Cryptocurrency Market Report Scope & Overview:

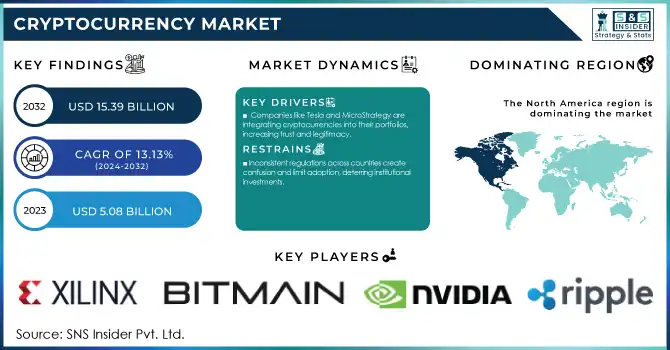

The Cryptocurrency Market was valued at USD 5.08 billion in 2023 and is expected to reach USD 15.39 Billion by 2032, growing at a CAGR of 13.13% from 2024-2032.

Get more information on Cryptocurrency Market - Request Sample Report

The cryptocurrency market’s remarkable growth is driven by rising adoption, innovative technology, and expanding use cases. Blockchain networks now host over 220 million monthly active addresses—a threefold increase since late 2023—demonstrating widespread global engagement. Stablecoins stand out as a transformative force, facilitating USD 8.5 trillion in transactions in Q2 2024, surpassing Visa’s USD 3.9 trillion during the same period. These digital currencies effectively bridge the gap between traditional financial systems and cryptocurrency, offering secure, low-cost, and efficient transaction solutions. Institutional interest continues to surge, as evidenced by companies like Tesla and MicroStrategy incorporating Bitcoin into their portfolios, boosting overall market confidence.

Technological advancements such as Ethereum’s upgrades and layer-2 scaling solutions have further enhanced transaction efficiency and cost-effectiveness, making cryptocurrencies increasingly attractive to both institutional and retail users. In South America, cryptocurrency ownership surged by over 116% in the past year, highlighting its role in fostering financial inclusion for underbanked communities. Asia, meanwhile, remains a major hub, with 327 million users driving the adoption of digital payments and blockchain applications. Beyond speculative trading, the market is diversifying with use cases like cross-border payments, non-fungible tokens (NFTs), and decentralized applications (dApps). Ripple’s XRP has become a preferred choice for global financial transfers due to its efficiency, while decentralized exchanges like Uniswap empower users by reducing reliance on traditional financial platforms.

Despite its rapid growth, the cryptocurrency market faces challenges such as price volatility and evolving regulatory frameworks, which will be critical in determining its long-term scalability and sustainability.

Market Dynamics

Drivers

-

Companies like Tesla and MicroStrategy are integrating cryptocurrencies into their portfolios, increasing trust and legitimacy

-

Innovations such as Ethereum 2.0 and layer-2 scaling solutions improve transaction speed and reduce costs

-

Applications in cross-border payments, NFTs, decentralized finance (DeFi), and decentralized apps (dApps) are broadening crypto's utility

The cryptocurrency market is increasingly expanding its applications beyond speculative trading, leveraging cross-border payments, non-fungible tokens (NFTs), decentralized finance (DeFi), and decentralized applications (dApps) to redefine traditional industries. These innovations are fostering financial inclusion, driving technological innovation, and enhancing operational efficiency across various sectors. In cross-border payments, cryptocurrencies such as Bitcoin, Ripple's XRP, and stablecoins offer rapid, cost-efficient alternatives to traditional banking systems. By eliminating intermediaries like banks, these solutions enable near-instant transfers at reduced costs, making them highly appealing for remittances and international trade. This disrupts conventional systems like SWIFT by bypassing prolonged settlement periods and high fees.

NFTs are transforming digital ownership and intellectual property rights in fields like art, gaming, and entertainment. Platforms such as OpenSea empower creators to mint and trade NFTs directly, fostering a new digital economy. The gaming industry, in particular, utilizes NFTs for tokenized in-game assets that can be traded or sold, boosting user engagement and monetization.

DeFi platforms leverage blockchain to offer decentralized versions of traditional financial services, including lending, borrowing, and insurance. Solutions like Aave and Compound enable users to earn interest or secure loans without relying on banks, which is particularly impactful in underbanked regions. By offering inclusive financial opportunities, DeFi is unlocking access to millions of people worldwide. Decentralized applications (dApps) further enhance blockchain’s utility by addressing use cases such as decentralized exchanges, supply chain management, and identity verification. These applications prioritize transparency, security, and censorship resistance, making them indispensable in industries requiring high trust and accountability.

Together, these advancements demonstrate the transformative potential of cryptocurrency, fostering more inclusive, decentralized, and efficient systems while driving continued market growth.

Restraints

-

Inconsistent regulations across countries create confusion and limit adoption, deterring institutional investments

-

Extreme fluctuations in cryptocurrency prices undermine its viability as a stable investment or payment method

-

Vulnerabilities like hacking, scams, and fraud in exchanges and wallets raise trust issues among users

The cryptocurrency market continues to face significant challenges posed by vulnerabilities like hacking, scams, and fraud, especially in exchanges and wallets—key ecosystem components. These security flaws weaken user confidence and present major hurdles to wider market adoption.

Cryptocurrency exchanges, which enable the trading of digital assets, have consistently been high-value targets for cybercriminals. Noteworthy incidents, the USD 625 million hack of the Ronin Network in 2022, highlight the scale of potential damage. These attacks expose gaps in platform security and lead to substantial financial losses, undermining trust in centralized exchanges and the overall crypto ecosystem.

Wallets, particularly hot wallets connected to the internet, also present significant security concerns. These wallets are frequently targeted by phishing scams, malware, and private key theft, with the loss of private keys resulting in permanent access loss to funds. Fraudulent schemes like Ponzi scams and fake ICOs have further exploited users, leading to billions in losses. For example, phishing attacks targeting wallet users rose sharply in 2024, by over 45%, underlining the urgent need for improved security and user education.

These vulnerabilities lead to financial damages and deter retail and institutional investors who demand secure and trustworthy platforms for asset management. To counter these risks, platforms invest in robust security measures, such as multi-factor authentication, hardware wallets, and decentralized exchanges to reduce reliance on vulnerable centralized systems. Regulatory authorities are also stepping in to enhance compliance, accountability, and oversight, aiming to curb fraudulent activities and strengthen user trust.

While these efforts have made progress, the ongoing risks of hacking and fraud remain a significant challenge for the cryptocurrency market. This underscores the critical need for continued advancements in security technology and comprehensive regulatory frameworks to ensure user trust and long-term market stability.

Segment Analysis

By Type

Bitcoin dominated the market and represented a significant revenue share of more than 40.25% in 2023. Bitcoin will continue to grow due to its strong status as the first cryptocurrency and its increasing adoption by institutional investors such as Tesla and MicroStrategy which are integrating Bitcoin into their balance sheets. Moreover, Bitcoin is known as a store of value, or "digital gold," which is another factor maintaining this market domination. DeFi, NFTs, and the shift towards proof-of-stake (Ethereum 2.0) are major catalysts for growth. Continued dApp adoption from the functionality of its network

Ethereum is anticipated to register the highest compound annual growth rate (CAGR) during the forecast period. Ethereum’s innovative smart contract capabilities and the rise of decentralized finance (DeFi) applications have driven its rapid adoption. Ethereum’s transition from proof-of-work to proof-of-stake through its Ethereum 2.0 upgrade has also enhanced scalability, reduced energy consumption, and attracted more developers. The rise of DeFi, non-fungible tokens (NFTs), and Ethereum’s move to proof-of-stake (Ethereum 2.0) are key growth drivers. The Ethereum network's ability to support decentralized applications (dApps) continues to fuel adoption.

By Component

The Hardware segment dominated the crypto market and represented a significant revenue share of 68.23%, and this can be attributed to significant demand for mining hardware such as ASICs and GPUs. For large coins like Bitcoin or Ethereum, validating their transactions requires mining. With the increasing complexity of mining operations, and the price of cryptocurrencies such as Bitcoin continuing to soar, there is a greater demand for purpose-built hardware to address these challenges. The continued transition to Ethereum 2.0 and the expansion of institutional mining operations have also pushed hardware demand higher.

The software segment is anticipated to grow at the fastest growth rate in the cryptocurrency market. These are driven by the rising utilization of blockchain platforms, decentralized finance (DeFi) solutions, wallet applications, and cryptocurrency exchanges. As the use cases of block chain technology expand in the form of NFTs, Smart contracts, and decentralized applications (dApps), a growing need for crypto-related software has emerged. The main forces behind it are the expansion of DeFi platforms, innovations of Ethereum 2.0, and growing interest of secure non-custodial wallets. The software sector is leading in terms of growth with increasing BaaS (blockchain-as-a-service) offerings for businesses giving another momentum to the software sector.

By Process

The mining segment dominated the cryptocurrency market and represented a significant revenue share of 62.3%, serving a crucial role in transaction validation and blockchain security. Mining is vital for creating new digital currencies and upholding transaction integrity, particularly for dominant assets like Bitcoin and Ethereum. As digital asset adoption grows and values increase, the demand for specialized mining hardware and energy-intensive operations rises significantly. The transition to Ethereum 2.0, which shifts from Proof of Work (PoW) to Proof of Stake (PoS), is redefining mining processes while sparking innovation in mining hardware, especially for Bitcoin and other cryptocurrencies. Key factors driving mining market growth include the surge in Bitcoin prices, rising institutional investments, and the growing complexity of mining algorithms, all contributing to a demand for more advanced, efficient mining hardware.

The transaction segment is anticipated to witness the highest compound annual growth rate (CAGR) in the cryptocurrency market. This segment covers the processing and validation of cryptocurrency transactions, a growth area driven by the increasing use of digital currencies for payments, remittances, and decentralized finance (DeFi) services. With blockchain technology becoming more mainstream, the volume of transactions across platforms like Bitcoin, Ethereum, and stable coins continues to rise. Factors fueling this growth include widespread cryptocurrency adoption for daily transactions, the expansion of decentralized exchanges, and innovations in transaction speed and cost efficiency, notably through Layer-2 technologies like the Lightning Network.

Do you need any customization research study on Cryptocurrency Market - Enquiry Now

Regional Analysis

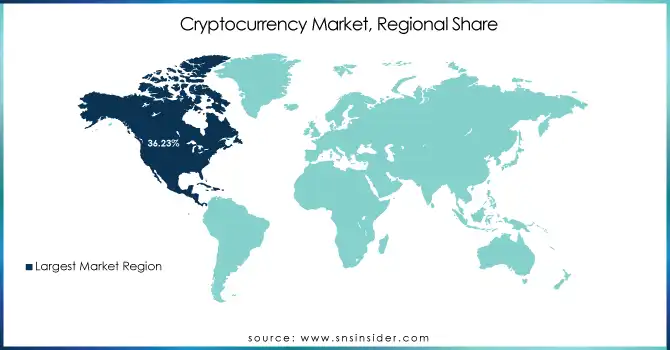

In 2023, North America dominated the cryptocurrency market and represented revenue share of 36.23%, driven by the concentration of cryptocurrency mining farms, such as Riot Blockchain, Marathon Digital, and Bitfarm. These facilities play a critical role in validating transactions and securing blockchain networks, especially for cryptocurrencies like Bitcoin and Ethereum. The rapid adoption of cryptocurrencies in the U.S. and the recognition of digital currencies as viable investment assets by major financial institutions are also contributing to the region's growth. Moreover, the increasing use of cryptocurrencies for transactions in retail spaces further supports this expansion. Moving forward, North America is expected to maintain strong growth, especially with institutional investments and technological advancements in blockchain systems

The Asia Pacific region is experiencing the highest compound annual growth rate (CAGR) in the cryptocurrency market. Countries like Japan, South Korea, and China are driving this growth, thanks to their strong focus on blockchain innovation and cryptocurrency infrastructure. In particular, Japan’s government-backed initiatives and China’s dominance in mining hardware production contribute significantly. Additionally, decentralized finance (DeFi) and blockchain research in the region continue to thrive, attracting both institutional and retail investors. The active development of blockchain applications for a wide range of industries, from finance to supply chain management, is poised to further accelerate market expansion in the region

Key Players

The major key players along with their products are

-

Coinbase - Coinbase Exchange

-

Binance - Binance Exchange

-

Kraken - Kraken Exchange

-

Gemini - Gemini Wallet

-

Bitfinex - Bitfinex Exchange

-

Ripple Labs - Ripple (XRP)

-

Ethereum Foundation - Ethereum Blockchain

-

Bitcoin Foundation - Bitcoin Protocol

-

Chainalysis - Chainalysis Reactor (Compliance and Investigation Tool)

-

BlockFi - BlockFi Interest Account (BIA)

-

Bitmain - Antminer S19 Pro (ASIC Miner)

-

Ledger - Ledger Nano X (Hardware Wallet)

-

Tether - Tether (USDT)

-

OKX - OKX Exchange

-

KuCoin - KuCoin Exchange

-

Crypto.com - Crypto.com App

-

Cardano (IOHK) - Cardano Blockchain

-

Polkadot - Polkadot Blockchain

-

Avalanche - Avalanche Blockchain

-

Uniswap - Uniswap Protocol

Recent Developments

January 2024 – SEC Approval of Bitcoin ETFs: The U.S. Securities and Exchange Commission (SEC) is expected to make a historic decision on the approval of spot Bitcoin Exchange-Traded Funds (ETFs) by January 2024. This has created considerable anticipation in the market, with experts predicting a high likelihood of approval. This approval is anticipated to bring more institutional investors into the cryptocurrency space, potentially boosting mainstream acceptance of digital currencies

January 2024 – Ethereum’s Layer-2 Scaling Solutions: Ethereum has made notable progress with its Layer-2 scaling solutions aimed at reducing transaction congestion and fees. These solutions are expected to significantly enhance the platform's scalability and improve user experiences, driving further adoption in the decentralized finance (DeFi) space

| Report Attributes | Details |

| Market Size in 2023 | USD 5.08 billion |

| Market Size by 2032 | USD 15.39 Billion |

| CAGR | CAGR of 13.13% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

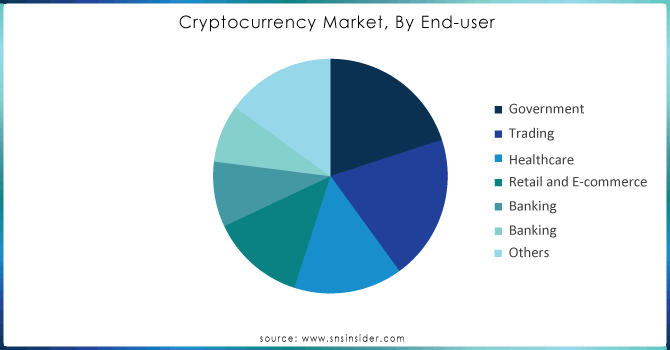

| Key Segments | • By Component (Hardware, Software) • By Process (Mining, Transaction) • By Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dash, Others) • By Application (Trading, Payments, Remittance, Banking, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bitmain, NVIDIA, Xilinx, Intel, Advanced Micro Devices, Ripple Labs, Ethereum Foundation, Bitfury Group, Coinbase, BitGo, Binance Holdings, Canaan Creative, Bitstamp. |

| Key Drivers | •Companies like Tesla and MicroStrategy are integrating cryptocurrencies into their portfolios, increasing trust and legitimacy •Innovations such as Ethereum 2.0 and layer-2 scaling solutions improve transaction speed and reduce costs •Applications in cross-border payments, NFTs, decentralized finance (DeFi), and decentralized apps (dApps) are broadening crypto's utility |

| Market Opportunities | •Inconsistent regulations across countries create confusion and limit adoption, deterring institutional investments •Extreme fluctuations in cryptocurrency prices undermine its viability as a stable investment or payment method •Vulnerabilities like hacking, scams, and fraud in exchanges and wallets raise trust issues among users |