Perfume Packaging Market Report Scope & Overview:

Get More Information on Perfume Packaging Market - Request Sample Report

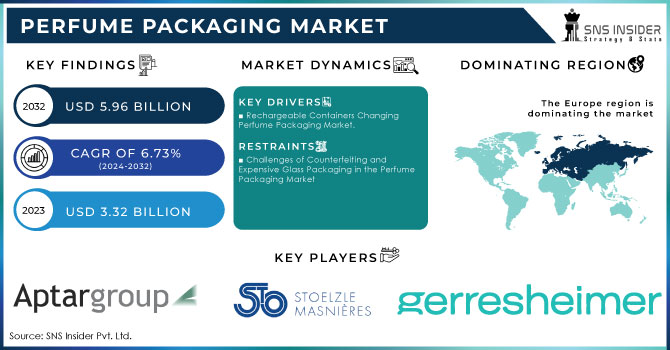

The Perfume Packaging Market Size was valued at USD 3.32 billion in 2023 and is expected to reach USD 5.96 billion by 2032 and grow at a CAGR of 6.73% over the forecast period 2024-2032.

The perfume packaging market plays a vital role in preserving scents and attracting consumers, reflecting the evolving tastes of a diverse audience. The surge in global perfume consumption, particularly among younger generations like Gen Z, has been significantly driven by the increasing acceptance of varied cultures and changing lifestyles. This demographic is increasingly seeking personalized scents, which has led to innovations in sustainable fragrance packaging styles and options. Companies are focusing on creating packaging that is not only eco-friendly but also practical, catering to the values of younger shoppers who prioritize environmental consciousness and customization in their purchasing decisions. This trend is evident in the adoption of new materials and methods that enhance the user experience while preserving the fragrance. Additionally, the growing popularity of layering scents has prompted brands to design unique packaging options that facilitate various application methods. As consumer preferences continue to evolve, perfume packaging factories must adapt to these changes to meet the demands of a dynamic market, resulting in heightened fragrance consumption and a stronger connection between consumers and their favorite scents.

Recent innovations at this year's Luxe Pack show in Monaco demonstrate a strong influence from Gen Z on perfume packaging design. Brands are adjusting to the tastes of this group, who see fragrance as an important part of their well-being, self-expression, and identity. As an example, the new "Layering Perfume" Collection from Superga Beauty demonstrates the changing usage habits of Gen Z, highlighting their preference for personalization by combining different scents. The assortment includes creative ways to apply, like roll-ons, sticks, and foam tips, departing from usual spray systems.This trend shows the importance for brands to create new packaging options that suit mobile lifestyles, allowing for touch-ups and easy travel. Gen Z's preference for eco-friendly products is reflected in the recent shift towards more tactile and sensory-based applications, as well as sustainable packaging options. Superga's latest packaging features a patented rotating head that prevents leaks and is fully recyclable, in line with the younger generation's dedication to sustainability. Additionally, the creation of their gel oil scents, which are both alcohol-free and vegan, satisfies the growing desire for natural beauty products.With sales in the fragrance market up by 21% in 2021 and 15% in 2022 post-pandemic, brands need to adopt and make use of these trends. Mastering the technique of combining fragrances enables individuals to craft custom scents suited to their feelings or events, increasing the demand for flexible packaging options. In general, Gen Z's preference for creative, eco-friendly, and customized scent experiences is transforming the perfume packaging industry, prompting brands to adjust their products accordingly. This change boosts product attractiveness and maintains relevance in a competitive market where consumer loyalty is driven by personalization and sustainability.

Market Dynamics

Drivers

-

Rechargeable Containers Changing Perfume Packaging Market.

The increasing desire for sustainability among consumers has driven innovation in the perfume packaging market, leading to refillable and reusable options becoming a major factor in driving growth. The recent introduction of Lancôme's refillable perfume bottle, which includes a unique pump that is 10% lighter than other options on the market, demonstrates this pattern. Aptar Beauty's pump combines luxury and sustainability by utilizing a POM-free cartridge and anodized metal, fitting the brand's aesthetic while reducing environmental impact. In different industries, consumers are showing a growing preference for eco-friendly choices, motivating brands to consider reusable and refillable packaging styles. This tendency is not limited to high-end items; it also applies to everyday products, showing a wider move towards cutting down on waste. Lancôme's innovative approach reflects an overall industry trend towards incorporating sustainable practices into packaging design while maintaining product effectiveness and aesthetic appeal. Other instances such as Pingo Doce’s reusable bread bags and North Coast Seafood's recyclable packaging show that sustainability is becoming an important factor in setting companies apart. Refillable options are anticipated to be influential in the future of the perfume packaging industry, allowing brands to satisfy consumer needs and abide by environmental guidelines.

Restraints

-

Challenges of Counterfeiting and Expensive Glass Packaging in the Perfume Packaging Market

The perfume packaging market is greatly hindered by the rising presence of fake products and the expensive nature of glass packaging. Fake perfumes, crafted to closely imitate authentic ones, are wrapped using cheap materials that copy the look of high-end packaging. This deceitful strategy devalues genuine perfume packaging, confusing consumers in distinguishing between real and counterfeit products. Consequently, a large number of patrons choose these more affordable options, hindering the expansion of the authorized market. Moreover, the elevated costs associated with glass packaging in the beginning and for transportation hinder market growth even more. Glass is heavier than plastic, despite being preferred for its high-end appearance and eco-friendliness, resulting in increased expenses across the supply chain, from manufacturing to shipping. The increasing prevalence of counterfeit products and the financial strain of using glass packaging are hindering the expansion of the worldwide perfume packaging market.

Market Segmentation Analysis

By Material

In the perfume packaging market of 2023, glass dominated with the highest revenue share of 53.00%. Glass is still the favored choice for luxury brands because of its high-end appearance, capacity to maintain fragrance quality, and recyclable nature. Multiple companies have utilized the advantages of glass in their perfume packaging advancements. An example of this is Lancôme's recent introduction of a refillable perfume bottle for its Idôle Eau de Parfum, which boasts a glass design that matches the brand's luxurious aesthetic. The bottle features a new pump system from Aptar Beauty that keeps the perfume's integrity intact with no scent interference. Another instance is the Dior "J'adore" collection, which went through a design makeover, with an emphasis on a stylish, eco-friendly glass container. These developments mirror the increasing inclination of perfume producers to utilize glass as an eco-friendly and aesthetically pleasing option for packaging. Consumer demand for green packaging is pushing companies to prioritize glass, in efforts to lower plastic usage without compromising quality. Therefore, glass continues to hold a strong position in the perfume packaging sector, with ongoing efforts to enhance sustainability and luxury, bolstering its supremacy in the market.

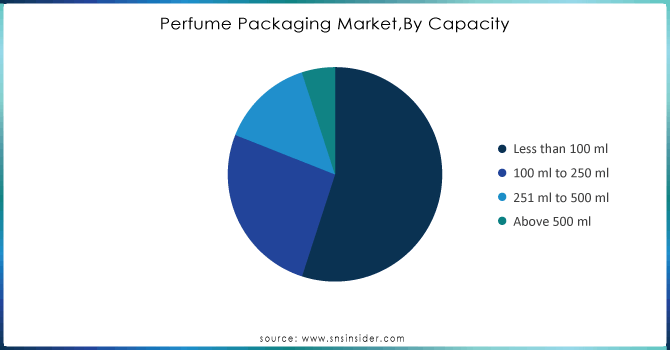

By Capacity

In 2023, perfume packaging market generated the most revenue from perfume bottles with under 100 ml capacity, which made up 55.00% of the market share. The rise of this segment is fueled by the growing demand from consumers for portable and small scents that are convenient for use while travelling. Prominent companies have met this need by introducing new products and advancements designed specifically for this size range. Chanel recently launched a more compact edition of its famous "Coco Mademoiselle" perfume, presented in a stylish 50 ml glass container, ideal for on-the-go use while still maintaining its high-end image. In a similar fashion, Dior introduced a new 30 ml size to its "Miss Dior" line, targeting customers who value convenience and affordability. Multiple brands are working on creating refillable and personalized choices for this particular market. Lancôme's 75 ml refillable edition of Idôle aims to minimize waste and provide a high-quality experience, merging eco-friendliness with convenience. Younger generations, such as Gen Z, are especially drawn to the trend of making things smaller and more luxurious, as they prioritize personal expression and convenience. The increasing importance of small perfume bottles in meeting modern consumer demands is emphasized by these advancements, further establishing the segment's dominance in the worldwide perfume packaging market.

Need any customization research on Perfume Packaging Market - Enquiry Now

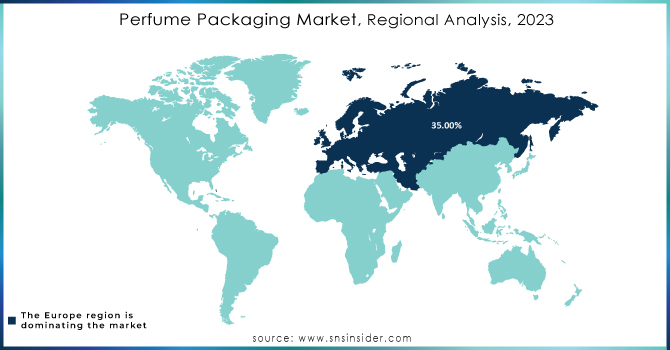

Regional Analysis

In the year 2023, Europe had the highest market share in perfume packaging worldwide, accounting for 35.00% of the market. The area's leadership is predominantly influenced by its deep roots in the fragrance sector, housing prestigious labels such as Chanel, Dior, and Lancôme that are consistently pushing boundaries in perfume presentation. European customers are recognized for desiring high-quality and visually attractive items, leading to an increasing demand for luxury packaging options. In 2023, Lancôme introduced a new refillable perfume bottle called "Idôle", which has a pump system that decreases waste and keeps a luxurious look. The bottle, adorned with rose gold details and made from recyclable materials, mirrors Europe's increasing emphasis on sustainability in packaging.Chanel debuted a fresh iteration of its "Gabrielle" fragrance in a chic, shiny 100 ml glass container, embracing the luxury minimalist trend. This is in line with the European market's tendency towards high-quality glass packaging, which is renowned for its sophistication and strength. Aptar Group, a company based in France, is among the leaders in developing recyclable packaging solutions to meet the growing need for eco-friendly luxury products. These advancements showcase Europe's crucial position in leading luxury and sustainable trends in perfume packaging.

In 2023, North America emerged as the second fastest-growing region in the perfume packaging market, driven by rising consumer demand for luxury fragrances and eco-friendly packaging solutions. Key developments in the region include innovative launches by major brands focusing on sustainable and premium packaging. For instance, U.S.-based luxury fragrance brand, Estée Lauder, introduced a line of refillable perfume bottles with sleek, modern designs aimed at reducing environmental waste. Additionally, several brands have adopted sustainable packaging materials, such as recyclable glass and biodegradable plastics, to align with North American consumers' growing preference for environmentally responsible products. Canada, in particular, is witnessing rapid growth, with an increasing number of niche perfume brands adopting sustainable packaging solutions to differentiate themselves in the competitive market. Meanwhile, U.S. companies are investing heavily in research and development to innovate packaging designs that appeal to Gen Z and Millennial consumers who prioritize both aesthetics and sustainability. This regional growth is further bolstered by advancements in packaging technologies, such as lightweight glass and refillable systems, enabling brands to offer environmentally friendly options without compromising on luxury and quality, cementing North America as a key player in the global perfume packaging market.

Key Players

Some of the Key Players in Perfume Packaging market who provide product and solution:

-

AptarGroup, Inc. (Spray pumps, dispensers)

-

Berry Global (Plastic bottles, closures)

-

Stölzle Glass Group (Glass bottles, flacons)

-

Gerresheimer AG (Glass packaging, ampoules)

-

VERESCENCE (Luxury glass bottles, cosmetics packaging)

-

Albea S.A (Plastic and metal packaging, tubes)

-

ZIGNAGO VETRO (Glass bottles, jars)

-

Trivium Packaging (Metal packaging, aerosol cans)

-

Silgan Holdings, Inc. (Plastic containers, closures)

-

Premi Industries (Glass bottles, caps)

-

SGB Packaging Inc. (Plastic bottles, jars)

-

HCP Packaging (Plastic bottles, tubes)

-

SKS Bottle and Packaging Inc. (Glass and plastic bottles, jars)

-

Vitro Corporation (Glass containers, closures)

-

Coverpla S.A. (Plastic bottles, cosmetic packaging)

-

Others

Recent Developments

-

On October 3, 2024, Lancôme introduced its innovative refillable perfume bottle, featuring a pump that is 10% lighter than the market average. The pump is anodized to match the brand's signature rose gold colorway, enhancing both the aesthetics and sustainability of the product. This development reflects the growing trend towards environmentally friendly packaging solutions in the fragrance industry.

-

On June 18, 2024, Christian Dior launched a solid stick version of its Miss Dior perfume, enhancing its luxury line. The Miss Dior Blooming Bouquet and Miss Dior Eau de Parfum are now offered in a stylish translucent pink stick, encased in a handwoven houndstooth jacquard pattern created by specialized weaver Oriol and Fontanel.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.32 Billion |

| Market Size by 2032 | USD 5.96 Billion |

| CAGR | CAGR of 6.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Glass, Plastic, Metal, Paperboard, and Others) • By Capacity (Less than 100 ml, 100 ml to 250 ml, 251 ml to 500 ml, and Above 500 ml) • By Packaging Type (Bottles, Tubes & Roll-Ons, Caps & Closures, Droppers & Pumps, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AptarGroup, Inc., Berry Global, Stölzle Glass Group, Gerresheimer AG, VERESCENCE, Albea S.A, ZIGNAGO VETRO, Trivium Packaging, Silgan Holdings, Inc., Premi Industries, SGB Packaging Inc., HCP Packaging, SKS Bottle and Packaging Inc., Vitro Corporation, and Coverpla S.A.& Others |

| Key Drivers | • Rechargeable Containers Changing Perfume Packaging Market. |

| Restraints | • Challenges of Counterfeiting and Expensive Glass Packaging in the Perfume Packaging Market |