Cyclopentane Market Report Scope & Overview:

Get more information on Cyclopentane Market - Request Sample Report

The Cyclopentane Market Size was valued at USD 360 million in 2023, and is expected to reach USD 573 million by 2032, and grow at a CAGR of 5.3% over the forecast period 2024-2032.

The demand for cyclopentane is rising positively as the rigid polyurethane foams manufactured by refrigeration and insulation industries are using it largely due to the lowering of global warming effect when utilized in place of traditional HFC blowing agents. As the level of environmental regulations increases, so has the switch towards greener options by firms to not only fulfill international agreements such as the Paris Agreement but also due to the competition of preferences for greener goods and services in an evolving market. Investment signals that could bring forth a more cyclopentane-manufacturing viable firm are emerging.

Recent trends show evidence of strategic investments in becoming more viable for cyclopentane production from manufacturers. The most widely utilized cyclopentane in the chemical industry has a highly significant facility for the production of cyclopentane, which is pushing to expand its facilities to meet growing demand. This expansion is part of the general strategy to diversify portfolios of products while being in line with sustainability goals. Besides, research institution collaborations with manufacturers have brought innovations in synthesizing cyclopentane, which maximizes productivity and efficiency of production while reducing its effects on the environment. They are useful reminders that innovation is the way to maintain competitiveness and relevance in the cyclopentane market.

The third area of contribution to increased demand for cyclopentane is the automobile sector. This is highly because of the rise of electric vehicles and subsequently, a quest for materials whose use enhances energy preservation in those automobiles. The increasing use of cyclopentane in light components bodes well for the further enhancement of energy efficiency in electric vehicles. These developments enhance sustainability in electric vehicles; thus, automotive manufacturers have begun to investigate cyclopentane as a suitable option for battery pack insulation and thermal management systems, raising the market share of this substance further.

The pharmaceutical industry, in turn, is now reaping the rewards of cyclopentane for use in the production of medical instruments and packaging materials. With its excellent thermal stability and minimal toxicity, manufacturers prefer to use it since health and safety regulation stipulations are taken quite seriously. Indeed, its prospects in the field of drug delivery systems are already confirmed by recent studies. It remains effective in sustaining its integrity, especially when its products are stored and transported. This developing application space demonstrates the immense flexibility of cyclopentane and its wide potential to penetrate diverse markets and promote further demand.

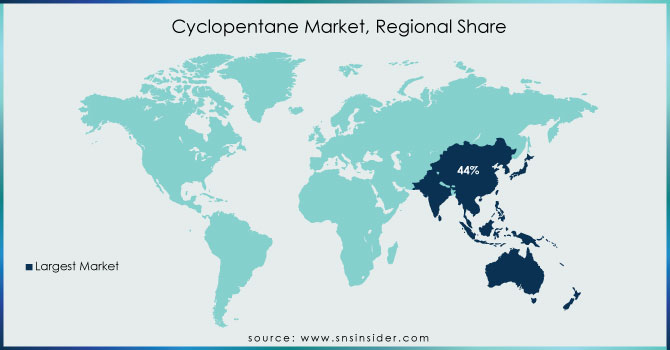

Geographically, the cyclopentane market is growing substantially in countries where manufacturing has some sort of old base and environmental regulations are set to be stringent. Countries in North America and Europe are well in the lead through policies enforcing the usage of low-impact materials. This includes driving initiatives in Europe, which are steadily phasing out HFCs and increasing the adoption of cyclopentane for various applications. On the other hand, Asian manufacturers are increasing their production capacities to take advantage of this increased demand that is now surfacing in emerging markets, mainly in the construction and automotive industries. Thus, cyclopentane will be included in the list of environmentally friendly materials and processes, for which the planet as a whole is already undergoing a change in its current status regarding many sectors.

Cyclopentane Market Dynamics:

Drivers:

-

Increasing Demand for Eco-Friendly Blowing Agents

The demand for cyclopentane as an eco-friendly blowing agent in rigid polyurethane foam production is significantly rising due to strict environmental regulations. As industries aim to replace traditional hydrofluorocarbons (HFCs) with sustainable alternatives, cyclopentane emerges as a favorable choice because of its low global warming potential and effectiveness in enhancing insulation properties. The shift towards greener alternatives is driven by commitments to reduce greenhouse gas emissions and comply with international climate agreements, propelling the cyclopentane market forward. Companies that adapt to these regulations by integrating cyclopentane into their production processes gain a competitive edge, making this driver crucial for market growth.

-

Growth in the Automotive Industry

The automotive sector is increasingly utilizing cyclopentane for insulation applications, particularly in electric vehicles (EVs). As manufacturers prioritize energy efficiency and lightweight materials, cyclopentane is favored for its excellent thermal insulation properties. The rise of electric and hybrid vehicles necessitates advanced insulation materials to maintain battery performance and safety, further driving the demand for cyclopentane. Manufacturers focusing on sustainable practices in vehicle production are more likely to adopt cyclopentane, aligning with consumer preferences for environmentally friendly solutions. This trend in the automotive industry not only boosts cyclopentane's market presence but also reinforces its role as a key material in future vehicle designs.

Restraint:

-

Fluctuating Raw Material Prices

The cyclopentane market faces a significant restraint due to the volatility of raw material prices. Cyclopentane is primarily derived from petroleum, and fluctuations in crude oil prices can lead to increased production costs. These variations can affect profit margins for manufacturers, making it challenging to maintain stable pricing for end products. Additionally, the reliance on petroleum as a feedstock poses risks related to supply chain disruptions and geopolitical factors. When raw material costs rise, manufacturers may hesitate to invest in cyclopentane production or pass these costs onto consumers, potentially hampering market growth. Companies may need to explore alternative sourcing strategies or develop more efficient production processes to mitigate this challenge and ensure competitiveness in a fluctuating market environment.

Opportunity:

-

Expansion in Emerging Markets

The cyclopentane market presents substantial opportunities for growth in emerging markets, particularly in Asia-Pacific and Latin America. As these regions industrialize and urbanize, the demand for insulation materials in construction, refrigeration, and automotive applications is expected to rise. Companies can leverage this opportunity by establishing local production facilities or partnerships to cater to the specific needs of these markets. Furthermore, increasing awareness of environmental sustainability among consumers and businesses in emerging economies is driving the transition towards eco-friendly materials. By positioning cyclopentane as a preferred solution in these markets, manufacturers can tap into new customer bases and significantly expand their market reach, ultimately fostering long-term growth.

Challenge:

-

Competition from Alternative Materials

The cyclopentane market faces significant challenges from alternative materials and technologies that can serve similar functions in insulation and other applications. With the growing emphasis on sustainability, numerous companies are exploring innovative materials that may outperform cyclopentane in certain aspects, such as cost-effectiveness or thermal performance. For instance, bio-based foams and other eco-friendly agents are emerging as competitors in various industries. As manufacturers evaluate their options, cyclopentane must demonstrate distinct advantages to retain market share. This competition necessitates continuous innovation and improvement in cyclopentane formulations and applications to ensure it remains a viable choice in an evolving landscape. Companies that can effectively differentiate cyclopentane through performance, sustainability, and cost efficiency will be better positioned to navigate this challenge.

Cyclopentane Market Segmentation Analysis

By Function

In 2023, the blowing agent and refrigerant segment dominated the cyclopentane market, accounting for an estimated market share of approximately 65%. This segment's prominence is primarily due to the increasing adoption of cyclopentane as a sustainable blowing agent in the production of rigid polyurethane foams, which are widely used in insulation applications for refrigerators, freezers, and construction materials. For instance, manufacturers in the appliance industry are transitioning from traditional HFCs to cyclopentane to meet stringent environmental regulations and enhance energy efficiency. Additionally, the automotive sector growing focus on electric vehicles has further fueled the demand for cyclopentane as an effective refrigerant in thermal management systems. This strong market presence underscores cyclopentane's critical role in advancing sustainable practices across multiple industries.

By Application

In 2023, the residential refrigerator segment dominated the cyclopentane market, holding an estimated market share of around 40%. This segment's leadership is largely driven by the increasing demand for energy-efficient and environmentally friendly refrigeration solutions. Cyclopentane is widely adopted as an effective blowing agent for insulation foam in residential refrigerators due to its low global warming potential compared to traditional alternatives like HFCs. For example, major appliance manufacturers have been shifting their production processes to utilize cyclopentane in foam insulation, enhancing the energy efficiency of their products while adhering to stricter environmental regulations. The growing consumer preference for sustainable appliances further propels the demand for cyclopentane in the residential refrigeration sector, solidifying its dominant position in the market.

Cyclopentane Market Regional Outlook

In 2023, North America emerged as the dominant region in the cyclopentane market, capturing an estimated market share of approximately 45%. This dominance can be attributed to the region's robust manufacturing base, particularly in the appliance and automotive industries, where the demand for energy-efficient and environmentally friendly solutions is rapidly increasing. For instance, major appliance manufacturers in the United States have been transitioning to cyclopentane as a blowing agent for insulation in refrigerators and freezers, driven by stringent environmental regulations and consumer demand for sustainable products. Additionally, the automotive sector's growing focus on electric vehicles and efficient thermal management systems has further fueled the use of cyclopentane in North America. The combination of regulatory support and innovation in manufacturing practices positions North America as a leader in the cyclopentane market.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest-growing market for cyclopentane, with an estimated CAGR of around 8% over the next few years. This growth is primarily driven by rapid industrialization and urbanization in countries like China and India, where the demand for insulation materials in construction and refrigeration is surging. For instance, as the residential and commercial sectors expand, the use of cyclopentane in rigid polyurethane foams for energy-efficient insulation is becoming increasingly prevalent. Additionally, the automotive industry in Asia-Pacific is witnessing a shift toward electric vehicles, which necessitates advanced insulation materials for battery management and thermal efficiency. Government initiatives promoting sustainable practices and environmental regulations further bolster the adoption of cyclopentane in various applications, positioning the Asia-Pacific region for significant growth in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Dymatic Chemical (Cyclopentane, Cyclopentane Blowing Agent)

-

Haldia Petrochemicals Limited (Cyclopentane, Cyclopentane Blowing Agent)

-

HCS Group (Cyclopentane, Cyclopentane Blowing Agent)

-

INEOS (Cyclopentane, Cyclopentane Blowing Agent)

-

Jilin Beihua Fine Chemical Co., Ltd. (Cyclopentane, Cyclopentane Blowing Agent)

-

Junyuan Petroleum Group (Cyclopentane, Cyclopentane Blowing Agent)

-

Liaoning Yufeng Chemical Co., Ltd. (Cyclopentane, Cyclopentane Blowing Agent)

-

Maruzen Petrochemical (Cyclopentane, Cyclopentane Blowing Agent)

-

SK Global Chemical Co., Ltd. (Cyclopentane, Cyclopentane Blowing Agent)

-

Zeon Corporation (Cyclopentane, Cyclopentane Blowing Agent)

-

BASF SE (Cyclopentane, Cyclopentane Blowing Agent)

-

Cyclics Corporation (Cyclopentane, Cyclopentane Blowing Agent)

-

Dow Chemical Company (Cyclopentane, Cyclopentane Blowing Agent)

-

Eastman Chemical Company (Cyclopentane, Cyclopentane Blowing Agent)

-

Huntsman Corporation (Cyclopentane, Cyclopentane Blowing Agent)

-

Kraton Corporation (Cyclopentane, Cyclopentane Blowing Agent)

-

Mitsubishi Gas Chemical Company, Inc. (Cyclopentane, Cyclopentane Blowing Agent)

-

Nippon Steel Chemical & Material Co., Ltd. (Cyclopentane, Cyclopentane Blowing Agent)

-

Petrochemical Corporation of Singapore (Cyclopentane, Cyclopentane Blowing Agent)

-

SABIC (Cyclopentane, Cyclopentane Blowing Agent)

Recent Developments

September 2023: HCS Group, a leading supplier of specialty hydrocarbon products, announced the successful completion of their acquisition by the International Chemical Investors Group (ICIG). This means HCS Group, with its 500 employees worldwide, is now officially part of ICIG, a private industrial group. Within ICIG, HCS Group will become the foundation for a brand new strategic business platform.

August 2023: HCS Group and Lufthansa Group teamed up to develop eco-friendly Sustainable Aviation Fuel (SAF) from plant waste. Production begins in 2026 at HCS's Germany facility. This partnership is a major step towards cleaner skies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 360 Million |

| Market Size by 2032 | US$ 573 Million |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Function (Blowing agent & refrigerant, Solvent & reagent, Others) •By Application (Residential Refrigerator, Commercial Refrigerator, Insulated Containers And Sippers, Insulating Construction Material, Electrical & Electronics, Personal Care Products, Fuel & Fuel Additives, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HCS Group (Germany), Zeon Corporation (Japan), Jilin Beihua Fine Chemical Co., Ltd. (China), Junyuan Petroleum Group (China), Dymatic Chemicals, Inc. (China), Haldia Petrochemicals Limited (India), INEOS (UK), Liaoning Yufeng Chemical Co., Ltd. (China), SK Global Chemical Co., Ltd. (South Korea), Maruzen Petrochemical (Japan) |

| Drivers | •HCFC Phase-Out Paves the Way for Cyclopentane in Insulation Manufacturing. |

| Opportunity | •Blowing agent boom in construction, automotive, and appliances drives cyclopentane demand. |