provide AI-based AML services to assist banks in dealing with AML risk. For instance, in April of 2024, Oracle Financial Services Compliance Agent introduced by Oracle An AI-based cloud service designed to help banks manage their AML risks more effectively. Banks can leverage this for scenario testing, identifying suspicious transactions, and enhancing transaction monitoring system efficiency. AI and machine learning offer important efficiencies to AML programs while also limiting costs and improving decision-making capabilities to propel this tool even further.

Need any customization research on Anti-Money Laundering Market - Ask For Customization

By Product

The transaction monitoring segment dominated the market and represented a significant revenue share in 2023. The increasing volume of financial crimes leading to the need for advanced monitoring systems that are capable of analyzing millions and billions of transactions in real-time has propelled the growth of this segment. Moreover, increasing regulatory pressure from global and regional authorities has inspired financial institutions to take a stricter approach toward the use of transaction monitoring tools that could help them avoid heavy penalties. On a parallel ground, we have a variety of companies around the world writing AML solutions to concentrate and shut down high-definitive activities. As an example, in October 2023 Workn Fusion introduced a new AI solution called Isaac that is aimed to automatically perform first-level alert reviews to improve AML transaction monitoring-related processes. Isaac uses machine learning to evaluate alerts, and automatically escalate suspicious ones for review while closing out non-suspicious alerts with documentation. It alleviated some of the work that AML analysts needed to do and shifted their focus to higher-risk activities.

Customer identity management segment is anticipated to register the highest CAGR during the forecast period. The segment growth is driven by the increasing necessity of strong Know Your Customer (KYC) processes against money laundering. Customer identity management solutions are being adopted by more financial institutions to ensure that they are not unknowingly helping their clients to finance any illegal activities. The growing digital banking and transactions have also increased the need for correct identity verification processes. These solutions have now begun to integrate advanced technologies like biometric authentication and AI-driven identity verification to make them more reliable, and accurate.

By Deployment

In 2023, the greatest revenue share of the market was held by the on-premise segment. The anti-money laundering on-premise segment is still important for companies that value control and security in their compliance systems. On-premise solutions are another preferred approach for many institutions across the globe which has allowed them to customize and blend into their existing IT infrastructure while also giving a higher level of control on data security and regulatory compliance. The benefit of an on-premise anti-money laundering system is that it can be created around each organization's specific requirements, testing for compliance at a far deeper level.

The cloud deployment form is projected to witness prominent growth from 2024 to 2032. The cloud segment in the global anti-money laundering market has become one of the fastest-growing categories, as it provides flexibility, scalability, and cost-related advantages. For organizations looking for streamlining, cloud-based anti-money laundering solutions provide the benefit of making frequent updates or easy integration which can be a hassle with on-premise systems. These solutions allow financial institutions to leverage next-generation capabilities and technologies – artificial intelligence, real-time data analytics, etc. — while avoiding the need for heavy investments in infrastructure. The emergence of remote work and the growing reliance on digital banking services have further boosted the transition to cloud-native AML options.

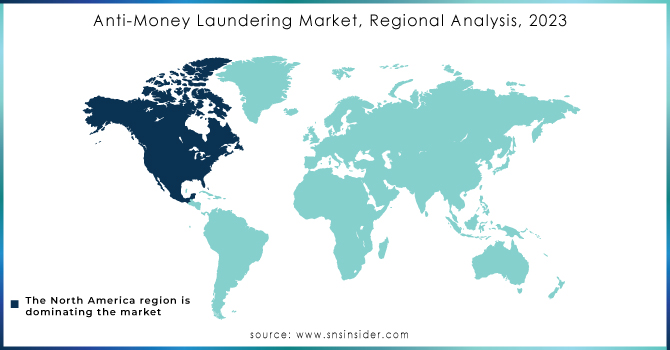

Regional Analysis

North America held the largest share of the market in 2023 with it being 30.4% of the total share. Thanks to its robust regulatory framework and strict enforcement of AML laws, this leadership stands firm. As complex regulations arise with bigger financial institutions to regulate them, the market for advanced AML Solutions needs it as a necessity in North America. It also commits extensive resources to emergent technologies such as artificial intelligence and machine learning, both of which are instrumental in the most effective modern AML constructs. Moreover, the high concentration of financial hubs coupled with the rapid increase in the volume of transaction types add to North America being a country having a higher share in the AML market.

The Asia Pacific anti-money laundering market is expected to grow significantly during 2024-2032. Increasing demand for sophisticated AML solutions across the region after growing cross-border transactions and expanding financial services will increase the growth of this market here. Additionally, accelerating economic development and financial system modernization within Asia Pacific regions are driving enhanced emphasis on AML compliance.

Key Players

The major key players with their products are

-

FICO - FICO TONBELLER

-

Oracle - Oracle Financial Services Analytical Applications

-

SAS Institute - SAS Anti-Money Laundering

-

LexisNexis Risk Solutions - LexisNexis AML Compliance

-

ACI Worldwide - ACI Universal Payments

-

NICE Actimize - NICE Actimize Anti-Money Laundering

-

InfrasoftTech - InfrasoftTech AML Compliance Solution

-

ComplyAdvantage - ComplyAdvantage Screening

-

Bae Systems - BAE Systems NetReveal

-

Palantir Technologies - Palantir Foundry

-

KYC Portal - KYC Portal

-

Actico - Actico Compliance Suite

-

Elliptic - Elliptic Navigator

-

AML Partners - AML360

-

Verafin - Verafin Fraud Detection

-

CaseWare RCM - CaseWare AML Risk Assessment

-

Quantexa - Quantexa Decision Intelligence Platform

-

Refinitiv - Refinitiv World-Check

-

Amlify - Amlify AML Solution

-

FinScan - FinScan AML Screening

Recent Developments

January 2024: FICO Launched an enhanced version of its AML solution with improved machine-learning algorithms for better anomaly detection.

February 2024: LexisNexis Risk Solutions: Introduced a new AML compliance tool designed to streamline KYC processes for financial institutions.

March 2024: SAS Institute: Announced updates to its AML solution, integrating advanced analytics to enhance fraud detection capabilities.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.53 Billion |

| Market Size by 2032 | USD 9.35 Billion |

| CAGR | CAGR of 15.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software And Services) • By Deployment Model (Cloud And On-Premise) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By Product (Compliance Management, Currency Transaction Reporting, Customer Identity Management, Transaction Monitoring) • By End-Use (BFSI, Government, Healthcare, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

FICO, Oracle, SAS Institute, LexisNexis Risk Solutions, ACI Worldwide, NICE Actimize, InfrasoftTech, ComplyAdvantage, Bae Systems, Palantir Technologies, KYC Portal, Actico, Elliptic, AML Partners, Verafin, CaseWare RCM, Quantexa |

| Key Drivers | •Growth in cyber-enabled fraud and complex financial crimes drives demand for sophisticated AML solutions. •Financial institutions leverage AI to streamline AML processes, improve accuracy, and reduce false positives. •Stricter Know Your Customer (KYC) requirements globally increase the need for comprehensive AML measures. |

| Market Opportunities | •Stricter data protection regulations can limit the ability of financial institutions to collect and analyze customer data necessary for effective AML processes. •Legacy systems often pose integration difficulties with new AML technologies, hindering efficient data flow and compliance. •A lack of skilled personnel with expertise in AML technologies and regulatory compliance can impede the effective implementation of AML strategies. |