Cryostat Market Size & Overview:

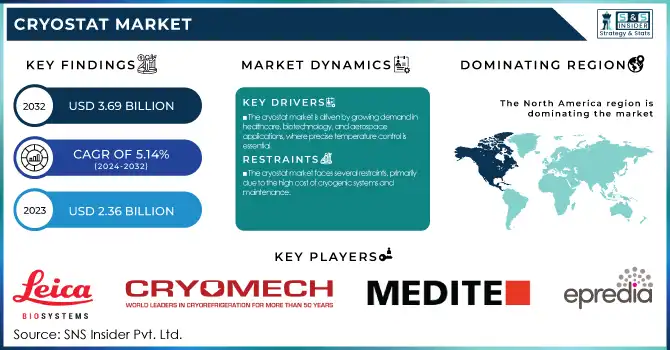

The Cryostat Market Size was valued at USD 2.36 Billion in 2023 and is projected to reach USD 3.69 Billion by 2032 and grow at a CAGR of 5.14% over the forecast period 2024-2032. This report presents sales and demand trends by regions, in addition to volume and installed base, capturing the growth of the market. The research examines revenue realization and expenditure by region, including government, commercial, private, and out-of-pocket investments, in addition to evaluating the effects of technological advancements and increasing R&D expenditures. It also examines regulatory and compliance trends that shape market dynamics, to ensure product standardization, safety, and efficiency, and to influence innovation and market entry strategies.

To Get more information on Cryostat Market - Request Free Sample Report

Cryostat Market Dynamics

Drivers

-

The cryostat market is driven by growing demand in healthcare, biotechnology, and aerospace applications, where precise temperature control is essential.

Growing usage of cryostats in healthcare imaging, including MRI machines, histopathology, and frozen section analysis, is a major impetus. For example, MRI systems use helium-based cryostats to support superconducting magnets, and the growing prevalence of cancer and neurological conditions has increased demand for such imaging equipment. Further, the widening application of cryogenic technology in quantum computing, space exploration, and superconducting research has also driven the market. Organizations such as IBM and Google are heavily investing in quantum computing, which necessitates ultra-low temperature cryostats for operational stability. Additionally, the semiconductor sector is also utilizing cryogenic cooling to enhance chip performance and minimize thermal noise in high-end manufacturing processes. The growing interest in renewable energy and hydrogen-based applications, wherein cryostats are employed for liquefaction and storage, is another key driver of growth. Additionally, ongoing developments in automation and remote monitoring of cryogenic systems are improving operational efficiency and lowering maintenance expenses. These factors, combined with government grants and R&D spending on cryogenic applications, are likely to maintain the demand for cryostats across different industrial and scientific applications.

Restraints

-

The cryostat market faces several restraints, primarily due to the high cost of cryogenic systems and maintenance.

The shortage of the helium supply poses a significant challenge, as liquid helium is a key cryogen utilized in MRI systems, quantum computing, and scientific applications. The volatility in the price of helium and scarcity have contributed to higher operational expenditure for institutions depending on cryogenic cooling. Also, cryostats demand bespoke infrastructure and professionals for installation, manipulation, and maintenance, a situation that compels small-scale laboratories and hospitals to struggle implementing these systems. The high energy requirements of cryostats, especially in closed-cycle and continuous-flow cryostats, also raise economic and environmental issues. Furthermore, the strict regulations for cryogenic handling and safety contribute to the market growth complexity, especially in those industries that handle hazardous cryogens. The low availability of inexpensive alternative cooling mechanisms also limits market growth. Furthermore, the gradual development of cryogenic systems in the emerging economies where financial constraints and low awareness undermine demand is yet another constraint. All these forces together pose impediments to the general acceptance of cryostats, particularly within price-sensitive economies where cost-reducing options are sought after.

Opportunities

-

The cryostat market presents significant opportunities, particularly with technological advancements in cryogenic cooling and automation.

The increasing demand for energy- efficient and miniaturized cryostats in research institutions and in medical imaging holds potential for expansion. Firms are investigating helium-recycling cryostats in order to tackle helium shortages, cutting operational expenditures and enhancing sustainability. The increased use of cryogenic applications in biotechnology such as cell storage, gene therapy, and regenerative medicine will stimulate market expansion. Cryogenic storage solutions for biological samples and vaccines have also become more prominent, particularly post-COVID-19, which has spurred more investments in biomedical cryostats. The aerospace sector is also a promising market, with more dependence on cryogenic systems for satellite propulsion, space exploration, and defense technologies. The production of high-temperature superconductors (HTS) for energy applications, including power grids and fusion reactors, also fuels demand for next-generation cryogenic solutions. In addition, the increasing interest in clean energy technologies, like hydrogen fuel cells, in which cryostats play a crucial role in liquefaction and storage, provides new opportunities. Developing markets and government-sponsored nanotechnology, material science, and astrophysics research projects will also drive the growth of cryostat applications. All these trends show a high likelihood of investment and innovation in next-generation cryogenic technologies.

Challenges

-

The cryostat market faces several challenges, including technical limitations and operational complexities that hinder widespread adoption.

One of the main challenges is that ultra-low temperatures are hard to sustain for prolonged periods without incurring high energy usage or loss of cryogen. System breakdowns caused by temperature instability, vacuum leaks, or component failure can result in expensive downtime, especially in critical applications such as MRI and quantum computing. The absence of uniform manufacturing and design standards for various types of cryostats also poses compatibility and integration into current systems as a challenge. In addition, innovation in alternative cooling technologies, including closed-loop cryocoolers and thermoelectric cooling, threatens traditional cryostat markets competitively. The transport and logistics issues of cryogenic materials, particularly in foreign markets where regulatory barriers to liquid helium and nitrogen are present, add complexity to global supply. Training and human resource development are also central among the challenges, as the handling of cryogenic systems necessitates specialized expertise and training. The increasing need for environmental concern and carbon footprint of cryogenic cooling technologies also calls for innovation in green cryogenic solutions. Overcoming these technical and operational challenges is critical to ensuring the long-term stability and growth of the cryostat market across various applications.

Cryostat Market Segmentation Insights

By Type

The closed-cycle cryostats segment was the market leader in 2023 because of its efficiency, low cost of operation, and capacity to operate without liquid cryogens. These cryostats are commonly employed in research laboratories, hospitals, and industrial processes, where accurate temperature control is required. Their ability to offer reliable cooling without the constant replenishment of cryogens has led to their usage in many industries. Furthermore, technological development and integration with remote monitoring equipment have also fortified their market strength.

In contrast, the bath cryostat market is expected to be the fastest-growing due to its growing utilization in material research and sophisticated medical applications. Bath cryostats offer better temperature stability, thereby making them unavoidable for experiments where low-temperature conditions are to be maintained over extended periods. Their increased usage in physics and chemistry research laboratories, in addition to the technology that makes them improve the uniformity of temperature, is driving their aggressive growth. As industrial firms and research organizations develop their cryogenic research processes, the use of bath cryostats is poised to accelerate, and therefore is one of the most potential areas over the coming years.

By Components

The dewars segment comprised the 25.6% market share in 2023, primarily because of their importance for cryogen storage, transportation, and handling. Dewars are vacuum-insulated containers that are invaluable in a variety of industries such as healthcare, aerospace, and scientific research. Their capacity to be kept at cryogenic temperatures for a long time has made dewars the most sought-after equipment among laboratories and hospitals utilizing liquid helium and nitrogen-based cryogenic systems. Moreover, the growing use of cryogenic applications in biotechnology and industrial gas storage has further driven the demand for dewars. Advances in material technology, including lightweight and high-durability designs, have also improved their use, ensuring long-term market growth.

The gas flow pumps segment is expected to experience the highest growth owing to the growing demand for accurate cryogen distribution and flow control in sophisticated cryogenic systems. They help to increase efficiency in closed-cycle and continuous flow cryostat operations by ensuring uniform and regulated flow of gases. With automation and digital monitoring also becoming commonplace for laboratory and industry cryogenic practices, gas flow pumps that incorporate real-time adjusting of flow rate are becoming more popular. Growing demand for high thermal management technology in semiconductor applications and superconductor applications should also drive growth for this market segment.

By Cryogen

The helium segment led the market in 2023, mainly due to its better cooling abilities and its extensive application in medical imaging, quantum computing, and low-temperature physics research. Helium is an essential cryogen for MRI machines, which contribute a considerable share of its demand in the healthcare industry. Apart from that, its capability to achieve very low temperatures also makes it a key component of superconducting application in research facilities and high-energy physics research. Its ongoing improvement in recovery and recycling technologies for helium has contributed to its continued market supremacy, overcoming supply shortage issues and price volatility.

The nitrogen segment, on the other hand, is forecasted to record the highest growth rate mainly because it is cheap, readily available, and has increasing applications in different industries. Liquid nitrogen finds applications in cryosurgery and preservation of biological samples, besides being used for food processing wherein efficient cooling needs to be obtained at affordable prices. Increasing adoption of nitrogen-based cryostats by the pharmaceutical sector and in the semiconductor sector, driven by rising demand, is further stimulating growth. In addition, growing activities in space exploration and related aerospace applications, demanding cryogenic cooling, are creating new market growth drivers around nitrogen-based cryostats. With sustainability and affordability emerging as key concerns for cryogenic technology, nitrogen-based systems are likely to be adopted in a big way.

By Application

The healthcare sector maintained the highest market share in 2023, primarily because cryostats have widespread applications in pathology, histology, and medical research. Cryostats are crucial in frozen section analysis, enabling rapid tissue diagnosis in cancer operations and other life-threatening medical procedures. The increasing number of cancer cases and neurodegenerative disorders has fueled demand for sophisticated cryogenic solutions within hospitals and diagnostic labs. Moreover, MRI systems, based on cryogenic cooling, have also helped to strengthen the market position of cryostats in the healthcare sector. With ongoing developments in medical imaging and precision medicine, the healthcare industry continues to be the most prominent application area for cryostats.

The biotechnology segment is likely to expand at the highest rate owing to the growing need for cryogenic preservation of biological samples. Cryostats are used extensively in genetic studies, stem cell storage, and drug development, where ultra-low temperatures are necessary to preserve the integrity of samples. The growing interest in personalized medicine and regenerative treatments is also fueling the use of cryostats in biotech research. In addition, with biobanks and cell culture research becoming increasingly prominent, there is a growing demand for precision cryogenic devices. Government and private investment in biotechnology research is likely to further spur the growth of the segment.

Cryostat Market Regional Analysis

North America captured a strong market share of 40.8% in 2023, which is the largest regional cryostat market. The region's dominance is mainly due to the high uptake of cryogenic technology in healthcare, biotechnology, and aerospace fields. The concentration of well-established research institutions, universities, and hospitals has boosted demand for advanced cryostats in clinical diagnostics and histopathology. In addition to this, a rise in the incidence of neurodegenerative diseases and cancers has driven cryostats demand in frozen section analysis, fueling market development. The United States continues to be the market leader, as large market companies invest in breakthrough cryogenic applications and increase the breadth of products. Government sponsorship for space missions (NASA), quantum computing research, and superconducting activities has also continued to drive the market leadership position of North America.

Conversely, Asia-Pacific is anticipated to be the fastest-growing for cryostats market, led by fast development in healthcare infrastructure, biotechnology research, and industrial uses. China, India, and Japan are seeing rising investments in medical imaging, genetic studies, and semiconductor production, all of which involve cryogenic technology. The increasing need for cost-effective and efficient cryostats in hospitals and research centers, combined with government policies to promote scientific progress, is fueling market growth. The growing space exploration initiatives in China and India are also driving the adoption of cryostats in aerospace and defense applications further. As the region remains committed to investing in R&D and technological advancement, Asia-Pacific is set for significant growth over the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Cryostat Market and Their Products

-

Leica Biosystems – Leica CM1860, Leica CM1950

-

Cryomech Inc. – PT415, AL600 Cryostat

-

Amos Scientific – AS-620 Cryostat

-

MEDITE – CryoStar NX50, CryoStar NX70

-

Bright Instruments – Bright OTF5000, Bright 5040

-

Dakewe Medical – Dakewe 3060 Cryostat

-

Jinhua YIDI Medical Appliance Co., Ltd. – YD-1900 Cryostat

-

SLEE Medical GmbH – MEV Cryostat, MNT Cryostat

-

Advanced Research Systems – CCS-150, CCS-450

-

Lake Shore Cryotronics – Model 8425, Model 10T Cryostat

-

Epredia – HM525 NX Cryostat, CryoStar NX70

-

SM Scientific Instruments – SMSI Cryostat

-

Medimeas – MTC-6000 Cryostat

-

Hacker Instruments & Industries – H/I CryoStat

-

Boeckeler Instruments Inc. – MT990 Cryostat

-

Histo-line Laboratories – HL-3000 Cryostat

-

Lupetec – Crystat 2010

-

SciLab Co. Ltd. – SL Cryostat

-

Cryofab, Inc. – CF Series Cryostat

-

Precision Cryogenics – PC-100 Cryostat

-

attocube systems AG – ANS Cryostat

-

AMETEK Scientific Instruments – AMX Cryostat

-

Mirion Technologies – RT-500 Cryostat

-

BIOBASE – BK-Cryo Series

-

Sipcon Instrument Industries – SC-500 Cryostat

Recent Developments

In Jan 2025, Danaher Cryogenics acquired the Adiabatic Demagnetization Refrigerator (ADR) cryostat product line from High Precision Devices (HPD), a subsidiary of FormFactor. This acquisition strengthens Danaher’s portfolio of fully integrated sub-Kelvin cryostats and enhances its advanced cryogenic solutions.

In April 2023, INOXCVA developed a 4K helium cryostat for MRI magnet systems, enhancing India's capabilities in advanced cryogenic technology. This innovation supports the growing demand for efficient and high-performance cooling solutions in medical imaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.36 billion |

| Market Size by 2032 | USD 3.69 billion |

| CAGR | CAGR of 5.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Closed-Cycle Cryostats, Continuous-Flow Cryostats, Bath Cryostats, Multistage Cryostats] • By Components [Dewars, Transfer tubes, Gas flow pumps, Temperature controllers, High vacuum pumps, Microtome blades] • By Cryogen [Helium, Nitrogen] • By Application [Healthcare, Energy & Power, Aerospace, Metallurgy, Biotechnology, Forensic science, Marine biology] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Leica Biosystems, Cryomech Inc., Amos Scientific, MEDITE, Bright Instruments, Dakewe Medical, Jinhua YIDI Medical Appliance Co., Ltd., SLEE Medical GmbH, Advanced Research Systems, Lake Shore Cryotronics, Epredia, SM Scientific Instruments, Medimeas, Hacker Instruments & Industries, Boeckeler Instruments Inc., Histo-line Laboratories, Lupetec, SciLab Co. Ltd., Cryofab, Inc., Precision Cryogenics, attocube systems AG, AMETEK Scientific Instruments, Mirion Technologies, BIOBASE, Sipcon Instrument Industries. |