Network Attached Storage Market Report Scope & Overview:

Get More Information on Network Attached Storage Market - Request Sample Report

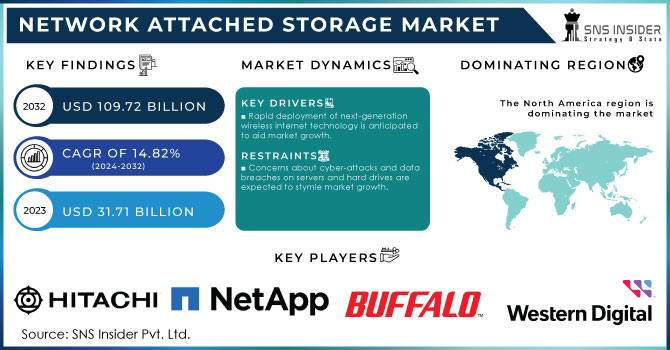

Network Attached Storage Market was worth USD 31.71 billion in 2023 and is predicted to be worth USD 109.72 billion by 2032, growing at a CAGR of 14.82% between 2024 and 2032.

NAS or Network Attached Storage is a centralized data storage connected to a network enabling the clients and authorized users to store any kind of data available in NAS. The introduction of Gigabit Ethernet and fast transport protocols has accelerated the adoption of these devices. Different industries need to store data in different ways law enforcement requires video surveillance storage, broadcasting requires processing of retained videos, finance needs long-term record maintenance and analytics support for both trade information storage as well as regulatory compliance documents while healthcare businesses are on the lookout for secure yet cost-effective safekeeping options. It does very well at handling High-Performance Computing (HPC) workloads. In the U.S., large enterprises would leverage NAS solutions with about 50% having incorporated them within their IT environment, as these are scalable storage and good for data backup, archive & disaster recovery and well in industries where there are strict compliance issues around managing terabytes or petabytes of data. Organizations have been relying on these systems to deal with the huge amounts of data generated by digital initiatives and enterprises as well as increasing use of big data analytics, which lowers the U.S. IT & telecommunications sector NAS adoption rate by approximately 55%.

NAS manufacturers are increasingly targeting cloud storage services like Google Drive, OneDrive, and Dropbox, as NAS offers strong capabilities in this area. Another major factor is the cheaper cost profile of NAS when compared to traditional private cloud storage. The surge in demand for scalable and economical storage solutions has influenced the growth of NAS systems, especially at a time when 60% of SMBs leverage these to store and manage data. The worldwide data created is estimated to go up to 175 zettabytes by the year, and a significant portion of this data requires storage solutions like NAS to manage unstructured data efficiently. Advanced hardware and software optimization has allowed current-generation NAS systems to reduce power consumption by up to 30% as compared with older models.

Drivers

-

Rapid deployment of next-generation wireless internet technology is anticipated to aid market growth.

-

Network Attached Storage (NAS) market is experiencing significant growth due to the proliferation of new products and entry investments in network technologies.

AT&T, T-Mobile US, Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, and Telefonica S.A. are among the telecom service providers that have invested in 5G service installations. Increased investment in 5G and the sale of millions of devices promote market growth and the development of smart cities, industry, and agriculture. Furthermore, there is an increasing desire for numerous smart applications, such as smart city projects and smart homes, to be linked to the cloud, which creates vast amounts of data. The growing sale of linked smart devices throughout the world, along with an increase in internet penetration, has fuelled market expansion.

The Network Attached Storage (NAS) market is experiencing significant growth due to the proliferation of new products and entry investments in network technologies. The wide release of such groundbreaking NAS devices has only been increasing the range in storage efficiency and providing relief to larger data needs. For instance, in January 2024, Ugreen, in collaboration with Intel, launched the UGREEN NASync devices, featuring automated decision-making capabilities, reflecting the trend of integrating advanced technologies into NAS solutions.

significant investments in network technologies, particularly in high-speed connectivity like 5G and fiber-optic networks, are propelling NAS adoption. The US, leader in technological advancement, has seen a 30% increase in 5G infrastructure investment over the past year. Also, important advancements for industries including telecommunications, which require NAS systems to manage the terabytes of data produced by digital content and services. In addition to this, hybrid clouds are being pushed by supplements of network availability and 75% or more US organizations say they would connect NAS with cloud storage. This market trend reflects the rise of NAS as an affordable, high-performing and adaptable solution to move data where it's most needed without compromising security.

Restrains

-

Concerns about cyber-attacks and data breaches on servers and hard drives are expected to stymie market growth.

Network-attached storage is a type of storage device that is linked to a network and delivers file services to computer systems. These devices include storage systems for data and papers. This stored data is vulnerable to cyber security threats posed by cyber attackers. Data security and privacy are critical considerations for network-connected storage servers and hardware. According to a Palo Alto Networks Inc. researcher's analysis, an estimated 240,000 QNAP Systems NAS systems and roughly 3,500 Synology NAS devices were vulnerable to cyber-attacks in August 2021.

Segment Analysis

By Product

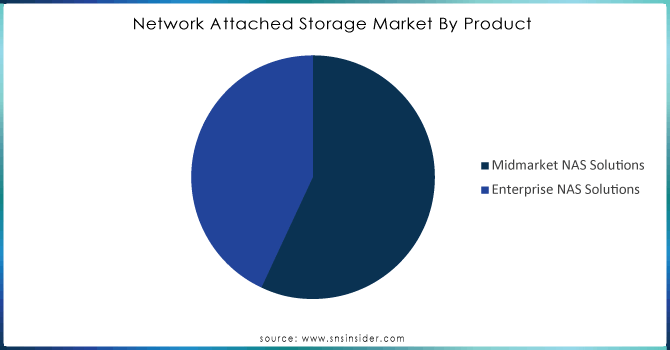

The largest share of NAS market is accounted by the midmarket NAS solutions segment. The rise of digital content, particularly in unstructured form due to an ever-growing tech-savvy generation dependent on smartphones and other devices such as tablets, laptops, or smart gadgets. NAS solutions are helping consumers easily manage these huge data amounts efficiently. This is also because video surveillance, media streaming, and backup system data needs are typically stored in centralized NAS systems. Midmarket NAS systems are used for personal uses, it is also a well-suited and much cost-effective for SMB marketplace. Their systems are geared more towards businesses than homeowners, offering a different set of features and functionalities that make them the perfect solution for corporations.

Need any customization research on Network Attached Storage Market - Enquiry Now

By End use Industry

The telecommunications and ITES segment held significant share of NAS solutions, with the increasing requirement for data mobility, storage virtualization and backup & recovery services in this field being one among the top contributors. The proliferation of digital media content which includes audio files, user-generated images and documents has increase the necessity for better data storage solutions. This data holds value for both providers and consumers, making robust storage systems essential for telecom companies.

With an increase in the proliferation of population using internet facilities and adapting to new technology advancements, telecom service providers find data storage as a burgeoning challenge for them. For that to happen they need storage solutions with the capabilities of storing huge amount of customer records and data related to their telecommunication services. This is where NAS devices come into the picture as they provide high-levels of storage to accommodate multimedia files and also ensures data security which falls in lines with the basic necessity for an ITES or telecommunications sector. This combination of capabilities is driving the segment's growth, as the industry continues to expand and the need for efficient, scalable storage solutions becomes more critical.

Regional analysis

The North America region led the market with more than 34% share in 2023, because of the demand for advanced analytics solutions which need extensive data storage capabilities. Network-attached storage (NAS) is widely used in the region, where it connects to networks via Ethernet ports or USB, and is assigned an IP address for direct access by end-users. The United States is held the major market share in North America, contributed significant share of global market. digital transformation sector with key focus areas such as professional services, discrete manufacturing and transportation. These industries are increasingly using digital solutions that give rise to growing amounts of unstructured data, leading companies to deploy more NAS systems in order to manage their files and users. The more significant NAS systems adoption in the U.S. is another cause mainly to hybrid cloud storage being developed, significantly increased redundancy of data backup, manageability and scalability In the current scenario, smart devices such as laptops and smartphones are used in almost all regions of the world which along with increasing market demand is adding to growing data volume. The Asia Pacific NAS market is expected to grow at a high CAGR during the forecast period, owing to rising capacity in decentralized storage networks where hundreds of petabytes are being onboarded creating demand for NAS.

Key Players:

The major players are Hitachi, Ltd., Hewlett Packard Enterprise Company, NetApp, Inc., Buffalo Americas, Inc., Synology, Inc., Dell Technologies Inc., QNAP Systems, Inc., Western Digital Corporation, Seagate Technology Public Limited Company (PLC), NETGEAR, Inc., and others in the final report.

Recent Developments:

-

January 2024, Ugreen and Intel released the UGREEN NASync network-attached storage gear, powered with automatic decisions, and maximizing the effectiveness of storing.

-

August 2023, Buffalo moved its TeraStation 6000 and 5010 Series NAS products to While Supplies Last status and announced a replacement with the TeraStation 5020 Series.

-

June 2023, Synology released the 2-bay DiskStation DS223j, a new addition to its J Series of entry-level products, particularly suitable for home office or small teams. It also grants users opportunities to work with various applications for everyday storage and processing to manage videos, files, synchronization, and backup.

-

April 2023, Seagate announced the creation of a store-from-the-edge-to-the-cloud enterprise storage solution with QNAP Systems Inc, targeting SMB and content creation.

| Report Attributes | Details |

| Market Size in 2023 | US$ 31.71 Bn |

| Market Size by 2032 | US$ 109.72 Bn |

| CAGR | CAGR of 14.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Storage Solution (Scale-up NAS, Scale-out NAS) • By Design (1–8 Bays, 8–12 Bays, 12–20 Bays, more than 20 Bays) • By Product (Enterprise NAS Solutions, Midmarket NAS Solutions) • By Deployment Type (On-premises, Remote/Cloud, Hybrid) • By End-user Industry (Telecommunications & ITES, Banking, Financial Services, and Insurance (BFSI), Consumer Goods & Retail, Energy, Healthcare, Government, Education & Research, Media & Entertainment, Manufacturing, Business & Consulting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hitachi, Ltd., Hewlett Packard Enterprise Company, NetApp, Inc., Buffalo Americas, Inc., Synology, Inc., Dell Technologies Inc., QNAP Systems, Inc., Western Digital Corporation, Seagate Technology Public Limited Company (PLC), NETGEAR, Inc., and others in the final report. |

| Key Drivers | • Rapid deployment of next-generation wireless internet technology is anticipated to aid market growth. |

| Market Opportunities | • The use of hybrid cloud storage is increasing. • Real-time data consistency is required. |