Cyanoacrylate Adhesives Market Report Scope & Overview:

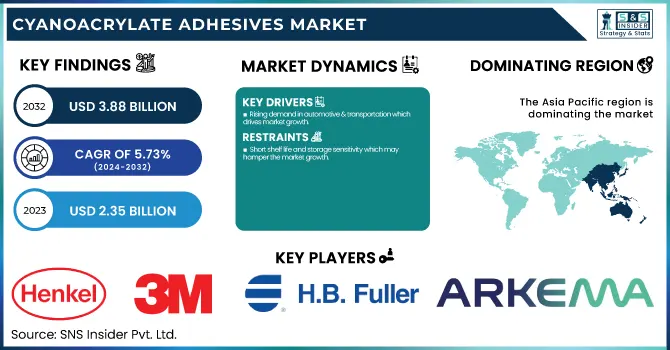

The Cyanoacrylate Adhesives Market size was USD 2.35 Billion in 2023 and is expected to reach USD 3.88 Billion by 2032 and grow at a CAGR of 5.73 % over the forecast period of 2024-2032.

To Get more information on Cyanoacrylate Adhesives Market - Request Free Sample Report

This report provides key statistical insights and trends in the cyanoacrylate adhesives market, covering production capacity and utilization by country and type in 2023. It analyzes raw material price trends across regions, highlighting cost fluctuations. The study examines regulatory impact and compliance by country, focusing on safety and environmental policies. Additionally, it explores innovation and R&D investments, showcasing advancements in flexible, medical-grade, and low-odor formulations. Environmental and sustainability metrics are assessed, including VOC emissions and recycling initiatives. The report also tracks end-user adoption trends across industries like automotive, healthcare, and construction. These insights offer a comprehensive understanding of market dynamics and growth factors.

Cyanoacrylate Adhesives Market Dynamics

Drivers

-

Rising demand in automotive & transportation which drives market growth.

Cyanoacrylate adhesives for interior components and electronic applications, especially in the automotive sector as the demand for assembling vehicles is continuously rising. Cyanoacrylate is a fast-curing, high-strength, high-adhesion adhesive to a variety of materials, including metals, plastics, rubber, and composites, and is used for a range of applications in automotive manufacturing. The growing emphasis on lightweight vehicle design produces strong fastening methods, which minimize the use of mechanical fasteners and improve vehicle performance and fuel efficiency by reducing the weight of the vehicle. Meanwhile, the increasing use of electric vehicles (EVs) is also driving demand, with cyanoacrylate adhesives being critical for battery assembly, wiring harnesses, and electronic components. The growth of the automotive industry especially in emerging markets such as China, India, and South-East Asia is expected to boost the adoption of these adhesives in structural and safety-critical applications.

Restraint

-

Short shelf life and storage sensitivity which may hamper the market growth.

The short shelf life and sensitive storage of cyanoacrylate adhesives are expected to hinder the growth of the global cyanoacrylate adhesives market over the forecast period. The adhesives are very reactive and can polymerize rapidly onto moisture leading to premature curing and decreased workability. Consequently, manufacturers and end-users must place them in controlled molding with low moisture content and room temperature fluctuations, usually needing a refrigerator whenever possible to prolong their time coding. Bulk Supply avails adhesive under continuous production flow, however, adhesive consumption is sensitive to environmental conditions. Unfavorable storage conditions influence storage life, and exorbitant levels of adhesive degradation can lead to total product loss of thousands of euros, causing a shift towards expense–driven operations. Moreover, this puts further difficulty on inventory improvements given that the shelf life is constrained, which is very complicated for huge-scale producers and distributors. This will discourage its adoption in use cases that involve long-term storage, and supply chain efficiency which is an overall hindrance to market growth.

Opportunity

-

Growing adoption of electric vehicles (EVs) creates an opportunity in the market.

The growing demand for electric vehicles (EVs), as automotive manufacturers stare at the introduction of high-performance bonding solutions which are lightweight and durable vehicle components. Due to the ongoing transition to EV battery technology, cyanoacrylate adhesives are essential for applications such as battery pack assembly, wire harness bonding, and integration of electronic components where high thermal stability and strength are required. These adhesives provide lightweight vehicle design solutions that reduce the need for traditional fasteners and also improve energy efficiency. Globally tightening emission regulations passed by governments and the gradual shift toward EV adoption via subsidies and incentives will increase the demand for advanced adhesives used in automotive manufacturing. Asia-Pacific & Europe experience rapid EV production and infrastructure development which further fuels this trend, thanks to healthy consumer demand for electric vehicles.

Challenges

-

Limited performance at high temperatures may challenge the market growth.

Low-high temperature resistance of cyanoacrylate adhesives must be considered, which restrains their growth in the market as a considerable physical property of adhesives as it becomes a challenge for bonding solution to resist large temperature range of gap or it must be replaced due to the limitations of characteristics. Most cyanoacrylate adhesives break down or lose their bond properties near 80–100°C rendering them ineffective for aerospace, automotive engines, and heavy machinery applications where high heat environments are common. This limited performance restricts them from being used in high-performance manufacturing processes, which causes industries to resort to competing high-temperature adhesives such as epoxies, silicones, or polyurethanes. These factors are compelling manufacturers in the cyanoacrylate adhesives market to increase R&D investments to improve heat resistance or hybrid formulations to retain the competitive edge in stress-prone applications.

Cyanoacrylate Adhesives Market Segmentation Analysis

By Technology

Reactive held the largest market share around 72% in 2023. owing to its bonding strength, Fast-curing behavior, and applicability in a wide array of industries. When exposed to moisture, reactive cyanoacrylate adhesives are cured into high-performance, long-lasting bonds and are popular for automotive, electronics, medical, and industrial applications. This becomes even more prominent with their capacity to create an instantaneous bond with various substrates such as metals, plastics, rubber, and ceramics. Moreover, high structural adhesives are mutually beneficial in automotive lightweighting, medical device assembly, and consumer electronics assembly as a result of the increasing demand for structural adhesives areas boosting their adoption in various applications. The reactive cyanoacrylate segment has continued to be the first choice for high-performance bonding solutions as industries search for efficiency and versatility in their applications.

By End-Use

The healthcare segment held the largest market share around 30% in 2023. This is owing to the increasing utilization of medical-grade cyanoacrylate adhesives for wound closure, surgical applications, and medical device assembly. Cyanoacrylate adhesives have been developed as a strong, biocompatible, and fast-bonding material and are used historically for wound sealing as a good substitute for traditional sutures and staples. The need for shorter recovery times, lower chances of infections, and higher patient comfort has contributed largely to their increased utilization in minimally invasive surgeries. Furthermore, the rising demand for medical devices, especially catheters, and syringes expansion of implants manufacturing, will directly contribute, to market growth. The healthcare segment has maintained the largest market share due to an increase in surgeries, the development of novel medical adhesives, and growing healthcare spending across the globe.

Cyanoacrylate Adhesives Market Regional Outlook

Asia Pacific held the largest market share around 42% in 2023. This is owing to Countries such as China, India, Japan, and South Korea are experiencing increased industrial manufacturing and infrastructure development which is boosting the demand for high performance adhesives. Cyanoacrylate adhesive usage in vehicles is majorly increasing in the automotive sector in China and India due to rapid expansion of structural bonding, electronic components, and interior assembly. The booming electronics sector is another reason, particularly in the consumer gadgets and semiconductor manufacturing. In addition, healthy growth of the medical device manufacturing industry and rising utilization of cyanoacrylate adhesives in wound closure and surgical applications are also driving the growth of the healthcare industry. In addition to this, cost-effective production, increasing R&D investments, and supportive government policies for industrial development are some important factors driving the market in the Asia Pacific region.

North America held a significant market share in 2023. It comprises a large number of automotive, aerospace, medical and electronics inclined industries. Growth in the advanced manufacturing sector and high demand for high-performance adhesives in the region are major factors driving market growth across the region. The properties of cyanoacrylate adhesives such as cryogenic flexibility, transparency, and excellent plasticity are extensively exploited in preparing surgical pouches, closure of surgical wounds, and in assembling medical devices at the fastening joints/upholstering. Increased healthcare spending as a result of the implementation of various government initiatives and stringent regulations imposed on the approval of healthcare products by the FDA is expected to be one of the key factors contributing to the growth of cyanoacrylate adhesives in the field of healthcare over the forecast period. Demand in the U.S. and Canadian automotive sectors also drives growth, as cyanoacrylate adhesives are being utilized for lightweight construction and in the production of electric vehicles (EV).

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Henkel AG & Co. KGaA (Loctite 401, Loctite 454)

-

3M (Scotch-Weld Instant Adhesive CA40H, Vetbond Tissue Adhesive)

-

H.B. Fuller Company (Cyberbond 2008, Cyberbond 2243)

-

Arkema Group (Bostik Super Glue Liquid, Bostik Fix & Flash)

-

Pidilite Industries Ltd. (Fevikwik, Zorrik 88)

-

Illinois Tool Works Inc. (Plexus MA300, Devcon 5 Minute Epoxy)

-

Soudal Holding N.V. (Souder Super Glue, Soudal High Tack)

-

Aica Kogyo Co., Ltd. (Aica Super Glue, Aron Alpha)

-

Hubei Huitian New Materials Co. Ltd (Huitian 401, Huitian 403)

-

NANPAO Resins Chemical Group (NANPAO Super Glue, NANPAO Instant Adhesive)

-

Mapei (ADESILEX PG1, ADESILEX PG2)

-

Tesa SE (Tesa Instant Glue, Tesa Easy Stick)

-

DELO Industrial Adhesives (DELO-CA 010, DELO-CA 020)

-

Permabond Engineering Adhesives (Permabond 910, Permabond 2011)

-

Panacol-Elosol GmbH (Penloc GTI, Vitralit 4731)

-

Parson Adhesives (Parson 2000, Parson 2020)

-

Adhesive Systems Inc. (ASI Instant Adhesive 502, ASI Instant Adhesive 606)

-

Cyberbond LLC (Cyberbond 2008, Cyberbond 2243)

-

Palm Labs Adhesives (Turbo Fuse 130, Turbo Fuse 110)

-

Chemence (Krylex KBond 210, Krylex KBond 230)

Recent Development:

-

In May 2023, H.B. Fuller acquired Beardow Adams, a leading industrial adhesives manufacturer. This acquisition is intended to expand H.B. Fuller's customer base while strengthening its technological expertise and manufacturing capabilities across the U.S. and Europe.

-

In February 2024, Henkel introduced Loctite 4011S and Loctite 4061S, two advanced cyanoacrylate adhesives designed to improve safety and performance in medical device applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.35 Billion |

| Market Size by 2032 | USD 3.88 Billion |

| CAGR | CAGR of 5.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Reactive, UV Cured Adhesives) • By End-Use (Aerospace, Automotive, Building & Construction, Healthcare, Woodworking, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, 3M, H.B. Fuller Company, Arkema Group, Pidilite Industries Ltd., Illinois Tool Works Inc., Soudal Holding N.V., Aica Kogyo Co., Ltd., Hubei Huitian New Materials Co. Ltd, NANPAO Resins Chemical Group, Mapei, Tesa SE, DELO Industrial Adhesives, Permabond Engineering Adhesives, Panacol-Elosol GmbH, Parson Adhesives, Adhesive Systems Inc., Cyberbond LLC, Palm Labs Adhesives, Chemence |