Dairy Product Packaging Market Report Scope And Overview:

Get More Information on Dairy Product Packaging Market - Request Sample Report

The Dairy Product Packaging Market size was USD 30.5 billion in 2023 and is expected to Reach USD 38.63 billion by 2031 and grow at a CAGR of 3% over the forecast period of 2024-2031.

The rising consumption of dairy products and the preference for specific types, such as single-serve options and yogurt drinks, are driving sales in certain packaging solutions. The increasing demand for convenient choices like single-serve milk and yogurt drinks is fueling growth in the dairy product packaging market. Furthermore, initiatives such as school milk programs are also contributing to the acceleration in sales of dairy product packaging.

Due to strict regulations from the U.S. EPA (Environmental Protection Agency) and the European Commission aimed at reducing carbon gas emissions, dairy product manufacturers are transitioning to eco-friendly packaging materials. Eco-friendly plastic packaging is preferred by manufacturers who aim to maintain product shelf-life without refrigeration. The dairy sector is experiencing structural advancements in packaging, including innovations like tap-it dispensers, multi-layered milk bags, and stand-up milk pouches. For instance, in November 2018, Haifa-based Copy Centre unveiled renewable paperboard-based packaging cups for Tnuva's dessert brand Yolo.

MARKET DYNAMICS

KEY DRIVERS:

-

The increasing desire for convenient and on-the-go consumption is expected to drive growth in the packaging of dairy products.

The rise in single-person households and busy lifestyles is driving the demand for single-serve, smaller, or portion-controlled packaging for dairy products such as cheese, milk, and yogurt, making them more convenient for on-the-go consumption and reducing waste. Increased consumer awareness about the importance of fresh food is leading to a growing demand for packaging solutions that preserve freshness and extend shelf life.

-

In response to consumer needs and preferences, innovative packaging technologies are being developed.

RESTRAIN:

-

Growing concerns about the adverse health effects of plastics stem from their potential to contain toxins, which may contribute to conditions such as cancer or reproductive system disturbances.

-

Regulations restricting plastic packaging are rising to minimize its environmental impact.

OPPORTUNITY:

-

Dairy manufacturers' focus on global trade drives demand for enhanced packaging solutions.

Dairy manufacturers are increasingly prioritizing the capture of a share in the global dairy trade by enhancing their capabilities in international export and local production. This heightened focus has led to a surge in demand for improved packaging solutions tailored specifically to dairy products. As companies strive to meet the stringent standards of international trade while also catering to local market needs, the need for advanced packaging technologies and materials that ensure product quality, freshness, and safety becomes foremost. This trend is driving innovation and investment in the development of better dairy-based packaging solutions across the industry.

-

Major players are creating attractive and eco-friendly packaging to attract consumers and reduce environmental harm.

CHALLENGES:

-

The variability in packaging costs, influenced by fluctuations in food prices, is anticipated to hinder the growth of the dairy packaging market.

-

Dairy product packaging firms face challenges in replacing plastic with alternatives, as available options significantly affect profit margins and diminish overall revenue potential.

IMPACT OF RUSSIAN UKRAINE WAR

As of the current moment, the European Union is in the process of formulating its tenth round of sanctions against Russia. In anticipation of potential sanctions directly affecting European supplies of raw materials and technologies, Russian dairy companies have devised contingency plans. Over recent months, the Ukrainian dairy sector has faced significant challenges due to power outages, caused by disruptions to critical energy infrastructure resulting from Russia's actions since October. Approximately 600 companies in Russia were using Tetra packaging. After Tetra Pak's departure from the country, its Russian plant was handed over to local management. However, it is acknowledged by Fedyakov that the local management has faced challenges in upholding the previous standard of product quality. Additionally, complaints have been reported regarding the stability of supplies.The increase in dairy product prices in Ukraine can be attributed to heightened energy consumption. Many factories have been compelled to resort to diesel generators, leading to escalated milk production costs.

IMPACT OF ECONOMIC SLOWDOWN

During an economic slowdown, the fluctuating price of crude oil notably impacts the cost of plastics. Key players in the milk and food packaging industry rely on crude oil for the production of virgin plastics. As crude oil prices rise by 10%, the demand for virgin plastics is projected to increase, leading to higher prices for plastics in the future. However, despite an increase in overall crude oil production, demand is expected to decrease due to ample supply, resulting in a significant decline in crude oil prices. Consequently, fluctuations in raw material prices, particularly in plastics, hinder the growth of the global dairy packaging market.

KEY MARKET SEGMENTS

By Type

-

Bottles

-

Cans

-

Pouches

-

Boxes

-

Films and Wraps

-

Bags and Wraps

-

Tubes

Plastic bottles, particularly HDPE (High-Density Polyethylene) bottles, are likely a dominant packaging type for various dairy products like milk, yogurt drinks, and some cheeses.

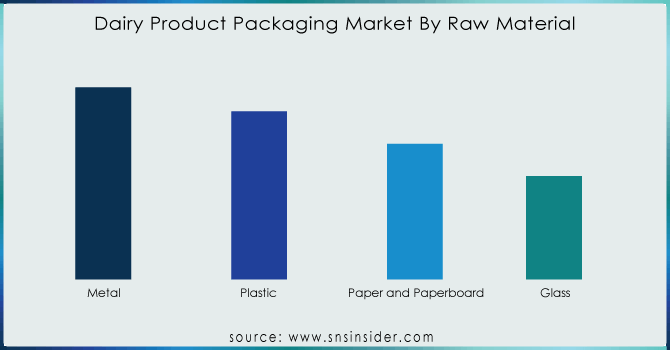

By Raw Material

-

Glass

-

Paper and Paperboard

-

Plastic

-

Metal

Steel material dominates the market with share 40.5%. Steel is widely employed in dairy product packaging due to its superior barrier properties compared to plastic, rendering it suitable for shelf-stable milk in regions with limited access for emergency preparedness. Additionally, the growing utilization of steel cans for storing condensed milk is further enhancing the segment's value.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Packaging Product

-

Rigid

-

Flexible

Rigid packaging, particularly plastic bottles, likely holds the majority market share. Rigid containers offer better protection for products during transportation and storage. Rigid containers often stack well for efficient storage and transportation in the supply chain.

By Application

-

Milk

-

Cheese

-

Butter

-

Frozen Products

-

Yogurt

-

Cream

-

Butter and Ghee

-

Ice-cream

-

Cultured Products

-

Others

Milk, being a highly nutrient-rich dairy product consumed worldwide, is regarded as a cornerstone of a healthy diet. This inherent nutritional value positions milk as the most sought-after dairy product, driving significant demand for its packaging in the dairy products packaging market.

By Distribution Channel

-

eCommerce

-

Specialty Retailers

-

Supermarkets and Hypermarkets

-

Others

Supermarkets and Hypermarkets are likely hold the majority market share for dairy packaging. Consumer habit of purchasing dairy products during regular grocery shopping trips. Online grocery shopping, including dairy products, is experiencing significant growth.

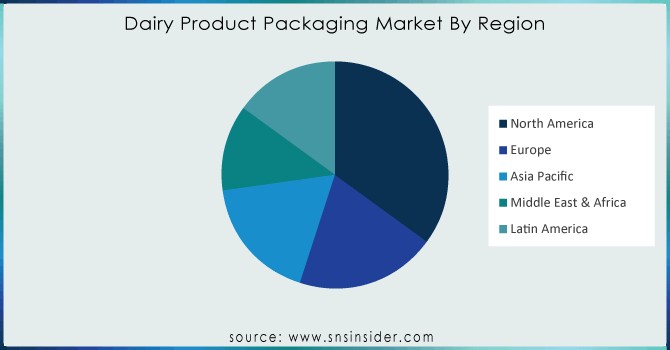

REGIONAL ANALYSIS

The North American region commands the largest portion of the global dairy packaging market, driven by heightened production and sales of dairy items like milk, cheese, and yogurt and holding market share of 42.5%. Recent years have witnessed a notable surge in dairy product consumption in the United States, particularly for cheeses like parmesan, provolone, and mozzarella, indicating a potential uptick in the country's dairy packaging sector. The dynamic shifts in consumer preferences towards packaged food and evolving economic conditions are having a notable impact on the dairy packaging market in the United States. The thriving trend of online grocery shopping is anticipated to have a favorable impact on packaging needs, particularly concerning shelf life extension and transportation logistics. There is a growing presence of market players in Spain's dairy product packaging sector.

The developing nations within the Asia-Pacific region are expected to experience steady growth rates, attributed to the overall economic expansion. Furthermore, significant investments made by key manufacturers are poised to bolster the growth of the milk packaging market. The Chinese consumer base is demonstrating a preference for premium dairy products, perceiving them as convenient and healthier options. Consequently, this translates to a rising demand for high-quality packaging with innovative designs and features.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Major players in Dairy Product Packaging Market are Evergreen Packaging, Ahlstrom, Rexam, Huhtamaki Group, International Paper Company, Consolidated Container Company LLC, Mondi Group, WestRock Company, Bemis Company Inc., CKS Packaging and others.

RECENT DEVELOPMENT

-

In January 2024, Emmi and Coop unveiled sustainable PET bottles for their dairy products. Coop's branded cream and milk products, as well as various Emmi-branded items like Emmi Energy Milk, are now offered in these environmentally-friendly PET bottles. Notably, this marks the sole type of plastic food packaging in Switzerland capable of being reprocessed and recycled within a closed loop system. This initiative represents a significant stride towards fulfilling the sustainability objectives of both companies and advancing the establishment of a circular economy.

-

In February 2024, Yaza launched Labneh Dairy Products in the United States, employing K3 sustainable cardboard-plastic cups from Greiner Packaging. The K3 design offers practical advantages such as facilitating portion control and enhancing customer handling experience.

-

In November 2023, Sidel unveiled 'ultra-small' and 'ultra-light' PET bottles, aiming to offer liquid dairy manufacturers a heightened competitive advantage. Through the introduction of these products, Sidel aims to expand its presence in the packaging solutions market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 30.5 Billion |

| Market Size by 2031 | US$ 38.63 Billion |

| CAGR | CAGR of 3 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bottles, Cans, Pouches, Boxes, Films And Wraps, Bags And Wraps, Tubes) • By Raw Material (Glass, Paper And Paperboard, Plastic, Metal) • By Packaging Product (Rigid, Flexible) • By Application (Milk, Cheese, Butter, Frozen Products, Yogurt, Cream, Butter And Ghee, Ice-Cream, Cultured Products, Others) • By Distribution Channel(ECommerce, Specialty Retailers, Supermarkets And Hypermarkets, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Evergreen Packaging, Ahlstrom, Rexam, Huhtamaki Group, International Paper Company, Consolidated Container Company LLC, Mondi Group, WestRock Company, Bemis Company Inc., CKS Packaging |

| Key Drivers | • The increasing desire for convenient and on-the-go consumption is expected to drive growth in the packaging of dairy products. • In response to consumer needs and preferences, innovative packaging technologies are being developed. |

| Market Opportunities | • Dairy manufacturers' focus on global trade drives demand for enhanced packaging solutions. • Major players are creating attractive and eco-friendly packaging to attract consumers and reduce environmental harm. |