Tax Tech Market Report Scope & Overview:

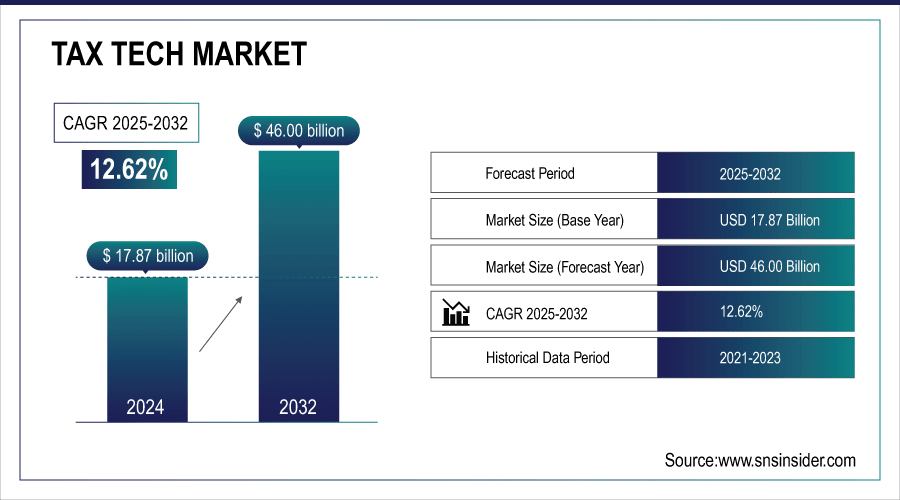

Tax Tech Market was valued at USD 17.87 billion in 2024 and is expected to reach USD 46.00 billion by 2032, growing at a CAGR of 12.62% from 2025-2032.

The Tax Tech Market is growing rapidly due to increasing automation in tax compliance, rising adoption of AI and analytics for accurate reporting, and growing regulatory complexities across regions. Enterprises are investing in digital tax solutions to streamline operations, reduce errors, and ensure real-time compliance. Additionally, cloud-based and SaaS tax platforms are driving scalability, efficiency, and cost optimization, fueling sustained market growth.

The U.S. Department of the Treasury's report on the financial services sector's adoption of cloud services indicates that financial institutions find SaaS applications to be the easiest cloud-based services to deploy and manage.

Moreover, the U.S. Congressional Research Service's report on AI and machine learning in financial services highlights applications such as enhancing customer service and identifying investment opportunities, which are directly relevant to improving tax reporting and compliance.

To Get More Information On Tax Tech Market - Request Free Sample Report

Tax Tech Market Trends

-

Rising demand for automated tax compliance and reporting to reduce errors and save time.

-

Cloud-based tax solutions are enabling scalability, remote access, and real-time updates.

-

Integration with AI and analytics is improving accuracy, risk management, and predictive tax planning.

-

Growing adoption across enterprises, SMEs, and fintech platforms is driving market expansion.

-

Increasing regulatory changes and global tax reforms are pushing companies to adopt advanced tax technologies.

-

Focus on digital invoicing, e-filing, and blockchain-based solutions is enhancing transparency and security.

-

Managed services, consulting, and SaaS models are supporting faster implementation and adoption of tax tech solutions.

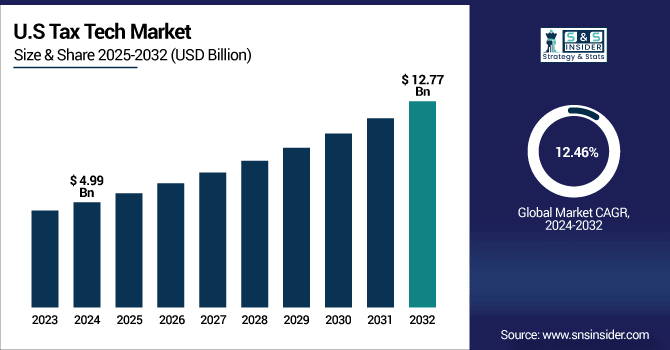

U.S. Tax Tech Market was valued at USD 4.99 billion in 2024 and is expected to reach USD 12.77 billion by 2032, growing at a CAGR of 12.46% from 2025-2032.

The U.S. Tax Tech Market is expanding due to increasing demand for automated tax compliance and reporting solutions among enterprises. Rising adoption of AI, machine learning, and analytics enhances accuracy and efficiency in tax processes. Additionally, stringent federal and state tax regulations, coupled with the shift toward cloud-based and SaaS platforms, are driving businesses to invest in advanced tax technologies, fueling consistent market growth.

Tax Tech Market Growth Drivers:

-

Rising digital transformation across finance functions creating greater need for cloud-based tax solutions and advanced analytics adoption

Digital transformation initiatives in finance departments are reshaping traditional tax processes, encouraging enterprises to adopt cloud-based tax solutions for scalability and agility. Integration of AI and advanced analytics improves accuracy, forecasting, and reporting efficiency, enabling finance teams to make data-driven tax decisions. Cloud adoption enhances accessibility and collaboration, reducing dependency on legacy systems and manual interventions. As organizations embrace automation, tax technology plays a vital role in driving transparency and minimizing errors. The growing focus on operational efficiency and cost optimization further strengthens the market demand, positioning tax tech as a critical enabler of modern finance operations.

Tax Tech Market Restraints:

-

Data privacy concerns and cybersecurity risks hindering broader acceptance of digital tax platforms across regulated industries

Growing reliance on digital tax solutions raises concerns about data privacy, security breaches, and regulatory compliance with strict data protection laws. Tax systems handle highly sensitive financial data, making them prime targets for cyberattacks. Many organizations hesitate to fully transition to cloud-based tax platforms due to fears of unauthorized access and non-compliance with jurisdictional data residency requirements. The risk of penalties from data breaches further deters adoption. Although providers invest heavily in security, skepticism remains high in regulated industries like banking, insurance, and healthcare, creating hesitation and slowing the pace of mass adoption of tax technology solutions.

-

In the United States, the Federal Trade Commission (FTC) has warned tax preparation companies about potential civil penalties if they misuse consumer data collected for tax purposes, emphasizing the importance of adhering to data privacy laws and maintaining consumer trust.

Tax Tech Market Opportunities:

-

Growing adoption of AI, automation, and predictive analytics offering tax technology firms potential to revolutionize compliance and advisory services

Advancements in artificial intelligence, automation, and predictive analytics are opening new possibilities for tax technology providers. Enterprises can leverage these tools to automate routine processes such as tax filing, reconciliation, and reporting, improving accuracy and efficiency. Predictive analytics enhances risk assessment, compliance forecasting, and tax planning, empowering finance teams to make proactive decisions. Such innovations enable tax tech solutions to go beyond compliance and offer value-added advisory services. As businesses prioritize digital transformation, providers that integrate AI and analytics into tax systems are well-positioned to capitalize on this opportunity and expand their market share significantly.

-

Thomson Reuters' 2025 survey reveals that organizations with a defined AI strategy are twice as likely to experience revenue growth driven by AI, underscoring the strategic value of AI in tax functions.

-

The same survey indicates that professionals using AI could save an average of 5 hours weekly, translating to approximately $19,000 in annual value per person, highlighting the efficiency benefits of AI adoption.

-

Additionally, 21% of tax, audit, and accounting firms report using generative AI at an enterprise level, up from 8% in 2024, reflecting the rapid uptake of advanced AI tools in the industry.

Tax Tech Market Segment Highlights

-

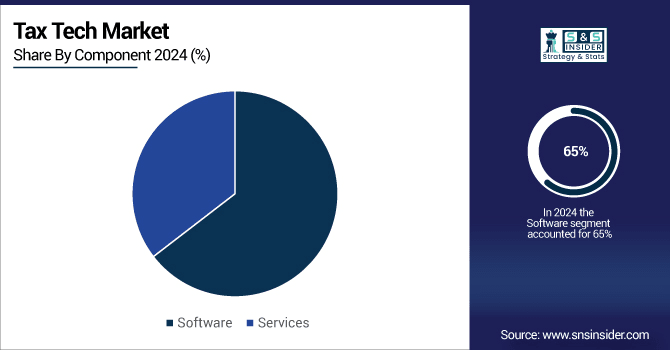

By Component, Software dominated with ~65% share in 2024; Writing & Content Services fastest growing (CAGR 13.88%).

-

By Organization Size, Large Enterprises dominated with ~65% share in 2024; Small and Medium Enterprises (SMEs) fastest growing (CAGR 13.88%).

-

By Vertical, Banking, Financial Services, and Insurance (BFSI) dominated with ~25% share in 2024; Retail & E-commerce fastest growing (CAGR 15.16%).

-

By Technology, Artificial Intelligence (AI) and Machine Learning (ML) dominated with ~30% share in 2024; Robotic Process Automation (RPA) fastest growing (CAGR 15.11%).

-

By Tax Type, Indirect Tax dominated with ~32% share in 2024; Indirect Tax fastest growing (CAGR 14.46%).

Tax Tech Market Segment Analysis

By Component, Software dominated while Writing and Content Services are expected to grow fastest

Software segment dominated the Tax Tech Market with the highest revenue share in 2024, driven by enterprises’ reliance on automated tax platforms for compliance, accuracy, and real-time reporting. Organizations increasingly adopt scalable and integrated solutions to replace manual systems, ensuring efficiency, cost reduction, and adherence to complex multi-jurisdictional regulations across global operations.

Writing & Content Services segment is expected to grow at the fastest CAGR from 2025-2032, supported by increasing demand for accurate documentation, digital tax reporting, and compliance-driven advisory services. Businesses rely on content solutions for localized tax filings, regulatory updates, and tailored compliance insights, positioning this segment as a critical enabler of global tax transformation.

By Enterprise Size, Large Enterprises led while SMEs are projected to grow fastest

Large Enterprises segment dominated the Tax Tech Market with the highest revenue share in 2024, as they manage complex, multi-jurisdictional operations demanding scalable solutions. Their greater financial resources, advanced IT infrastructure, and need for automation drive adoption of integrated tax technologies. These organizations prioritize risk reduction and compliance efficiency, making them the dominant adopters of tax technology platforms.

Small and Medium Enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2025-2032, driven by rising digital transformation and increasing affordability of cloud-based solutions. SMEs seek cost-effective platforms to improve efficiency, reduce compliance risks, and adapt to regulatory changes. The growing adoption of SaaS-based tax technologies further accelerates this segment’s rapid growth trajectory.

By Industry Vertical, BFSI dominated while Retail and E-commerce are expected to grow fastest

Banking, Financial Services, and Insurance (BFSI) segment dominated the Tax Tech Market with the highest revenue share in 2024, owing to stringent compliance requirements, regulatory scrutiny, and high transaction volumes. The sector requires advanced solutions to ensure accuracy, security, and transparency in tax reporting. BFSI’s early digital adoption further strengthens its leadership in the tax technology landscape.

Retail & E-commerce segment is expected to grow at the fastest CAGR from 2025-2032, driven by booming cross-border trade, digital transactions, and varied jurisdictional tax regimes. Companies increasingly rely on automated tax platforms to manage sales tax, VAT, and digital levies across multiple markets, positioning this sector for significant adoption of innovative tax technology solutions.

By Technology, AI and ML led while Robotic Process Automation is projected to grow fastest

Artificial Intelligence (AI) and Machine Learning (ML) segment dominated the Tax Tech Market with the highest revenue share in 2024, as enterprises leverage these tools for predictive analytics, automation, and fraud detection. AI-powered systems enhance compliance efficiency and reduce errors, providing scalable solutions that deliver real-time insights, proactive risk management, and optimization of complex tax operations.

Robotic Process Automation (RPA) segment is expected to grow at the fastest CAGR from 2025-2032, supported by rising demand for automation of repetitive tax tasks such as data entry, reconciliation, and filing. RPA enables significant cost savings, speed, and accuracy, making it particularly appealing for enterprises aiming to streamline workflows and enhance regulatory compliance outcomes.

By Tax Type, Indirect Tax dominated and is expected to grow fastest

Indirect Tax segment dominated the Tax Tech Market with the highest revenue share in 2024, as enterprises manage complex VAT, GST, and sales tax requirements across multiple jurisdictions. The segment is also expected to grow at the fastest CAGR from 2025-2032, driven by rising cross-border trade, e-commerce expansion, and evolving digital tax mandates. Increasing government adoption of real-time reporting and e-invoicing frameworks further accelerates demand for automated, scalable indirect tax solutions that ensure compliance, accuracy, and efficiency in a dynamic regulatory landscape.

Tax Tech Market Segment Highlights

-

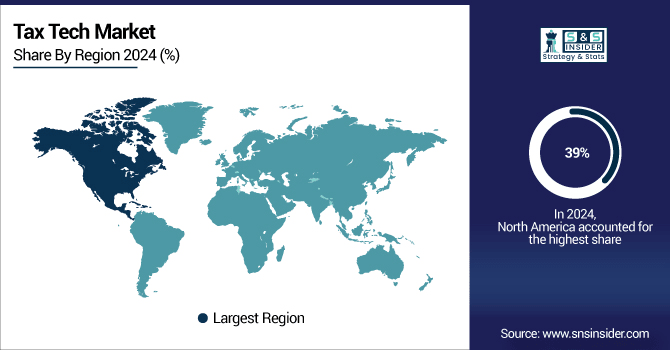

By Region, North America dominated with ~39% share in 2024; Asia Pacific fastest growing (CAGR 14.52%).

Tax Tech Market Segment Analysis

North America Tax Tech Market Insights

North America dominated the Tax Tech Market with the highest revenue share in 2024, supported by strong regulatory frameworks, high digital adoption, and widespread use of advanced financial technologies. Enterprises in the region prioritize automation, compliance efficiency, and integration of tax solutions with enterprise systems. The presence of leading tax technology providers, coupled with early adoption of AI, cloud, and analytics, positions North America as the most mature and dominant regional market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Tax Tech Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025-2032, driven by rapid digital transformation, expanding cross-border trade, and evolving tax regulations across emerging economies. Governments in the region are increasingly implementing e-invoicing, digital reporting, and real-time compliance mandates, creating opportunities for technology adoption. Rising investments by enterprises in automation, cloud-based platforms, and localized tax solutions accelerate market expansion, making Asia Pacific the fastest-growing regional hub.

Europe Tax Tech Market Insights

Europe in the Tax Tech Market is witnessing steady growth, driven by stringent regulatory frameworks, complex VAT systems, and evolving digital tax compliance mandates. The region emphasizes transparency, e-invoicing, and cross-border tax harmonization, pushing enterprises to adopt advanced solutions. Strong government initiatives, coupled with rising adoption of automation and analytics, position Europe as a key contributor to global tax technology adoption.

Middle East & Africa and Latin America Tax Tech Market Insights

Middle East & Africa in the Tax Tech Market is expanding steadily, fueled by ongoing digitalization, government-led VAT reforms, and increasing regulatory enforcement. Enterprises adopt tax technology to ensure compliance, transparency, and efficiency in evolving tax regimes.Latin America is emerging strongly, driven by mandatory e-invoicing, digital reporting, and complex tax frameworks. High regulatory scrutiny and rapid e-commerce growth accelerate adoption of automated, cloud-based tax technology solutions across the region.

Tax Tech Market Competitive Landscape:

Wolters Kluwer

Wolters Kluwer is a leading provider in the Tax Tech Market, offering comprehensive software and solutions for tax compliance, reporting, and automation. Its platforms leverage AI, analytics, and cloud technologies to streamline direct and indirect tax processes for businesses of all sizes. The company’s solutions enhance accuracy, reduce manual effort, and ensure regulatory compliance, making it a key player driving efficiency and innovation in the global tax technology landscape.

-

In 2024, Wolters Kluwer Introduced AI-powered enhancements across its CCH Axcess cloud suite to streamline return preparation, firm management, and audit workflows.

Vertex

Vertex is a prominent player in the Tax Tech Market, specializing in cloud-based and on-premise tax automation solutions for businesses worldwide. Its platforms streamline indirect and direct tax processes, ensuring accurate calculation, reporting, and compliance. Leveraging AI, analytics, and integration capabilities, Vertex helps organizations reduce errors, enhance efficiency, and maintain regulatory adherence. Its robust, scalable solutions make it a key contributor to innovation and growth in the global tax technology sector.

-

2024: Vertex acquired AI-driven tax categorization technology from Ryan, LLC, strengthening its generative AI capabilities to simplify complex tax mapping processes and enhance automation for global businesses.

-

2025: Vertex completed a $15 million strategic investment in AI-native startup Kintsugi, aimed at advancing automated sales tax compliance solutions tailored specifically for small and midsize businesses.

Avalara

Avalara is a leading provider in the Tax Tech Market, offering cloud-based solutions for automated tax compliance, calculation, and reporting. Its platform integrates with ERP, e-commerce, and accounting systems, helping businesses of all sizes manage sales, VAT, and other indirect taxes efficiently. By leveraging real-time data, Avalara ensures accuracy, reduces manual workload, and supports regulatory compliance, establishing itself as a key innovator driving digital transformation in global tax technology.

-

2025: Avalara launched “Avi for Tax Research,” a generative AI assistant embedded in its ATR platform, delivering instant, reliable answers to complex tax questions and improving efficiency for businesses and professionals.

H&R Block

H&R Block is a notable participant in the Tax Tech Market, providing tax preparation, filing, and compliance solutions for individuals and businesses. The company combines traditional tax services with digital platforms to automate calculations, streamline reporting, and ensure regulatory adherence. Leveraging technology and expert support, H&R Block enhances accuracy, reduces errors, and simplifies the tax process, positioning itself as a trusted provider in the global tax technology and services landscape.

-

2025: H&R Block partnered with OpenAI to launch a GenAI assistant, empowering 60,000 tax professionals with real-time insights, enhanced decision support, and improved efficiency in managing complex tax compliance processes.

Key Players

Some of the Tax Tech Market Companies

-

Wolters Kluwer

-

H&R Block

-

Avalara

-

Thomson Reuters

-

SAP

-

ADP

-

SOVOS

-

Intuit

-

Xero

-

TaxBit

-

Ryan

-

TaxAct

-

Anrok

-

TaxSlayer

-

Fonoa

-

Token Tax

-

Drake Software

-

TaxJar

-

Picnic Tax

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 17.87 Billion |

| Market Size by 2032 | USD 46.00 Billion |

| CAGR | CAGR of 12.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Tax Type (Direct Tax, Indirect Tax, Property Tax, Payroll Tax, Others) • By Technology (Robotic Process Automation (RPA), Big Data and Analytics, Natural Language Processing (NLP), Blockchain, Artificial Intelligence (AI) and Machine Learning (ML), Others) • By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)) • By Industry Vertical (Pharmaceutical & Healthcare, Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Retail & E-commerce, Oil & Gas, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Wolters Kluwer, H&R Block, Avalara, Vertex, Thomson Reuters, SAP, ADP, SOVOS, Intuit, Xero, TaxBit, Ryan, TaxAct, Anrok, Corvee, TaxSlayer, Fonoa, Token Tax, Drake Software, TaxJar, Picnic Tax |