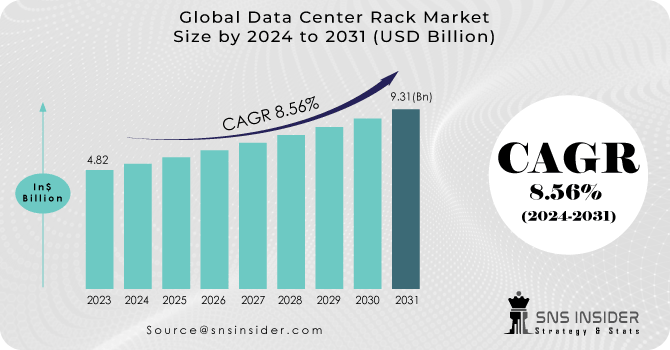

The Data Center Rack Market Size was valued at USD 4.82 Billion in 2023 and is expected to reach USD 9.31 Billion by 2031 and grow at a CAGR of 8.56 % over the forecast period 2024-2031.

The growth of the data center rack market is Driven by several factors, including the adoption of durable racks, increased deployment in colocation facilities, higher server density, and rising investments in data centers. The need for efficient handling of network services through Software-defined Data Centers (SDDC), data center optimization initiatives, and the benefits of proper airflow and device protection are driving organizations across various sectors to adopt data center racks. Factors such as server virtualization, remote control advancements, and the demand for compact and scalable server types are also positively impacting market growth. However, challenges like data security, power management issues, and UPS battery failures are hindering the market's full potential. The data Centre, data center racks are used mostly for infrastructure management. In the manufacturing, retail, financial services, information technology, and telecommunications industries, these are often utilized.

Get more information on Data Center Rack Market - Request Free Sample Report

Drivers

Adoption of durable racks enhances reliability and longevity.

Increase in deployment in colocation or data center whitespace facilities.

Increasing server density optimizes space and boosts efficiency.

Higher data center investments drive infrastructure upgrades.

Adoption of Software-defined Data Center (SDDC) architecture for efficient network services.

The Proliferation of data center facilities worldwide is important for effectively managing the immense volume of data generated from digital services, IoT devices, social media, and online transactions. This increase in data necessitates growing data center capacities for storage and processing. Cloud service providers such as AWS, Azure, and Google Cloud are expanding their data center presence globally to meet the growing demand for cloud services, leading to the establishment of new facilities in various regions. The businesses are investing more in data centers to ensure uninterrupted operations and disaster recovery capabilities, spreading these facilities across different areas to mitigate downtime risks, thereby driving market growth.

Restraints:

Concern related to Data security creates challenges to market growth.

Improper power management and UPS battery failures impact performance.

Complexity in managing remote control and virtualized servers.

Limited scalability and compactness in traditional rack solutions.

The Data security concerns are a significant challenge for the data center rack market, as they can increase to breaches, data loss, and regulatory issues, undermining trust hindering market growth. Improper power management practices and Uninterruptible Power Supply battery failures also impact performance, system failures, and potential data corruption. These issues not only affect operational efficiency but also help to increase costs and customer dissatisfaction. Growing data security risks and implementing robust power management strategies are essential for ensuring the reliability, resilience, and long-term success of data center rack solutions in the market.

Opportunities:

Increasing growth potential in IT, retail, and other sectors adopting data center racks.

Increasing demand for compact and scalable server types.

Adoption of advanced technologies like edge computing and AI.

Growing emphasis on data center optimization and efficiency.

Rising demand for data storage due to digital content explosion and IoT devices.

Challenges:

Ensuring data security amidst increasing cyber threats.

Addressing power management issues and UPS battery reliability.

Managing complexities in remote control and virtualized server environments.

Adapting to evolving technology trends and industry standards.

Competition from alternative storage solutions like cloud services.

The Russia-Ukraine war has caused disruptions in the supply chain, results to Increasing challenges in sourcing critical components for data center racks. This has resulted in price increases and delays in delivery times, impacting market growth. The conflict has contributed to a 10-15% increase in costs for data center equipment, further straining budgets and investment plans in the data center rack market. The geopolitical tensions and uncertainties have prompted some organizations to reassess their data center strategies, potentially affecting demand in the short term.

The economic downturn can significantly impact the data center rack market, leading to reduced IT budgets and delayed infrastructure investments. During economic downturns, the market for data center equipment, including racks, can experience a decline of up to 20% in demand due to cost-cutting measures by businesses. The uncertainty and financial constraints may cause organizations to prioritize essential infrastructure upgrades over rack expansions, affecting market growth. However, there may be an increased focus on cost-effective and efficient rack solutions to optimize existing data center operations amidst budgetary constraints.

By Component

Solutions

Services

By Rack Type

Open Frame

Cabinets

By Data Canter Size

Small and Mid-sized Data Canters

Large Data Canters

On the basis of data canter size, the sub-segment large data centres dominated the market, with holding revenue share of more than 58%, due to their ability to achieve cost efficiencies through the scale of infrastructure, cooling, and power distribution across Various servers and storage devices. They excel in storing and processing vast data volumes, making them ideal for organizations focusing on big data analytics, machine learning, and data-intensive tasks. The small and mid-sized data canters are expected to grow with the significant growth with a high CAGR during the forecast period, offering flexibility, scalability, ease of management, and simplified operations compared to larger counterparts.

By Rack Height

42U and Below

43U up to 52U

Above 52U

By Rack Width

19 Inch

23 Inch

Others

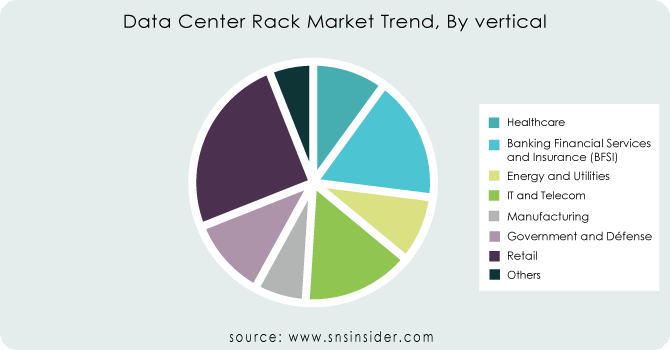

By Vertical

Banking, Financial Services, and Insurance (BFSI)

IT and Telecom

Government and Défense

Retail

Manufacturing

Healthcare

Energy and Utilities

Others

On the basis of vertical, the Retail sector dominated the data canter rack market with holding Revenue share of more than 26%, due to its heavy Dependence on these racks for managing online stores, e-commerce platforms, and inventory databases. This sector's need for efficient data storage and management drove significant market share. The healthcare industry is expected to grow with the substantial growth with highest CAGR, driven by the increasing adoption of digital technologies such as electronic health records and medical imaging, which require secure and organized data canter infrastructure for storage and protection, contributing to market expansion in the coming years.

Need any customization research on Data Center Rack Market - Enquiry Now

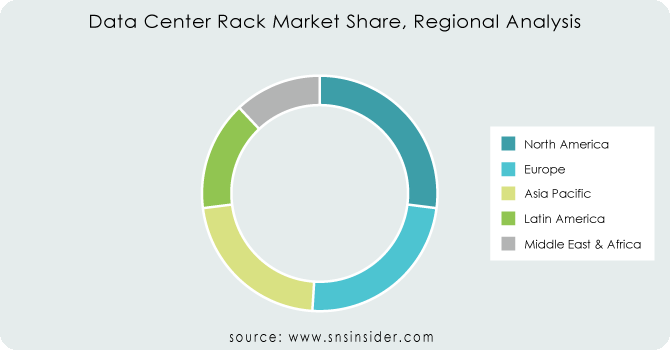

North America region is dominating the data center rack market with holding Revenue share of more than 34%, due to its extensive data center infrastructure and technological advancements. The region's focus on space optimization and performance enhancement drives the demand for data center racks, supported by a robust economic landscape, high IT budgets, and early adoption of edge computing, HPC, and AI technologies.

The Asia Pacific is projected to Growing with the highest growth rate, driven by its consistently growing e-commerce markets, 5G network rollout, and expanding telecommunications sector, all of which necessitate reliable data center infrastructure. The Europe anticipates moderate growth as cloud computing services gain traction, prompting investments in data center infrastructure for scalable cloud services and government initiatives such as digital governance and data analytics, emphasizing secure data storage and processing through advanced racks.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Schneider Electric SE, Belden Inc., Cisco Systems, Inc., Chatsworth Products, Dell Inc., Hewlett Packard Development LP, Oracle Corporation, Rittal, Fujitsu Limited, Vertiv Group Corp. & OtherPlayers

In May 2023, Legrand unveiled their latest generation of intelligent rack PDUs, featuring state-of-the-art hardware for enhanced security. These racks are equipped with Server Technology PRO4X and Raritan PX4 technology to optimize workloads, provide digital access control, and offer environmental monitoring.

In October 2022, Eaton introduced a new innovation as part of the Open Compute Project, specifically designed to meet the unique needs of data centers. This technology is tailored to deliver the necessary power for customers looking to deploy ORV3 racks.

In October 2022, Cisco Systems, Inc. established a data center in India to support their WebEx infrastructure. This move is aimed at enhancing user experience services and expanding the company's presence in India.

In July 2022, Eaton launched their xModular system, designed for the planning, deployment, and operation of data center facilities. The xModular system provides ample space for IT computing equipment, also known as white space.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.82 Bn |

| Market Size by 2031 | US$ 9.31 Bn |

| CAGR | CAGR of 8.56% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By rack type (Open Frame, Cabinets) • By data canter size (Small and Mid-sized Data Canters, Large Data Canters) • By rack height (42U and Below, 43U up to 52U, Above 52U) • By rack width (19 Inch, 23 Inch, Others) • By vertical (Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Government and Defense, Retail, Manufacturing, Healthcare, Energy and Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric SE, Belden Inc., Cisco Systems, Inc., Chatsworth Products, Dell Inc., Hewlett Packard Development LP, Oracle Corporation, Rittal, Fujitsu Limited, and Vertiv Group Corp |

| Key Drivers |

• Increase in deployment in colocation or data center whitespace facilities. • Increasing server density optimizes space and boosts efficiency. • Higher data center investments drive infrastructure upgrades. |

| Market Opportunities |

• Increasing demand for compact and scalable server types. • Adoption of advanced technologies like edge computing and AI. |

Ans: The projected market size for the Data Center Rack Market is USD 9.31 billion by 2031.

Ans: - Limited power supply and increasing rack density are two issues that need to be addressed.

Ans: - The segments covered in the Data Center Rack Market report for study are on the basis of component, rack type, data center size, and industry verticals.

Ans: - The major key players are Schneider Electric SE, Belden Inc., Cisco Systems, Inc., Chatsworth Products, Dell Inc., Hewlett Packard Development LP, Oracle Corporation, Rittal, Fujitsu Limited, and Vertiv Group Corp.

Ans. The study includes a comprehensive analysis of Speech-to-text API Market trends, as well as present and future market forecasts. DROC analysis, as well as impact analysis for the projected period. Porter's five forces analysis aids in the study of buyer and supplier potential as well as the competitive landscape etc.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Data Center Rack Market, By Component

9.1 Introduction

9.2 Trend Analysis

9.3 Solution

9.4 Service

10. Data Center Rack Market, By Rack Type

10.1 Introduction

10.2 Trend Analysis

10.3 Open Frame

10.4 Cabinets

11. Data Center Rack Market, By Data Canter Size

11.1 Introduction

11.2 Trend Analysis

11.3 Small and Mid-sized Data Canters

11.4 Large Data Canters

12. Data Center Rack Market, By Rack Height

12.1 Introduction

12.2 Trend analysis

12.3 42U and Below

12.4 43U up to 52U

12.5 Above 52U

13. Data Center Rack Market, By Rack Width

13.1 Introduction

13.2 Trend analysis

13.3 19 Inch

13.4 23 Inch

13.5 Others

14. Data Center Rack Market, By Vertical

14.1 Introduction

14.2 Trend analysis

14.3 Banking, Financial Services, and Insurance (BFSI)

14.4 IT and Telecom

14.5 Government and Défense

14.6 Retail

14.7 Manufacturing

14.8 Healthcare

14.9 Energy and Utilities

14.10 Others

15. Regional Analysis

15.1 Introduction

15.2 North America

15.2.1 USA

15.2.2 Canada

15.2.3 Mexico

15.3 Europe

15.3.1 Eastern Europe

15.3.1.1 Poland

15.3.1.2 Romania

15.3.1.3 Hungary

15.3.1.4 Turkey

15.3.1.5 Rest of Eastern Europe

15.3.2 Western Europe

15.3.2.1 Germany

15.3.2.2 France

15.3.2.3 UK

15.3.2.4 Italy

15.3.2.5 Spain

15.3.2.6 Netherlands

15.3.2.7 Switzerland

15.3.2.8 Austria

15.3.2.10 Rest of Western Europe

15.4 Asia-Pacific

15.4.1 China

15.4.2 India

15.4.3 Japan

15.4.4 South Korea

15.4.5 Vietnam

15.4.6 Singapore

15.4.7 Australia

15.4.8 Rest of Asia Pacific

15.5 The Middle East & Africa

15.5.1 Middle East

15.5.1.1 UAE

15.5.1.2 Egypt

15.5.1.3 Saudi Arabia

15.5.1.4 Qatar

15.5.1.5 Rest of the Middle East

15.5.2 Africa

15.5.2.1 Nigeria

15.5.2.2 South Africa

15.5.2.3 Rest of Africa

15.6 Latin America

15.6.1 Brazil

15.6.2 Argentina

15.6.3 Colombia

15.6.4 Rest of Latin America

16. Company Profiles

16.1 Schneider Electric SE

16.1.1 Company Overview

16.1.2 Financials

16.1.3 Products/ Services Offered

16.1.4 SWOT Analysis

16.1.5 The SNS View

16.2 Belden Inc.

16.2.1 Company Overview

16.2.2 Financials

16.2.3 Products/ Services Offered

16.2.4 SWOT Analysis

16.2.5 The SNS View

16.3 Cisco Systems, Inc.

16.3.1 Company Overview

16.3.2 Financials

16.3.3 Products/ Services Offered

16.3.4 SWOT Analysis

16.3.5 The SNS View

16.4 Chatsworth Products

16.4 Company Overview

16.4.2 Financials

16.4.3 Products/ Services Offered

16.4.4 SWOT Analysis

16.4.5 The SNS View

16.5 Dell Inc.

16.5.1 Company Overview

16.5.2 Financials

16.5.3 Products/ Services Offered

16.5.4 SWOT Analysis

16.5.5 The SNS View

16.6 Hewlett Packard Development LP

16.6.1 Company Overview

16.6.2 Financials

16.6.3 Products/ Services Offered

16.6.4 SWOT Analysis

16.6.5 The SNS View

16.7 Oracle Corporation

16.7.1 Company Overview

16.7.2 Financials

16.7.3 Products/ Services Offered

16.7.4 SWOT Analysis

16.7.5 The SNS View

16.8 Rittal

16.8.1 Company Overview

16.8.2 Financials

16.8.3 Products/ Services Offered

16.8.4 SWOT Analysis

16.8.5 The SNS View

16.9 Fujitsu Limited

16.9.1 Company Overview

16.9.2 Financials

16.9.3 Products/ Services Offered

16.9.4 SWOT Analysis

16.9.5 The SNS View

16.10 Vertiv Group Corp.

16.10.1 Company Overview

16.10.2 Financials

16.10.3 Products/ Services Offered

16.10.4 SWOT Analysis

16.10.5 The SNS View

17. Competitive Landscape

17.1 Competitive Benchmarking

17.2 Market Share Analysis

17.3 Recent Developments

17.3.1 Industry News

17.3.2 Company News

17.3.3 Mergers & Acquisitions

18. USE Cases and Best Practices

19. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Cloud Computing Market size was USD 445.3 billion in 2022 and is expected to Reach USD 1449.84 billion by 2030 and grow at a CAGR of 15.9 % over the forecast period of 2023-2030.

The Data Integration Market size was valued at USD 13.26 Billion in 2023 and is expected to grow to USD 33.78 Billion By 2031 and grow at a CAGR of 12.4 % over the forecast period of 2024-2031.

The Private 5G Network Market size was valued at USD 1.9 Billion in 2023 and is projected to reach USD 32.3 Billion in 2031 with a growing CAGR of 42.5% From 2024 to 2031.

The Payment Security Market size was valued at USD 22.82 billion in 2022 and is expected to grow to USD 66.01 billion by 2030 and grow at a CAGR of 14.2 % over the forecast period of 2023-2030.

The Neobanking Market size was valued at USD 103.54 billion in 2023 and is expected to grow to USD 3430.59 billion by 2031 and grow at a CAGR of 54.09% over the forecast period of 2024-2031.

The Passive Authentication Market size was valued at USD 2.29 Bn in 2022 and is expected to reach USD 11.37 Bn by 2030, and grow at a CAGR of 22.14 % over the forecast period 2023-2030.

Hi! Click one of our member below to chat on Phone