Ultra-High Molecular Weight Polyethylene (UHMWPE) Market Size:

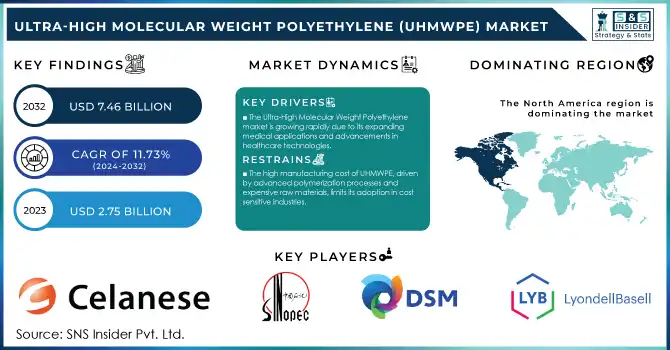

The Ultra-High Molecular Weight Polyethylene (UHMWPE) Market size was USD 2.75 billion in 2023 and is expected to Reach USD 7.46 billion by 2032 and grow at a CAGR of 11.73% over the forecast period of 2024-2032. The Ultra-High Molecular Weight Polyethylene (UHMWPE) market has experienced substantial growth in recent years, driven by its diverse applications across industries such as healthcare, automotive, defense, and industrial manufacturing. ultra-high molecular weight polyethylene, known for its exceptional properties like high impact resistance, low coefficient of friction, and excellent chemical resistance, has become a critical material in applications requiring superior durability and performance. One of the prominent trends in the market is the increasing adoption of ultra-high molecular weight polyethylene in the healthcare sector. Its biocompatibility and wear resistance make it ideal for medical implants, such as joint replacements, and other orthopedic applications. Additionally, the rising demand for lightweight, durable materials in the automotive and aerospace sectors is fueling innovation in ultra-high molecular weight polyethylene-based composites, offering weight reduction and enhanced energy efficiency.

Get E-PDF Sample Report on Ultra-High Molecular Weight Polyethylene (UHMWPE) Market - Request Sample Report

In the defense sector, ultra-high molecular weight polyethylene is gaining traction for manufacturing personal protective equipment (PPE) like bulletproof vests and helmets, owing to its high strength-to-weight ratio. Moreover, industrial applications, including conveyor belts, liners, and gears, continue to drive demand due to ultra-high molecular weight polyethylene's excellent wear resistance and self-lubricating properties. The market has also witnessed technological advancements in ultra-high molecular weight polyethylene processing techniques to enhance its performance characteristics. Enhanced recycling technologies are being introduced to address environmental concerns, which could pave the way for sustainable growth.

According to research, ultra-high molecular weight polyethylene is known for its tensile strength exceeding 2 GPa, making it significantly stronger than steel on a per-weight basis. It has a molecular weight ranging from 3.1 million to over 5.0 million g/mol, contributing to its exceptional performance. Its low friction coefficient, at approximately 0.1, further positions it as a preferred material for applications requiring reduced wear and high durability.

Ultra-High Molecular Weight Polyethylene (UHMWPE) Market Dynamics

DRIVERS

- The Ultra-High Molecular Weight Polyethylene market is growing rapidly due to its expanding medical applications and advancements in healthcare technologies.

The Ultra-High Molecular Weight Polyethylene (UHMWPE) market is experiencing robust growth, largely driven by its expanding applications in the medical sector. UHMWPE’s superior biocompatibility, exceptional wear resistance, and high impact strength make it an ideal material for medical devices, particularly orthopedic implants, joint replacements, and surgical instruments. As the global population ages, there is a significant rise in the prevalence of orthopedic conditions such as osteoarthritis and osteoporosis, leading to an increased demand for joint replacements and implants. According to industry reports, the global orthopedic implant market is projected to grow steadily, thereby fueling the demand for UHMWPE.

In addition to joint replacements, UHMWPE is gaining traction in the development of surgical robots and minimally invasive surgical tools due to its lightweight and low friction properties. Advancements in medical technologies, coupled with the increasing healthcare expenditure in developing economies, are further contributing to this growth. Moreover, the emergence of crosslinked UHMWPE has improved its longevity and performance in medical applications, making it a preferred choice over traditional materials. This trend underscores the critical role of UHMWPE in addressing the needs of an aging population and the global healthcare industry's ongoing evolution. The medical segment is expected to remain a key growth driver for the market.

RESTRAINT

- The high manufacturing cost of UHMWPE, driven by advanced polymerization processes and expensive raw materials, limits its adoption in cost-sensitive industries.

The production of Ultra-High Molecular Weight Polyethylene (UHMWPE) requires advanced polymerization techniques, such as gel-spinning or sintering, which involve sophisticated equipment and stringent processing conditions. These processes result in higher production costs compared to conventional polyethylene grades. Additionally, the need for high-purity raw materials further adds to the expense, making UHMWPE less competitive in price-sensitive markets. While its superior properties, such as exceptional strength, wear resistance, and durability, justify its use in high-performance applications, industries with tight budget constraints often opt for more affordable alternatives. The elevated costs also pose a challenge for its widespread adoption in developing regions where cost efficiency is a primary consideration. As a result, the high manufacturing cost of UHMWPE remains a significant barrier, limiting its potential to penetrate broader markets and hindering its application in sectors that prioritize cost over performance.

Ultra-High Molecular Weight Polyethylene (UHMWPE) Market Segmentation

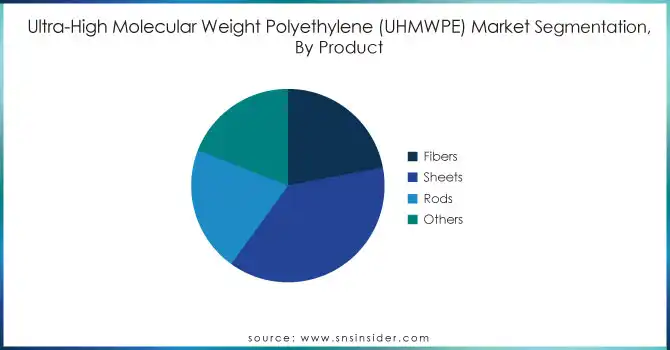

By Product

The sheets segment dominated with the market share over 38% in 2023, due to its versatile applications across various industries. In the medical sector, UHMWPE sheets are used in implants and prosthetics, particularly for joint replacements, due to their exceptional wear resistance and biocompatibility. In the automotive and industrial sectors, these sheets are employed in components that require high strength, durability, and resistance to abrasion, such as liners, conveyor belts, and wear pads. UHMWPE sheets exhibit low friction, making them ideal for reducing wear and tear in high-stress environments. Their ability to withstand extreme conditions like high pressure and temperature further drives their demand across industries. The combination of strength, resilience, and cost-effectiveness makes UHMWPE sheets the preferred choice, thereby contributing to their dominance in the market.

By Application

The Medical Grade & Prosthetics segment dominated with the market share over 35% in 2023. This dominance is driven by the increasing demand for UHMWPE in medical applications, particularly in orthopedic implants and prosthetics. UHMWPE is valued for its remarkable properties, such as exceptional wear resistance, low friction, and high biocompatibility, which make it an ideal material for joint replacements. It is commonly used in hip and knee prosthetics, where durability and longevity are crucial. The ability of UHMWPE to withstand repeated stress and its resistance to degradation in the human body ensures its effectiveness in long-term medical applications.

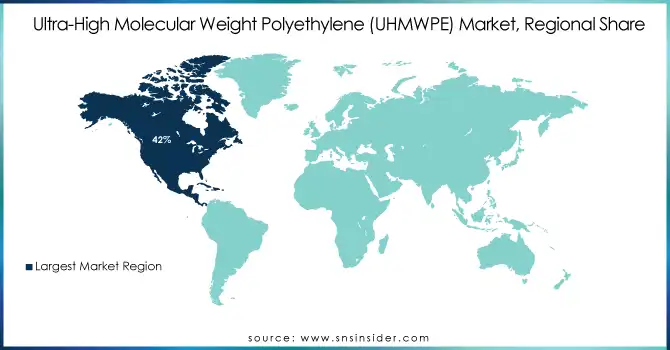

Ultra-High Molecular Weight Polyethylene (UHMWPE) Market Regional Analysis

North America region dominated with the market share over 42% in 2023. This dominance is primarily fueled by the robust demand from key industries such as automotive, healthcare, and industrial applications. UHMWPE's unique properties, including its high abrasion resistance, low friction, and durability, make it essential in various automotive components, medical devices, and industrial equipment. Additionally, North America's advanced technological capabilities and well-established manufacturing infrastructure contribute to its leading market position. The region also benefits from significant investments in research and development, leading to innovations in UHMWPE applications, further driving its adoption across different sectors.

Asia-Pacific is the fastest-growing region in the Ultra-high Molecular Weight Polyethylene (UHMWPE) market, driven by several key factors. The region’s rapid industrialization has led to increased demand for advanced materials across multiple industries, including automotive, healthcare, and textiles. UHMWPE, known for its high strength, low friction, and chemical resistance, is particularly valuable in manufacturing components for these industries. In the automotive sector, it is used for lightweight, high-performance parts, while in medical devices, its biocompatibility makes it ideal for implants and prosthetics.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Ultra-High Molecular Weight Polyethylene (UHMWPE) Market

- Celanese Corporation (POM, Acetyl Products)

- China Petrochemical Corporation (Sinopec) (UHMWPE, Polyethylene)

- Koninklijke DSM N.V. (Arnite, ULTEM)

- LyondellBasell Industries Holdings B.V. (Polyethylene, Polypropylene)

- Crown Plastics, Inc. (UHMWPE Sheets, UHMWPE Rollstock)

- Mitsubishi Chemical Advanced Materials Group (UHMWPE, High Performance Plastics)

- LianLe Chemical Corporation (UHMWPE, HDPE)

- Braskem (Polyethylene, UHMWPE)

- Honeywell International, Inc. (Spectra Fiber)

- Mitsui Chemicals, Inc. (UHMWPE, Specialty Polymers)

- TSE Industries, Inc. (UHMWPE Sheets, UHMWPE Rods)

- Dow Inc. (DOW UHMWPE)

- BASF SE (Ultramid, Ultradur)

- Polymer Technology Systems, Inc. (UHMWPE Films, Polymer Sheets)

- U.S. Chemical & Plastics, Inc. (UHMWPE, UHMWPE Sheets)

- SABIC (Ultrahigh Molecular Weight Polyethylene)

- Solvay (UHMWPE, Specialty Polymers)

- DuPont (Zytel, Vespel)

- Ensinger (UHMWPE Sheets, UHMWPE Rods)

- Asahi Kasei Corporation (UHMWPE, Chemical Products)

Suppliers for (producing high-grade UHMWPE resins and fibers, particularly for industrial, medical, and consumer goods sectors) of Ultra-High Molecular Weight Polyethylene (UHMWPE) Market

- Celanese Corporation

- DSM Engineering Materials

- Mitsui Chemicals, Inc.

- INEOS Olefins & Polymers USA

- LyondellBasell Industries

- Royal DSM

- Quadrant EPP USA Inc.

- SABIC

- Asahi Kasei Corporation

- Teijin Limited

RECENT DEVELOPMENT

In April 2024: LyondellBasell announced the launch of a plastics recycling joint venture (JV) in Zhaoqing, Guangdong Province, Southern China, in collaboration with Genox Recycling (Genox). The new plastic recycling facility, utilizing mechanical recycling technology, processes plastic waste into new polymers, further enhancing LyondellBasell's CirculenRecover product portfolio.

In January 2024: Asahi Kasei and its affiliated company received ISCC PLUS certification for a range of products, including thermoplastic elastomers, engineering plastics, and rubbers. This certification confirms the sustainable management of biomass and recycled materials across the supply chain, supporting Asahi Kasei's commitment to achieving a carbon-neutral material value chain. The company plans to strengthen its collaboration and sustainability efforts as part of its medium-term management plan for fiscal 2024.

In October 2024: Honeywell International Inc., a key player in the global materials market, revealed plans to spin off its advanced materials business, with the goal of fostering individual growth. The company aims to become a publicly traded U.S. entity, targeting the completion of this process by the end of 2025 or early 2026.

In October 2023: Mitsubishi Chemical Group (MCG Group) revealed that it had acquired full ownership of CPC SRL (CPC), a renowned Italian manufacturer and distributor of carbon fiber composite (CFRP) automotive parts. This acquisition, which followed a minority stake purchase in 2017, aligns with MCG Group's long-term strategic goals to expand and strengthen its vertically integrated carbon fiber supply chain. The deal, pending regulatory approval, was expected to close by the end of 2023.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.75 billion |

| Market Size by 2032 | USD 7.46 billion |

| CAGR | CAGR of 11.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fibers, Sheets, Rods, Others) • By Application (Medical Grade & Prosthetics, Filtration, Batteries, Fibers, Additives, Membranes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Celanese Corporation, China Petrochemical Corporation (Sinopec), Koninklijke DSM N.V., LyondellBasell Industries Holdings B.V., Crown Plastics, Inc., Mitsubishi Chemical Advanced Materials Group, LianLe Chemical Corporation, Braskem, Honeywell International, Inc., Mitsui Chemicals, Inc., TSE Industries, Inc., Dow Inc., BASF SE, Polymer Technology Systems, Inc., U.S. Chemical & Plastics, Inc., SABIC, Solvay, DuPont, Ensinger, Asahi Kasei Corporation. |

| Key Drivers | • The Ultra-High Molecular Weight Polyethylene market is growing rapidly due to its expanding medical applications and advancements in healthcare technologies. |

| RESTRAINTS | • The high manufacturing cost of UHMWPE, driven by advanced polymerization processes and expensive raw materials, limits its adoption in cost-sensitive industries. |